Chinese Automakers Forge Ahead in South Africa with Strategic Foresight

![]() 11/17 2025

11/17 2025

![]() 605

605

Introduction

All past experiences have been put to good use in this endeavor.

Few could have predicted that an African nation, seemingly peripheral to the automotive world and rarely in the global spotlight, would emerge as a bustling hub for international carmakers.

The South African automotive market, once firmly under the sway of international titans like Toyota, Volkswagen, and Ford, is now undergoing a seismic shift, led by the rising influence of Eastern automakers. This phenomenon mirrors a broader trend emerging across global markets. However, Chinese automakers, tempered by past challenges, are approaching this new phase with unprecedented maturity and sophistication.

The transformation began in earnest in 2022 when the South African automotive landscape, traditionally dominated by Japanese, European, and American brands, was disrupted by a swift influx of Chinese automotive names. Led by Chery, BYD, and Great Wall Motors, these Chinese automakers did not merely rely on price competition in this strategic market. Instead, they engaged in a multifaceted battle encompassing product diversification, technological innovation, channel optimization, and even localized production.

Their battle tactics were familiar yet effective: Chinese automakers spearheaded their market entry with hybrid and electric technologies, riding a wave of brand expansion. They not only filled market gaps but also, within a few short years, transitioned from being viewed as skeptical newcomers to dominant forces, opting for deep localization strategies.

01 Similar Success Stories Unfold

Chery's return to South Africa marked a pivotal moment for Chinese automakers' large-scale market penetration. Having previously entered the market in 2007 but withdrawn in 2018 due to outdated product strategies, Chery made a triumphant comeback in 2022. By 2023, its Tiggo series SUVs had propelled the brand to sixth place in sales rankings.

Building on this momentum, Chery swiftly launched its premium brand, Omoda, in 2023, featuring stronger design and technological appeal that resonated with young, style-conscious consumers. In 2024, Chery doubled down by introducing Jaecoo, positioned as a light luxury off-roader, and Jetour, catering to outdoor adventure enthusiasts.

Data reveals that in 2024 alone, the Tiggo 4 Pro model sold 12,646 units, surpassing traditional favorites like the Volkswagen Polo. Subsequently, in 2025, Chery unveiled two highly cost-effective products: the Tiggo Cross Super Hybrid (CSH), priced at just 439,900 rand, becoming the most affordable hybrid in the local market, and the Tiggo 7 CSH plug-in hybrid, priced at 619,900 rand.

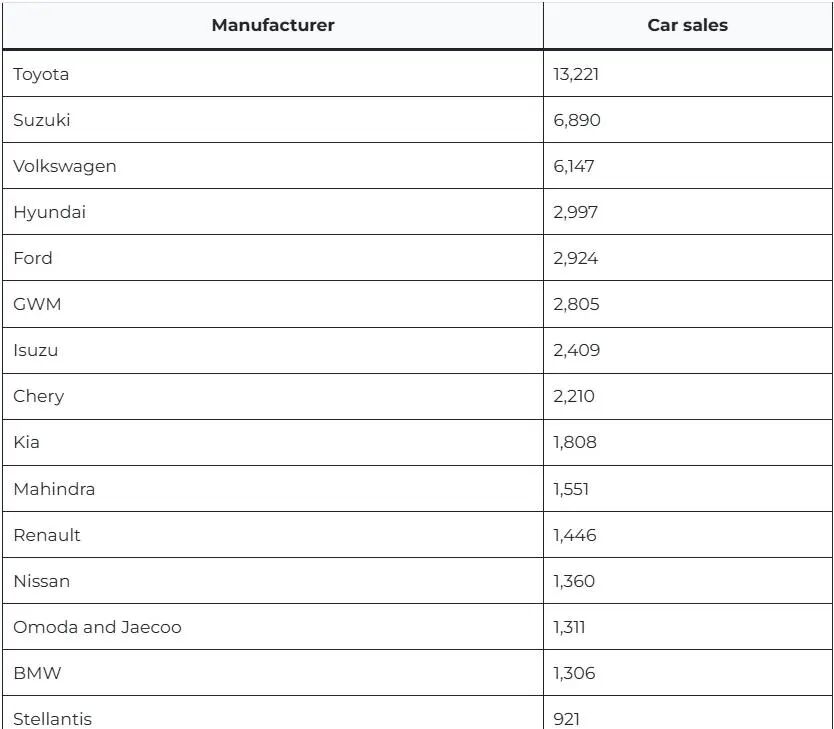

This dual strategy enabled Chery's product pricing to span a broad range, from over ten thousand rand to eight hundred thousand rand, creating a powerful market synergy. By October 2025, the combined sales of Chery, Omoda, Jaecoo, and Jetour reached 4,377 units, propelling them to fourth place in overall market rankings, just behind Toyota, Suzuki, and Volkswagen, and surpassing established players like Hyundai and Ford.

These electrified products perfectly addressed local users' pain points by offering low-cost electric driving for daily commutes while eliminating range anxiety for long-distance travel. This success stemmed from Chinese automakers' technological edge, proving to be a golden rule for entering emerging markets.

As China's new energy products rapidly expanded globally, traditional European and American brands proceeded cautiously in their new energy transitions, leaving a significant market vacuum. Faced with Chery's success, other Chinese automakers were quick to follow suit.

Great Wall Motors capitalized on its Haval SUVs and Tank series to establish a strong presence in South Africa's popular SUV and pickup segments, ranking second among Chinese brands and sixth overall with 2,805 units sold in October 2025.

BYD, the global new energy vehicle giant, took an even more aggressive approach by entering with a full lineup of electric drives. Debuting low-key in June 2023, its first model, the pure electric SUV ATTO 3, did not immediately explode in the market. However, the 2024 launch of the Dolphin hatchback, priced at 539,900 rand, became one of the most affordable pure electric models at the time, rapidly gaining traction.

In 2025, BYD strategically introduced the plug-in hybrid models Sealion 6 SUV and Shark 6 pickup. The former, priced at 639,900 rand, briefly became South Africa's cheapest plug-in hybrid SUV, exerting strong pressure on competitors with its exceptional cost-effectiveness and rich configurations.

Other Chinese automakers soon joined the fray. Geely Automobile made a high-profile return to South Africa after a 14-year hiatus, bringing the pure electric and hybrid versions of its EX5 compact crossover, and planning to expand its dealer network to 80 outlets by 2028. Its subsidiary brand, Riddara, simultaneously launched the RD6, then the most affordable pure electric pickup in the South African market.

Meanwhile, Changan Automobile landed alongside its electric subsidiary brand Deepal, while Leapmotor introduced its extended-range electric vehicle C10 through a joint venture with Stellantis. The entry of these new players further enriched Chinese brands' product portfolios and diversified their technological routes.

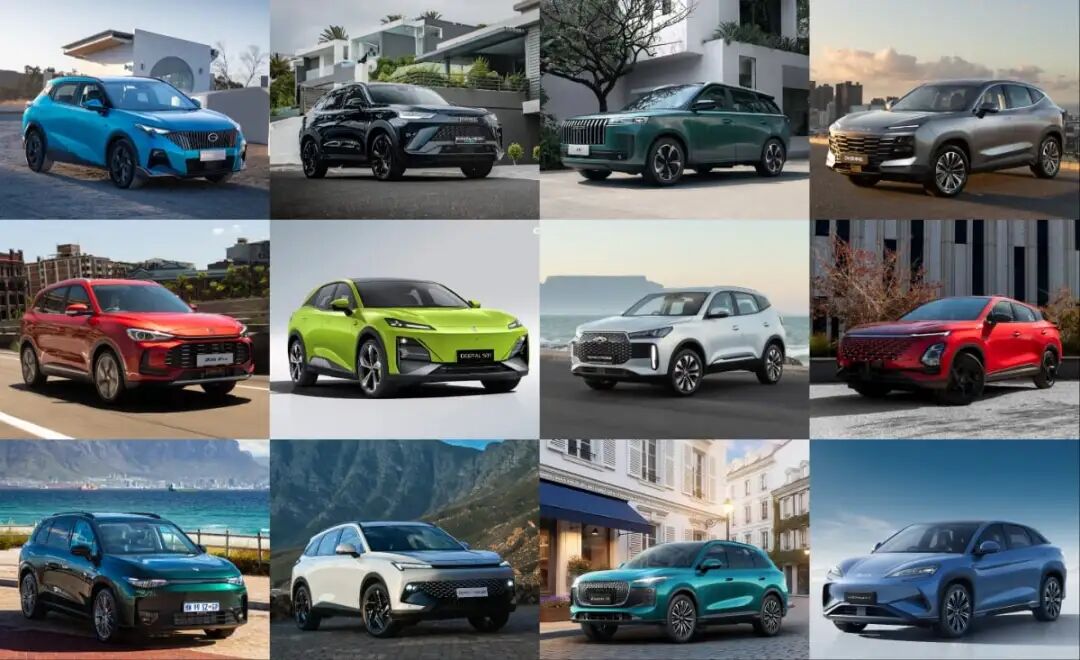

By 2025, 16 Chinese automotive brands were active in the South African market, accounting for one-third of all available brands and offering over 40 passenger car models, with new energy vehicles comprising a significant portion. This beachhead operation, driven by technological innovation and multi-brand strategies, successfully propelled Chinese automakers from market fringe players to mainstream competitors.

02 Rapid Localization: The Key to Success

As Chinese brands rapidly expanded their market share in the second half of 2025, the competitive landscape and external environment in South Africa underwent profound changes. The simple model of exporting complete vehicles faced unprecedented challenges, prompting Chinese automakers' South African strategies to evolve toward deep localization and ecosystem construction.

The influx of Chinese brands, while offering abundant choices, also sowed seeds of homogeneous competition and internal brand cannibalization. In October 2025, the South African automotive industry issued sharp warnings.

Bonitt Vandermeerwe, CEO of Mazda South Africa, pointed out the severe risk of market cannibalization locally, where excessive models with similar positioning, pricing, and target demographics were competing against each other, undermining individual brands' premium capabilities and image.

She further highlighted the long-term challenges facing Chinese brands: used car residual values and after-sales service systems. Due to their relatively short market presence, most Chinese brands had not yet established reliable valuation systems in the used car market, leaving consumers concerned about high maintenance costs and low resale values.

Diederik van der Walt, CEO of WeBuyCars, South Africa's largest used car trading platform, shared similar views, believing the current influx of Chinese brands was unsustainable. He predicted the market would undergo self-correction in the coming years, potentially forcing out some brands lacking core competitiveness.

Moreover, the strong rise of Chinese brands had drawn keen attention from international giants like Toyota, Volkswagen, and Ford, which had deep-rooted local manufacturing in South Africa. These traditional players began lobbying the South African government for more proactive measures to support local manufacturing and protect domestic employment.

A clear possibility emerged that the government might raise tariffs on imported complete vehicles, directly undermining Chinese brands' greatest competitive advantage: price appeal. The South African Trade Minister also publicly stated that cheap imported cars were exerting pressure on the domestic automotive industry.

In response, the South African government was considering adjusting its subsidy and incentive policies to favor local production more strongly, aligning with the goals outlined in the South African Automotive Masterplan 2035 to raise localization rates to 60% and achieve annual production of 1.4 million units.

Faced with these challenges, leading Chinese automakers responded swiftly and decisively, initiating strategic transformations from merely selling cars to establishing roots. This process reached its climax in October 2025, as BAIC Group and Foton Motor took the lead in demonstrating their commitment to local manufacturing.

Foton rolled off the first locally assembled Toplander G7 pickup at BAIC's CKD plant in the Coega Special Economic Zone. BAIC subsequently announced it would produce the B30 SUV at the same facility, emphasizing that the 11 billion rand plant represented an "investment in South Africa's sustainable automotive future."

Chery and Great Wall Motors, the two major leaders, also explicitly prioritized local production. In October 2025, Chery's South African CEO revealed that the company would decide on a CKD plant construction plan within three to six months, with options including taking over existing capacity or building a new facility. Initial production would focus on the Tiggo 4 series, with future plans to export to other African regions.

Great Wall Motors' South African Chief Operating Officer admitted that despite facing a high entry threshold of 50,000 annual units, they were negotiating joint pickup production with local assemblers and seeking more attractive investment return schemes.

If localized production addressed current challenges, then massive investment in charging infrastructure aimed to build an insurmountable moat for future market competition. BYD took the initiative here, with its Executive Vice President announcing an ambitious plan in November 2025:

Investing billions of rand to triple its dealer network in South Africa and construct 300 public electric vehicle charging stations, including technologically advanced 1MW ultra-fast chargers capable of delivering a "5-minute charge, 400-kilometer range" experience. This dual strategy of vehicle sales and energy infrastructure development not only resolved core user anxieties but also demonstrated BYD's long-term patience and substantial investment in market cultivation as an industry leader.

03 Why South Africa: A Strategic Goldmine

Many wonder why South Africa, a market of this nature, justifies such extensive efforts from Chinese automakers. The most direct objective is to seize South Africa, the most mature and largest automotive market on the African continent. South Africa boasts a developed automotive industry with annual production exceeding 500,000 units, and the market is on an upward recovery trajectory with significant consumption potential.

More critically, Chinese automakers have astutely capitalized on the window of opportunity left by traditional European and American brands' sluggish new energy transitions. By launching affordable hybrid and pure electric models, they swiftly satisfied market demand for advanced yet economically practical mobility solutions, achieving a leap from newcomers to mainstream players.

Of course, Chinese automakers' ambitions extend far beyond South Africa alone. More profoundly, they aim to establish South Africa as a bridgehead and production base for radiating across the entire African continent and even globally. This springboard strategy is evident in multiple automakers' layouts: BAIC Group explicitly stated it "views South Africa as the gateway to the African continent." The first pickup rolled off Foton's South African assembly line targeted other African markets.

Brands like Chery and Great Wall Motors plan to establish CKD plants locally with clear long-term goals of exporting to the African continent. This model of local production and regional exports not only effectively circumvents high tariffs on imported complete vehicles but also aligns highly with the South African government's industrial policy of transforming the country into a global automotive manufacturing hub.

South Africa's unique geographical location constitutes its primary advantage as a strategic stronghold for the global automotive industry. Situated at the southernmost tip of the African continent, this "Rainbow Nation" not only maintains deep connections with African nations but also sits across the sea from major international markets like Europe and Asia, naturally positioning it as an ideal regional automotive export hub.

This geographical advantage is further amplified by South Africa's well-developed modern infrastructure. Its efficient ports, railways, and road networks collectively form a mature logistics system, providing solid guarantees for the smooth import and export of automotive components and complete vehicles, significantly optimizing supply chain management.

Meanwhile, South Africa takes pride in its highly skilled industrial workforce. The nation offers a range of professional automotive engineering and manufacturing training programs, which consistently supply society with a labor force endowed with both solid theoretical knowledge and practical experience. This, in turn, injects a continuous flow of talent into the automotive manufacturing industry, bolstering its vigorous development.

What is even more noteworthy is that South Africa has fostered a highly competitive automotive component manufacturing ecosystem within its borders. From tires to engine components, the comprehensive supply chain not only caters to domestic production needs but also garners widespread acclaim in the international market for its high-quality products, which are exported far and wide.

In other words, amid the global wave of electrification transformation sweeping through the automotive industry, South Africa is poised for takeoff and has the potential to emerge as a leader in electric vehicle manufacturing across Africa. Continued investment in charging infrastructure and advanced manufacturing capabilities will further empower South Africa to play a more pivotal role in this burgeoning market.

Editor-in-Charge: Cao Jiadong Editor: Chen Xinnan

THE END