2024 for Electronic Component Distributors: Navigating Success and Challenges

![]() 05/22 2025

05/22 2025

![]() 616

616

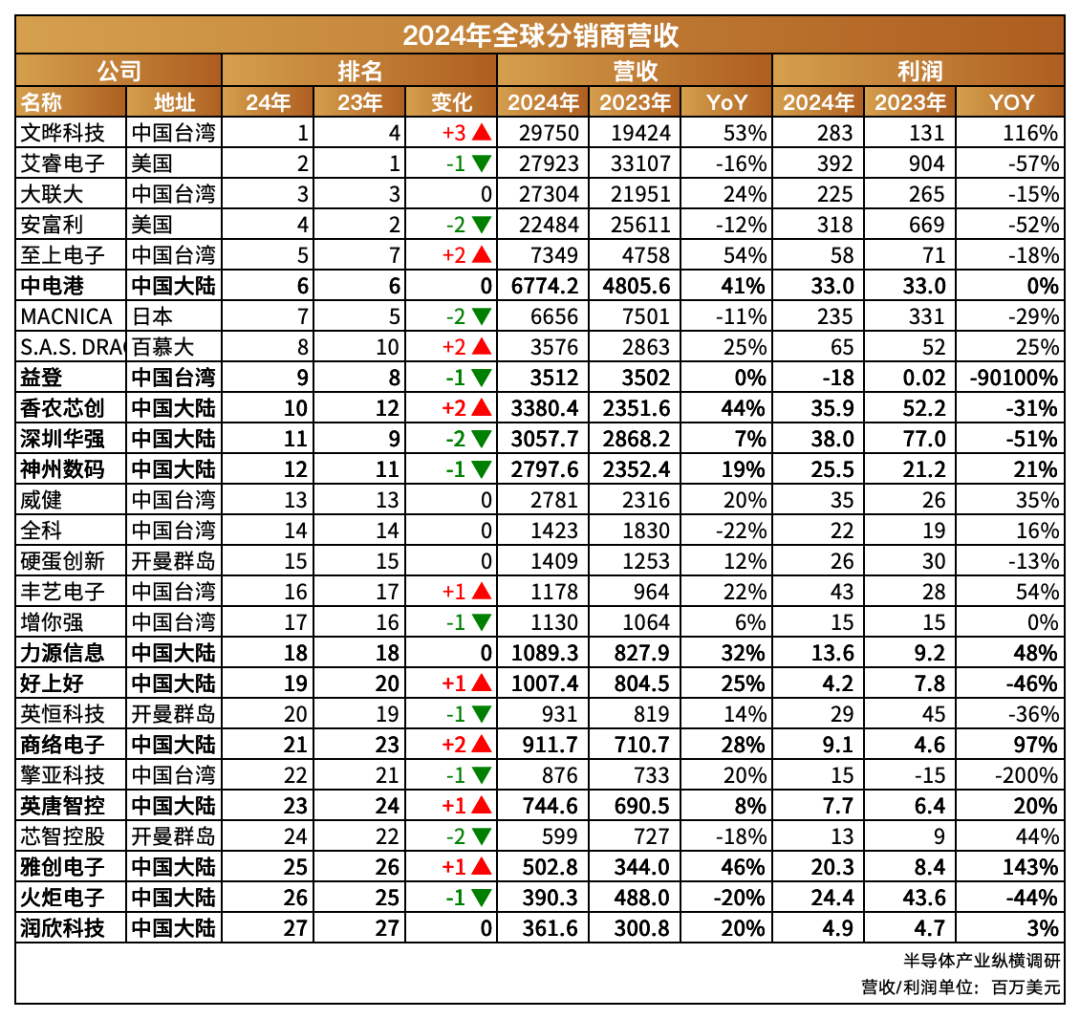

The global semiconductor market is projected to reach $635.1 billion in 2024, marking a 19.8% year-on-year increase. According to Semiconductor Industry Verticals, the combined revenue of 27 listed electronic component distributors amounted to $159.9 billion in 2024, accounting for roughly a quarter of the entire semiconductor market. Notably, the combined revenue of Mainland China's semiconductor distributors hit $21 billion, signifying a 27% year-on-year growth.

Semiconductor Industry Verticals analyzed the receivables of 27 global distributors in 2024 and found that with the semiconductor market's recovery, electronic component distributors stand at a pivotal juncture.

Among the global top 5, WPG Holdings stands alone in achieving profit growth. However, it's worth noting that in terms of profit, WPG still trails Synnex, even after factoring in the $3.8 billion cost of WPG's acquisition of Future.

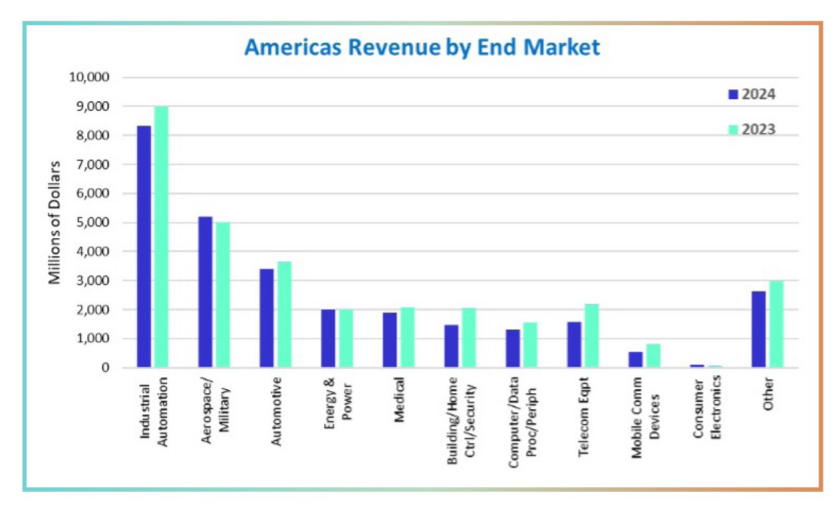

The financial performance of American companies reveals that 2024 was a challenging year for them. According to ECIA statistics, the combined revenue of 50 American electronic component distribution companies worldwide declined from $126.5 billion in 2023 to $124 billion in 2024, a 2.0% drop. Sales in the Americas region fell even more sharply, from $31.4 billion in 2023 to $28.5 billion in 2024, a 9.3% decrease.

Source: ECIA

In terms of products, the demand for semiconductors and passive components has significantly waned. As the primary business areas of the top five American distributors, these segments have been hit hardest. Semiconductors remain the largest product category but have seen their market share drop from 49.8% in 2023 to 46.4%. Conversely, the power and battery category has witnessed rapid growth, reaching 20.8%, while electromechanical components grew by 4.4% and interconnect components by 0.9%. Passive components and computer/system products also showed some growth, albeit at a slower pace.

Notably, these American companies experienced a 9.1% increase in revenue in the Asia-Pacific region, indicating the region's market demand recovery in 2024.

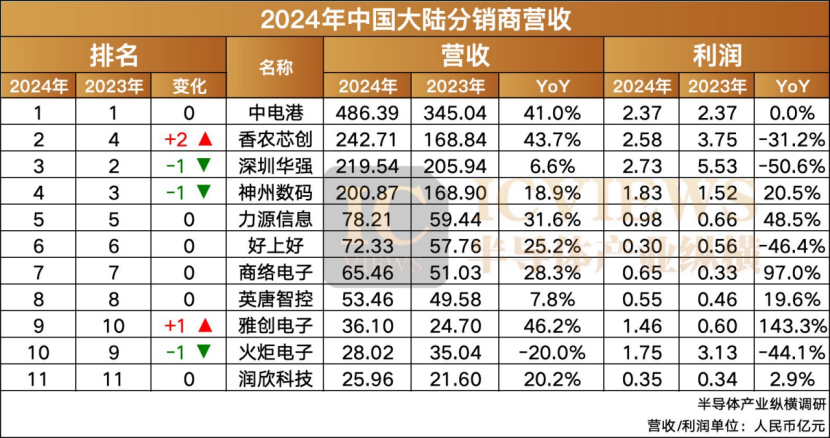

In 2024, the top 10 electronic component distributors in Mainland China generated a total revenue of RMB 148.56 billion, a 27% year-on-year increase, significantly outpacing the growth rate of global distributors.

For the Mainland China component distribution market, memory and AI-related devices have emerged as dual engines of growth. Companies like CEC Port, represented by its server storage solutions and SK Hynix DDR5, have benefited from investments in AI computing power. In Q2 2024, server demand propelled XLCX's non-GAAP profit to a record high. Simultaneously, localization efforts are accelerating. Cloudchip's domestic chip database now covers over 300 manufacturers. Yachuang Electronics' automotive-grade analog chips and OmniVision's CIS sensors continue to gain market share in the new energy vehicle sector. Industry research indicates that the proportion of domestic components in distribution procurement increased from 18% in 2022 to 27% in 2024.

CEC Port led the pack with a revenue of RMB 48.639 billion (up 40.9% year-on-year), though its net profit has remained stable at RMB 237 million for two consecutive years. CEC Port attributes its revenue growth to the recovery of the consumer electronics market and the surge in AI investments, which drove an increase in memory and processor shipments in 2024. Regarding inventory changes, as of the end of 2024, CEC Port's inventory book value stood at RMB 10.694 billion, accounting for 203.99% of net assets, an increase of RMB 2.046 billion from the end of the previous year.

XLCX climbed two spots in the rankings in 2024. According to its annual report, the growth of its business was fueled by the addition of the AMD product line. Additionally, XLCX commenced the development and construction of its own brand, "Hyper Memory," in 2023. The company has completed R&D and trial production of enterprise-grade DDR4, DDR5, and Gen4 eSSD, which boast excellent performance and are utilized in cloud computing storage (data center servers) and other fields. Currently, it has completed certification and adaptation work for several major domestic server platforms and has officially entered mass production.

Yachuang Electronics achieved over 46% growth in 2024, benefiting from various segments of the automotive intelligent driving market, including smart cockpits, ADAS-related automotive cameras, LiDAR, intelligent connectivity, autonomous driving, and wire-controlled chassis. Meanwhile, its self-developed ICs have indirectly established a stable cooperative relationship with Toyota, a giant in the Japanese automotive industry, and its products have successfully entered Toyota's supply chain system, achieving sales of over ten million yuan during the reporting period. Additionally, the company is vigorously expanding its business in the European and Indian markets, forming partnerships with renowned automotive component manufacturers like Magneti Marelli and Visteon, and achieving small-batch shipments.

Among electronic component distributors in Mainland China, Digital China's microelectronics business reached a scale of RMB 20 billion in 2024. While driving the rapid recovery of the company's overall distribution business, this segment has accelerated the layout of domestic semiconductors, introducing top domestic brands such as Hisilicon and BOE. It has also continuously improved its microelectronics business layout around four categories: controllers, storage, screens and drivers, and discrete devices. Simultaneously, it is committed to building an application electronics industrial ecosystem service platform, forming an industrial ecosystem in the field of application electronics that includes a professional information pool, resource database, and private traffic pool within the circle.

In 2024, memory, logic chips, and microprocessors achieved positive growth. Memory products like HBM, high-performance DRAM products, and server SSDs saw significant sales growth driven by demand from large AI models, with memory product growth reaching 75.6%, making it the fastest-growing category among semiconductor products. However, product homogeneity is severe in this market, and gross margins generally fall below 5%. For distributors, continuously expanding their scale is necessary to offset price fluctuation risks. In 2023, a leading distributor witnessed its net profit shrink by 30% due to a sharp drop in memory prices, with inventory impairment losses accounting for 5% of revenue. GPUs, FPGAs, and ASICs also experienced rapid growth in logic chip products due to increasing demand for computing power. The market sizes of analog chips, optoelectronic devices, sensors, and discrete devices experienced slight declines.

Synnex stated that the rapid popularization of generative artificial intelligence (AI) has significantly increased the demand for related components such as AI servers, power supplies, PCs, laptops, and Android phones, prompting customers to actively stock up. Premier Farnell, a distributor from Taiwan, China, noted that with the advent of the post-PC era, the growth rate of the traditional desktop computer and peripheral device market has dropped to single digits. Emerging fields like smart homes, the Internet of Things (IoT), and automotive electronics are on the rise, and the key to distributors' success has shifted to capturing "killer applications" and making advance layouts for related core components.

Facing high-threshold products such as automotive-grade chips, industrial sensors, and AI accelerators, providing customized technical support will become a crucial capability for distributors to differentiate themselves. Some distributors have indicated that in this sector, gross margins can reach 15% to 20%, but this depends on the technical team's capabilities and accurate market predictions. Missteps, such as premature layout of AR/VR chips, may lead to inventory accumulation and cash flow disruptions.

In the first quarter of 2025, global semiconductor sales reached $167.7 billion, a 18.8% year-on-year increase but a 2.8% quarter-on-quarter decrease, showcasing a characteristic of "strong year-on-year, weak quarter-on-quarter." March sales amounted to $55.9 billion, a 1.8% month-on-month increase, marking the 11th consecutive month of year-on-year growth exceeding 17%. The American market, with a 45% year-on-year growth rate, served as the primary driver, while China (7.6%) and Asia-Pacific/Other Regions (15.4%) also achieved positive growth. John Neuffer, president of the Semiconductor Industry Association (SIA), pointed out that despite the seasonal decline in quarter-on-quarter sales, demand remains high, particularly in areas such as data centers and AI servers, where demand continues to expand.

In the digital logic chip sector, AMD achieved a net profit of $709 million, a 476% year-on-year increase, while Qualcomm's net profit reached $2.812 billion, a 21% year-on-year increase. In the memory chip sector, despite Samsung's memory business revenue declining by 17% month-on-month, Micron's revenue reached $8.053 billion, a 38% year-on-year increase, and SK Hynix's net profit reached KRW 8.11 trillion, a 323% year-on-year increase. In analog chips, Texas Instruments (TI) reported a net profit of $1.179 billion, a 7% year-on-year increase. In the discrete devices sector, Infineon and STMicroelectronics (ST) combined for revenue of EUR 3.591 billion. Notably, the European and American markets are gradually recovering, with WPG's subsidiary Future achieving positive quarter-on-quarter growth in the first quarter. Among them, its industrial control business grew by approximately 6%, marking the first positive growth since 2024, indicating that industry inventory adjustments are nearing completion and demand is gradually recovering.

With the continuous growth of the global semiconductor market, particularly the rapid development of the AI server and data center sectors, distributors are poised to welcome more business opportunities. To capitalize on this trend, distributors must strengthen inventory management and supply chain collaboration for AI-related chips (such as GPUs, Ethernet, and HBM chips) to meet downstream customer needs.

Secondly, as market demand grows, the stability of the supply chain becomes increasingly critical. Distributors need to establish closer cooperation with suppliers to address potential supply shortages and delivery delays. Additionally, distributors must enhance their technical support capabilities to assist customers in better designing and optimizing products, especially in the fields of AI and high-performance computing.

The rapid market growth may also lead to intensified competition. Distributors need to continuously improve their service quality and customer response speed to maintain a competitive edge. The value chain position of semiconductor distributors is undergoing rapid restructuring.

Leading companies are exhibiting trends and advantages of ecologicalization, building barriers through "products + services + ecosystems" by adding products, launching their own brands, and establishing developer communities. In 2024, DigiKey added over 1.1 million parts and 455 suppliers. DigiKey aims to expand the market by introducing new products from innovative suppliers. In 2024, DigiKey achieved significant expansion in terms of product variety and the number of suppliers, driving a record number of customers. Synnex continues to expand its role as a traditional IC and component distributor, strengthening supply chain management capabilities through the "Logistics as a Service" (LaaS) model and optimizing supply chain services using information technology.

Simultaneously, with the rapid evolution of technology, distributors must strengthen their technical training and market insights to promptly provide customers with the latest product and technical information. Small and medium-sized manufacturers can enhance their specialization and focus on niche markets, such as the RISC-V ecosystem and HBM memory, to exchange premium space for technical depth.