European and American Automakers Accelerate Decoupling from China's Supply Chain | Business Tide

![]() 11/19 2025

11/19 2025

![]() 461

461

Written by | Hou Tian

Recently, several major news stories in the automotive industry have drawn significant attention, signaling an escalation in supply chain rivalry within the sector.

First, Reuters reported that General Motors has requested thousands of suppliers to remove Chinese components from their supply chains. Similar directives began as early as the end of 2024 and became more urgent this year amid rising U.S.-China trade friction. Some suppliers were even explicitly told to "completely sever procurement relationships with China by 2027."

Following this, The Wall Street Journal revealed that Tesla is pushing to eliminate Chinese components from its U.S. production lines. The company has already started using parts from other countries and plans to fully phase out Chinese suppliers within the next 1-2 years.

Additionally, three mainstream European automakers—Stellantis, BMW, and Volkswagen—have collectively requested suppliers to replace all Chinese-made semiconductors within the next 1.5 years, shifting toward a so-called "China-free" approach.

European and American countries have been promoting manufacturing reshoring for years, exploring ways to reduce reliance on Chinese supply across various industries, including automotive manufacturing. This year, global geopolitical tensions have intensified, fueling stronger demands from European and American automakers for supply chain autonomy. The United States, in particular, has imposed tariff restrictions on multiple countries.

Breaking free from global dependence, especially on China's supply chain, is no easy feat for the global automotive industry.

The automotive industry chain, shaped over a century, is vast and deeply globalized. While developed countries like the United States have strong foundations in traditional fuel vehicles, they face higher costs and weaker competitiveness in emerging fields like new energy and intelligent vehicles. Rebuilding a complete supply system for new automotive models while cutting costs from the old system poses significant challenges in the short term.

For Chinese enterprises, the pressure from decoupling with European and American markets is real. With a high proportion of domestic automotive component exports, the current exclusion will inevitably lead to a decline in global demand. Although China has accumulated advantages in automotive manufacturing efficiency and cost, relying solely on manufacturing and price advantages is no longer sufficient to sustain long-term industry development amid accelerating supply chain restructuring.

Ascending to brand value and high-value-added segments, strengthening supply chains, and advancing overseas layouts have become essential choices for Chinese enterprises in the next phase. This time, China's automotive industry chain is truly facing a global blockade war without limits.

Reshoring

The recent urgency among European and American automakers to break away from China's supply chain is linked to a series of chain reactions caused by the recent Nexperia semiconductor supply disruption.

Nexperia, a wholly-owned subsidiary of Chinese chipmaker Wingtech Technology, is a major global supplier of automotive-grade semiconductors. Its diodes, transistors, power devices, and other products hold over 30% of the global automotive-grade market share, used by automakers ranging from BMW and Volkswagen to Stellantis and Mercedes-Benz.

Last month, the Netherlands suspended wafer supplies to Nexperia on "national security" grounds, halting its exports. This disrupted supply chains for multiple automakers in Europe, the United States, and Japan. The American Automobile Association even warned the White House directly that a large-scale automotive production halt in the United States could occur within weeks if Nexperia's chip supply is not restored.

CCTV News reports on the Nexperia semiconductor incident

Against this backdrop, anxiety among European and American automakers over "supply chain controllability" has reached its peak. Over the past few years, persistent U.S.-China tensions, fluctuating tariff policies, and the recent Nexperia incident have heightened fears of another "supply halt." Reducing reliance on China's supply chain has become a consensus among developed country automakers.

This attempt to reshape the supply chain is not solely targeted at China but reflects a broader effort by countries to regain control over their industrial chains. For instance, General Motors in the United States has also issued directives to reduce dependence on supplies from countries like Venezuela and Russia, aiming to lower overall supply chain risks.

Since the 1990s, developed countries in the United States and Western Europe have large-scale ly (massively) relocated manufacturing, leading to a continuous outflow of mid-to-low-end production capacity. While this has brought significant cost benefits to European and American capital, it has also resulted in hollowed-out domestic manufacturing and vulnerabilities in key sectors.

Over the past decade, Western countries like the United States have become highly dependent on foreign supplies in critical areas such as minerals, semiconductors, and energy equipment. Meanwhile, China's industrial system has become increasingly complete, with a supply chain that demonstrates growing resilience.

Given this reality, the demand for manufacturing reshoring in European and American countries has become more urgent.

The automotive industry is one of the most comprehensive sectors in the manufacturing system, with an extremely broad industrial chain spanning steel, aluminum, electronics, motors, chemicals, materials, rare earths, glass, and other industrial sectors. It serves as a "comprehensive representation" of the industrial system.

Once the automotive industry chain begins to rebuild, it can drive a comprehensive restart across multiple industrial manufacturing sectors.

Data underscores the importance of the automotive industry to national economies and employment. In China, for example, the automotive industry accounts for about 10% of GDP and tax revenue, making it the largest industrial sector. In Germany, it similarly contributes nearly 10% of GDP and nearly half of the manufacturing value-added. In Japan, the automotive industry contributes up to 20% of GDP, with direct and indirect employment accounting for 10% of the national workforce.

For this reason, European and American countries view the automotive industry as a "strategic high ground that must be regained," not just to de-Sinicize but to stabilize their industrial manufacturing foundations by rebuilding the automotive industry chain.

Supply

Reshoring industrial chains, whether in Europe or North America, is not achievable through mere rhetoric, especially for an industry like automotive, which is highly globalized and intricately divided in its supply chain.

The United States serves as a prime example. Since the 1980s, when manufacturing began to Large scale relocation (relocate en masse), its automotive industry has continuously shifted to countries like South Korea, Mexico, and China. The proportion of U.S. manufacturing has steadily declined, and its supply chain has become increasingly reliant on external low-cost production.

This trend accelerated further after the implementation of the North American Free Trade Agreement (NAFTA) in 1994. At that time, the U.S. domestic automotive manufacturing workforce stood at 282,000, but by 2018, it had dropped to 234,000, a 17% decline. A significant portion of production shifted to Mexico, leading to the closure of domestic factories and the fragmentation of the U.S. automotive industry's integrity.

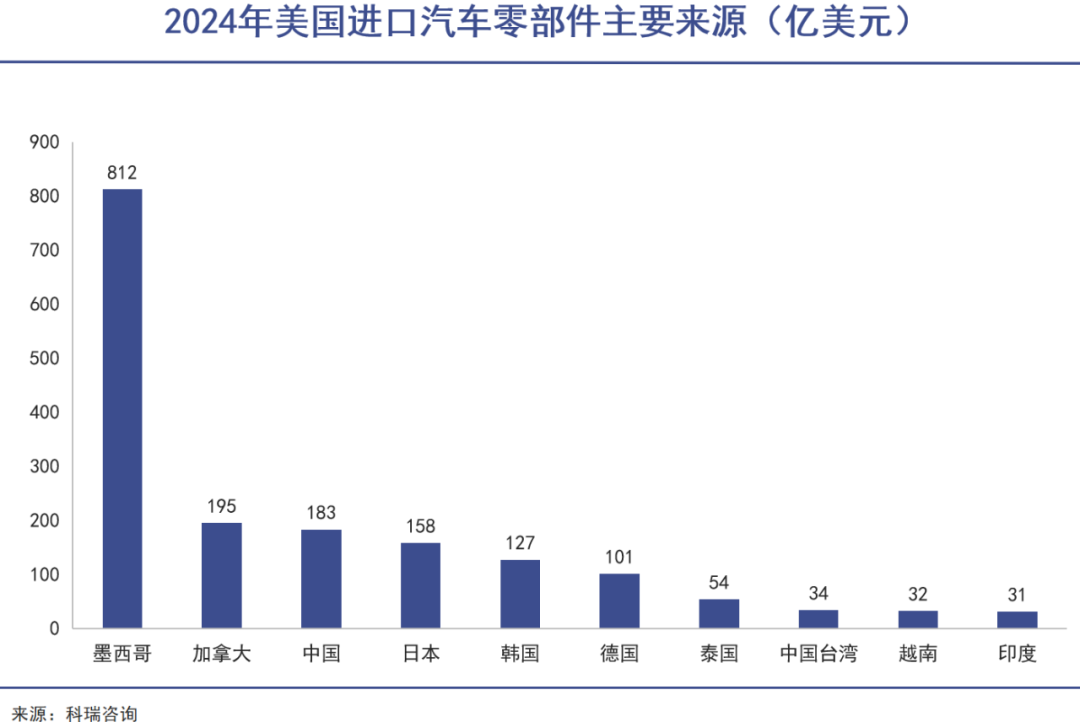

Today, approximately 60% of U.S. automotive components are imported, with major sources including Mexico, Canada, China, and Japan. Mexico accounts for over 40%, while China contributes about 11%.

U.S. imports from China cover various segments, including bodywork, chassis, tires, glass, automotive electronics, electronic control systems, and lithium-ion batteries, spanning multiple modules of the vehicle system. This means that even if the United States aims to accelerate "de-Sinicization," it will struggle to quickly rebuild supply capabilities for these segments in the short term.

Currently, the rivalry over automotive supply chains in Europe and North America primarily revolves around fuel vehicles. After a century of development, European and American fuel vehicles have accumulated deep expertise in key industrial areas such as engines, transmissions, fuel injection systems, and emission controls. These segments are highly technology-intensive and supported by mature industrial clusters, providing the foundation for European and American supply chain management in the automotive sector.

In contrast, the European and American manufacturing systems lack significant influence and competitiveness in the new energy sector. Whether in infrastructure like charging station density and power grids or in mid-stream manufacturing areas such as upstream power batteries, electronic controls, motors, IGBTs, and intelligent driving software and hardware, China holds a substantial lead over Europe and the United States.

Although the United States and Europe attempt to promote supply chain de-Sinicization through policies, they struggle to find viable "alternatives" to China in terms of industrial infrastructure capabilities, supply chain completeness, and cost control. This means that forcing decoupling will lead to a series of issues, including rising domestic production costs and significantly longer delivery times in Europe and the United States.

Rivalry

In the electric vehicle era, China has become an indispensable supply chain hub for the global automotive industry.

In the upstream core area of power batteries for new energy vehicles, China currently accounts for over 60% of the global supply. Rare earths, essential for permanent magnet motors, are nearly 90% sourced from China. While European and American countries possess mineral resources like lithium and rare earths, their processing capabilities, industrial clusters, and energy infrastructure remain relatively weak.

In mid-stream manufacturing, Chinese enterprises demonstrate significant cost and efficiency advantages. For instance, data shows that Chinese companies have approximately 40% lower production costs than foreign counterparts in wire harness manufacturing, with response cycles about 30% shorter.

In areas such as electronic controls and structural components, Chinese suppliers offer lower costs, more comprehensive support, and larger scales. In production segments like aluminum die-casting, China has become one of the most scalable global Production capacity base (production bases), capable of balancing output, yield rates, and delivery speeds.

These advantages make it difficult for U.S. and European automakers to find alternative suppliers that simultaneously meet cost, yield, and stable delivery requirements in the short term. From a commercially rational perspective, a complete decoupling from China's supply chain is unrealistic.

Therefore, the most likely strategy for overseas automakers in the medium to short term is not a complete decoupling from China but bypassing Chinese domestic production while continuing to leverage the capabilities of Chinese supply chain enterprises. Specifically, an increasing number of Chinese enterprises will establish production capacities in Mexico, Vietnam, and other locations to fulfill overseas orders from North American and European automakers like Tesla, General Motors, and Mercedes-Benz.

A group of Chinese automotive component companies, including Wencan Co., Ltd., IKD, Ningbo Xusheng Group, Lizhong Alloy Group, Tuopu Group, Yongmao Tai, Joyson Electronics, and Sanhua Intelligent Controls, have already set up factories in Mexico, covering core segments such as wheels, chassis, structural components, die-castings, and electronic controls. This trend sidelines direct supply from China.

Tuopu's interior factory in Mexico

However, this shift comes with certain costs for European and American enterprises. While decoupling from China reduces supply chain risks, it also entails higher costs and slower delivery cycles.

Amid intensifying global automotive industry competition, this will further weaken the market competitiveness of their domestic industries. Unless European and American countries continue their "isolationist" policies in relevant fields, they will struggle to truly prevail against Chinese products.

For Chinese enterprises, the restructuring of the supply chain also poses challenges. In the short term, some export-dependent companies in the mid-to-low value chain will inevitably face order fluctuations. Suppliers deeply tied to North American and Japanese automakers will also be directly impacted by overseas policy changes, leading some enterprises to exit the market.

Ultimately, no one wishes to see a global business landscape defined by camp confrontation (factional confrontation) rather than genuine market competition.

Epilogue

In the long run, this profound and ongoing supply chain adjustment will bring new opportunities for relevant Chinese enterprises.

Leveraging manufacturing efficiency and scale advantages, China has gradually established a leading market position in the automotive industry, particularly in electric vehicles. This achievement represents a victory for the system and the people, an undeniable success.

Facing subsequent confrontational measures, China's manufacturing industry will continue to ascend toward higher value chain segments in the next phase—moving from mid-to-low value-added areas like structural components and wire harnesses to more technologically advanced and competitive fields such as automotive chips, electronic electrical architectures, and electrification core systems, forming an unstoppable upward force.

Given the immense stakes involved, voices advocating for "de-Sinicization" will persist, and a profound reshaping of the global automotive supply chain is inevitable. However, for China, this external shock also serves as a catalyst to accelerate overseas expansion and strengthen supply chains. This passive transformation may well become a turning point that propels the entire industry to a higher level.