Global Battery Loading Volume from January to May: CATL 152.7GWh, BYD 70GWh, LG 39.9GWh, and More

![]() 07/07 2025

07/07 2025

![]() 575

575

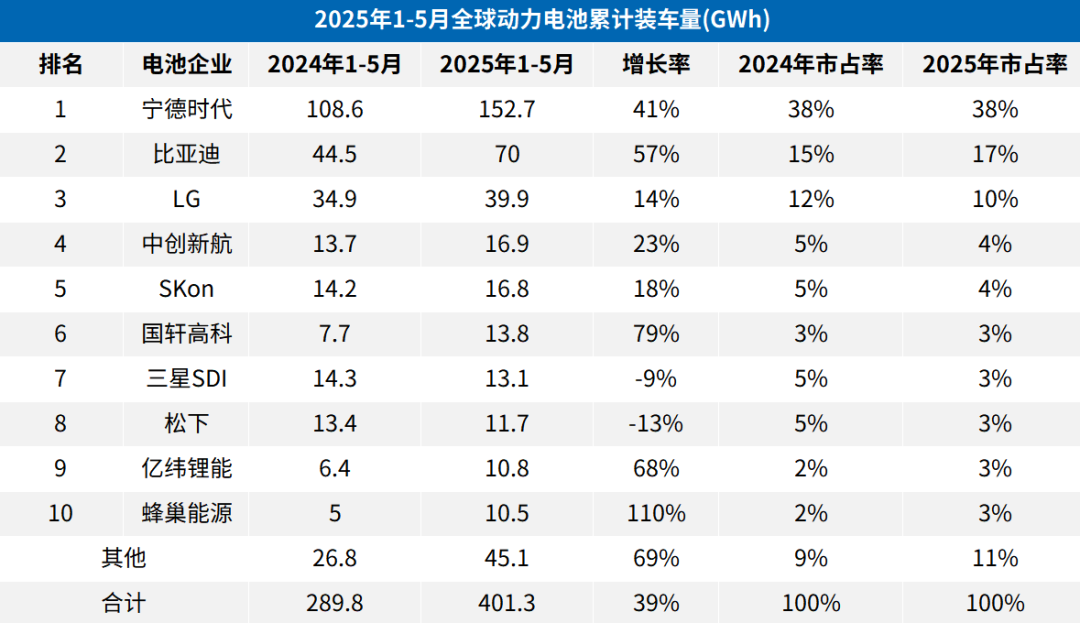

According to the latest data released by SNE Research, the cumulative global power battery loading volume from January to May 2025 amounted to 401.3GWh, marking a 38.5% increase from the 289.8GWh recorded in the same period of 2024. This surge underscores the expanding global new energy vehicle market, with battery loading volumes rising in tandem.

In terms of loading volume, CATL led the pack with a cumulative loading volume of 152.7GWh from January to May 2025. Compared to 108.6GWh in the same period of 2024, this represents a growth rate of 40.6%. Its market share also slightly increased from 37.5% in 2024 to 38.1% in 2025. This accomplishment is attributed to CATL's relentless pursuit in technology R&D, capacity expansion, and customer outreach. The consistent introduction of high-energy-density, long-life battery products has met the market's burgeoning demand for high-performance power batteries. Additionally, a diverse range of global customers, including several renowned automakers, has provided robust support for its sales growth.

BYD also performed impressively, with a cumulative loading volume of 70GWh from January to May 2025, up 57.1% from 44.5GWh in the same period of 2024. Its market share rose from 15.4% to 17.4%. BYD's full-chain layout advantage in the new energy vehicle sector is becoming increasingly prominent. Its Blade Battery, known for its high safety and low-cost features, is not only extensively used in its own brand models but has also begun external supply, further broadening its market reach.

However, not all companies are experiencing growth. For instance, Samsung SDI and Panasonic recorded loading volumes of 13.1GWh and 11.7GWh, respectively, from January to May 2025, representing declines of 8.8% and 12.9%, respectively, from the same period in 2024. Consequently, their market shares have also diminished.

Looking at the geographical distribution of battery companies, among the top 10 Chinese companies from January to May, the combined loading volumes of CATL, BYD, CALB, GuoXuan High-Tech, EVE Energy, and Hive Energy totaled 274.7GWh, and their market share further climbed to 68.4%.

For Korean companies, among the top 10 from January to May, the combined loading volumes of LG ES, SKon, and Samsung SDI amounted to 69.8GWh, accounting for a market share of 17.5%. The market shares of all three companies have declined.

Japan's Panasonic ranked 8th from January to May with a loading volume of 11.7GWh, a year-on-year decrease of 12.9%, and a market share of 2.9%, down 1.70% from the same period last year.

SNE analysis reveals that in 2025, the global electric vehicle market, centered on Europe, has exhibited significant recovery momentum. With tightening CO2 emission regulations, electric vehicle sales in major countries like Germany and the UK have surged notably. In contrast, while the US may reduce tax incentives, early purchase demand remains limited. China has maintained a growth trajectory fueled by new energy policies, but excess inventory has given rise to the risk of intensified price competition.

Since Trump took office, policies such as the early repeal of the IRA, the rescission of administrative orders mandating electric vehicle use, and the passage of tax reduction bills have undergone rapid changes, significantly impacting the global electric vehicle supply chain and market demand. These policy shifts have led to a general decline in South Korea's battery and material exports. Therefore, battery companies need to develop defensive strategies to ensure long-term stable market demand amidst North American policy risks and intensifying European competition.