Weekly Stock Review | "A Slump in May, a Crash in June, and a Rebound in July" – Can Investors Find Hope in This July?

![]() 07/07 2025

07/07 2025

![]() 641

641

Reviewing the week's auto stocks reveals the diverse conditions prevailing in the automotive market.

As of last Friday's (June 27, 2025) close, China's A-share market saw mixed performances across its three major indices. The Shanghai Composite Index bucked the trend, exhibiting overall volatility and a trend of consolidation. All three indices peaked and then retreated, with the Shanghai Composite Index closing at 3424.23 points, down 0.70%.

From Monday to Tuesday of this week, market performance oscillated amidst a wait-and-see mood. On July 3, the three major A-share indices rose collectively; on July 4, the Shanghai Composite Index performed impressively, attacking the 3500-point mark with continuous support from the large financial sector in the afternoon. As of the close, the Shanghai Composite Index stood at 3472.32 points, up 0.32%, with an intraday high of 3497.22 points, marking a new high for the year.

Since breaking through the 3400-point mark, the Shanghai Composite Index has oscillated above 3400 points for eight trading days. Investors' sentiment has continued to rise, pushing the A-share market towards the 3500-point threshold. It is foreseeable that there will be a small climax next week.

Additionally, at noon on Friday, the Ministry of Commerce announced that China and the United States had reached a consensus on the details of the London talk framework. China will approve export license applications for controlled items that meet the conditions in accordance with the law, and the United States will correspondingly cancel a series of restrictive measures against China. This was like a booster shot of good news for Chinese investors.

Compared to the strong rise in the banking sector, the auto sector showed signs of fatigue this week after leading the gains last week.

Entering July, next week will essentially mark the release of mid-term exam results for major automakers. Judging from the sales performance that has been announced, the four major listed new forces have all achieved impressive year-on-year growth.

Leap Motor sold over 220,000 vehicles in the first half of 2025, a year-on-year increase of 138%, firmly establishing itself at the forefront of the new energy sector. In terms of product strategy, it accurately targets the mainstream 150,000-250,000 yuan market. The C series wins over family users with its intelligent experience and sense of quality, while the dual routes of pure electric and extended range alleviate range anxiety. The T series caters to the needs of large families, with monthly sales nearing the 50,000-unit threshold.

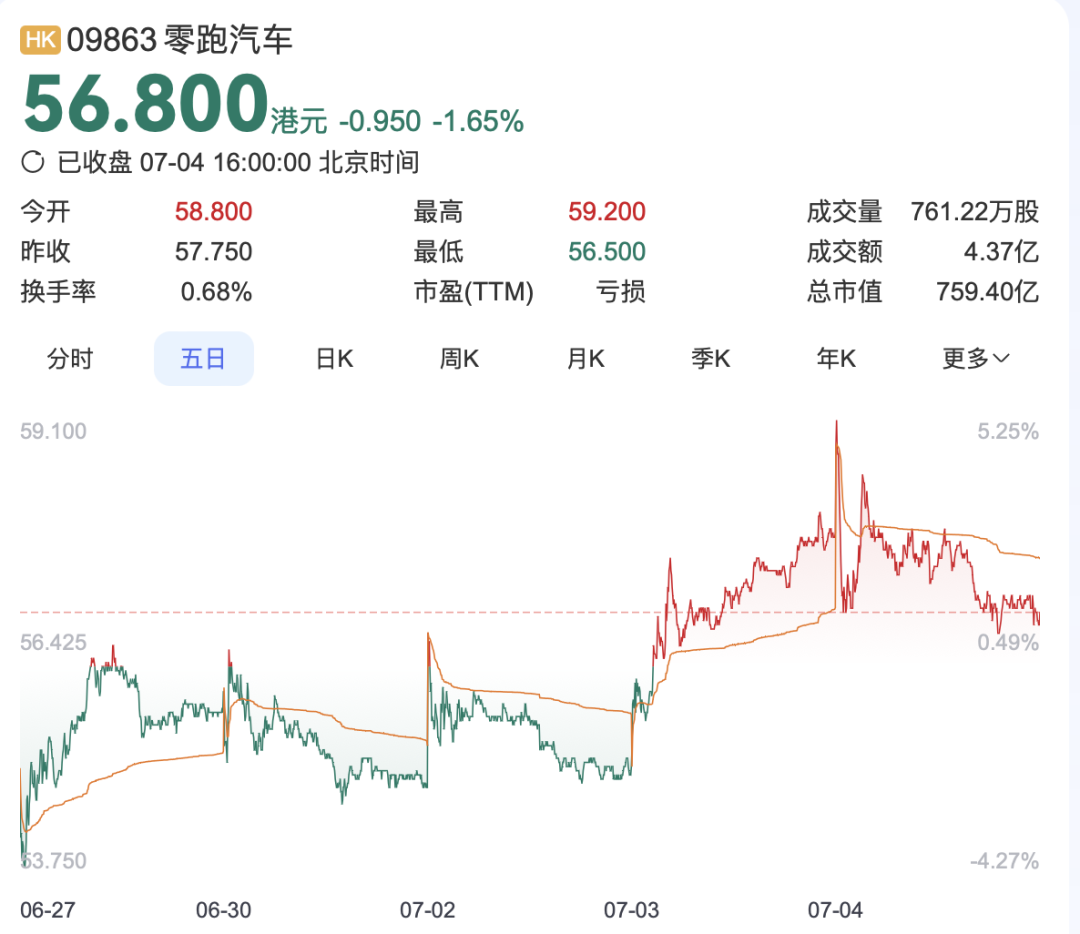

In terms of share price performance, Leap Motor recorded a cumulative increase of 0.49% last week, with its share price reaching HK$56.8 per share. Although it did not reach the new high of HK$67 in May, with sales on the rise, there is still room for Leap Motor's share price to increase.

As a relatively stable player among the new forces, Li Auto delivered 204,000 vehicles in the first half of the year, a year-on-year increase of 7.9%. If Li Auto's sales target of 700,000 vehicles for the full year remains unchanged, its current completion rate is about 29%, indicating considerable delivery pressure.

Delivering 36,300 new vehicles, a month-on-month decline of 11% and a year-on-year decline of 24%, Li Auto's vehicle deliveries declined significantly in June. It is worth noting that in May this year, Li Auto delivered 40,800 new vehicles, a year-on-year increase of 16.7%, which is quite a contrast.

In the second quarter of this year, Li Auto delivered a total of 111,000 vehicles, a slight increase compared to the 108,600 vehicles delivered in the second quarter of the previous year. However, the overall performance was far from expectations.

In terms of share price performance, Li Auto also experienced consecutive minor declines this week, with a cumulative decline of 8%, and the Hong Kong share price is now HK$103.7 per share.

It is worth noting that before the disclosure of second-quarter delivery data, Wang Xing, CEO of Meituan, had already cashed out a significant amount of Li Auto shares. Coupled with the earlier reduction of holdings by several executives, this has had some impact on some investors.

The Li Auto i8, positioned as a mid-to-large pure electric SUV, will be released in late July, with an expected price range of around 300,000 to 400,000 yuan, competing with models such as the AITO M9, XPeng G9, and NIO ES8. The mid-size SUV Li Auto i6 has also been declared with the Ministry of Industry and Information Technology and will be launched in September.

It is believed that with the addition of these two pure electric products, Li Auto's sales bottleneck can be effectively alleviated.

Compared to Leap Motor and Li Auto, NIO's activity in the Hong Kong stock market is much lower, with a turnover rate of only 0.21%. The share price has remained largely unchanged amidst low volatility, closing at HK$26.6 per share on Friday.

Fortunately, with the support of Ledao and Firefly, NIO's sales have started to pick up. In the first half of 2025, NIO delivered a total of 114,150 new vehicles, a year-on-year increase of 30.6%. For NIO, the recovery in sales is a positive signal, potentially indicating that the dark night is about to end and dawn is approaching.

On July 3, XPeng Motors launched its new model, the G7, which should have been positive news, but its share price fell by more than 6%. As of Friday this week, it closed at HK$69.1, with a decline of 6.56%.

Some analysts believe that the pricing strategy of the new G7 model has raised profit concerns for XPeng Motors. The starting price of the G7 is officially set at HK$195,800, a direct reduction of HK$40,000 from the pre-sale price of HK$235,800.

Although this has a stimulating effect on sales, the market is concerned that the low-price strategy will squeeze the already weak profitability.

Moreover, in order to offer a surprising price for the G7, XPeng did not hesitate to overlap its price with that of its own G6 model, which may lead to internal competition in the future.

As of the first half of this year, XPeng Motors has delivered a cumulative total of 197,189 new vehicles, surpassing its total sales for the entire year of 2024. Among them, the monthly delivery volume in June reached 34,611 units, maintaining over 30,000 units for eight consecutive months.

In the secondary market, including some investors, if the product level fails to break through upwards in the long run, XPeng's profitability remains a concern.

After reaching a historic high in its share price in May, Thalys, representing the Huawei ecosystem, began to gradually decline and stabilize at around RMB 135 per share. On June 30, CATL announced the official commissioning of two CTP 2.0 high-end battery pack production lines at Thalys' super factory. The next day, Thalys also announced that sales of its AITO brand in the first half of the year were 152,200 vehicles, a year-on-year decrease of 16.63%. Amid the tug-of-war between positive and negative news, the share price this week also saw little volatility, closing at RMB 135.08 per share.

Similar to Thalys, BYD also gradually declined after reaching a historic high of RMB 416.98 on May 23 and stabilized near RMB 330.

In the first half of this year, BYD sold 2.146 million vehicles, a year-on-year increase of 33%. Although growth remains strong, there is still a considerable distance from its established target of 5.5 million vehicles, with a completion rate of less than 40%. If BYD is to achieve its annual sales target in the second half of the year, it will need to sell an average of over 450,000 vehicles per month, posing a certain challenge.

Why is BYD, already the domestic leader, putting such pressure on itself? The outside world may not know, but if BYD accomplishes the feat of selling 5.5 million vehicles, it will undoubtedly be a historic moment for China's auto industry.

Unlike the steady progress of domestic enterprises, Tesla may be facing another awkward period. This week, Tesla announced global vehicle deliveries of 384,122 in the second quarter of 2025, a decline of about 14% from the same period last year, marking the second consecutive quarter of year-on-year decline.

The decline in sales also means a loss of profits, and Tesla is once again on the brink of losses. If it were not for the sale of carbon credits worth US$447 million in the first quarter of this year, Tesla's net profit would have been negative.

Apart from the company's performance, the dispute between Musk himself and US President Trump is another challenge currently faced by Tesla.

In recent days, Tesla CEO Musk and US President Trump have once again engaged in a verbal spat over the "Buy American, Hire American" Act, with Trump even claiming to consider deporting Musk, reigniting tensions. As a result, Tesla's share price fell by more than 5% on Tuesday.

Trump threatened to investigate government subsidies received by Musk's companies (including Tesla and SpaceX), especially as the Act would severely impact Tesla's "carbon credit revenue". The Act abolishes key rules for carbon credit trading and sets fines for corporate average fuel economy standards to zero, effectively eliminating the incentive for traditional automakers to purchase Tesla's carbon credits.

Apart from being unable to continue selling carbon credits, Tesla's other businesses, including battery manufacturing, supercharger networks, and solar roofs, will almost all lose important federal support or tax credits.

Daring to confront the US President head-on for the sake of a little immediate gain, it has to be said that the red-capped businessman Musk should probably buy a copy of "Comprehensive Mirror to Aid in Governance" and take a look.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.