Battery Sector Skyrockets! Pure Electric Large Three-Row SUVs Lead the Pack. Is a New Era for New Energy Vehicles Upon Us?

![]() 11/17 2025

11/17 2025

![]() 581

581

This week, the power battery sector has once again taken center stage in the A-share market, with leading stock CATL [300750] briefly nearing its record peak.

From a broader perspective, the battery sector's ascent is intricately linked to the automotive industry's structural evolution.

In October of this year, the monthly penetration rate of new energy vehicles soared past the 50% mark for the first time, a historic milestone. Since July, wholesale sales of pure electric vehicles in China have witnessed substantial year-on-year growth for four consecutive months, hastening the advent of the pure electric era and sustaining a robust demand for power batteries.

Moreover, battery capacities vary significantly across models of different class levels and powertrain types. Larger vehicle sizes and a higher proportion of pure electric sales exert a more pronounced influence on market growth.

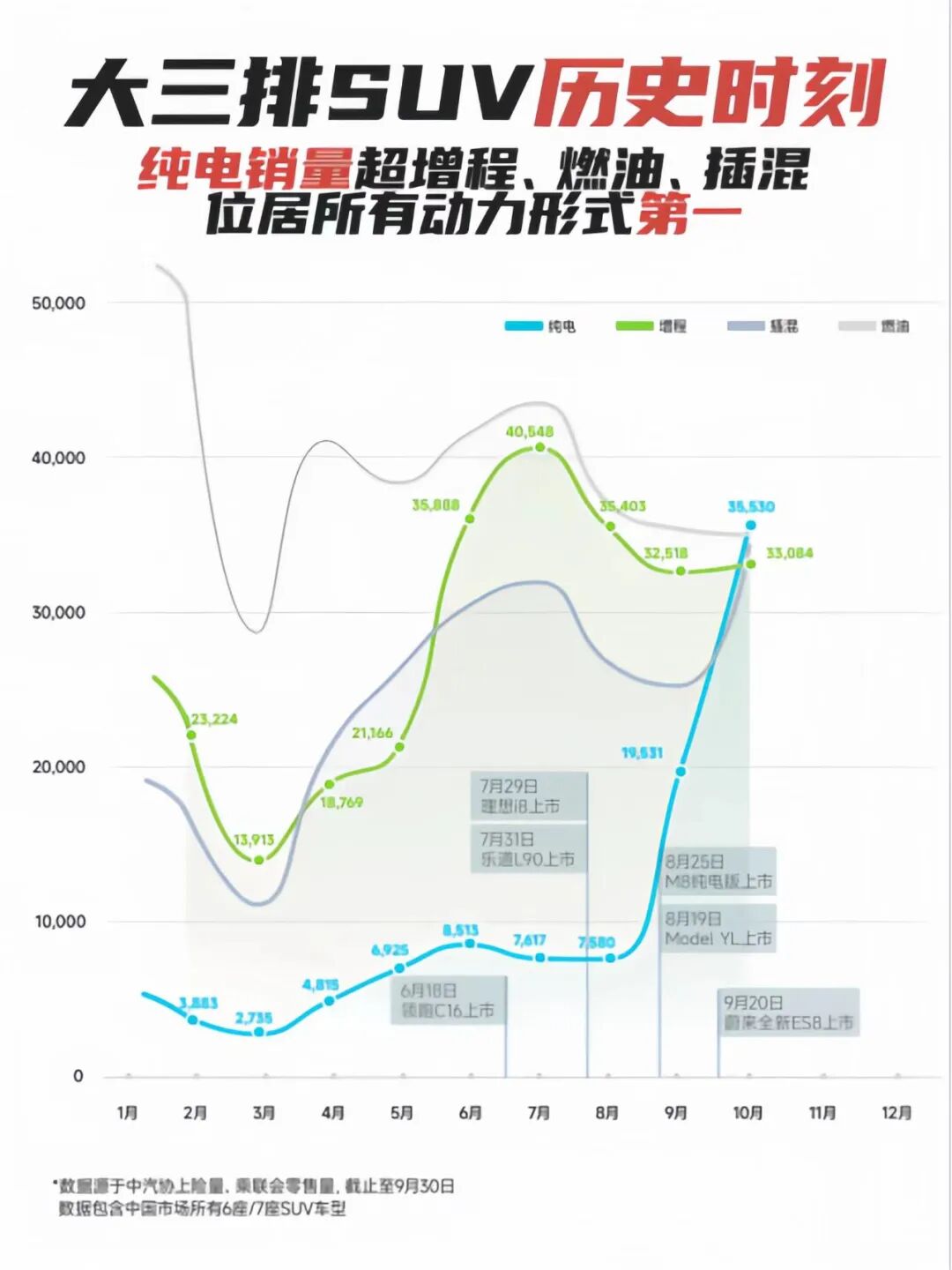

In September of this year, the Chinese automotive market witnessed a historic moment: monthly sales of pure electric large three-row SUVs reached 35,530 units, outpacing comparable models powered by extended-range, plug-in hybrid, and fuel engines for the first time.

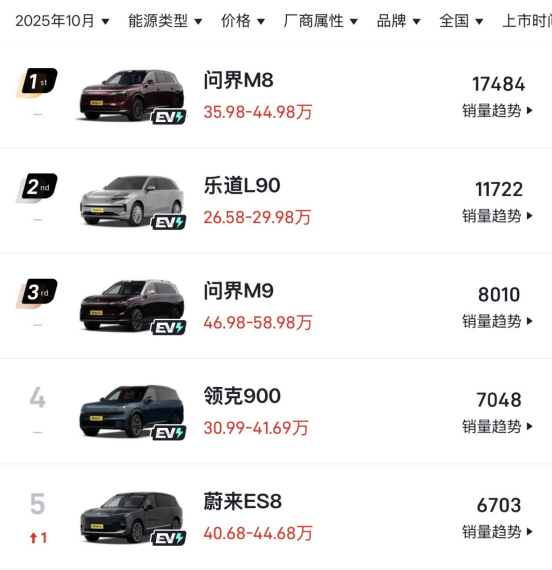

In October, two pure electric large three-row SUVs from NIO—the Lexo L90 and the all-new NIO ES8—secured spots among the top five in large SUV sales, further solidifying the dominance of pure electric vehicles.

01. The Pure Electric Turning Point Arrives, and NIO Achieves Sales Breakthrough

In fact, as early as the first half of April 2024, the penetration rate of new energy vehicles in the passenger car market surpassed 50%, only to decline subsequently. Additionally, at that time, pure electric vehicles were not the unequivocal mainstream in the new energy market, as narrowly defined plug-in hybrids and extended-range vehicles also enjoyed robust growth.

However, since the latter half of this year, the tripartite market division among pure electric, plug-in hybrid, and extended-range vehicles has been disrupted, with pure electric models gradually emerging as the absolute mainstream in the new energy market. According to data from the China Passenger Car Association, in October, pure electric models accounted for 62.9% of wholesale new energy vehicle sales, more than double that of plug-in hybrids and nearly ten times that of extended-range vehicles.

As the saying goes, "The duck knows first when the spring river warms." In September of this year, William Li, Founder, Chairman, and CEO of NIO, remarked, "2025 will mark a turning point when the experience benefits of pure electric technology outweigh the experience losses caused by inconvenient charging. User choices and market data already suggest that the high-end new energy vehicle market is accelerating its transition to pure electric."

In October of this year, NIO delivered 40,397 vehicles, marking a year-on-year increase of 98% and surpassing 40,000 units for the first time, while also setting a new historical high for three consecutive months.

Besides automotive companies like NIO that have long focused on the pure electric market, numerous automakers operating on multiple fronts, or even primarily relying on other powertrain types, have also sensed the arrival of the turning point. In the latter half of this year, Li Auto, which previously relied on extended-range SUVs for its sales, launched two pure electric SUVs, the i8 and i6. Various indicators suggest that pure electric is the trend of the future, and the turning point has already arrived.

02. NIO's Dominance in Pure Electric Large Three-Row SUVs: The Secret to Their Success

Prior to the turning point, the primary obstacles deterring consumers from choosing pure electric vehicles were concerns about space and charging anxiety.

Affected by multiple factors such as technological conditions and raw material prices for batteries, the three-electric systems (battery, motor, and electric control) of pure electric vehicles had a significant impact on the vehicle's effective space and cost structure. However, by 2025, with the widespread adoption of technologies like high-voltage platforms and the decline in battery prices, this disadvantage is gradually diminishing. Some automakers have even achieved technological breakthroughs, enabling the interior space of their pure electric models to surpass comparable products.

For instance, NIO pioneered the adoption of its self-developed 925V full-domain platform in the industry and optimized the vehicle's structure to achieve extreme compression in the layout of key components. Both the Lexo L90 and the all-new NIO ES8 boast over 200L front trunks and a 'six-seat equal rights' cabin space, leading their class in space utilization.

In terms of energy replenishment, the ratio of new energy vehicles to charging piles in China improved from 3.1:1 in 2020 to 2.3:1 in 2025. Meanwhile, the coexistence of multiple energy replenishment methods, such as slow charging, fast charging, and battery swapping, has provided consumers with more diverse choices and significantly alleviated charging anxiety.

This progress is driven by policies from relevant national departments and long-term investments in energy replenishment infrastructure by power grids, automakers, and other stakeholders.

On November 12, Xin Guobin, Member of the Party Leadership Group and Vice Minister of the Ministry of Industry and Information Technology, stated at the 2025 World Power Battery Conference that efforts would be made to further promote the expanded application of power batteries in related fields and support innovations in battery swapping models and vehicle-to-grid interaction trials.

NIO is one of the automakers with the longest and most substantial investments in energy replenishment infrastructure in China. To date, NIO has constructed 8,351 charging and battery swapping stations nationwide, including 3,565 battery swapping stations.

The 'fortress' of large three-row SUVs was breached by pure electric products in the latter half of this year, coinciding with the market-wide arrival of the pure electric turning point. NIO's long-term and sustained investments in technology and infrastructure over the past decade are now beginning to yield significant returns.

Summary: The battery sector's rise is intricately linked to the automotive industry's structural evolution.

- End -