Amazon Wants Temu's 'Life'

![]() 11/15 2024

11/15 2024

![]() 599

599

Author|Zheng Yijiu

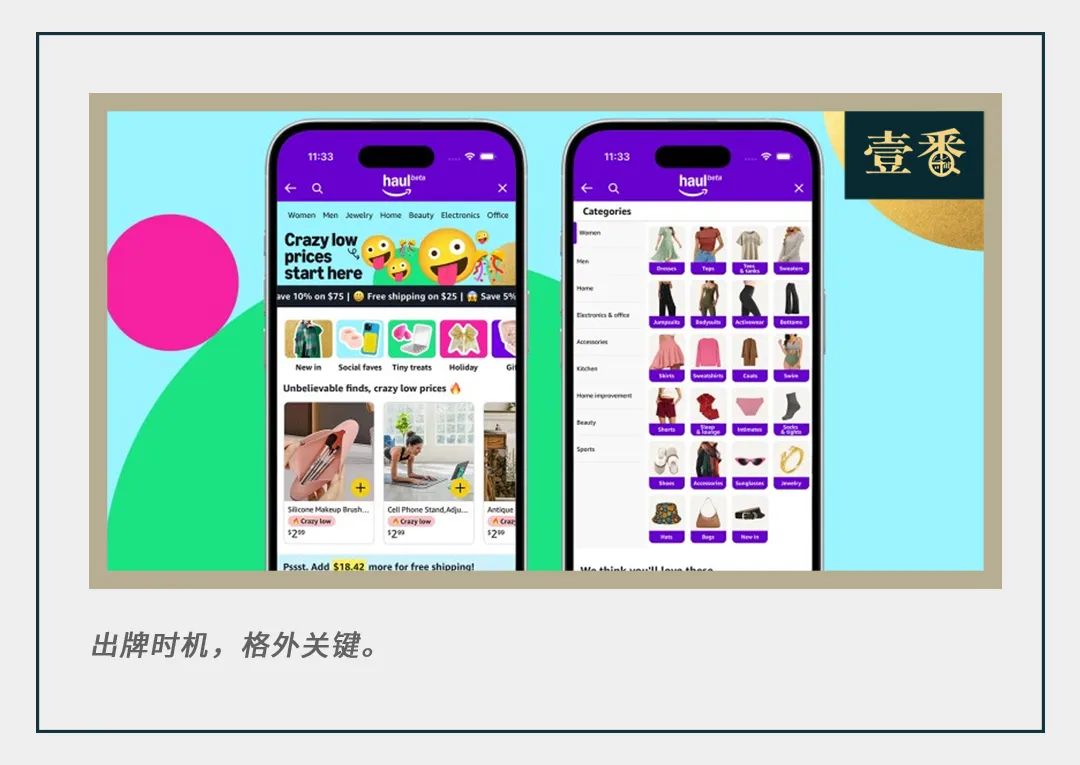

Against the backdrop of US consumers continuously seeking alternatives to save expenses, e-commerce giant Amazon announced on November 14 the launch of a new, targeted weapon—Amazon Haul.

Leveraging this new section positioned as 'insanely low prices,' Amazon began directly competing head-on with Temu, Shein, and TikTok Shop.

What's more noteworthy is that Amazon's timing in launching this service is clearly well-planned: with Trump set to return to the White House, his cabinet's generally hardline stance towards China could exert even greater pressure on China's cross-border e-commerce.

By positioning in the low-price market at this time, Amazon aims to secure a foothold in advance and prepare for any potential market vacuum. 01 'Price Slayer' Hits, Catching Amazon Off Guard

For years, Amazon has dominated the e-commerce landscape with its vast user base, efficient logistics system, and sophisticated advertising recommendation mechanism.

However, Temu's emergence over the past two years, posing as a 'price slayer,' is shaking Amazon's market position.

According to EMarketer's predictions, Temu's share in the US e-commerce market is expected to jump from 0.7% in 2023 to 2.3% in 2025, marking a staggering growth momentum.

Source: Internet

Meanwhile, the relentless pursuit of Shein and TikTok Shop has intensified competition in the low-price market even further.

Temu's success demonstrates the market's insatiable demand for ultra-low prices.

Leveraging the low-cost advantages of domestic supply chains, gamified marketing strategies, and seller-friendly policies, Temu has successfully created an image of a 'bargain paradise.' This model not only makes product prices more competitive but also creates better profit margins for sellers, fostering a virtuous cycle.

This undoubtedly compelled Amazon, the long-time dominator, to take action.

02

War Sustained by War:

Amazon's Precise Counterattack and Keen Senses

Amazon Haul's current exclusivity in the US market underscores Amazon's emphasis on this market threat.

According to Neil Saunders, Managing Director of GlobalData, while Amazon has always had a reputation for 'value for money,' its wide range of products has never given consumers the impression of 'everyday low prices.'

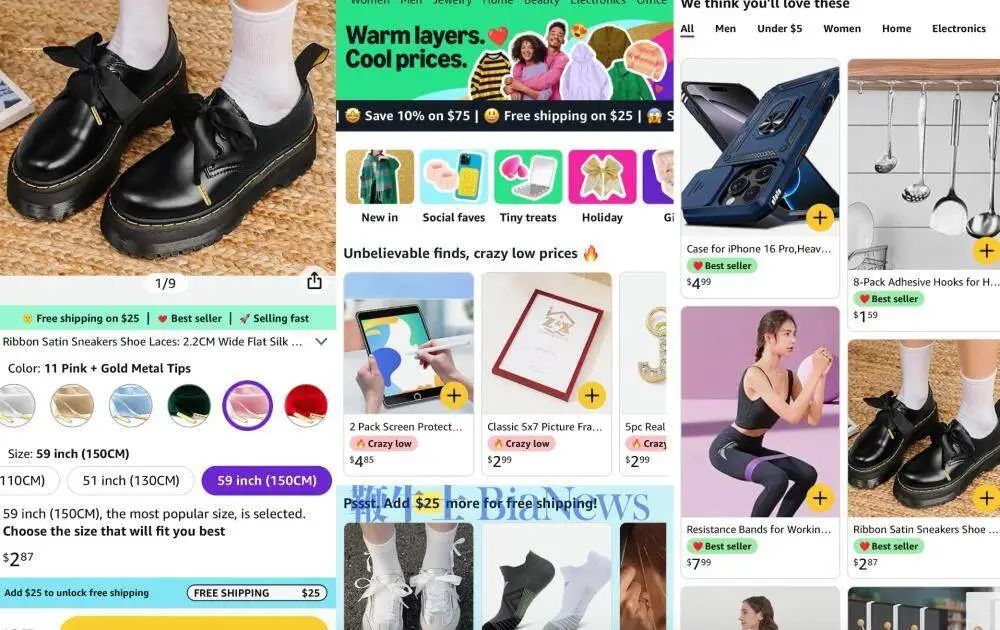

The newly launched Haul section represents a strategic transformation: all products are priced at no more than $20, with most under $10, and many as low as $1.

Amazon Haul

Behind this pricing strategy lies Amazon's precise grasp of consumer behavior. In the current economic environment, consumers are increasingly prioritizing cost-effectiveness and turning to cheaper goods and private label products.

However, Amazon Haul has made some compromises compared to Prime: delivery times are extended to one to two weeks, and free shipping is only available on orders over $25, with a $3.99 shipping fee otherwise. These policies show that while pursuing low prices, Amazon is also striving to balance cost-effectiveness.

03

Is the Game Already Set?

New Battles in E-commerce Going Abroad Amid Political Rivalries

The direction of competition will largely depend on changes in the US political environment.

Trump's potential return to the White House and his China policy could exert greater operational pressure on domestic cross-border e-commerce platforms like Temu. Under these circumstances, the strategic significance of Amazon's early layout in the low-price market becomes even more prominent.

However, this does not guarantee Amazon's victory.

Amazon needs to address several core issues—

Source: Internet

How to maintain the sustainability of this low-price model without affecting existing businesses?

Especially since Prime members are accustomed to fast delivery, will this downgrade in service affect user experience?

More importantly, according to CNBC, Amazon's low-price section also relies on sellers from China to provide low-priced goods. In the event of tariff hikes, can Amazon remain unscathed?

Amazon wants Temu's 'life,' but its chosen path differs little from Temu's, except for its brand influence and status as an American company. Therefore, the current timing of its move is particularly crucial.

However, for consumers, fierce competition among platforms is undoubtedly a good thing. Even for low-price consumption, having more options is always better.

-END-