NetEase Youdao enters the harvest season: advertising leads the way, AI empowers, and compound interest emerges

![]() 11/15 2024

11/15 2024

![]() 618

618

After years of accumulation and timely release, NetEase Youdao's compound interest effect has only just begun to emerge, with long-term dividends yet to be unleashed.

Written by Wang Shuran

Edited by Chen Jiying

In an era where cost reduction and efficiency enhancement have become a consensus, the value of listed companies is not reflected in fancy stories, trendy concepts, or extensive but low-quality growth, but rather in the improvement of profitability.

Using this yardstick, NetEase Youdao, five years after its listing, has just delivered a solid financial report.

NetEase Youdao's net income for the third quarter of 2024 reached RMB 1.57 billion, an increase of 2.2% year-on-year. Operating profit amounted to RMB 110 million, turning a profit compared to a loss in the same period last year. This marks the company's first quarterly profit in the third quarter and a record-high profit for a single quarter.

This new high in quarterly profit is not a temporary peak but a turning point, indicating that the company's profitability is gradually increasing, and this improvement is becoming the norm. With the continuous emergence of compound interest effects, the turning point from quarterly to annual profitability has already appeared.

NetEase Youdao's transition from a bumpy exploration period to a harvest period with dividends emerging is not an overnight success but the result of the compound interest effects brought about by its long-term approach, which is finally beginning to show results.

I

NetEase Youdao enters the harvest season

In recent years, life has been tough for educational technology companies. NetEase Youdao is no exception, having faced two major challenges in its five years since listing: the strong impact of tightening policies on the ed-tech sector and the ongoing disruption caused by the three-year pandemic.

Amidst this tumultuous journey, educational technology companies have taken different paths. New Oriental has pivoted to live-streaming e-commerce to chart a new growth trajectory, while companies like TAL Education have increased the proportion of their non-academic education businesses. NetEase Youdao's transformation and upgrading differ markedly from other players, as it chose to revamp its core business with AI. Its advertising model, which was the first to succeed, has now become the main driver of growth. Having successfully upgraded, NetEase Youdao has also accumulated resilience to navigate economic cycles.

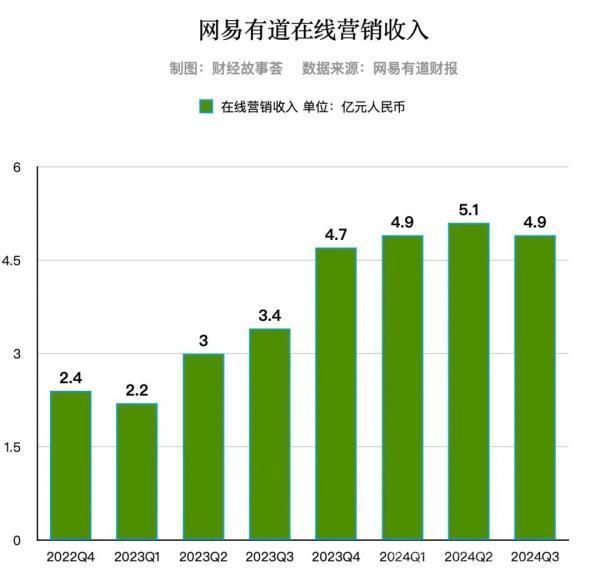

This quarter, the advertising segment performed particularly well, with net income of RMB 490 million, a year-on-year increase of 46%. This marks the eighth consecutive quarter that NetEase Youdao's advertising business has maintained a high growth rate of around 50% year-on-year.

Amidst the stagnation in the overall advertising market, this achievement is particularly noteworthy. In comparison, NetEase Youdao's 46% growth rate in advertising revenue this quarter is 20 times that of the overall advertising market in the same period. According to CTR Media Intelligence, China's advertising market grew by only 2.3% year-on-year in the first three quarters of 2024. This growth rate is also significantly higher than that of the segmented internet advertising sector. According to QuestMobile data, the size of China's internet advertising market increased by 5.5% year-on-year in Q3 2024.

Over the past 20 years, regardless of market cycles, advertising, e-commerce, and gaming have been the three main monetization models of the internet. The high growth in advertising revenue has turned NetEase Youdao into a "cash cow." Over the past two years, advertising has contributed increasingly to NetEase Youdao's revenue, now accounting for nearly one-third of it. This acts as a ballast, allowing NetEase Youdao to maintain stable revenue amidst environmental turbulence, policy impacts, and economic cycles. It also enhances the balance of NetEase Youdao's revenue structure, reducing its reliance on a single business. Furthermore, the advertising business serves as an economic barometer. When new trends or dividends emerge, NetEase Youdao can capitalize on them through advertising, taking the lead in capturing these opportunities.

Beyond advertising, AI subscriptions and hardware segments also deserve praise.

The AI subscription business is the most technologically innovative segment of NetEase Youdao. This quarter, revenue from AI subscription services reached nearly RMB 70 million, a year-on-year increase of over 150%.

Smart hardware is a staple business for NetEase Youdao, with the keyword for this quarter being "recovery of growth."

Unlike other internet giants that dabble in hardware, NetEase Youdao treats its smart hardware business as a primary operation.

Previously, due to NetEase Youdao's proactive reorganization of hardware sales channels and focus on its strong dictionary pen category, hardware revenue declined for three consecutive quarters from Q4 2023 to Q2 2024.

This quarter, thanks to the popularity of the flagship dictionary pen X7 Pro, NetEase Youdao's hardware revenue finally emerged from its decline and entered a rebound cycle, with net income of RMB 320 million, a year-on-year increase of 25% and nearly double the RMB 167 million in Q2 2024, validating the foresight of its previous restructuring moves.

Overall, NetEase Youdao's revenue structure is more balanced this quarter, and full-year profitability is within reach. The company has navigated the tumultuous exploration period and entered a harvest season of continuous growth and emerging compound interest.

II

Underestimated NetEase Youdao Advertising: Long-term Compound Interest Emerges

NetEase Youdao is no newcomer to the advertising field, having made long-term investments spanning 18 years. It has experienced the full lifecycle of internet advertising and now covers three major categories: performance advertising, brand advertising, and overseas advertising.

NetEase Select primarily handles performance advertising, with its mobile advertising traffic alliance bringing together three major traffic sources: NetEase-affiliated products, directly signed educational and entertainment products, and partner media. It covers six user groups, including college students, professionals, parents and infants, senior citizens, gamers, and leisure enthusiasts, with daily traffic exceeding 6 billion. Youdao Preferred handles brand advertising, reaching over 1 billion users, particularly high-potential consumers aged 18 to 35. Youdao Preferred also combines online and offline strategies; its "Hundred Campus Tours" project has held nearly 80 events at 500 universities, attracting over 20 brand partnerships and generating tens of millions in revenue. The two platforms complement each other, achieving a true integration of brand and performance.

For overseas advertising, Youdao Ads has accumulated over 10 million global influencers and boasts rich experience in overseas media and social media advertising. It is one of the eight high-level certified service providers authorized by TikTok in 2024. These long-term investments have built a global network of influencer resources and media channels.

The continuous high growth of NetEase Youdao's advertising business for eight consecutive quarters is the result of long-term investments, continuous evolution, and seizing three major trends, leading to the full emergence of long-term compound interest.

The first trend is going global.

Going global to find incremental growth has become a consensus among Chinese enterprises. According to the Ministry of Commerce, China's direct outward investment in all sectors reached RMB 884.6 billion from January to September 2024, a year-on-year increase of 10.6%.

Overseas marketing services have also risen in tandem, forming a comprehensive industrial ecosystem encompassing brand strategy, direct-to-consumer (DTC), overseas media procurement, promotion, digitization, business intelligence (BI) data analysis, platform integration, and more. Participants of different sizes can find their place in this ecosystem.

When entering an unfamiliar overseas market, a brand's domestic marketing strategy may no longer be effective, and growth supported by user acquisition cannot be sustained or accumulate long-term brand assets. How can a brand quickly build influence and public awareness within a short window of opportunity for going global?

Overseas influencer marketing offers a shortcut—starting with insights into local users, endorsing the brand through influencers, and efficiently converting their fan base into loyal brand users.

In terms of influencer resources, NetEase Youdao has a global reserve of over 10 million influencers, with over 70% directly signed and over 1,000 exclusively signed major bloggers. In terms of traffic resources, NetEase Youdao continuously expands its network, with official collaborations with Google and Meta exceeding six years and being one of the eight high-level certified service providers authorized by TikTok in 2024. With both IP and traffic in hand, NetEase Youdao can quickly amplify brands' overseas presence.

From a segmented perspective, gaming is the main force in going global. According to the "China Game Industry Quarterly Report for July-September 2024," China's self-developed games generated record-high overseas revenue of US$5.169 billion in Q3 2024, a year-on-year increase of 20.75%. Relying on overseas game promotion, Youdao Ads' KOL advertising revenue also surged, with a year-on-year increase of over 50%. Currently, NetEase Youdao has long-term collaborations with 70% of the top 30 Chinese mobile game companies going global, including miHoYo and Lilith Games.

It is worth mentioning that in mid-November, Youdao Ads launched a blogger order platform where a massive number of mid-to-long-tail KOC bloggers worldwide can register, accept orders, deliver, and settle. Simultaneously, it provides Chinese enterprises going global with richer and more accessible influencer marketing solutions.

Previously, when NetEase Youdao connected with leading companies and KOLs, it heavily relied on professional talent and experience. Now, through the platform model, it connects with a vast number of KOCs and small-to-medium-sized enterprises, achieving programmatic and scaled services with significantly reduced marginal costs. The platform's exponential effect is evident, showcasing considerable growth potential.

In comparison, public data shows that currently, international brands spend 40% of their total marketing budget on influencer marketing, while Chinese brands going global allocate far less than 20%, with many allocating less than 10%. If aligned with international enterprises, there is still significant room for growth in the influencer marketing budgets of Chinese brands going global, presenting ample opportunities for pioneers like NetEase Youdao.

The second trend is AI.

Since 2023, the AI wave has surged, with application landing becoming the main theme, and the advertising industry has become a super arena for AI models. According to the "2024 China Digital Marketing Trends Report," up to 44% of advertisers are turning to AI marketing.

In the field of AI marketing, NetEase Youdao was an early entrant, having started its layout in 2022. Its capabilities now cover AIGC for advertising content creation, AI live streaming, KOL marketing, data analysis, and more. It produces over 500 video content materials daily and over 400 real-person materials weekly, with 20% of advertising content created by generative AI.

Recently, Youdao Ads produced an entirely AI-generated video advertisement for a home appliance company, with creativity and visual quality approaching that of professional advertising teams. Relying on AI technology, NetEase Youdao significantly reduces advertising costs while maintaining creativity and brand tone, gaining market recognition.

While AI significantly enhances cost-effectiveness in advertising creativity, it also excels when combined with Real-Time Bidding (RTB) technology in ad delivery.

A persistent issue for advertisers has been the black box nature of ad delivery results, with "uncertainty" stemming from three reasons: dispersed target audiences, outdated delivery methods, and mismatched timing strategies.

To address this issue, NetEase Youdao's advertising platform, NetEase Select, introduced the NetEase Data Management Platform (DMP), continuously collecting and integrating over 5,000 personalized tags from different traffic sources. This platform combines user needs with client product features to achieve efficient matching and series connection, thereby enhancing conversion efficiency. Meanwhile, NetEase Select continuously optimizes delivery technology through the integration of AI and RTB. By combining AI advertising algorithms and RTB technology, NetEase Select develops a recommendation system based on user needs for clients. Combined with RTB technology, NetEase Select accurately judges user input information, clearly understanding when users are most likely to convert in specific scenarios, thereby helping advertisers convert users with the most reasonable materials and timing strategies.

The "AI + RTB" combination drove RTB advertising revenue to over RMB 150 million this quarter, a record high and a year-on-year increase of over 100%.

The third trend is domestic influencer marketing.

"Where users are, advertising should be," according to the "2024 China Digital Marketing Trends Report," which found that 83% and 76% of advertisers focus on social media and short videos, respectively, while 71% favor KOL marketing. Enterprises with strong spending power in gaming and e-commerce, in particular, prefer influencer marketing, where NetEase Youdao has deep accumulations and significant achievements. It is understood that NetEase Youdao has internally incubated nearly 100 drama, street interview, and music animation influencers while externally signing nearly 500 gaming influencers.

In the third quarter of this year, NetEase Youdao's advertising boosted brand exposure and popularity for multiple gaming projects, helping games like Egg Party, Hearthstone, and Naraka: Bladepoint trend on various social media platforms. It also helped classic game IPs like World of Tanks achieve their goals of recalling old customers.

Being able to quickly seize trends is not solely dependent on keen senses and efficient responses but also on NetEase Youdao's continuation of NetEase's long-term approach. In a letter to shareholders, William Ding once said, "Trends will fade, and wind directions will change. Only people's hearts remain unchanged, and user needs endure." Many of NetEase's businesses excel not in explosive power but in endurance.

Looking back at the advertising business, whether in terms of technical system construction, customer resource accumulation, or platform and channel development, long-term accumulations are essential. Only by being fully prepared can one hit the mark when trends emerge.

Currently, the three major trends of going global, AI, and influencer marketing can unleash long-term dividends. Therefore, NetEase Youdao's advertising business is expected to maintain high growth in the long term.

III

AI leads the way and is used first, with high-quality growth becoming habitual

Behind the continuous evolution of NetEase Youdao's three core front-end businesses lies a common technological foundation—AI.

Currently, amidst the AI model trend, many companies are still obsessed with comparing parameters. However, Zhou Feng, CEO of NetEase Youdao, is a step ahead, proposing that "models are applications."

It is a consensus that large models and AIGC are naturally suited for the education sector. As a pioneer, NetEase Youdao officially launched "Zi Yue," China's first educational large model, in July last year, along with six applications. Within a year, it subsequently launched over ten AI applications, covering various scenarios such as translation, essay grading, grammatical elaboration, sentence analysis, physical education, oral practice, and homework tutoring. These applications have been integrated into the company's entire software and hardware product line, making NetEase Youdao the fastest enterprise to implement AI applications in educational scenarios in China.

In deploying AI applications, making the right choices is crucial. Scattering resources indiscriminately is not advisable. Only by identifying the most promising segments can one catch the "big fish."

Globally, AI membership subscriptions are a well-validated model for large model To C businesses. OpenAI is a precedent, with its 2024 revenue expected to soar to US$3.7 billion, 75% of which is contributed by membership subscriptions.

NetEase Youdao's approach is similar to OpenAI's but is more focused on the broader education sector. It launches native AI applications and comprehensively upgrades existing products with AI, driving revenue from AI subscription services to nearly RMB 70 million this quarter, a year-on-year increase of over 150%.

In September this year, Youdao Dictionary, a national-level learning APP with over 1 billion users, renewed its slogan from "Word to World, accompany you to see the world" to "All is AI, an AI learning assistant for 1 billion people". It also added over 20 AI functions such as AI simultaneous interpretation and AI English essay generation, covering various learning and office efficiency scenarios. Among them, Youdao Dictionary's AI simultaneous interpretation function has been widely praised. In its first quarter after launch, AI simultaneous interpretation became the top-converting paid feature of Youdao Dictionary, with over 4 million uses in the third quarter.

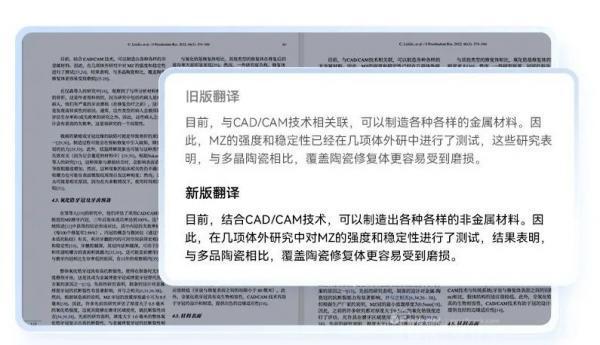

Youdao Translate has also undergone a comprehensive upgrade, improving its sentence comprehension ability, supporting multimodal information input from image and document sources, and significantly enhancing the overall user experience. It not only achieves precise semantic transmission but also excels in professional fields. Additionally, it can mimic various language styles to meet diverse needs, truly appealing to both the refined and the popular tastes, making it a professional AI productivity tool. To date, Youdao AI Document Translation has translated 100 million documents.

This image shows the upgraded Youdao Translate tool with more professional translation results

Integrating smarter and richer AI applications into hardware products has also revitalized Youdao's once declining hardware business, returning it to a growth trajectory. According to the "2024 AI Education Hardware Panorama Report," the AI education hardware market is expected to reach 16.5 billion yuan in 2024, with a compound annual growth rate of 40.27% over the next five years.

In the third quarter of this year, NetEase Youdao launched the flagship dictionary pen X7 Pro, an AI-powered premium product offering a 78 million-word dictionary and an AI camera. It supports AI-native applications such as Xiao P Teacher, a comprehensive question-answering product based on large models, and Hi Echo, the world's first virtual speech coach. These features have doubled the activation of some dictionary pen models year-on-year.

Particularly noteworthy is that the X7 Pro is the industry's first learning device to support offline large model translation, addressing a major pain point for users – "intelligent with an internet connection, stupid without it" – and even surpassing online NMT in accuracy.

The AI large model technology supports the high-end market positioning of the X7 Pro, indicating that AI has the potential to help normalize and increase the profitability of Youdao's hardware business in the future. Despite its high-end positioning, users have shown great favor toward it. During this year's "Singles' Day," Youdao Dictionary Pen ranked first in sales on both JD.com and Tmall for the entire period, achieving the industry's top position for five consecutive years. Notably, the X7 Pro won the top sales volume in the dictionary pen category on both JD.com and Tmall.

2024 Tmall Electronics Dictionary Bestsellers List

In fact, the current AI dividend in the education sector has only just scratched the surface – there are 150 million primary and secondary school students and nearly 50 million college students in China, but the total number of teachers is less than 20 million, averaging one teacher for every ten students. The shortage of teachers can only be compensated by AI in the long run. Therefore, the AI potential in this sector is immense, and NetEase Youdao's journey to tap into this potential is still long.

Four

Conclusion

A company's market capitalization and valuation are short-term voting machines, determined by the market's current perception. In the long run, however, they are weighing machines, with market capitalization and value tending to converge. So, how to measure a company's long-term value?

Investment master Warren Buffett provides the answer – his annual investment return rate is only around 20%, which may seem low, but his ability to reach the pinnacle of the investment world stems from the "compound interest effect" akin to rolling a snowball down a long, steep hill. Being a friend of time, long-term and steady growth is the most valuable. NetEase Youdao's compound interest effect has just begun to emerge, with long-term dividends yet to be unleashed.