Extended-range Vehicles Embrace "Large Batteries"

![]() 09/19 2025

09/19 2025

![]() 636

636

The "large battery" trend in extended-range vehicles may have found the perfect balance, offering a unique "transitional solution" for the automotive industry's transformation.

Original Tech Insights - New Energy Vehicle Team

At the Chengdu Auto Show in late August, Zeekr reshaped the extended-range landscape with a large battery approaching pure electric thresholds, IM Motors showcased a 250km CLTC pure electric range on its display vehicle, and Hyper HT aggressively expanded battery capacity. This silent competition represents the new energy vehicle industry's sharpest collective inquiry into technological pathways.

Amid the pure electric wave, extended-range and plug-in hybrid models face unprecedented identity crises: burdened with the "transitional technology" label, they seek validation through larger batteries; fearing incomplete charging networks yet confronting fading policy incentives. This "large battery + small fuel tank" revolution raises questions: survival wisdom born of crisis or final echoes of an era? Answers may lie in exaggerated range figures, sales pitches emphasizing "dual fuel flexibility," and profit-loss reports haunting automakers' late-night decisions.

01 Bowing to Pure Electric?

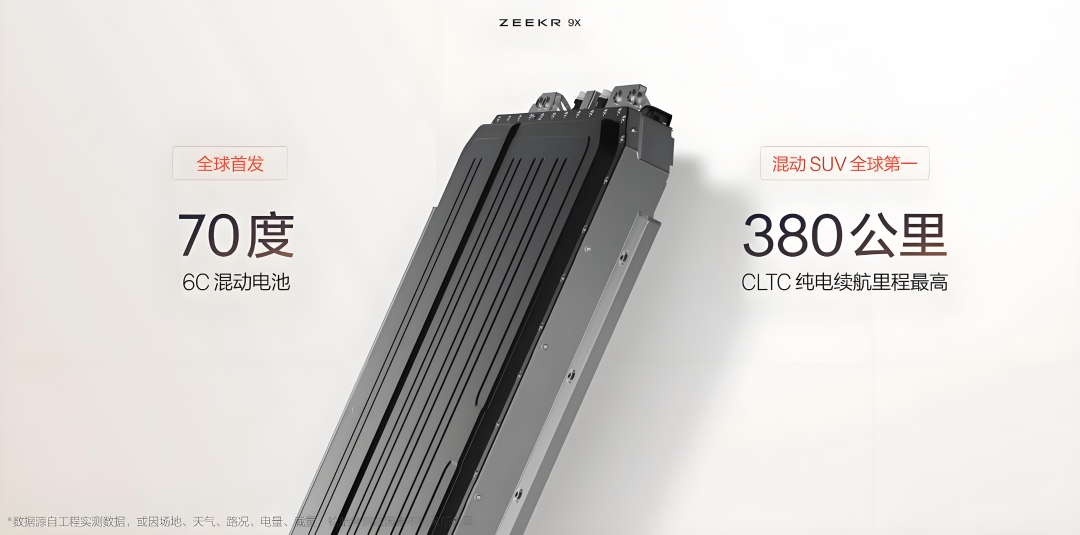

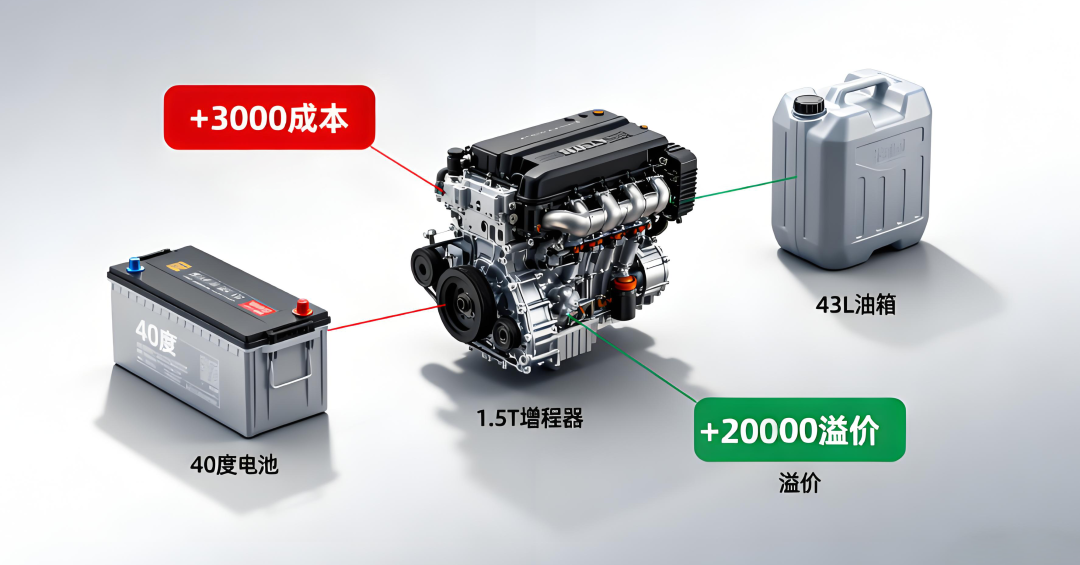

Looking back at late summer, China's new energy market has been dramatically reshaped by pure electric vehicles. CPCA data shows July pure electric wholesale volumes surged 30% year-on-year, while extended-range categories struggled with single-digit growth. The once-dominant "range anxiety-free" extended-range narrative shows fatigue, prompting automakers to emphasize "pure electric range" prominently on display vehicles to retain potential customers. This dramatic shift reflects deep market transformations. The 250km pure electric range, once considered entry-level, now represents a technical benchmark for extended-range models. Zeekr's bold 50kWh battery packs stem from precise cost-benefit analyses: with battery prices plummeting 40% in two years and public charging stations increasing 43% in urban density (from 1.7 to 2.43 per km²), the foundation for this "pseudo-pure electric" revolution is solid. Automakers calculate: a 40kWh battery + 1.5T range extender + 43L tank costs just 3,000 yuan more but commands 20,000 yuan in premium pricing.

Image/AI Generated

This transcends mere product upgrades - it's a strategic pivot for survival. Shanghai and Beijing will exclude plug-in hybrids from green license privileges after 2025, leaving automakers with a shrinking window measured in months. Prioritizing pure electric range enhancements before policy deadlines becomes the most pragmatic survival tactic. Automakers desperately push product "electricity content" toward regulatory thresholds. This aggressive strategy reflects tactical retreat under pure electric pressure - a calculated survival maneuver. Market shifts also manifest in user demographics. Early extended-range adopters were mostly third/fourth-tier city users with charging challenges or families needing long-distance travel. Now, nearly 60% of extended-range buyers come from first/second-tier cities with dedicated parking and home chargers. They choose extended-range not for charging convenience but as a "pure electric insurance policy" - electric for daily use, gasoline for emergencies. This mindset shift fundamentally redefines product positioning.

02 Track Switching

Dissecting this sudden "large battery movement" reveals roots in structural industry contradictions. The steep decline in battery prices contrasts with the uneven growth of charging infrastructure. While CATL and others slash battery costs through economies of scale, State Grid's charging network still navigates urban-rural divides. This mismatch creates unique market opportunities: affordable batteries' "pseudo-pure electric" experience fills psychological gaps from inadequate charging coverage.

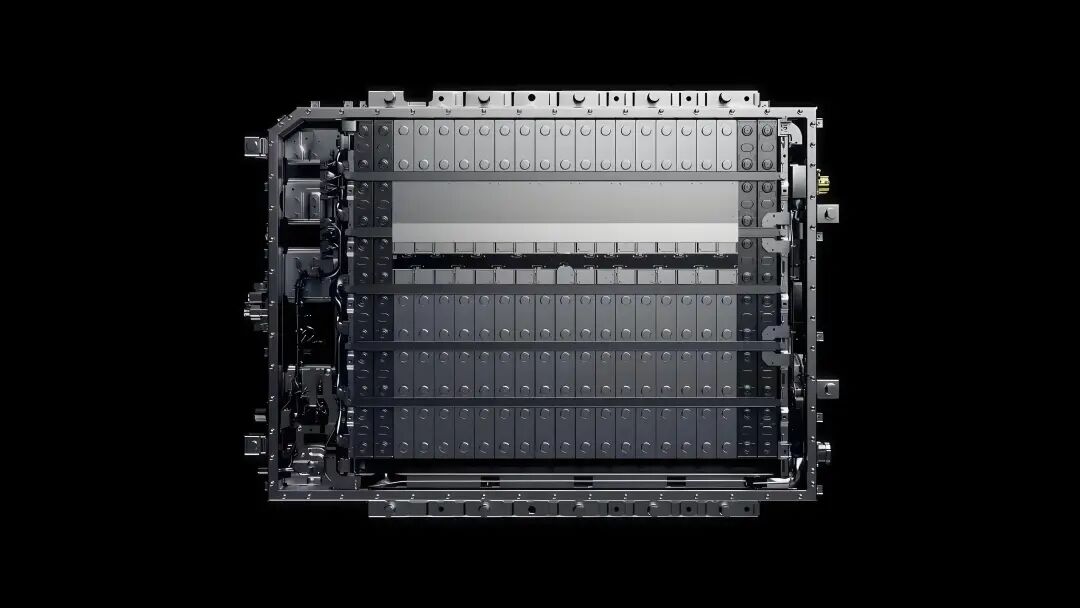

Automakers' calculations prove brilliant. Unable to quickly replicate gasoline service networks, they use large batteries to alleviate range anxiety. With fast-charging still stuck at ten-minute thresholds, bigger batteries extend practical range. This "space-for-time" strategy passively adapts to infrastructure shortcomings. The danger lies in consumers growing accustomed to daily pure electric commuting via large batteries. When charging networks mature, current designs may reveal redundant flaws. Yet technology pendulums swing constantly. The original "small battery + range extender" model prioritized cost reduction, as high per-kWh costs necessitated strict capacity control. Now, battery price declines outpace expectations, making "large battery + small tank" combinations commercially viable. This represents supply chain revolution, not technological evolution. Like smartphone makers adopting high-pixel sensors despite algorithmic limitations, hardware parameters now prioritize market appeal. Energy management intelligence becomes key differentiator. CATL's XiaoYao super hybrid battery boosts control precision by 40% and utilization by 10% through SOC modeling. XPENG's AI power system autonomously decides fuel/electric usage. BAIC's intelligent system switches energy modes based on road conditions, such as activating range extenders during highway cruising and regenerating battery power.

Image/CATL

Miniaturization of range extenders addresses past bulkiness issues. New models reduce power from 60-80kW to 20-30kW, favoring two-cylinder over four-cylinder engines. IM Motors' LS6 1.5T range extender achieves 5.32L/100km fuel consumption and 40% NVH improvement via stratified combustion. Hyundai's upcoming extended-range SUV adopts flux motor technology, shrinking volume by 37% and weight by 102kg. However, a deeper paradox emerges: could this apparent progress delay genuine technological breakthroughs?

03 Luxury Cure

While mass markets battle fiercely, the luxury sector above 500,000 yuan tells a different story. Here, extended-range technology unexpectedly becomes an energy transition channel for traditional luxury users. The launches of Zeekr 009 Radiant Edition , Yangwang U8, and Lotus Eletre extended-range versions suggest a truth: price-insensitive buyers cling to engine-derived security.

Image/Yangwang U8

The crux lies in nuanced consumer psychology. Millionaire buyers care little about 100,000 yuan purchase taxes but deeply dislike charging uncertainties. They crave electric torque while doubting battery longevity; desire new energy status yet resist changing driving habits. Extended-range technology bridges these gaps, eliminating purchase dilemmas. Luxury brands exploit this. They position range extenders as "silent guardians," using German-engineered naturally aspirated engines to offset battery coldness. In this narrative, large chassis -occupying batteries become tech prowess symbols rather than compromises. The 35% premium space precisely targets buyer psychology while creatively redefining luxury. With predictions of 50% new energy penetration in luxury cars by 2026, pure electrics may capture just 30% of this market. The remaining 70% could become extended-range technology's final stage. Small, efficient generators with special soundproofing and intelligent energy systems form complete value narratives.

The essence of "large battery, small tank" remains an interim product of energy system transitions. It balances industrial chain interests, capital market valuation models, and consumer fear of change. Yet historically, all transitional forms yield to mainstream paradigms - the difference lies in grace of exit. Automakers need strategic resilience beyond cyclical pressures. Rather than obsessing over battery capacity, they should cultivate core competencies: reconstructing direct sales like Tesla, vertically integrating supply chains like BYD, or ecosystem empowerment like Huawei. When five-minute charging and highway service station swaps arrive, today's tactical maneuvers will fade. In energy revolution coordinates, extended-range technology won't be the destination . Its existence reflects market economy laws. As the industry shifts from "range competition" to "experience revolution," technological pluralism will become normal. For automakers, the priority surpasses choosing extended-range or pure electric - it's about balancing user needs, technological iteration, and commercial viability.

References: Tech Planet, "Sales Plummet 11%, Automakers Stumble on Extended-Range?" Baobian, "Burdened with Large Batteries, Extended-Range and Plug-In Hybrids Compete with Pure Electrics?" Economic Observer, "Extended-Range Vehicles' Pure Electric Range Expands: Progress or Deviation?" Late Auto, "Extended-Range Vehicles Enter Long Pure Electric Range Era: Better EVs or Awkward Ones?"

- The end -