Splashing $5 billion on software, Volkswagen has Xpeng and now another backup

![]() 06/27 2024

06/27 2024

![]() 664

664

Xpeng is no longer the "only one". On June 25, Volkswagen Group announced that it would invest $5 billion (about RMB 36.3 billion) in Rivian Automotive, a new force in US carmaking, which is considered a formidable rival to Tesla. According to the agreement, the two parties will establish a new, equally controlled joint venture to share electric vehicle architecture and software. The last time Volkswagen Group made such a big investment in the automotive industry was when it invested in domestic new force Xpeng Motors. In July 2023, Volkswagen announced plans to invest $700 million in Xpeng Motors. At that time, Xpeng and Volkswagen announced that they would jointly develop two B-class pure electric vehicle models based on their respective core competencies, Xpeng's G9 model platform, smart cabin, and high-level assisted driving system software, and sell them in the Chinese market under the Volkswagen brand.

Obviously, whether it's investing in Rivian or Xpeng, Volkswagen's goal is software. Behind the frequent investments in software in both China and the US is Volkswagen's long-standing struggle with software.

01 Unlike Xpeng, Volkswagen and Rivian will not develop joint models

Volkswagen's investment in Rivian, to some extent, is a risk reduction measure. From Volkswagen's perspective, cooperating with Xpeng is part of its strategy to achieve self-sustainable development in China amid escalating global trade tensions.

The cooperation with Rivian, on the other hand, is more oriented towards the global market. A Volkswagen spokesperson said that the software developed jointly with Xpeng is only for use in China, while the software developed jointly with Rivian can technically be used anywhere, but no accurate decision has been made yet. In addition, this deal also strengthens Volkswagen's ties with the US, and Volkswagen plans to double its market share in the US by 2030 to balance its largest single market in China.

Meanwhile, there are also slight differences in the way of cooperation between the two. Volkswagen will not develop joint models with Rivian. Broadly speaking, the cooperation between Volkswagen and Rivian mainly includes two aspects. First, Volkswagen and Rivian plan to establish a 50:50 joint venture to develop electric vehicle software. Volkswagen will invest $2 billion in the joint venture, half of which will be in place by the end of 2024 and the other half by the end of 2026. The investment will be made through direct equity and loan agreements. Second, Volkswagen will directly invest $3 billion in Rivian, which will be evenly distributed between 2024 and 2026. The first investment will be made in 2024 through mandatory convertible notes, while the other two investments will be linked to undisclosed financial and technological implementations in subsequent years. Volkswagen's large-scale capital injection will enable Rivian to develop more models and reduce operating costs by leveraging production volumes.

Rivian also brings its intellectual property in software, which will be licensed to the joint venture and applied to Rivian vehicles such as R2, as well as subsequent Volkswagen Group brands including Audi, Porsche, and the revived Scout brand. According to Rivian, the cooperation between the two parties aims to focus on the design and development of software, electronic control units, and related network architectures. Volkswagen plans to start using Rivian's regional ECU architecture and other technologies in 2026. It is reported that Rivian has tested Audi components to understand how they can be integrated with its technology. From Xpeng to Rivian, and even rumors of cooperation with Huawei, behind it all is Volkswagen's "software crisis".

02 Volkswagen's journey in software is exceptionally difficult

Volkswagen is one of the companies that recognized the importance of software earlier, but unfortunately, the results have not been significant, and software capabilities have always been a weak point for the Volkswagen Group. In 2020, the delivery of Volkswagen Group's first pure electric model, the ID.3, was delayed due to software issues; later, the vehicle system encountered widespread blackouts and crashes during severe cold weather, leading to collective complaints from car owners and frequently trending on social media. There is a classic "story" where, after the ID.3's delayed delivery due to software issues in 2020, Volkswagen's engineers had to conduct "wired OTA" updates for about 12,000 new cars using laptops in a "tent workshop" on a three-shift basis to fix software bugs. This was a painful lesson.

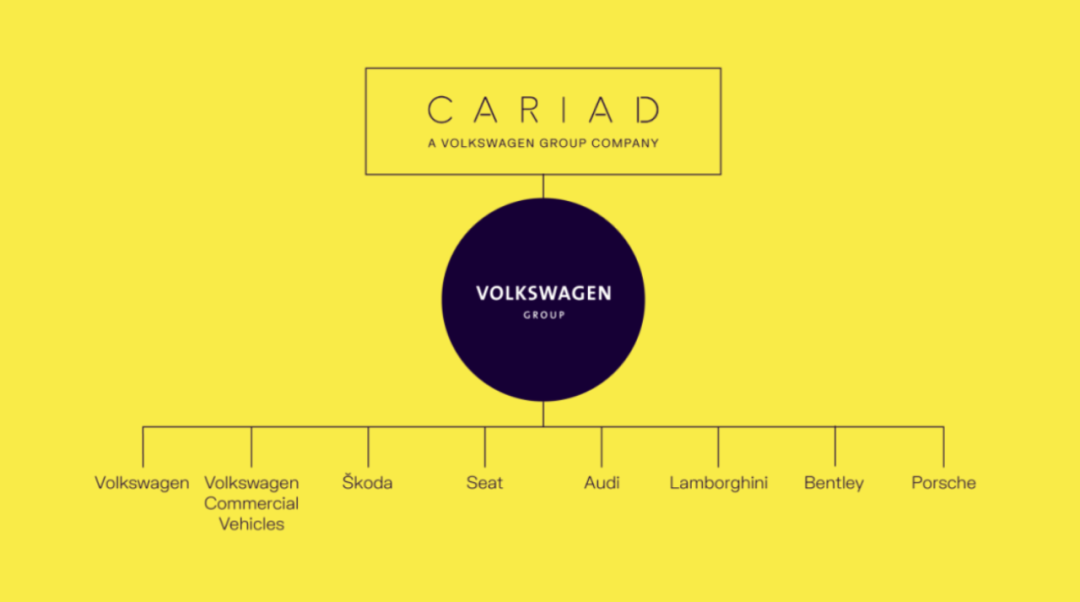

In 2020, Volkswagen Group established the automotive software company CARIAD, which began independent operations in early 2021. In July of the same year, Volkswagen Group released the "2030 NEW AUTO" strategy, proposing to accelerate its transformation into a software-driven mobility service provider. Among them, CARIAD will play an important role in transforming Volkswagen from a car manufacturer to an intelligent mobility service provider through software. Its main tasks include: developing a new vehicle electronic and electrical architecture, the Volkswagen operating system VW.OS, and the Volkswagen cloud VW.AC. In terms of autonomous driving, CARIAD plans to develop assisted driving and advanced autonomous driving systems together with partners.

As the main architecture for all models in the group, CARIAD is developing three software platforms: The E³ 1.1 version has been launched, which can upgrade and remotely update products on the MEB platform and has been applied to models such as the Volkswagen ID.4, Škoda Enyaq, and CUPRA Born; In 2023, CARIAD will release the high-end software platform E³ 1.2 version. This platform will enable various functions, including a new unified infotainment stack and remote online updates for Audi and Porsche vehicles; By 2025, CARIAD plans to launch a brand-new, unified, and scalable software platform and end-to-end electronic architecture: The software stack 2.0 version will include a common operating system suitable for all group brands and, more importantly, will be adapted for L4-level autonomous driving. According to this plan, the software platform 2.0, together with the SSP platform (Scalable Systems Platform), will become the "soul and body" of all Volkswagen Group models. That is: by 2025, the Volkswagen Group will undergo a complete transformation, not only opening up a new ecosystem but also new business models.

Currently, CARIAD's development speed is far behind schedule, leading to repeated delays in the launch of new vehicles. In May 2022, the Volkswagen Supervisory Board pointed out in a meeting that it was CARIAD's delay in the E³ architecture that led to the delay of projects such as the Audi Artemis and Porsche Macan EV. In May 2023, Volkswagen CFO Arno Antlitz publicly stated that CARIAD may not be able to bring its next-generation 2.0 platform to market until 2027 or 2028, further delaying the release of new software. Meanwhile, foreign media reported that Volkswagen's first electric vehicle project based on the SSP platform, Trinity, will also be delayed until 2030. In October of the same year, there were even rumors that Cariad would lay off 2,000 employees. In March of this year, Oliver Blume, CEO of Volkswagen Group, announced the "Ten-Point Action Plan" for 2024, which makes digitization and software upgrades an independent strategy and states that Volkswagen will also launch a platform strategy in the software field. However, there has been no significant progress.

Successive investments in Xpeng and Rivian have also raised doubts about the future of Volkswagen's software subsidiary Cariad, which has been suffering from delays and losses. In response, a Volkswagen spokesperson said that Cariad will continue to develop its own projects, including autonomous driving software. He also said that the deal with Rivian is a "complement" to the existing software strategy. Peter Bosch, CEO of Cariad, also said that the Rivian joint venture will accelerate Volkswagen's software development efforts and reduce costs.

03 Layout in both Chinese and US markets, with different priorities

Judging from Volkswagen's statements, it still chooses a "multi-legged walking" development strategy in software development. Obviously, given that self-developed software progress has not met expectations, exchanging technology through investment is not a bad method. At least in the short term, Volkswagen is relying more on partners to implement its strategy, focusing on the Chinese and US markets, with different priorities. The reason for choosing to cooperate with Xpeng in China is largely due to its intelligent driving capabilities.

In 2019, Volkswagen set a record market share of 19.8% in the Chinese market, but under the impact of subsequent Chinese automakers, Volkswagen's share in China has continued to decline, falling to 11% in 2023. Especially in terms of new energy vehicles, in 2023, Volkswagen Group delivered about 190,000 new energy vehicles in China, with an increase of 23%, far below the overall growth rate of 37% in the Chinese new energy vehicle market, and the sales of new energy vehicles accounted for less than 6% of Volkswagen Group's annual cumulative deliveries in China. In April this year, Oliver admitted in an interview that Volkswagen has struggled to maintain its leadership in China's new energy vehicle sector. To reverse the situation, Volkswagen must focus on both electrification and intelligence. At this time, Xpeng, labeled as "intelligent," is a good partner, especially as the Chinese market becomes increasingly competitive in urban NOA. There has been some progress in the cooperation between the two parties. In less than a year, Volkswagen Group and Xpeng have signed three agreements. On July 27, 2023, Volkswagen Group and Xpeng signed a share purchase agreement; on February 29, 2024, Xpeng and Volkswagen signed a joint development agreement on platform and software strategic technology; on April 17, 2024, Xpeng and Volkswagen issued a joint statement announcing that they would sign a new strategic cooperation framework agreement on electronic and electrical architecture technology.

Under multiple agreements between Volkswagen China CEO Bernd Osterloh and the SUV model outline, the cooperation between the two parties is also continuously advancing. In May this year, at the "Foreign Enterprise Roundtable" during the investment trip to Anhui, a relevant person in charge of Volkswagen (China) Investment Co., Ltd. Anhui Branch revealed that the first model of the Volkswagen-Xpeng cooperation is planned to be produced in Hefei in 2026, with the first model being an SUV. Although the cooperation with Rivian is global, it is mainly aimed at accelerating the layout of the US market. Volkswagen said earlier this year that despite the slowdown in the growth of the electric vehicle market, it still insists on launching 25 electric vehicles in North America by 2030. The best-selling model in the US is pickup trucks. However, Volkswagen believes that it is not a big player in the US large SUV and pickup truck segment, and its crossover electric SUV ID4 has not made a breakthrough. The cooperation with Rivian provides the company with options. Earlier this year, Volkswagen Group announced the launch of the "Scout" brand, which focuses on electric pickups and SUVs. The brand name comes from the off-road vehicle "Scout" produced by the US agricultural machinery company International Harvester, and Volkswagen Group acquired the Scout trademark through the acquisition of Navistar.

According to reports, Rivian's software will be used by the Scout brand, which will establish its first vehicle production plant in South Carolina, US, investing $2 billion to build a base with an annual production capacity of over 200,000 units, scheduled to go into production by the end of 2026. Volkswagen Group is consolidating its position in the US electric vehicle market through the Scout brand and competing fiercely with competitors such as Ford, Chevrolet, Hummer, Tesla, and Rivian. Obviously, as a leading global automaker, Volkswagen Group, which has led in sales for a long time, still wants to maintain its global advantage in the next automotive era. Of course, this will not be easy.