Nezha Auto Files for Hong Kong IPO: Cash on Hand of Only 2.8 Billion, Loss of 18.3 Billion in Three Years, Focus on Overseas Market!

![]() 06/27 2024

06/27 2024

![]() 523

523

On June 26, Beijing time, Hezhong New Energy Automobile Co., Ltd., the main company of Nezha Auto, a new force in the automotive industry, officially submitted its prospectus to the Hong Kong Stock Exchange, revealing its operating conditions, cash reserves, company development direction, and other information over the past three years.

Note: Since Nezha is a brand name and widely recognized, we will uniformly use Nezha Auto below.

Let's take a look at the core information in Nezha Auto's prospectus:

I. Basic Financial Situation

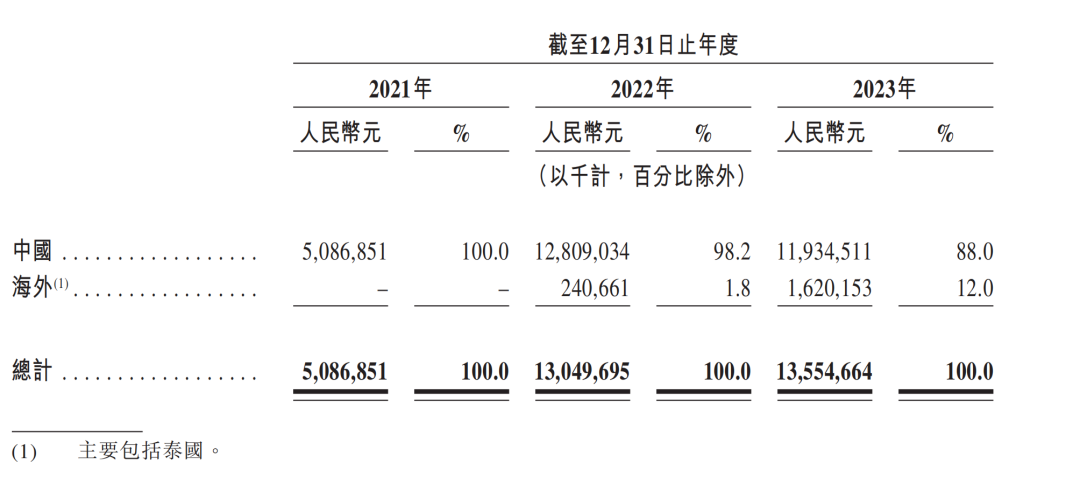

1. Revenue: From 2021 to 2023, Nezha Auto's revenue was 5.087 billion, 13.05 billion, and 13.555 billion, respectively.

Note: In 2021, overseas revenue accounted for zero, 1.8% in 2022, and 12% in 2023. This indicates that Nezha Auto's overseas business is developing rapidly.

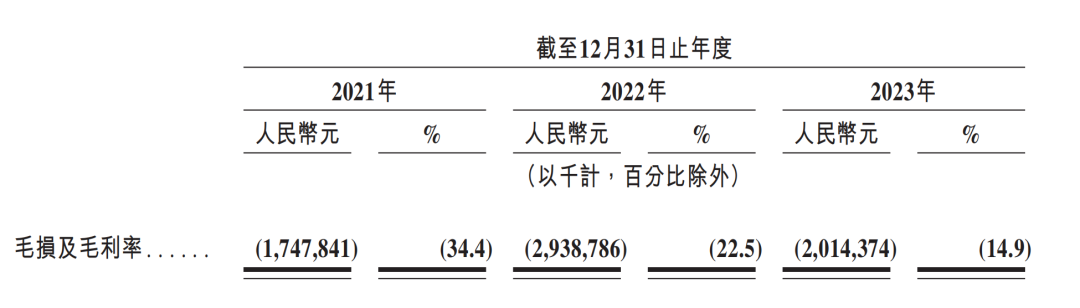

2. Gross Loss and Gross Margin: From 2021 to 2023, Nezha Auto recorded gross losses, with gross losses and gross margins of 1.748 billion and 34.4%, 2.939 billion and 25.5%, and 2.014 billion and 14.9%, respectively.

Note: Although the gross loss is narrowing and the gross loss rate is declining, there is still a long way to go before the gross profit turns positive.

3. Net Loss: From 2021 to 2023, the net losses were 4.84 billion yuan, 6.666 billion yuan, and 6.867 billion yuan, respectively, totaling over 18.3 billion yuan in losses over three years.

4. R&D Expenditure: From 2021 to 2023, R&D expenditures were 541 million, 906 million, and 1.598 billion, respectively. In terms of R&D personnel, as of December 31, 2023, Nezha Auto had 2,132 R&D personnel, accounting for 26.9% of the total employees.

Note: Although R&D expenditures have increased year by year, such expenditures are insufficient to support a car company's continuous investment in battery, motor, and intelligent technology.

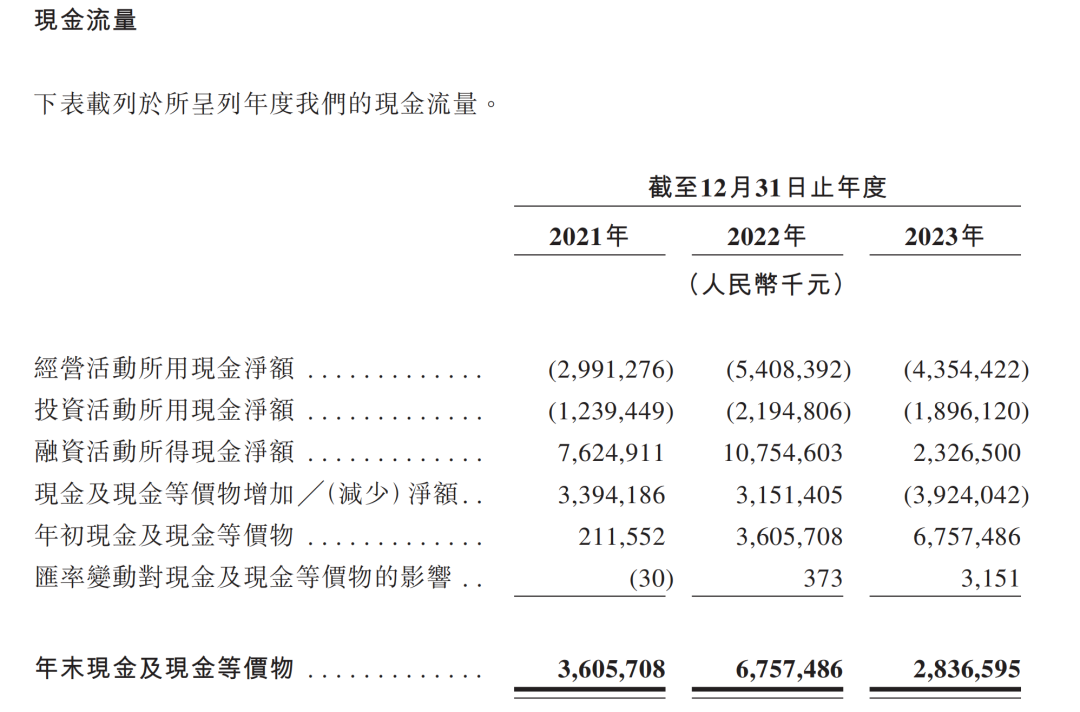

5. Cash on Hand: According to the prospectus, from 2021 to 2023, Nezha Auto's year-end cash and cash equivalents were 3.606 billion, 6.757 billion, and 2.837 billion, respectively.

6. Net Cash Used in Operating Activities: From 2021 to 2023, Nezha Auto's net cash used in operating activities was 2.991 billion, 5.408 billion, and 4.354 billion, respectively.

7. Net Cash from Financing Activities: From 2021 to 2023, Nezha Auto's net cash from financing activities was 7.624 billion, 10.754 billion, and 2.326 billion, respectively. The main sources of financing were bank loans, shareholder injections, and other loans.

Note: Judging from the net cash from financing activities, Nezha Auto's financing ability declined rapidly in 2023, even as the net cash used in operating activities declined, leading to a significant drop in Nezha's cash on hand.

8. Total Borrowings: In terms of debt, from 2021 to 2023, Nezha Auto's total borrowings were 1.499 billion, 4.966 billion, and 5.757 billion, respectively. As of April 30, 2024, the total borrowings were 5.755 billion, unaudited.

The prospectus also pointed out that as of April 30, 2024, Nezha Auto had approximately 2.068 billion in unused bank financing.

Worth mentioning is that on April 15, 2024, Nezha Auto officially announced that it had obtained investment totaling no less than 5 billion yuan from Tongxiang City State-owned Capital Investment and Operation Co., Ltd., Yichun Jinhe Equity Investment Co., Ltd., and Nanning Minsheng New Energy Industry Investment Partnership (Limited Partnership), and coordinated relevant resources to expedite the IPO.

And indeed, on June 26, Nezha Auto finally submitted its listing prospectus to the Hong Kong Stock Exchange.

II. Gradual Increase in Average Auto Sales Price:

Nezha Auto's average auto sales prices in 2021-2023 were 71,000 yuan, 84,000 yuan, and 109,000 yuan, respectively, further rising to 113,000 yuan in the first four months of 2024.

The company attributes this to the increasing sales of its high-end models, Nezha S and Nezha GT. Based on insurance data, the sales proportion of these two models rose from 1% in 2022 to 24.6% in 2023.

This means that for Nezha Auto, increasing the average sales price helps improve gross profit levels, which in turn can turn losses into profits.

III. Betting on the Overseas Market

Nezha Auto's progress in betting on the overseas market is as follows:

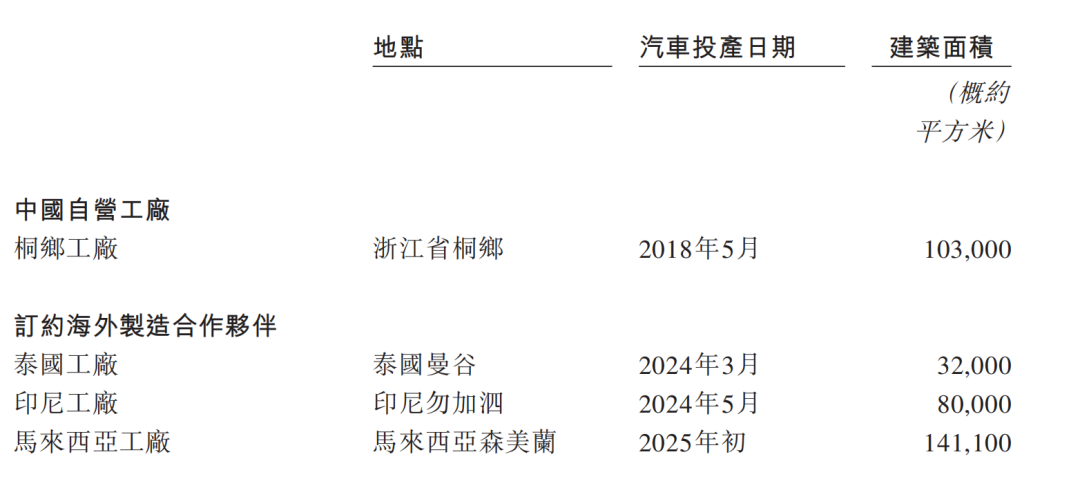

1. Factory Construction: According to the prospectus, Nezha Auto has two overseas factories in operation, with the Thai factory commencing production in March 2024 and the Indonesian factory commencing production in May 2024. Meanwhile, construction of the Malaysian factory began in January 2024.

Note: Nezha Auto only has one vehicle assembly plant in Tongxiang, Zhejiang province, in China.

The Tongxiang plant has a maximum annual capacity of 160,000 vehicles, producing 70,000, 155,000, and 116,000 vehicles in 2021-2023, respectively, with capacity utilization rates of 43.8%, 97.2%, and 72.7%, respectively.

The under-construction Malaysian plant will have an annual capacity of 150,000 vehicles and is expected to commence production in early 2025.

2. Sales Channels: As of December 31, 2023, Nezha Auto had arranged approximately 100 sales and after-sales outlets overseas. The specific approach will select the operating structure based on local conditions. In markets with large capacity and sufficient market competition, a cooperative operating model between subsidiaries and local dealers will be adopted to achieve control over branding, channels, services, and user operations. In emerging markets with limited capacity and abundant agent resources, an authorized agency model will be adopted to quickly expand the market at a low cost.

Note: Nezha Auto has established a total of 539 outlets in China, including 114 Nezha direct-sales outlets.

3. Sales Performance:

Nezha's AYA series, which is mainly used in overseas markets, is the main sales model. In 2023, according to insurance data, the AYA series ranked first among small pure electric vehicles in Southeast Asia, with a market share of 52%.

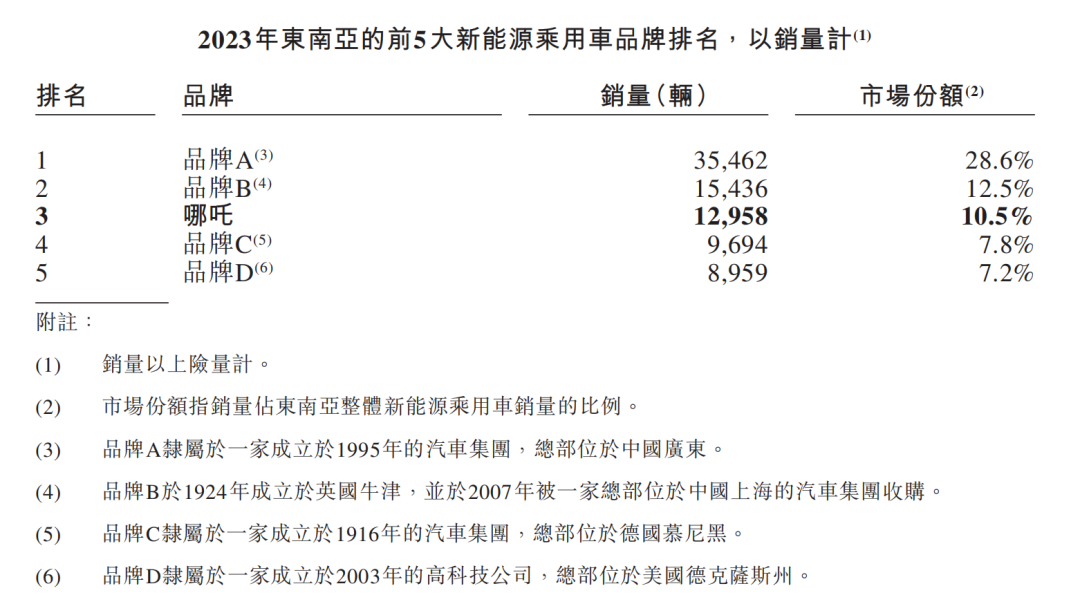

In 2023, Nezha Auto sold 12,958 vehicles, ranking third among Southeast Asian new energy passenger vehicle brands. This was achieved with only one model, the Nezha V, which ranked second among pure electric passenger vehicle models.

Judging from Nezha Auto's actions, it is basically betting on the overseas market. This may also be an opportunity for Nezha Auto, and this IPO hopes to supplement the funds urgently needed to expand the overseas market.