Sony Honda's Electric Vehicle Venture Faces Market Hurdles Amidst Billion-Yuan Losses

![]() 07/07 2025

07/07 2025

![]() 695

695

In the realm of electric vehicles, cross-border collaborations, while seemingly a shortcut to success, often lead to significant setbacks.

"Our infotainment system can play PS5 games!"

At CES, Sony Honda flaunted this eye-catching feature, unaware of the daily financial burden of 7 million yuan.

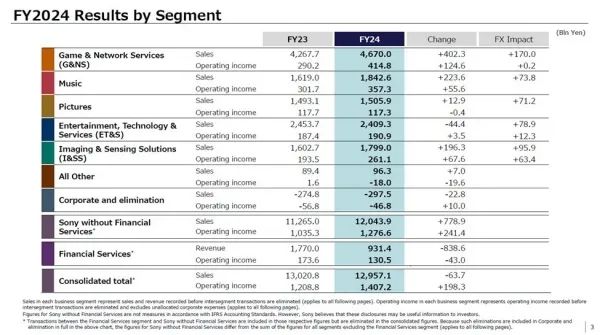

The latest financial report reveals that Sony Honda Mobility incurred an operating loss of 52 billion yen (approximately 2.59 billion yuan) in fiscal year 2024, equivalent to burning through 7 million yuan daily. This represents a 153% year-on-year increase from the previous year's loss of 20.5 billion yen. Notably, this is the second consecutive year that the joint venture has operated without generating revenue, with all capital expenditures sourced from the two parent companies.

Undeniably, this highly anticipated cross-border project is hemorrhaging funds at an alarming rate, akin to the selling price of one top-spec Afeela (644,000 yuan) vanishing every 8 hours.

Cost Black Hole Amid Technological Glamour

Flashing back to June 16, 2022, Sony and Honda officially inked an agreement to establish Sony Honda Mobility Inc., a 50-50 joint venture focused on the mobility sector. The aim was to commence selling electric vehicles (EVs) and providing mobility services by 2025.

Initially, some doubted this collaboration, viewing it as a desperate measure. Indeed, from a contemporary perspective, it was a last-resort option.

In fiscal year 2021, Sony Group achieved sales revenue of 9.9215 trillion yen, a 10% year-on-year increase; operating profit was 1.2023 trillion yen, up 26% year-on-year. While this was a decent performance, net profit decreased by 14.7% year-on-year to 882.2 billion yen. Sony's major business operations appeared glamorous but actually showed signs of fatigue.

Wall Street analysts have expressed skepticism, noting that despite Sony's launch of high-margin products like a digital game sales platform and PS Plus subscription service, the profit margin of its gaming business has not improved. The analysts believe the bigger issue facing the Japanese tech giant is the persistently low operating profit margin of its crucial gaming business.

Thus, Sony urgently sought a pivot point that could integrate its strengths and drive future growth. Initially, it was smartphones, but then the focus shifted to automobiles.

As early as 2017, Sony unveiled an electric concept car, SC-1, equipped with self-developed LiDAR, ultrasonic sensors, and other technologies. However, "Sony making cars" did not garner widespread attention at that time.

During CES 2020, the VISION-S concept car propelled "Sony making cars" into the limelight. Amid external doubts, Sony firmly stated: "The company is committed to the development of autonomous driving technology. VISION-S is only for showcasing technology, and we have no intention of manufacturing cars."

While claiming not to manufacture cars, Sony harbored ambitions to do so. However, financial pressures related to factory construction, channel sales, and other aspects forced the plan to be shelved.

Honda's approach to Sony came at the right moment, presenting a "win-win" scenario. For Honda, accelerating electrification and intelligent transformation was urgent, and doing so alone was a long and arduous journey.

In April 2021, after Toshihiro Mibe replaced Takahiro Hachigo as the new president, Honda's electrification reform could only be described as a modest attempt. Prior to that, the focus was mostly on the hybrid field.

At the beginning of his tenure, Toshihiro Mibe stated that Honda would stop selling gasoline vehicles after 2040 and achieve carbon neutrality by 2050. According to the latest plan, Honda's total R&D budget for the next decade is 8 trillion yen, with 5 trillion yen earmarked for electrification and software. By 2030, Honda plans to launch 30 pure electric vehicles globally with an annual production capacity exceeding 2 million vehicles.

Compared to previous strategies, this one is quite aggressive; however, compared to other automakers, Honda's transformation progress still lags behind. To keep pace and achieve its goals, Honda needed to take proactive steps.

Sony thus became a viable option, but reality proved far harsher than idealism.

Firstly, R&D investment spiraled out of control. It is reported that developing an intelligent cabin capable of recognizing the driver's emotions consumed 35% of the budget alone, due to sensor development.

Tatsuo Yoshida, a senior analyst at Bloomberg Intelligence, pointed out that developing a new car typically involves substantial prototype manufacturing and R&D investments, and sales in the luxury car market are inherently limited, making future profitability challenging. "Although Sony Honda Mobility seems to intend to recover costs through higher pricing, it may be difficult to fully offset expenses."

Furthermore, mass production has been delayed. The Afeela model, originally scheduled for delivery in early 2025, has been postponed to the end of the year due to software adaptation issues. The Afeela's starting price of $89,900 (approximately 644,000 yuan) directly competes with the Porsche Taycan.

"Luxury electric vehicles require a longer market education cycle," noted Tatsuo Yoshida, an analyst at Bloomberg Intelligence. "When the Mercedes-Benz EQE has already dropped to the $50,000 range, the high-premium logic of new brands is collapsing."

Cross-Border Risks

For a long time, electric vehicle companies have been the "darlings" that Honda and Sony wanted to leverage to enter the American capital market.

Electric vehicle startups such as Rivian, Lucid, and Fisker have thrived in the capital market, with their valuations soaring and even surpassing those of established traditional automakers. Rivian has even been hailed as the "Tesla killer," Lucid is seen as Tesla's most competitive rival, and Fisker is also regarded as a promising startup.

However, strikingly, none of Rivian, Lucid, or Fisker have been able to sustain this growth. Each company's market value has shrunk by 75% or more, and all have reported substantial losses and dwindling cash supplies. Take Lucid as an example; Q1 2025 deliveries declined by 37% year-on-year, with a loss of $82,000 per vehicle (approximately 586,000 yuan), and its share price has plunged 92% since its IPO.

Moreover, cross-border collaborations carry inherent risks, and the window for internet companies to partner with automakers to make cars is closing. This trend first emerged in China last year.

On July 2, it was reported that Hezhong New Energy, the parent company of Nezha Auto, recently initiated bankruptcy reorganization proceedings. This new force automaker, which once sold 150,000 vehicles annually and had over 460,000 cumulative users, is now seeking a "lifesaver."

As one of the earliest new forces to form a joint venture with the internet company 360, Nezha Auto quickly opened the market with a low-price strategy in 2018. Models such as the N01 and V were once sold briskly, reaching a peak annual sales volume of 150,000 vehicles in 2022, with the product line extending from entry-level vehicles priced at 80,000 yuan to GT sports cars priced at 200,000 yuan. However, the low-price strategy lacked staying power, and with the intensification of market competition, it finally collapsed in November last year.

In December 2024, Geely Auto and Baidu's joint venture brand, Jiyue Auto, directly disbanded on the spot. Since then, Geely and Baidu, as the two major shareholders, have been busy cleaning up Jiyue's "mess."

Undoubtedly, the new energy vehicle industry is witnessing a brutal "law of the jungle."

On one side, giants like BYD and Tesla are expanding their territories with hundreds of billions of yuan in cash flow and technological moats. On the other side, once-glorious new forces are suddenly "losing speed" after their rapid advance. WM Motor and HiPhi have successively experienced "sudden death," while Nezha and Jiyue are deeply entrenched in the "ICU" - the life-and-death speed of these enterprises serves as the most glaring warning light for the industry's major reshuffle.

As subsidies recede and capital cools, enterprises relying on PPT car-making and burning money to stay afloat are experiencing the most painful "weaning period." This is not simply a matter of survival of the fittest but a revolution concerning the way of survival: either evolve or be eliminated.

Therefore, when a daily loss of 7 million yuan becomes the new normal and a pricing of 640,000 yuan degrades into a tombstone of technological obsession, Sony Honda's predicament essentially represents a final showdown between the technological revolution and the laws of manufacturing.

After all, while Afeela's demo video continues to showcase the PS5 in-car gaming feature, Wall Street is more concerned about when it can break out of the vicious cycle of "losing money on every sale." This cross-border experiment may prove that in the electric vehicle sector, there is still an insurmountable BOM cost sheet between technological sentiment and commercial reality.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.