Growth Rate Decline in Six Months: Is Extended Range the Savior of Sales?

![]() 07/03 2025

07/03 2025

![]() 689

689

The first half of the year has drawn to a close, and automakers that were once celebrating their successes are now abandoning the one-trick pony approach.

As data from major automakers continues to be released, it's more thrilling than checking college entrance exam scores. After all, the college admission rate is not low, with an overall admission rate of 79.65% in 2024. Relevant institutions have predicted that the undergraduate admission rate in 2025 will reach around 53%. While college entrance exam scores mainly determine future opportunities, in the fiercely competitive automotive industry, changes in sales figures can even determine survival.

Who is celebrating as the first half of the year comes to an end? Huawei HarmonyOS Smart Driving, Xiaomi, XPeng, and AITO are constantly setting new records above the 300,000 yuan mark. Xiaomi set a record for orders in the Chinese auto market, and XPeng surpassed its 2024 annual sales in just half a year, with a year-on-year growth rate of over 300%.

However, apart from a handful of automakers, most choose to quietly make money or not celebrate prematurely. I won't list them all here because there are many names on the list, including BYD, Geely, Chery, Great Wall, Changan, SAIC, Haval, Lantu, Zeekr, Lynk & Co., and others.

BYD is naturally quietly making money, Chery is aiming for an IPO, and Geely has raised its full-year sales forecast to 3 million vehicles to boost confidence in capital and other aspects. Li Auto and NIO face similar trends and need to maintain their growth momentum.

But among them, if we filter through, the conclusion will actually be very different from the beginning of 2025, because the one-trick pony approach is really gone. After Lei Jun's Xiaomi YU7 exploded in sales, investors in major automakers have unanimously put forward the same requirement: "Force automakers to break out of their circle and provide emotional value."

Extended Range is a Breakthrough, but Not a Savior

At the end of 2024 and the beginning of 2025, many automaker management teams judged that extended range would be the savior of sales. Li Bin couldn't avoid the question at every communication session for launch events, "When will you make extended range vehicles?"

The reason is that Zeekr and XPeng are not only focusing on pure electric vehicles, and the race track they are on is getting smaller and smaller. Moreover, on the first day of the second half of 2025, IM Motors also quickly updated its extended range plan. Of course, Li Bin must have his reasons, which could be that battery swapping is better than extended range, pure electric is the future, or it could be Great Wall Motors' insistence on "never doing extended range," or he has other judgments.

As data for the first half of 2025 is released, new variables have emerged in extended range technology, which was previously considered a sales breakthrough.

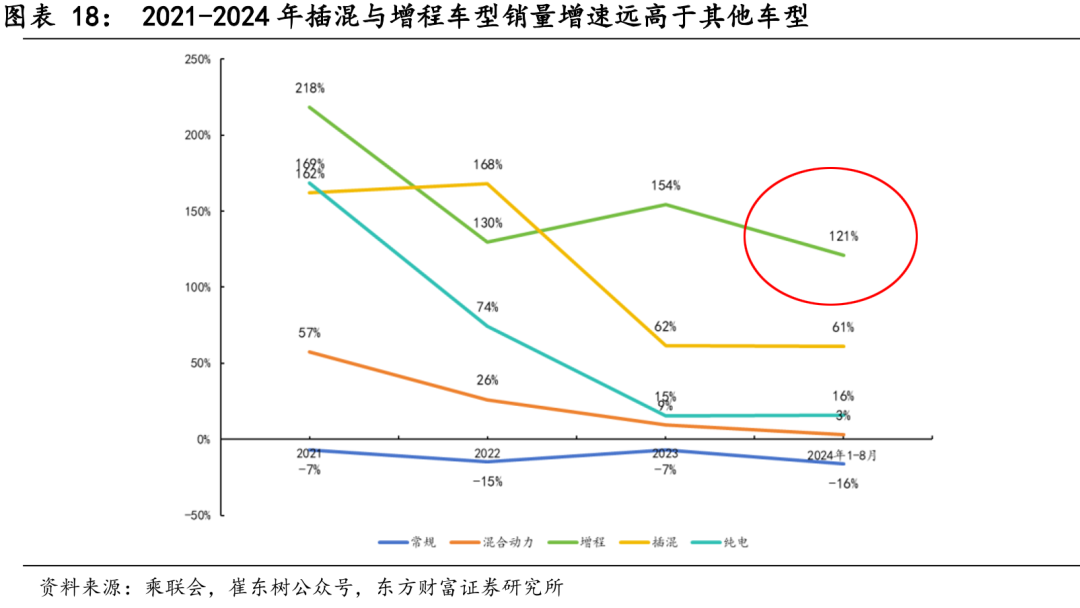

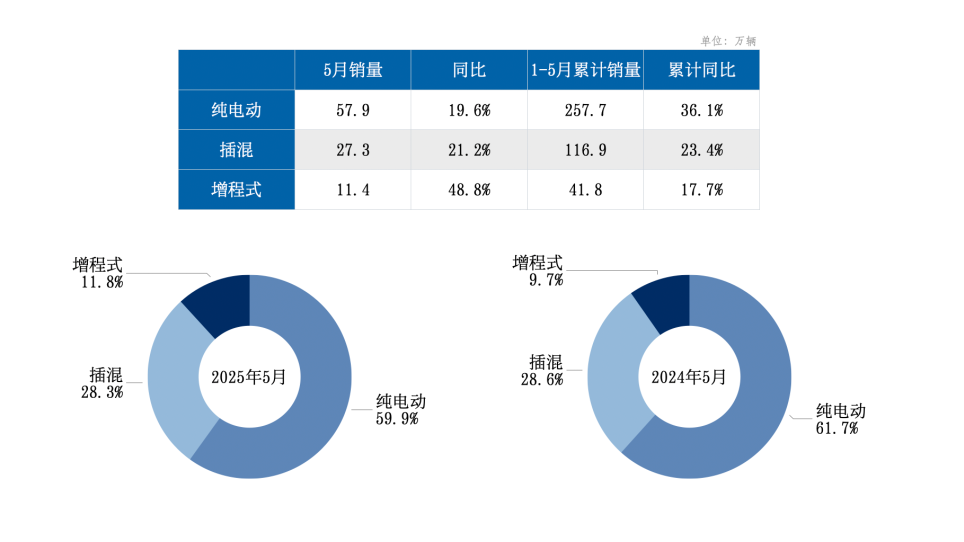

With the addition of more players, the growth rate of extended range is declining. In the first half of 2024, sales of passenger vehicles with extended range were 469,000 units, with a year-on-year increase of 124.2%. In the second half of 2024, sales of extended range vehicles were approximately 520,000 units, with a year-on-year increase returning to within 100%, around 99%.

Statistics for the first half of 2025 will take some time, but looking at data from January to May, sales of extended range technology were approximately 980,000 units, with a year-on-year increase of 82%.

Technological development follows a pattern and has limits, and extended range is now experiencing the same path as pure electric and plug-in hybrid vehicles have already traveled.

Starting from 2021, the emergence of BYD DM-i drove the surge in plug-in hybrid sales. The growth rates in recent years are 140% in 2021, 150% in 2022, 84.7% in 2023, and 84.5% in 2024. By 2025, sales data for January to May is 1.27 million units, with a year-on-year increase of 31%.

Pure electric vehicles have also experienced such a development trajectory, with a growth rate of 202% in 2015. Affected by subsidy reductions along the way, it came back to 158% in 2021, and the growth rate fell to within 25% in 2023 and 2024.

Essentially, the current extended range market is mainly composed of three major players: HarmonyOS Smart Driving, Li Auto, and Leapmotor. The pattern embodied in them is naturally that as the first-mover advantage brought by extended range becomes smaller and smaller, each is looking for new support points to complete their new strategies.

From a sales perspective, the characteristics of extended range that can currently match consumer demand are: either very expensive or very cheap. Leapmotor sold 221,600 units in the first half of the year, basically stabilizing performance above 40,000 units per month, and firmly capturing users in third- and fourth-tier cities. However, contrary to public perception, Leapmotor's sales are mainly supported by pure electric vehicles, not extended range.

For example, in the first quarter of this year, the cumulative sales of extended range models in Leapmotor's C series were actually around 18,500 units, meaning that extended range currently accounts for about 20% of Leapmotor's sales.

Therefore, this is roughly the performance of top players within 250,000 yuan. Behind this, our research and analysis have concluded that home-oriented car buyers do not have a clear distinction between plug-in hybrids, pure electric vehicles, and extended range vehicles. They mainly look at pure electric driving range and battery size.

Therefore, the cost of low-priced vehicles is limited, and long-range driving requires a large battery, which in turn brings high costs, so there is an impossible triangle. As for a series of new players entering the market later, such as XPeng, it can only take the route of extreme cost-effectiveness above 250,000 yuan to compete with Li Auto and HarmonyOS Smart Driving.

The market above 250,000 yuan is a battle between Li Auto and Huawei HarmonyOS Smart Driving, with no other variables. Li Auto L6's half-year sales are around 100,000 units, supporting half of the brand's sales. However, AITO M7 will soon be replaced, and the two will continue to compete fiercely. The latest sales decline and downward revision of delivery expectations for Li Auto in June are mainly due to the fact that after the launch of AITO M8, it can achieve at least 4,400 sales per week, squeezing Li Auto L7, Li Auto L8, and Li Auto L9.

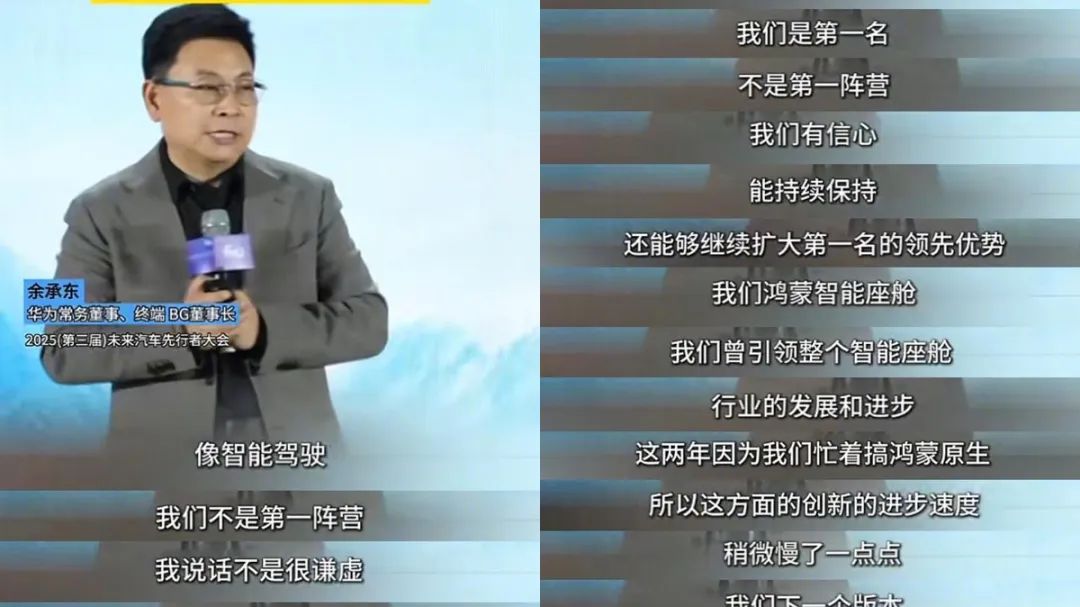

To summarize the extended range market, the early days of Li Auto ONE brought the idea that extended range has low costs, so it can bring extreme cost-effectiveness and solve range anxiety, which can no longer be used as a selling point in 2025. Among the two leading enterprises, in terms of sales and user reputation, Huawei is first in intelligent driving assistance and is expected to be first in autonomous driving, while Li Auto is second. In the field of intelligent cockpits, under the same caliber statistics, Li Auto is first, and Huawei is definitely in the top 3. Compared to extended range, technology, brand, home use, emotional value, etc., are the main means for them to achieve sales.

As for other new players that will enter the extended range market next, it is also impossible to achieve extreme cost-effectiveness due to the impossible triangle. Taking XPeng as an example, if it can reduce the prices of X9 and G9 by 30,000 to 50,000 yuan on the basis of pure electric vehicles, the products seem very attractive. However, there is a mismatch in user groups. The purchase demand of groups above 300,000 yuan covers having money, leisure time, parking spaces, and children. However, groups with lower budgets actually lack these elements.

Even Autonomous Driving Can Only Be a 50% Savior

Moreover, there are more cases illustrating that different power technologies cannot determine sales in 2025.

FAW-Volkswagen's report card shows 436,100 vehicles in the first half of the year, with a year-on-year increase of 3.5% and a 0.7% increase in fuel vehicle share. German brands that focus on fuel vehicles have basically survived the toughest times. After more plug-in hybrid and extended range new vehicles are launched in the fourth quarter of 2025, there will be a new turnaround. Looking at what they did right in half a year, it is nothing more than keeping up with the changes of Chinese consumers, lowering prices to match psychological expectations, providing intelligent configurations, and providing consumer confidence through warranties, free maintenance, or resale value of used cars.

The performance of leading Chinese brands such as BYD, Geely, Changan, Great Wall, Chery, and even SAIC Group is also verifying the logic that a single technology is not a magic bullet.

BYD quietly achieved 2.1459 million units in the first half of the year, with export data of 470,000 units. From the data in the June production and sales bulletin, plug-in hybrids continue to be its main sales force, and the growth rate is good, with a cumulative year-on-year increase of 23.71%, and pure electric vehicles also have a cumulative year-on-year increase of 40.93%. Therefore, after opening up overseas markets, automakers' powertrain combinations can already achieve more flexible matching, rather than what public opinion says, "pure electric is over," "plug-in hybrid is over," or "extended range is the magic bullet."

The same is true for Geely, with cumulative sales of 1.4092 million units in the first half of the year and exports of 180,000 units, quickly approaching BYD. Geely's rapid sales rise is also due to walking on three legs. Sales of China Star fuel vehicles exceeded 610,000 units, and new energy vehicle sales were 725,200 units. In the market below 200,000 yuan, pure electric vehicles are dominant, but plug-in hybrids are growing very fast, with the Xingyuan model alone delivering over 200,000 units. Since the launch of Geely Xingyao 8, it has quickly surpassed BYD Han, although BYD will counterattack with new models.

In the market above 200,000 yuan, Geely is basically split evenly between pure electric and plug-in hybrid vehicles. All current Zeekr models are pure electric, and electric hybrids will be launched at the end of the year. However, given the high price of Zeekr 9X, its main goal is not to achieve explosive sales, but rather to upgrade profits and brand recognition. After all, the social attributes of Huawei and Xiaomi are something that other automakers cannot learn in a short period of time.

Another concept previously promoted by new forces, which has actually contributed less to sales growth, is intelligent driving assistance, especially high-level assistance, which has been strictly regulated this year. Similarly, analyzing the performance of leading automakers, Huawei models' typical characteristic in the first half of this year is "not explosive in sales, but explosive in profits."

AITO M7 sold over 100,000 units in the first half of 2024, while it sold 25,400 units from January to May in 2025, resulting in a gap in the sales performance

On the contrary, we observe cases like Xiaopeng and even NIO. NIO's situation is somewhat straightforward: the NWM World Model was finally launched in May, yet the sales difference between May and June was minimal, at just 2,000 units (23,200 in May versus 24,900 in June). The current assessment is that there was some stimulus, but it was not significant.

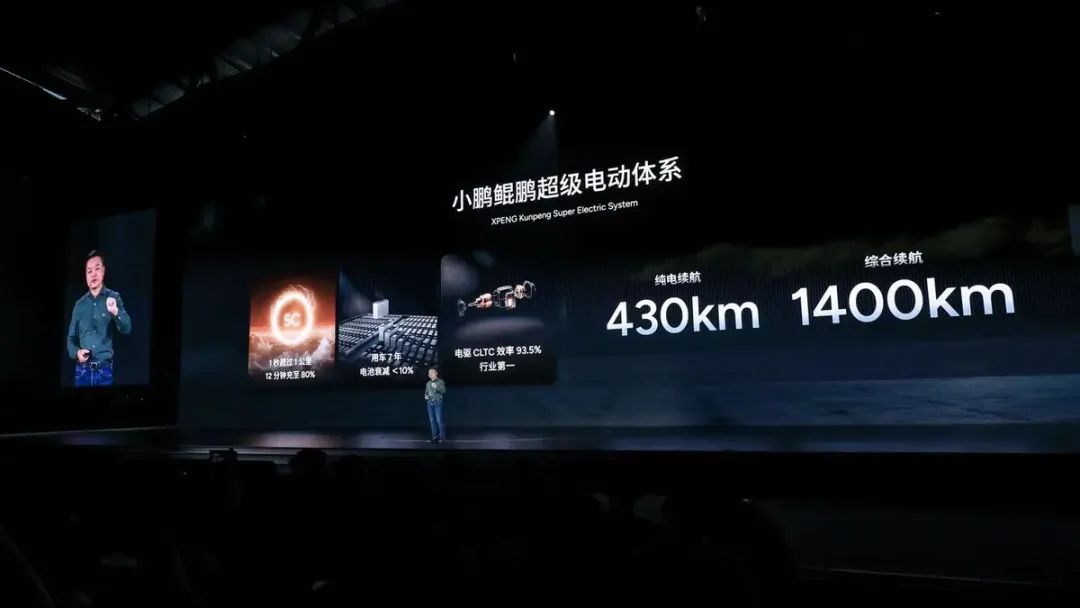

A similar pattern emerges with Xiaopeng. Despite surpassing its entire 2024 sales volume in the first half of 2025 with 197,100 units, the Xiaopeng MONA M03 accounted for 79,800 units, marking the largest incremental contribution. However, the success of this model does not hinge on intelligent driving but rather on the cost savings and lower prices enabled by hardware downgrades. If there's any connection to intelligence, it's the intelligent parking assistance, which effectively appeals to novice young drivers.

Regarding whether autonomous driving can markedly boost sales performance, there appear to be two primary bottlenecks. Firstly, the initial models of autonomous driving are anticipated to be expensive, limiting their contribution to sales figures. Secondly, relevant regulations are yet to be implemented, leaving automakers accountable rather than the insurance industry. In essence, we are on the cusp of an outbreak period but have not quite reached it yet.

Final Thoughts

So, what are we currently competing for?

It essentially boils down to human nature. In practical terms, it's about who has the loudest voice, the most sophisticated marketing strategies, the least negative information, who can create trending topics, and who has a larger fan base when technical capabilities are relatively similar.

This is easily explained due to the abundance of choices available in the market with a limited budget. During our interviews with executives from major automakers in the first half of this year, a common theme emerged: "How do we ensure that users prioritize our cars on their shopping lists?"

Only after achieving this initial step can we delve into other aspects such as sales growth. The current competitive landscape is vastly different from five years ago. A single failure, accident, or defect in a car can directly derail the sales performance of an entire brand. Examples abound, such as Li Auto's MEGA in 2024 or the substantial cognitive pressure faced by joint venture brands in recent years due to the underwhelming performance of their new energy models post-launch. The same applies to Tesla, which has been sluggish in introducing new models.