The "Regression" of Electric Vehicle Transition: What Is Happening in the US Auto Market?

![]() 06/26 2024

06/26 2024

![]() 657

657

European and American automakers have pressed the "pause" button on the transition to electric vehicles.

Mercedes-Benz announced adjustments to its electric vehicle transition plan, postponing the target of achieving "50% of sales from electric vehicles" by 2025 to 2030, and slowing down the goal of "full electrification by 2030." The company promised to continue updating its internal combustion engine vehicle products in the next decade.

Apple announced the shutdown of its decade-long electric vehicle project, "Titan."

Volkswagen officially announced the indefinite postponement of the launch plan for its flagship electric sedan, the ID.7, in the North American market.

At the beginning of the year, Ford Motor Company announced the shutdown of all electric vehicle production lines, while General Motors postponed the construction plan for a new factory. Both companies stated that due to market demand falling short of expectations and declining corporate profits, they would postpone some investments related to the electric vehicle industry.

The "regression" of the electric vehicle transition is affecting product planning, transformation directions, platform development, and product marketing in the US auto market.

An analysis report from BofA Securities showed that automakers' product planning departments are struggling with decisions regarding the powertrain of their vehicles, as the decision on what type of power to provide for future cars is more uncertain than ever before. "The powertrain dilemma here has indeed led to product planning issues we have never seen before," said John Murphy, a senior automotive analyst at Bank of America Securities.

Mary Barra, CEO of General Motors, recently adjusted the company's electric vehicle transition expectations and will continue to launch a diverse range of automobiles, including traditional gasoline-powered cars and pure electric vehicles. The company's confidence in the growth of alternative fuel vehicles (electric vehicles, hybrid vehicles, fuel cell vehicles, etc.) is weakening. In fact, besides fully electric companies like Tesla, Lucid, and Rivian, traditional gasoline-powered cars are regaining popularity across the industry.

GM originally expected that the number of new models of alternative fuel vehicles would account for 64% of the total new car launches in the coming years, but currently, the company has lowered this target to 60%. Auto analyst Murphy believes that the drop from 64% to 60%, although only a 4% difference, actually signifies the continuation of the life of gasoline-powered cars and a significant shift in the entire industry towards them.

Murphy said that while automakers have a lot of discussions about hybrid cars, there is more talk than actual action. The analysis report showed that the number of new alternative powertrain vehicle products will increase from 36 in 2025 to 58 in 2027, but then drop back to 54 in 2028.

The reason gasoline-powered cars are "regaining life" is that they can make money for automakers, especially large pickups, high-end SUVs, and crossovers. The money earned from these gasoline-powered cars can be used for the development of other alternative powertrain products in the future. So when chaos or uncertainty dominates, taking some time to retreat to the comfort zone while still planning for the future is also a viable approach.

What some US automakers may be doing now is "returning to their comfort zone and leveraging their strengths." It can already be seen that GM, Ford, and Stellantis are refocusing on trucks and crossovers, while Japanese and Korean automakers are also paying attention to small and large car platforms as well as crossover platforms.

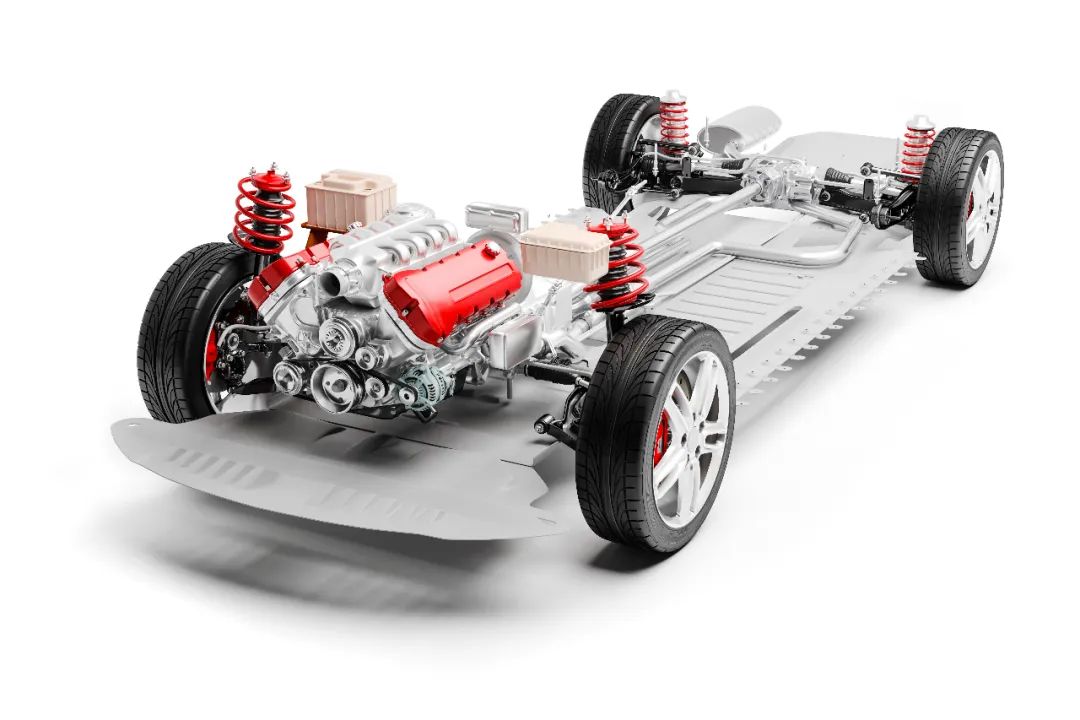

Meanwhile, with the uncertain future of the electric vehicle market, automakers are "abandoning" dedicated electric vehicle platforms.

Sam Fiorani, Vice President of Global Vehicle Forecasts at AutoForecast Solutions, believes that gasoline-powered cars will continue to dominate for the next 10 to 15 years. Automakers need production platforms with greater freedom and flexibility. Dedicating platforms and factories to a single powertrain would involve significant costs, and a single platform would not be able to function when it comes to transferring powertrains.

For example, Stellantis's STLA platform has a traditional internal combustion engine architecture but can actually accommodate hybrid, plug-in hybrid, and gasoline engines. Tesla also plans to launch a next-generation "platform" that can accommodate all its models to further reduce production costs.

In addition, major automakers with independent electric vehicle marketing channels, such as Mercedes-Benz's EQ, BMW's i series, and Toyota's BZ, are adjusting or abandoning these sub-brands and choosing to incorporate electric vehicle names into the same sub-brands as traditional models. This move can reduce marketing costs, lower car purchase costs, and merge electric vehicle sales into the total sales of gasoline-powered vehicle versions, making the financial statements "look better."

However, it should be noted that China's electric vehicle industry is currently developing rapidly, greatly exacerbating the concerns of European and American automakers about the evolution of the future global automotive landscape. Smart electric technology is the general trend of the automotive industry. If European and American automakers "give up halfway" at this time, while Chinese automakers continue to move forward in the electric vehicle race, the future situation may become more passive.

Although the future automotive industry will have a variety of fuel/powertrain combinations, it seems more like a mosaic, more diverse and complex. But for multinational automakers, it may be difficult to have both in the era of electrification.

Edited by Yang Shuo

Typesetting by Zheng Li

Source: Forbes, Autoweek

Image Source: QianTu.com