Lianyun Technology IPO: The world's second position questioned by the exchange,剥离 of overseas subsidiary and natural person C inquired

![]() 11/18 2024

11/18 2024

![]() 597

597

author

Baker Street Detective

On November 18, Lianyun Technology (Hangzhou) Co., Ltd. (hereinafter referred to as "Lianyun Technology") is about to begin its IPO subscription.

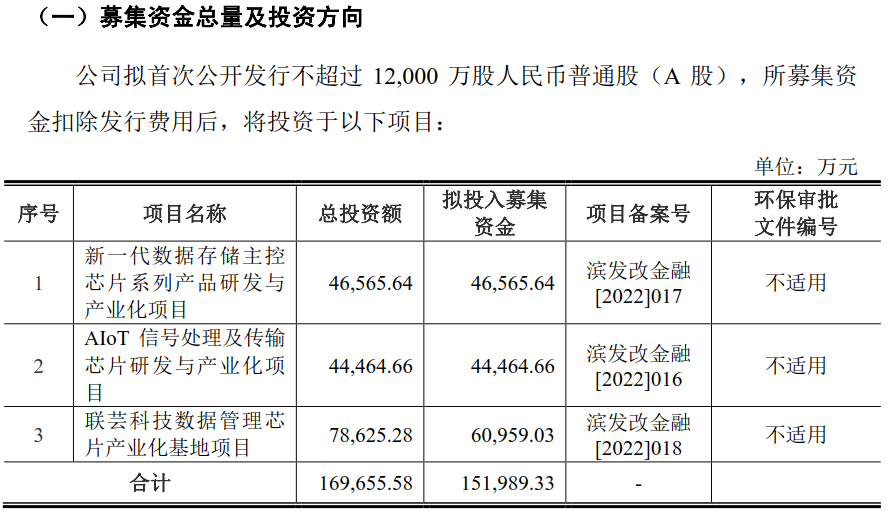

Lianyun Technology is a platform-based chip design enterprise that provides data storage master control chips, AIoT signal processing and transmission chips. For this IPO, the company plans to raise 1,519,893,300 yuan, of which 465,656,400 yuan will be used for the "R&D and industrialization project of a new generation of data storage master control chip series products"; 444,646,600 yuan will be used for the "R&D and industrialization project of AIoT signal processing and transmission chips"; and 609,590,300 yuan will be used for the "Lianyun Technology data management chip industrialization base project".

During the IPO application process, the exchange sent two rounds of inquiry letters to Lianyun Technology, questioning its position as the world's second-largest player in the market and inquiring about the company's divestment of its overseas subsidiary and related matters.

01

Divestment of overseas subsidiary, natural person C inquired

The exchange noted that Lianyun Technology's subsidiary, Bestech, controlled overseas subsidiary A through an agreement, and overseas subsidiary A held 100% of overseas subsidiary B, allowing Lianyun Technology to control overseas subsidiary B through an agreement. The shares of overseas subsidiary A were held on behalf of natural person C, the original shareholder.

On June 30, 2022, Bestech and natural person C signed a "Termination of Investment Agreement," mutually agreeing to terminate the "Equity Transfer Agreement" signed in September 2017, which stipulated that the equity and corporate legal representative's change of registration would no longer proceed. Within two months after overseas subsidiary B completed liquidation and distributed the remaining assets to its shareholders, natural person C would refund $1 million to Bestech. At the end of June 2022, other receivables of Lianyun Technology included equity transfer payments of 6.7114 million yuan, which were receivables arising from the disposal of overseas subsidiary B.

Non-operating expenses for each period of the reporting period were 5,000 yuan, 31,000 yuan, 88,200 yuan, and 704,000 yuan, respectively, primarily consisting of non-current asset write-off losses incurred from the transfer of overseas subsidiary B. Overseas subsidiary B was primarily engaged in the packaging and sales of the company's products outside of mainland China, with foreign sales revenue accounting for approximately 29.77%, 16.04%, 15.16%, and 9.48% of Lianyun Technology's revenue for each period of the reporting period. After the divestment, its customer Adata became a direct customer of Lianyun Technology, and the remaining customers were assigned to company D for service.

Three employees from the former management of overseas subsidiary B invested and established company D, becoming a buyout distributor for Lianyun Technology. From January to June 2022, the procurement amount from Lianyun Technology was 9.3278 million yuan, with an ending inventory ratio of 47.04%.

The exchange required Lianyun Technology to explain the role of natural person C in establishing the agreement control structure, the assets and business conditions of A and B when Lianyun Technology acquired overseas subsidiary A, whether natural person C actually participated in the operation of overseas subsidiaries A and B when holding the equity of overseas subsidiary A on behalf, and the various business contents and revenue composition of overseas subsidiary B.

The specific timing of the divestment of overseas subsidiaries A and B, the specific liquidators, liquidation status, and ownership of related assets, the commercial rationality of divesting the subsidiaries and natural person C refunding $1 million to Bestech by terminating the "Equity Transfer Agreement," the accounting treatment and financial impact of the divestment, the current liquidation status, the legality and compliance of the relevant liquidation process, and compliance with tax, capital, and foreign exchange regulations.

Whether the divestment of overseas subsidiary B has a significant adverse impact on the stability and sustainability of Lianyun Technology's business outside mainland China; the basic situation of company D, whether it is actually controlled by Lianyun Technology, whether there are other benefit arrangements with Lianyun Technology, the reason for the high ending inventory ratio and post-period sales realization, and whether there is stockpiling for Lianyun Technology.

Lianyun Technology stated that natural person C's role in establishing the agreement control structure was as the nominal shareholder of overseas subsidiary A, holding the equity of overseas subsidiary A on behalf of Bestech and exercising the shareholder rights and fulfilling shareholder obligations of overseas subsidiary A according to Bestech's instructions, but not actually participating in the operation and management of overseas subsidiaries A and B.

Overseas subsidiary A had not conducted any business operations since its establishment in March 2017, had no operating cash inflows, did not own/lease large assets such as real estate, and did not apply for intellectual property rights. From its establishment in April 2016 to its dissolution and deregistration in June 2022, overseas subsidiary B was primarily engaged in the packaging and sales of Lianyun Technology's SSD master control chip products outside mainland China.

Regarding the divestment of overseas subsidiaries A and B, as of June 30, 2022, Lianyun Technology had completed the divestment of overseas subsidiaries A and B, with the legal person shareholder, overseas subsidiary A, appointing the director of overseas subsidiary B as the liquidator. The liquidated assets belonged to the shareholder, i.e., overseas subsidiary A, after the liquidation was completed.

The company believed that according to the "Equity Transfer Agreement" signed by Bestech when acquiring the equity of overseas subsidiary A from natural person C, Bestech acquired 100% of the equity of overseas subsidiary A for a consideration of $990,000.

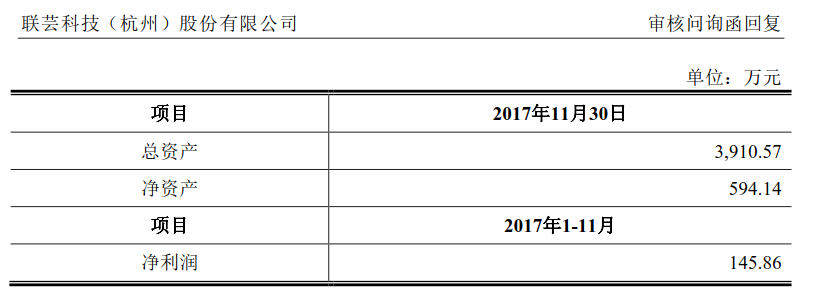

As of June 30, 2022, the net assets of overseas subsidiary B were approximately $1.0068 million, and overseas subsidiary A had no other assets besides its holding of the equity of overseas subsidiary B. Based on factors such as the net assets of overseas subsidiary B, investment costs, estimated liquidation costs, and estimated taxes for the repatriation of liquidation surplus assets, both parties, through friendly negotiation, determined that natural person C would refund $1 million to Bestech.

In November 2017, Bestech paid the equity transfer payment to natural person C for acquiring the equity of overseas subsidiary A; in June 2022, Bestech completed the divestment of overseas subsidiary B by terminating the acquisition of the equity of overseas subsidiary A held by natural person C. Based on the aforementioned investment relationship, both parties agreed to refund the investment funds according to the original investment path.

On June 30, 2022 (hereinafter referred to as the "disposal date"), Lianyun Technology transferred the 100% equity of overseas subsidiary A held by natural person C. The operating results and cash flows of overseas subsidiary A before the disposal date had been appropriately included in the consolidated income statement and consolidated cash flow statement. On the disposal date, the difference between the share of net assets of overseas subsidiary A enjoyed at the consolidated financial statement level and the disposal price was recorded in the current profit and loss. On June 30, 2022, the share of net assets of overseas subsidiary A enjoyed at the consolidated financial statement level (already including overseas subsidiary B) was 7.0313 million yuan, with a difference of 319,900 yuan from the disposal price of $1 million, resulting in a confirmed investment loss of 319,900 yuan, accounting for 0.4% of the net profit in 2022.

Lianyun Technology emphasized that the liquidation process of overseas subsidiary B was completed on February 2, 2023, and overseas subsidiary B had completed all required procedures in accordance with local laws, including but not limited to pre-approval for foreign exchange business for the repatriation of remaining assets, tax declaration, and tax liquidation, without involving tax obligations and foreign exchange management procedures in Hong Kong. The liquidation process of overseas subsidiary B was overall compliant.

According to Lianyun Technology, overseas subsidiary B was primarily engaged in the packaging and sales of Lianyun Technology's early SATA interface products, the MK6XX series and MK8XX series master control chips, outside mainland China. The customers of overseas subsidiary B were all local customers, and sales were only conducted outside mainland China. After Lianyun Technology divested overseas subsidiary B, some customers switched to direct procurement from Lianyun Technology, while others procured through Lianyun Technology's distributors, which would not have a significant adverse impact on the stability and sustainability of Lianyun Technology's business outside mainland China.

Regarding whether there were other benefit arrangements between company D and Lianyun Technology, the reason for the high ending inventory ratio, post-period sales realization, and whether there was stockpiling for Lianyun Technology, Lianyun Technology stated that company D was established in January 2022 with a registered capital of 100 million local currency. It was invested and established by three employees from the former management of overseas subsidiary B after leaving overseas subsidiary B. It was primarily engaged in the sales of electronic components such as chips.

Due to the promising market prospects for Lianyun Technology's products, company D also participated in the promotion and sales of Lianyun Technology's products outside mainland China. Since its establishment, company D has been independently operated by its team as a buyout distributor of Lianyun Technology outside mainland China, is not actually controlled by Lianyun Technology, and has no other benefit arrangements with Lianyun Technology.

02

World's second position questioned

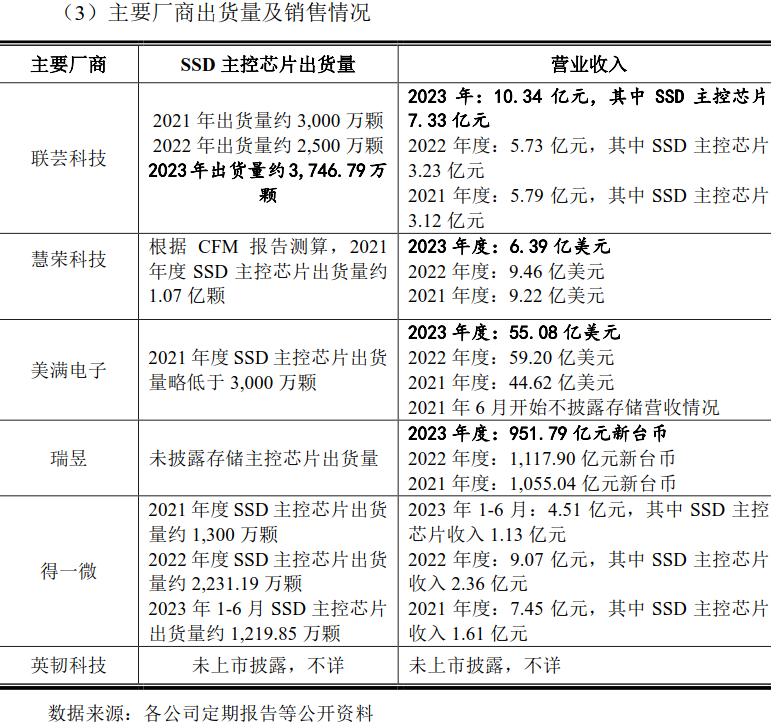

In public information, Lianyun Technology emphasized that in the independent SSD master control chip market, the company's SSD master control chip shipments accounted for 16.67% of the market in 2021, ranking second globally.

In response, the exchange required Lianyun Technology to explain its market position in different downstream markets based on the market size of SSD master control chips and AIoT signal processing and transmission chips in the aforementioned downstream application fields, the global/domestic market competition landscape, major manufacturers' shipments and sales, and whether the aforementioned ranking data were objective, accurate, and in line with actual conditions.

Lianyun Technology stated that there were subdivisions in the SSD master control chip market. In the consumer-grade SSD master control chip market, Lianyun Technology ranked second globally in terms of market share among independent SSD master control chip manufacturers in 2023.

The enterprise-grade SSD market had a high degree of concentration, primarily dominated by overseas manufacturers such as Samsung, Intel, and Microchip Technology. Lianyun Technology had a lower market share in the enterprise-grade SSD master control chip market.

The overall shipments in the industrial-grade SSD master control chip market were relatively low. Currently, the major global players in this field included Samsung, Western Digital, and other NAND particle manufacturers, as well as independent SSD master control chip manufacturers such as Silicon Motion, Phison Electronics, Marvell, Microchip Technology, and Lianyun Technology. According to data provided by China Flash Market, Lianyun Technology's global market share of industrial-grade SSD master control chip shipments was approximately 6.09% in 2023, making it an important master control chip provider in this field.

Regarding AIoT signal processing and transmission chips, Lianyun Technology stated that the company's AIoT signal transmission and processing chips were standardized products for general use. The application of AIoT in downstream fields had customer-defined characteristics, and the company did not classify them into public, industrial, and consumer grades when delivering to customers, so it was temporarily unable to count the company's market share in various fields.

The company's perception signal processing chips began mass production in 2021 and were still in their infancy. Based on the above market size calculations, the market share was less than 1%. Lianyun Technology believed that thanks to the rapid development of China's AIoT downstream applications in recent years, the market size of China's high-definition video chips had grown rapidly, and the localization rate was expected to continue to increase. While this conclusion was correct, Lianyun Technology also faced competition from more enterprises as the localization rate increased. Novatek, Ambarella, Rockchip, and Beijing Actions were some of the competitors Lianyun Technology needed to face.

In the wired communication chip field, from the perspective of the competitive landscape, the current self-sufficiency rate of Ethernet physical layer chips in China was not high, and they primarily relied on imports. Marvell, Realtek, Broadcom, Texas Instruments, and Qualcomm monopolized more than 90% of the global market share and more than 87% of the Chinese mainland market share.

Lianyun Technology currently only mass-produced Ethernet physical layer chips and was still in its infancy, with a relatively small revenue scale. According to data from the China Automotive Technology and Research Center Co., Ltd., based on the market size of global Ethernet PHY chips of 12 billion yuan in 2021, the company's revenue accounted for less than 1% of the market. In addition, A-share listed commercial Ethernet switch chip manufacturers also included Centec Networks.

The exchange required Lianyun Technology to fully explain its business layout and customer development in AIoT chips, based on downstream market demand for AIoT chips, customer concentration, R&D progress, orders in hand, etc., and whether there was any market development risk.

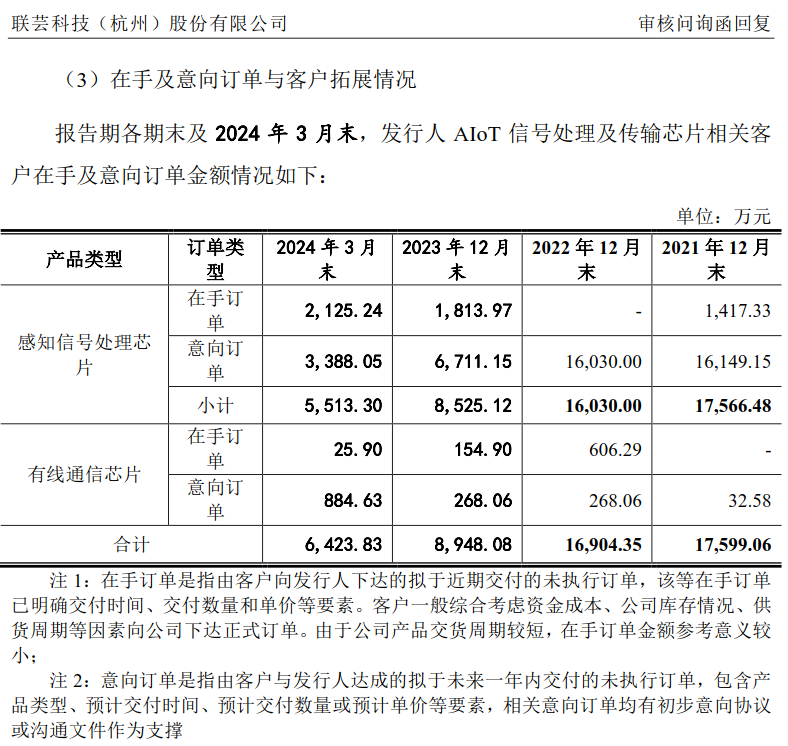

Lianyun Technology admitted that its AIoT chip business was still in its infancy, with AIoT signal processing and transmission chips beginning mass production in 2021. Therefore, there were currently few customers, and the company was rapidly expanding. It also disclosed the amount of orders in hand and intended orders for Lianyun Technology's AIoT signal processing and transmission chips at the end of each reporting period and the end of March 2024.

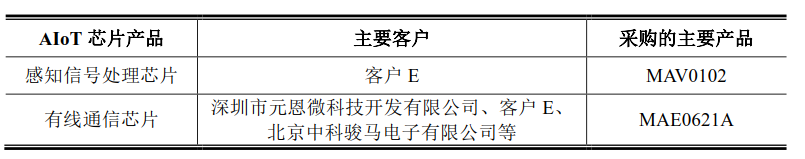

At the end of each reporting period, the amount of orders in hand and intended orders for Lianyun Technology's AIoT signal processing and transmission chips was relatively stable. Lianyun Technology's AIoT signal processing and transmission chip business was in its infancy, with five new customers added in 2023 compared to 2022, and it disclosed the current specific development of AIoT signal processing and transmission chip products.

Lianyun Technology stated that its perception signal processing chip customers were relatively concentrated, with customer E as the primary customer. Lianyun Technology had established long-term and stable cooperative relationships with its major customers. The product introduction process was strict and lengthy. Lianyun Technology continuously provided competitive products and high-quality services to its major customers, becoming a qualified supplier for them. However, if the company's major customers experienced business layout adjustments, fluctuations in operating performance, or supplier changes in the future, it would adversely affect the company's performance. The current revenue scale of the company's wired communication chips was relatively small. If customer development was ineffective in the future, it would result in a waste of the company's investments in technology research and development, product development, market expansion, and other areas, adversely affecting the company's operating performance. Regarding the subsequent subscription of Lianyun Technology, Baker Street Detective will continue to pay attention.

© THE END

All materials are from official public information and prospectuses

This article does not constitute any investment advice.

This article is originally created by Baker Street Detective and should not be reproduced without permission.

Images are sourced from public information. If there is any infringement, please contact us for deletion.