Behind the Blockbusters: Xiaomi vs. Huawei - Who Faces Greater Risk?

![]() 07/01 2025

07/01 2025

![]() 750

750

Three years ago, comparing Xiaomi and Huawei in the automotive race would have seemed implausible.

But after 2024, everything shifted. In the latter half of the new energy vehicle (NEV) era, the protagonists and the playing field have changed. Technology and blockbusters are abundant, but user trust remains scarce.

AITO gained popularity, with SU7 and YU7 skyrocketing in sales. One leverages the platform, the other the brand.

Huawei partnered with Thalys to launch AITO, claiming the top spot in domestic mid-to-high-end smart cars. EnjoyAI S9 has been the sales champion for pure electric vehicles priced above 400,000 yuan for seven consecutive months, followed by WisdomAI and HonorAI. Huawei swiftly transforms partner brands into "Huawei cars" through HarmonyOS, ADS intelligent driving, and Smart Selection channels. Whether it's JAC or BAIC, they all become Huawei once they join.

On the other hand, Xiaomi is even more explosive. SU7 received over 88,000 orders within 24 hours, and YU7 surpassed 200,000 orders within three minutes of its launch, approaching 300,000 within an hour, breaking Tesla Model 3's global record for first-day sales. Lei Jun proudly stated that Xiaomi YU7 has created a new miracle in China's automotive industry.

While Huawei leverages its platform to elevate brands, Xiaomi defines its platform through its brand. Different paths, yet similar results: both are blockbusters.

This is not coincidental but the true starting point of the second half of the NEV era. The two most influential non-traditional automakers are using opposing approaches to answer the same question: in the era of smart cars, who can truly retain users?

-Both are blockbusters, but with different logics-

Huawei cars gained popularity upon launch, living up to the phrase "far ahead." Xiaomi cars have directly stunned competitors.

Everyone is asking, why are they blockbusters?

From breaking into the high-end market to expanding in the mid-range, both achieved individual car success. Their paths seem similar, but their essential strategies are entirely different.

In Huawei's model, users are not buying products from a specific automaker but rather Huawei's full suite of offerings. From viewing cars in Huawei stores, to interacting with HarmonyOS, experiencing ADS intelligent driving, to after-sales service and OTA updates, users are immersed in the Huawei ecosystem from start to finish. Partner brands are more like manufacturing collaborators. Thalys was an early success story, while BAIC and JAC are more like OEM shadows with minimal presence.

But the result is the same: in users' eyes, it's not the XXM9 but the Huawei M9. Even highly successful models like EnjoyAI S9 struggle to shake off the dominant Huawei label. System empowerment can indeed boost sales, but whether partner brands can truly stand on their own remains questionable.

Xiaomi, on the other hand, insists on brand dominance, with almost all resources built around the core concept of Xiaomi cars. The brand tells the story, accounts connect scenarios, Mijia enhances the experience, and the launch rhythm is highly unified. The platform, supply chain, and technical architecture are all incorporated into the logic of brand sovereignty management.

The recent verbal spat between Lei Jun and Yu Chengdong was a fierce collision between these two logics.

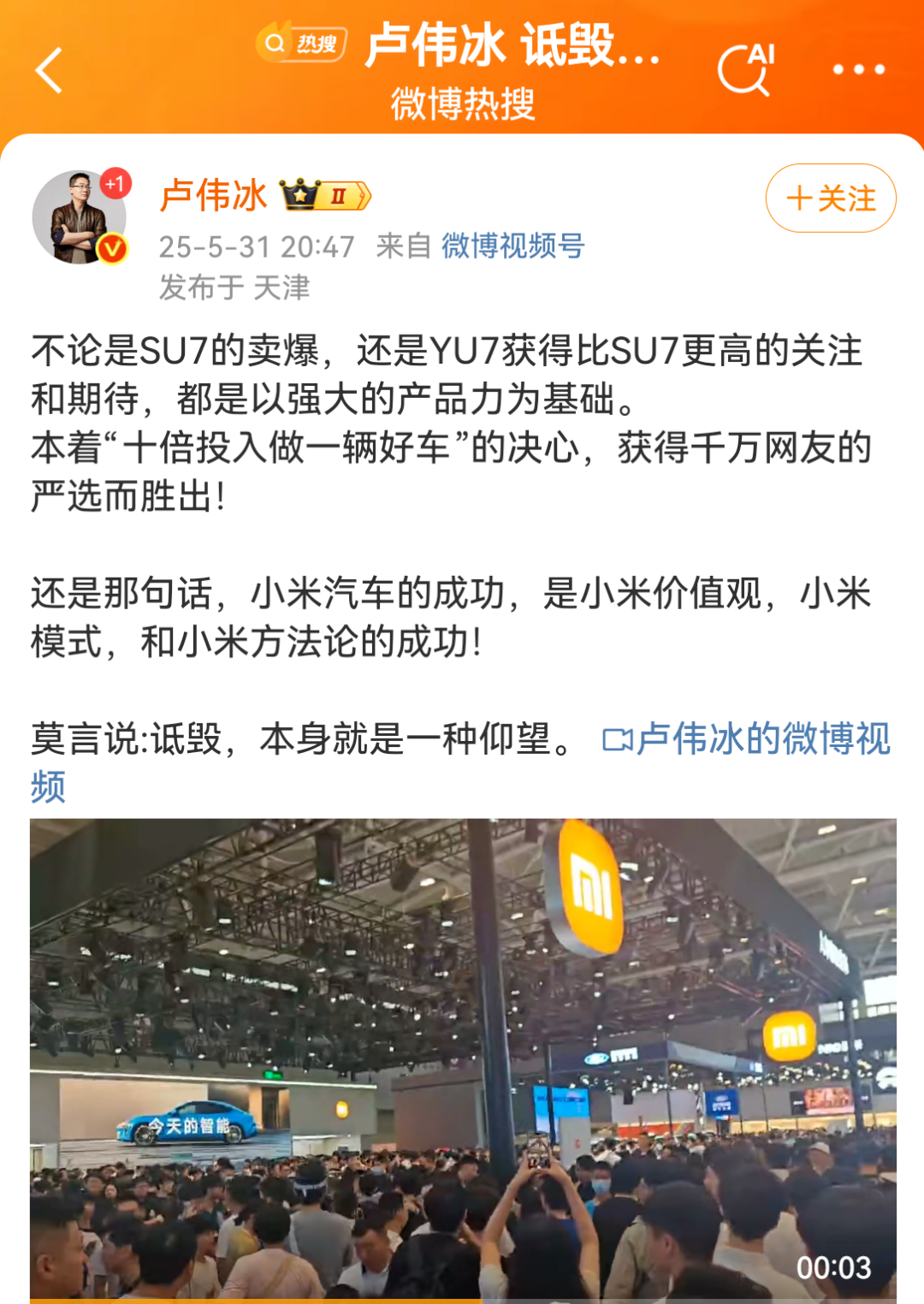

At this year's Guangdong-Hong Kong-Macao Auto Show Forum, Yu Chengdong hinted that some new brands had become blockbusters with just one car, but their quality might not be good, and they still sold better than Huawei. This remark stirred up controversy, and Xiaomi quickly retaliated. Lei Jun live-streamed a car test, Lu Weibing sarcastically wrote that "slander itself is admiration," and Wang Hua engaged in a PR battle on social media with phrases like "sharp-tongued, thick-skinned, and hollow inside."

This is not the first confrontation between the two sides but the first direct confrontation on the main battlefield of automobiles.

Huawei aims to set the standard for smart cars, using Harmony SmartRide, ADS, and the Smart Selection model to set rules and build systems, leading a group of automakers to debut jointly. Xiaomi's approach is closer to consumer electronics logic, not rushing to set industry standards but rather penetrating the market with blockbuster products, retaining users with a unified ecosystem, and challenging existing rules driven by pain points.

Essentially, this battle is not about product collisions but about the struggle for discourse power.

Who defines the user experience of "smart cars"?

Who has the right to interpret traffic?

Who decides the criteria for a good car in users' minds?

Huawei defines the experience but weakens brand independence. Xiaomi emphasizes brand memory but makes the technology platform invisible. You might remember HarmonyOS but not who made the car. Or you might know you're a Xiaomi car owner but not who provides the intelligent driving system.

This is not ambiguity but a choice.

Xiaomi chooses to start with brand perception, connecting the Mijia ecosystem, account system, and voice control into a closed-loop experience—although underlying intelligent driving still relies on suppliers, Xiaomi has solidified its brand experience through technology in interactive and car-home interconnection, which are perceivable to users. Huawei, on the other hand, chooses full-stack technology integration, standardizing and systematizing all experiences, sacrificing the visibility of partner brands in exchange for a highly efficient closed loop.

Which of these two models is more efficient and which has stronger stickiness? It's hard to say, but what's certain is that:

Users buy AITO and EnjoyAI because of the Huawei brand, but what truly keeps them in the car are Huawei's ecosystem, including HarmonyOS, ADS intelligent driving, and Smart Selection stores.

When users buy Xiaomi, there is certainly emotional identification, but more because they are already part of the Xiaomi universe—phones, appliances, routers, and now a car.

Lei Jun, a powerful IP, is also a significant entry point for Xiaomi cars. This entrepreneur, who established strong trust in the Internet era, is using his personal credibility to endorse Xiaomi's entire automaking endeavor.

-Who has more staying power?-

From SU7 to YU7, from AITO to EnjoyAI, both Xiaomi and Huawei have proven their ability to create blockbusters. But in the second half of the NEV era, blockbusters are just the stepping stone; the ecosystem is the moat.

For Xiaomi, SU7 was a phenomenal brand breakout, and YU7 validated the thickness of the user pool and brand appeal. But after the frenzy, the real challenge has just begun.

As a newcomer to automaking, Xiaomi's problem lies not in its explosive power but in its system capabilities to support those explosions. Currently, intelligent driving is not fully in-house developed and still relies on external platforms.

Xiaomi started late in automaking but has not been slow in building its network. By May 2025, Xiaomi's automotive service outlets had covered 88 cities with 153 locations and 298 sales outlets, with an additional 37 to be added in June, basically catching up with NIO and XPeng's initial levels.

Although the foundation has been quickly established, the system has not truly run smoothly. Xiaomi's car delivery rhythm is polarized, with SU7 achieving over 10,000 deliveries in 43 days through intense scheduling, but the YU7 series' delivery cycle is generally over six months, with the longest reaching nearly 60 weeks, exceeding industry warning lines. Competitors have started to target this weakness, with NIO and ZEEKR reportedly initiating interception efforts.

The service system is also struggling to handle the pressure brought by the surge in orders, with Xiaomi's after-sales complaint rate reaching 37%, far above the industry average of 15%.

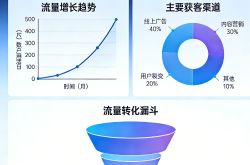

On the surface, Xiaomi fought a beautiful battle with fan dividends. With 50 million MIUI users as a natural seed pool, the pre-sale conversion rate is five times the industry average. Lei Jun's live stream attracted 39 million viewers, and customer acquisition costs are only one-tenth of those of new forces.

But enthusiasm does not equal loyalty. Within 72 hours of SU7's launch, the order lock rate was only 35-40%, with a cancellation rate as high as 40%. With the product and service system still imperfect, traffic is always a double-edged sword. The high expectations set by fans can easily turn into a fuse for a reputation explosion when a detail goes awry. This has already been reflected in SU7, causing Lei Jun, who is always on top of trends, to remain silent for an extended period.

That's why Lei Jun frequently goes down to talk about, test, and respond to cars, even directly counterattacking after Yu Chengdong's sarcasm. This is both to escort the brand and to declare to the outside world that Xiaomi's automaking is not a whim but a long-term battle with structured investments.

The closed ecosystem is both Xiaomi's opportunity and its greatest pressure. Mijia integration, account interoperability, and system integration are imaginative, but to translate them into real user retention requires time, organizational capabilities, and stronger product extensions. Enthusiasm can create a car, but only a system can build a company.

Huawei's problem is the opposite.

Huawei does not lack a system. With HarmonyOS, ADS intelligent driving, Smart Selection stores, and brand influence, AITO's approach can almost be copied and pasted—EnjoyAI has it, HonorAI has it. This model is highly efficient and closed-loop, with each car resembling a standardized and replicated system terminal.

But the problem is that while the cars are popular, the brands are not. Beyond AITO, EnjoyAI and HonorAI are almost swallowed by the Huawei label. Under Huawei's full-stack empowerment, partner automakers increasingly resemble white-label OEMs for Huawei cars. Cars may sell, but brands may not survive, ultimately turning partners into full-time tools.

Xiaomi has yet to cash in on its ecosystem, while Huawei has cashed in too quickly, suppressing the growth space of its own brands. Both models are pushing the extremes and approaching their respective critical points.

Whoever can retain users and keep them paying for the lifestyle you provide will be the future leader.

As the Mi Fan effect wanes, does Xiaomi have the organizational capability to take on the heavy burden of ecosystem fulfillment? When brand recognition is lacking, can Huawei's cooperation system still be maintained?

Brands and ecosystems will ultimately converge.

Xiaomi and Huawei, despite appearing to take different routes, are essentially competing for the digital hub of users' lives.

The ecosystem determines how many devices you can connect horizontally and how many scenarios you can integrate. The brand determines whether users are willing to identify with you, stay, and even influence others to join you.

In the end, what will survive is not the one who hosts the best press conferences or stacks the most parameters but the brand system that makes users accustomed to aligning its product rhythm with their lifestyle rhythm.

Just like Apple, which doesn't sell hardware but an ecosystem. And Tesla, which doesn't sell cars but a lifestyle. In the second half of the smart car era, this is what's being competed for.

So today's collision between Huawei and Xiaomi is truly about competing for the sovereign entry point to future smart living.

Huawei continues to advance on its current path and may not need to truly self-operate to create a de facto "Huawei Car" where users only remember Huawei and not the automaker.

And if Xiaomi completes its in-house intelligent driving research, service closed loop, and factory system construction, it may grow into the next "ecological automaker."

In the second half of the NEV era, the competition is no longer just about making cars but also about who can build a stronger community.

Images sourced from the internet. If infringement occurs, please contact us for deletion.

-END-