Xiaomi Group: Discounted Share Placement for Electric Car Ventures, Challenges in Elevating Smartphone Premium Image

![]() 03/27 2025

03/27 2025

![]() 541

541

On March 25, Xiaomi Group (01810.HK) announced on the Hong Kong Stock Exchange its plan to place 800 million existing shares, anticipating net proceeds of approximately HK$42.5 billion. This marks the largest fundraising since its listing. Market observers believe that these funds will likely be invested in the company's smart electric vehicle (EV) business.

Securities Star noted that Xiaomi currently incurs a loss of approximately RMB 45,000 per EV sold. Amidst the company's accelerated production capacity expansion and the intensifying competitive landscape in the new energy vehicle industry, capital reserves have become crucial for its survival.

As Xiaomi's core business, smartphone revenue recorded steady growth last year. However, shipments fell out of the top five in the market, and the company's premium strategy has had limited impact. Xiaomi is currently accelerating its AI layout but still needs breakthroughs in AI technological innovation.

Discounted Share Placement for EV Funding, Stock Price Drops to Record Trading Volume

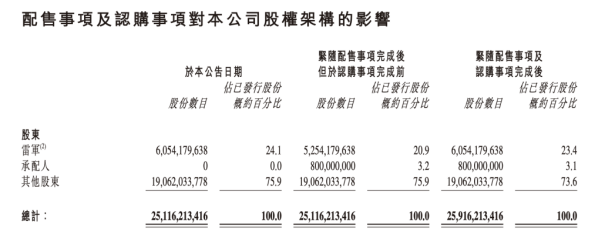

The announcement reveals that Xiaomi Group's share placement accounts for approximately 3.2% of the company's issued share capital, with a placement price of HK$53.25 per share, representing a 6.6% discount compared to the previous day's closing price of HK$57 per share.

The company also disclosed its latest shareholding structure. As of March 25, Lei Jun held 24.1% of Xiaomi Group's shares, with other shareholders holding 75.9%. Upon completion of the placement, Lei Jun's shareholding ratio will drop to 23.4%, the placees' shareholding ratio will be 3.1%, and other shareholders' shareholding ratio will decrease to 73.6%.

Xiaomi Group plans to utilize the net proceeds from this share placement for accelerating business expansion, R&D investment to bolster technological strength, and other general corporate purposes. The market anticipates that this fundraising will be directed towards the company's smart EV business.

In terms of business, Xiaomi Group delivered 136,900 SU7 new vehicles in 2024 and plans to expand factory capacity, targeting an annual delivery of 350,000 vehicles in 2025. In 2024, the company's total revenue from innovative business segments, including smart EVs, amounted to RMB 32.8 billion, with an adjusted net loss of RMB 6.2 billion, equivalent to a loss of approximately RMB 45,000 per vehicle sold. As delivery targets increase, losses may widen, necessitating financial support for capacity expansion and sustained operations.

It's worth noting that the new energy vehicle industry has entered a phase of intense competition, with capital reserves becoming pivotal for automakers' survival.

Zhang Xiang, Secretary-General of the International Intelligent Transport Technology Association and Visiting Professor at Huanghe Science and Technology College, told Yicai that the current new energy vehicle industry is undergoing a reshuffling phase, with many players still focusing on intense price competition. As the industry matures, the number of new energy automakers will consolidate, and the current situation of dozens of automakers will not persist. Therefore, some automakers may still be eliminated by 2025.

Another significant use of Xiaomi Group's share placement funds is for R&D investment. In 2024, the company's R&D expenditure increased by 25.9% year-on-year to RMB 24.1 billion, mainly due to increased expenses related to innovative businesses such as smart EVs. Additionally, Lei Jun, Xiaomi's founder, Chairman, and CEO, stated at the Xiaomi 15 Ultra launch event that the company's R&D budget will exceed RMB 30 billion in 2025.

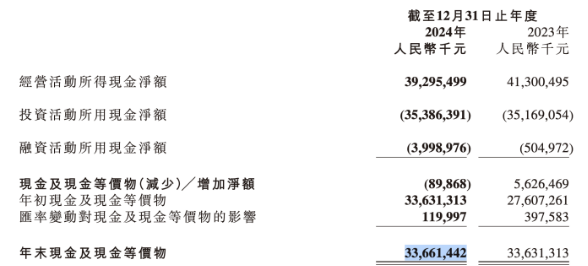

As of the end of 2024, Xiaomi Group's cash and cash equivalents amounted to RMB 33.7 billion. Considering the company's business expansion and R&D investment, its on-book funds may not meet these demands.

Securities Star noted that after the announcement, Xiaomi Group's stock price fell at the opening on March 25. By the closing bell, the company's stock price was HK$53.4 per share, down 6.32%, with a trading volume of HK$71.8 billion, setting a record high.

Shipments Fall Out of Top Five, Limited Effectiveness of Premium Strategy

In 2024, Xiaomi Group achieved revenue of RMB 365.9 billion, an increase of 35% year-on-year; adjusted net profit for the year reached RMB 27.2 billion, an increase of 41.3% year-on-year.

Focusing on Xiaomi's smartphone business, in 2024, the company's smartphone revenue was RMB 191.8 billion, and smartphone shipments were 169 million units, both achieving varying degrees of growth year-on-year. Meanwhile, the average selling price (ASP) of the company's smartphones increased from RMB 1,081.7 per unit last year to RMB 1,138.2 per unit in 2024, an increase of 5.2% year-on-year.

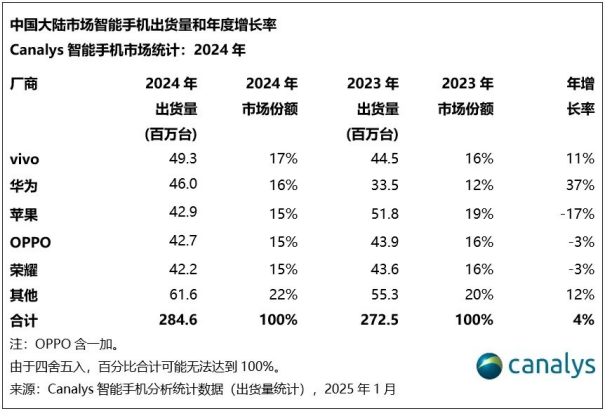

Securities Star noted that although Xiaomi's smartphone business performed well on the performance level, in terms of global shipments, the company fell out of the top five rankings. According to Canalys' data on annual smartphone shipments in mainland China in 2024, the top five vendors were vivo, Huawei, Apple, OPPO, and Honor, with Xiaomi failing to make the list.

Behind this phenomenon is Huawei's strong comeback in 2024, which altered the competitive landscape, causing Xiaomi, which was once ranked fifth, to drop out of the rankings.

In the smartphone business, Xiaomi, known for its cost-effectiveness, has been implementing a premium strategy in recent years. The company mentioned in its 2024 financial report that shipments of its "premium" smartphones priced above RMB 3,000 accounted for 23.3% of its total shipments, an increase of 3 percentage points year-on-year. In the mainland market, Xiaomi's market share in the 4,000-5,000 RMB price segment reached 24.3%.

However, industry commentator Zhang Shule pointed out that Xiaomi's so-called "premium" smartphones, in the context of its overall product line, are more akin to high-end replacements within the mid-range segment. In his view, compared to Huawei, which has demonstrated a premium stance both in terms of brand and phone form factor, Xiaomi still struggles to provide users with a clear premium feeling. At least compared to other competitors, the difference is not significant.

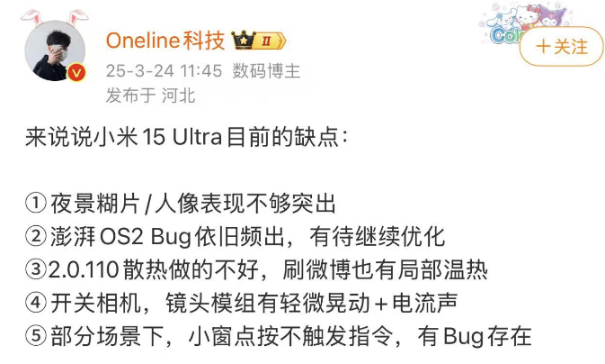

Securities Star noted that in February this year, Xiaomi 15 Ultra entered the high-end market with a starting price of RMB 6,499. While maintaining flagship-level performance, this phone is equipped with a Leica quad-camera lens system, providing users with a top-tier imaging experience. However, some digital bloggers have reported five major issues with the phone, including blurry night scenes, inadequate heat dissipation, and frequent bugs in the Pengpai OS system.

Additionally, in terms of gross margin indicators, the implementation of the premium strategy has not improved the gross margin of Xiaomi's smartphone business. In 2024, the business's gross margin dropped from 14.6% in 2023 to 12.6% in 2024. The company attributed this to rising prices of core components.

Increasing Investment in AI Development, Efforts Still Needed for Multi-scenario Ecosystem Collaboration

China's smartphone market has fully entered an era of stock competition, with major vendors viewing AI technology as the key to breaking the deadlock.

Since 2024, smartphone vendors have shifted their focus in the AI field from blindly competing on large model parameters to more specific application scenarios. Guo Tianxiang, Research Manager at IDC China, believes that vendors are now attempting to push AI phones into the second stage, where future phones will utilize built-in localized edge models to provide better personalized services to users, including information integration, correlation, and processing.

Currently, Xiaomi Group is gradually applying AI capabilities to products such as smartphones, smart EVs, and smart homes, empowering its "human-car-home ecosystem" strategy. At the same time, the company is continuously increasing its investment in AI. During the 2024 conference call, President Lu Weibing stated that the company would invest approximately one-quarter of its total R&D budget, around RMB 7 billion to RMB 8 billion, into AI.

However, some analysts pointed out that Xiaomi Group has not yet found a clear solution for AI innovation capabilities. The AI functions carried by Xiaomi 15 flagship phones are still limited to basic levels such as writing and voice recognition. In comparison, Honor's Magic OS 9.0's YOYO intelligent assistant can already order takeout through voice commands, while OPPO's Find X8 Pro provides a one-click screen inquiry function through ColorOS 15, solving users' search needs.

Moreover, Xiaomi's Super XiaoAi AI assistant has also experienced malfunctions. During Xiaomi's annual summary live stream at the end of last year, when Lu Weibing demonstrated Xiaomi phones' Super XiaoAi function, issues such as failed activation, no response to voice commands, and inability to post on Weibo via voice were encountered, reflecting deficiencies in intelligence, stability, and response speed. Against this backdrop, Xiaomi Group still needs to make efforts to build a truly intelligent and collaborative multi-scenario ecosystem. (This article was originally published on Securities Star, Author|Li Ruohan)

- End -