Changan to Establish European Factory / Geely Enters UK Market, Intensifying Competition

![]() 07/08 2025

07/08 2025

![]() 683

683

Introduction

"Let him be strong; the wind will still blow over the mountain. Let him be fierce; the moon will still shine over the river."

Recently, news broke that Changan Automobile intends to build a factory in Europe to bolster its sales in the region, with potential locations currently under evaluation. Nic Thomas, Head of Marketing and Sales for Changan Europe, stated, "We are committed to taking root in Europe, producing locally, and serving the European market."

"We are exploring solutions for local production," Thomas added, noting that he could not disclose specific timing for the factory's construction but said, "We are confident we will reach the necessary sales scale, and we have thus entered the planning stage."

Changan Automobile, a Ford partner in China, is currently introducing the Deep Blue S07 in Germany, Norway, Denmark, and the Netherlands, with a starting price of 45,000 euros. At a March press conference in Germany, Changan Automobile announced plans to launch the Deep Blue S05 model this year and the Changan E07 in 2026.

The company aims to expand its retail network in Europe from about 100 dealers in 2025 to over 1,000 by 2030, planning to launch 8 models. Thomas, who oversees Changan's UK operations, revealed that the company will begin selling the Deep Blue S07 to UK consumers this year, with deliveries starting in September.

According to automotive industry analyst Felipe Munoz, Changan Automobile ranked 16th globally in 2024 with sales exceeding 2.2 million vehicles. Thomas noted that Changan Automobile sold 600,000 vehicles overseas last year and aims to increase this to 1 million this year.

Currently, multiple Chinese auto brands, including Changan Automobile, have joined BYD and Chery in selling vehicles in Europe. Both BYD and Chery have announced plans for local production, with BYD building an electric vehicle factory in Hungary and Chery producing cars in Spain with local joint venture partner Ebro.

01 European Strategies of Chinese Automakers

Notably, on July 3, Geely Automobile announced plans to launch two crossover models in the Italian market in the fourth quarter: the fully electric EX5 and a super hybrid plug-in model. The company has partnered with Saudi-controlled dealer Jameel Motors, following an agreement reached in Poland this April.

This move expands Geely's presence in one of Europe's largest auto markets, despite Italy lagging behind countries like Germany and France in electric vehicle adoption. Chinese automakers, led by BYD, are rapidly growing in the region, focusing on pure electric and hybrid models.

Furthermore, on July 2, Geely Automobile announced plans to introduce the Geely brand in the UK in the fourth quarter of 2025, following the footsteps of other Chinese automakers entering one of Europe's largest auto markets. While Geely's Lotus, Volvo Cars, and Polestar brands are already present in the UK, the company has yet to introduce its mainstream Geely brand from China.

Geely is launching the EX5 model globally, currently available in markets such as Australia, Thailand, Indonesia, Brazil, and Germany. Earlier this July, the Geely brand was introduced in Greece, also led by the EX5. The UK is a significant market for pure electric vehicles in Europe, with 382,000 registrations in 2024.

The company confirmed that the first Geely model to be sold in the UK will be the EX5 pure electric SUV, noting that the model is still undergoing "intensive research and development work" to meet UK car buyers' standards. Geely affirmed that the EX5 "will be the first in a series of diverse, high-quality, and affordable models tailored for the UK market."

Indeed, Chinese auto brands have fully prepared for their overseas expansion.

In October 2023, Chery Automobile urgently gathered engineers and suppliers at a test site in Zhaoyuan City, Shandong Province. That weekend, they aimed to comprehensively revamp the suspension and steering system of the Chinese version of Chery's Omoda5 crossover for the European market.

Europe is crucial for Chery's global expansion, but the car was originally designed for China's flat roads and lower speeds. Now, it must adapt to Europe's winding and bumpy roads.

Just six weeks later, Chery began delivering the European-specification Omoda5 to dealers, equipped with a brand-new steering system, traction control system, brakes, shock absorbers, and tires. Riccardo Tonelli, a senior vehicle dynamics expert at Chery who led the revamp, remarked, "If it were a European automaker, you couldn't expect it to be completed this quickly. It's simply impossible."

Tonelli, who has worked for an Italian automaker and a Korean tire manufacturer, predicts that Western manufacturers would take far more than a year to implement similar improvements due to their relatively bureaucratic organizations.

Chery's revamp of the Omoda5 exemplifies the disruptive speed and flexibility of Chinese automakers. These companies have seized control of the world's largest auto market from once-dominant foreign competitors. Now, China's rising auto giants are racing to expand into global markets, with Chery leading the charge as a prominent exporter.

Industry executives suggest that BYD, the electric vehicle giant and China's largest automaker, poses a greater competitive threat in the long run.

China's ascendancy in the automotive sector largely benefits from its remarkable manufacturing achievements, cutting car development time in half. The shortest development time for a new or redesigned model is just 18 months. AlixPartners, a consulting firm, found that the average time to market for electric vehicles or plug-in hybrid vehicles from Chinese brands sold in the Chinese market is 1.6 years, compared to 5.4 years for foreign brands.

This speed disrupts traditional automakers, who historically redesign models roughly every five years and pickup trucks roughly every ten years.

02 Challenges for Western Manufacturers

Despite tariff barriers, Chinese automakers are thriving in Europe, replacing Western competitors at an accelerated pace. European automakers reported only slight single-digit sales growth in May, while Chinese auto brands led market growth, more than doubling their market share.

These figures exclude Western brands controlled by Chinese companies, making the situation even more challenging for European firms.

In recent years, China has made significant strides in the automotive sector, evident not only in its domestic market but also in Europe. Despite high tariffs imposed by the European Union on Chinese cars last year, Chinese automakers continue to accelerate their market share gains, squeezing established automakers.

European companies like the Volkswagen Group, Renault Group, Mercedes-Benz, BMW Group, and American Ford Motor Company all reported slight single-digit sales growth in May. Other established automakers, such as Stellantis Group, Hyundai-Kia Group, and Toyota Motor Corporation, experienced slight declines in sales during the same period.

However, overall sales in the European auto market increased by 2.5% to 1,107,517 vehicles, largely due to Chinese brands.

Sales of Chinese auto brands surged by 111%, from 31,000 in May 2024 to nearly 66,000 this year, excluding European companies controlled by Chinese companies. In terms of market share, Chinese brands now account for 5.9% of total car sales in the region, more than doubling from 2.9% in May 2024.

In May, MG recorded 29,400 registrations, a year-on-year increase of 30%, with year-to-date cumulative registrations reaching 133,400, surpassing Fiat's 125,000. Meanwhile, BYD's registrations soared by 397% year-on-year. Despite rapid growth, BYD sold only 40 fewer vehicles than Tesla in May, after overtaking the American brand for the first time in April.

Other notable Chinese automakers include Jaecoo, with 7,449 registrations and sales surpassing Honda; Omoda with 4,213 registrations and sales surpassing Mitsubishi. Leapmotor recorded 1,723 registrations, surpassing Lancia, whose sales declined by 80% year-on-year.

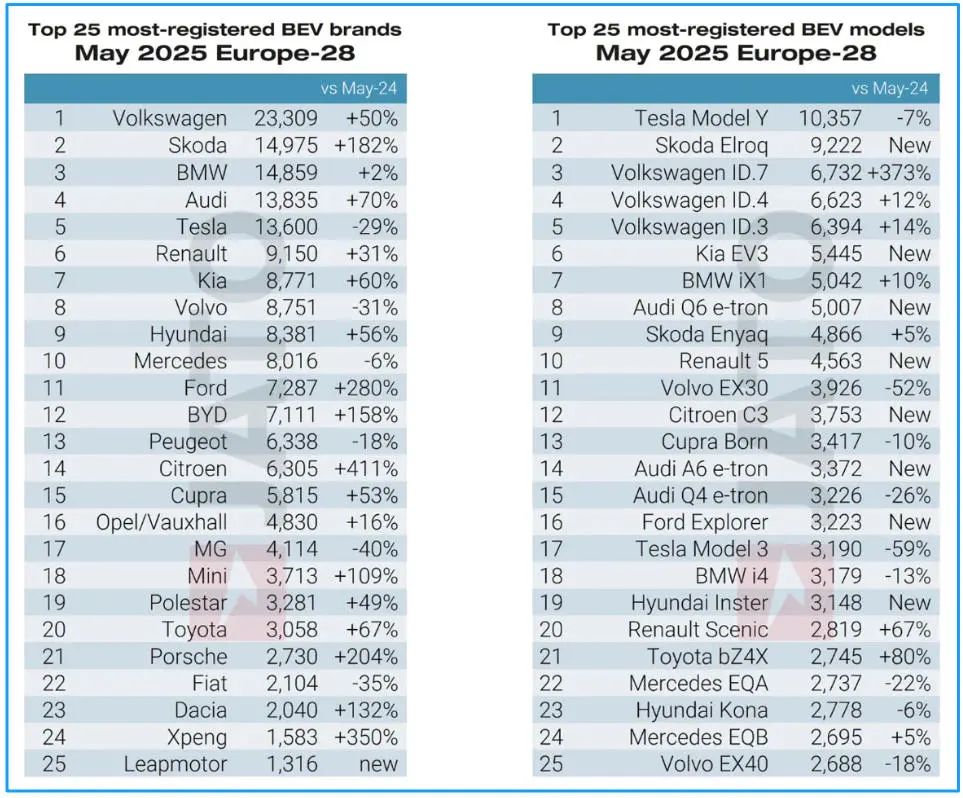

In electric vehicle sales, Tesla's momentum further weakened, with sales falling by 29% to just 13,600 in May. This dropped it to fifth place in Europe, behind Volkswagen, Skoda, BMW, and Audi. Volkswagen Group brands in the top 25 sold a total of 58,000 electric vehicles in Europe, more than four times Tesla's sales.

While the Tesla Model Y remained the top-selling electric vehicle with 10,357 sales (-7%), the newly introduced Skoda Elroq closely followed with 9,222 sales. Volkswagen made it into the top five with the ID.7 (6,732 sales), ID.4 (6,623 sales), and ID.3 (6,394 sales). The Tesla Model 3 saw a 59% decline in sales, with only 3,190 sold, dropping to 17th place.

Undeniably, despite the European Union's tariff barriers, Chinese auto brands have defied trends in the European market, demonstrating strong competitiveness and resilience. This is attributed to China's automotive industry's recent breakthroughs in technology research and development, manufacturing, and cost control, enabling it to quickly capture market share with high cost-performance and new energy technology advantages.

In contrast, traditional automakers are constrained by high research and development and manufacturing costs, and their pace of electrification transformation is slow, resulting in sluggish market growth. This shift in the market landscape not only underscores China's automotive industry rise but also heralds a profound transformation in the global auto market competition due to the injection of Chinese power.

Editor-in-Charge: Cao Jiadong | Editor: He Zengrong