Nezha's overseas expansion story sounds impressive

![]() 06/30 2024

06/30 2024

![]() 535

535

Editor-in-Chief | Su Huai

NIO (09866.HK) traded at HK$33.85 per share, with an IPO price of HK$160 per share;

Li Auto (02015.HK) traded at HK$70.2 per share, with an IPO price of HK$118 per share;

XPeng Motors (09868.HK) traded at HK$29.65 per share, with an IPO price of HK$165 per share;

Zero Run Auto (09863.HK) traded at HK$26.4 per share, with an IPO price of HK$41 per share.

As of the close on June 28, the performance of the four new-force automakers already listed on the Hong Kong Stock Exchange was not ideal.

For Hezhong New Energy, the parent company of Nezha Auto, which recently submitted an application to the Hong Kong Stock Exchange hoping to join this group, it needs to tell a more convincing story to the capital market in order to achieve its desired gains.

"The company has proactively laid out the overseas market in advance, achieving exports of 17,019 vehicles in 2023, accounting for 13.7% of our total sales in 2023, and contributing 12.0% of sales revenue." In the prospectus, Nezha Auto repeatedly mentioned "globalization" and "overseas markets" in the sections on "advantages" and "strategy." Clearly, going overseas is the story that Nezha is betting on.

But is that enough for Nezha to put on a good show in the capital market?

01

Old rivals also expanding overseas

Nezha Auto's overseas advantage lies in starting early.

In August 2022, the right-hand drive version of the Nezha V was launched in Thailand, marking the first step in Nezha's "going overseas" strategy, making Nezha the first new-force automaker in China to land in Thailand. Starting from Thailand, Nezha models have gradually been launched in countries such as Thailand, Nepal, Bhutan, Israel, and Myanmar. In 2022, Nezha's overseas expansion map had already expanded to ASEAN, South Asia, and the Middle East markets.

Image source: AutoHome

In addition, Nezha has begun building factories overseas.

In March 2023, the foundation stone for Nezha's Thai factory was laid, and it went into production in November of the same year, with large-scale production starting in March 2024. The Indonesian factory also signed a memorandum of cooperation in July of that year and achieved mass production in April 2024. In January 2024, Nezha announced the establishment of its third overseas factory in Malaysia, which is expected to go into production in 2025.

Nezha's first-mover advantage has brought impressive results.

Nezha achieved exports of 17,019 vehicles in 2023, accounting for 13.7% of its total sales and contributing 12% of sales revenue for that year. From January to May 2024, Nezha exported 16,458 vehicles, ranking fifth in terms of new energy vehicle exports among automakers and first among new-force automakers. As of the end of May, Nezha's cumulative exports reached 35,000 vehicles.

Among them, Nezha's performance in the Southeast Asian market is particularly impressive. According to a report from CIC Consulting, in terms of insurance premiums, the Nezha AYA series ranked first in sales among small pure electric vehicles in Southeast Asia in 2023, with a market share of up to 52.0%.

However, since this year, going overseas has become a common topic across the entire industry, and the domestic auto market has shown a trend of moving outwards. Taking Nezha's most proud Southeast Asian market as an example, in the past six months, automakers such as Changan Shenlan, GAC Aion, and Zeekr have successively entered the market, with sales performance showing rapid growth.

According to public information, during the 14-day 45th Bangkok International Auto Show in 2024, Chinese brands accounted for 5 of the top 10 automotive brands in terms of order quantity, namely BYD (5,345 vehicles), MG (3,518 vehicles), Changan (3,073 vehicles), Aion (3,018 vehicles), and Great Wall Motors (2,815 vehicles). Nezha ranked sixth among Chinese brand automakers with 1,618 vehicles, with Zeekr and XPeng closely following.

According to new car registration data from relevant departments in Thailand, the Changan Shenlan S07 became the national sales champion for new energy vehicles in April 2024 with 754 vehicles sold. The car started selling in the Thai market in January.

With more and more domestic rivals entering the market, Nezha's first-mover advantage is being eroded. To maintain its leadership, ultimately, it still needs to win the market on the product dimension.

02

Rolling from Nezha L to the C-end market

Looking back at Nezha's previous trends, its highlight moments were mainly supported by the sinking market and the B-end market, but it has become difficult to replicate.

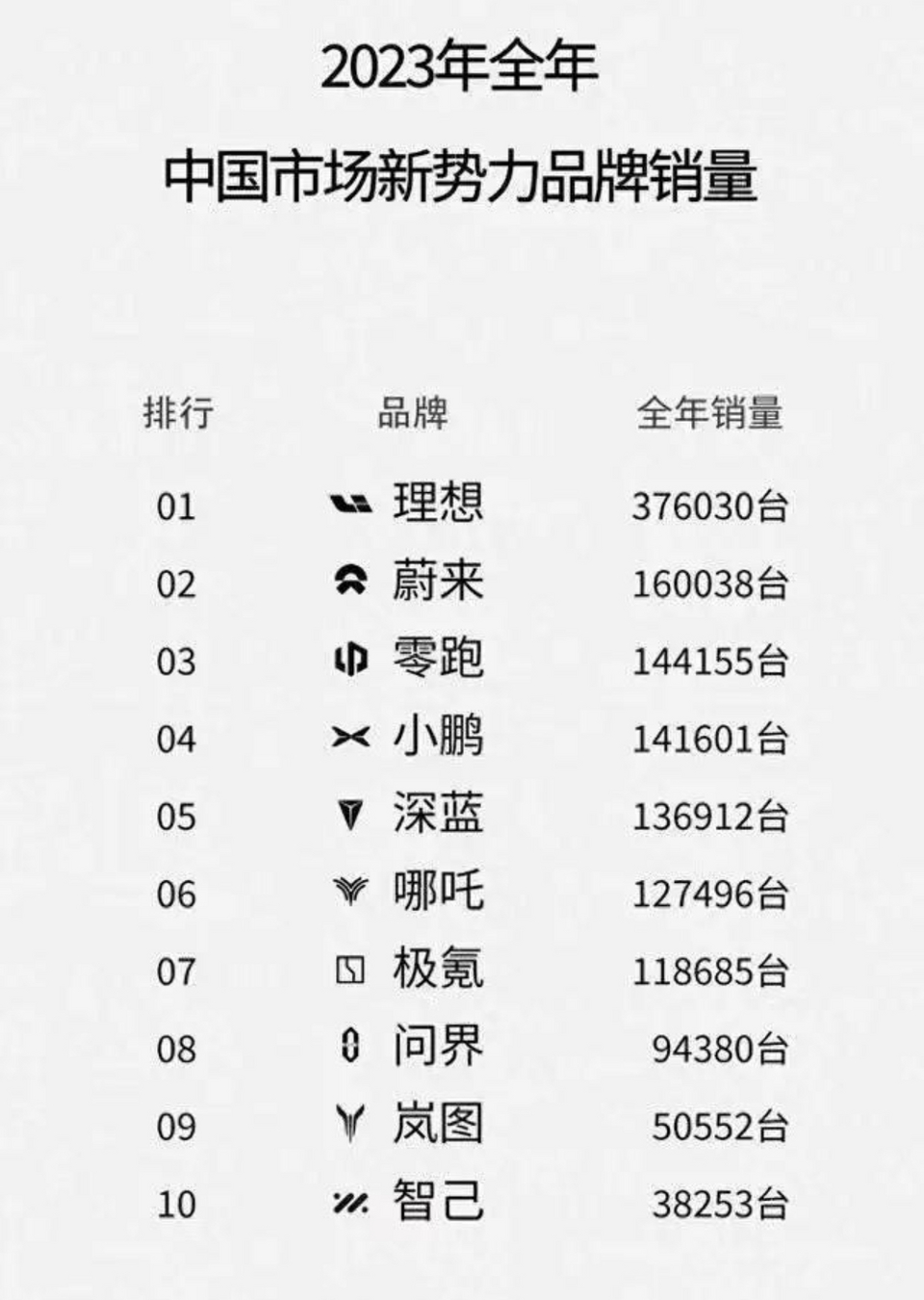

In 2022, Nezha's cumulative sales reached 152,073 vehicles, an increase of 118% year-on-year, achieving year-on-year growth for 29 consecutive months, once surpassing "NIO, XPeng, and Li Auto" to become the sales champion among new-force automakers. In 2023, Nezha's upward momentum slowed down somewhat, but it still achieved annual sales of 127,496 vehicles, ranking sixth among new-force automakers, ahead of Zeekr and AITO (Wenjie).

Such achievements were achieved by Nezha starting with low-end cars priced below 100,000 yuan and focusing on the sinking market strategy. Compared to urban areas, which have become a red ocean in the new energy vehicle market, townships are an incremental market with rapid development potential. In 2020, 2021, and 2022, sales of new energy vehicles in rural areas increased by 87%, 169%, and 87% year-on-year, respectively.

Zhou Jiang, vice president of Nezha, once publicly stated that Nezha is fully committed to laying out county-level market channels and strives to achieve one store per county within three years.

The Nezha V, as a small entry-level pure electric SUV, has a price range of around 60,000 to 80,000 yuan. In 2021, sales of this model reached 49,646 vehicles, accounting for over 70% of overall sales, with the B-end market contributing a significant portion of those sales.

According to reports from the Nanning Production Group, the Nezha V is a new energy crossover vehicle jointly developed by the Nanning Production Group and Zhejiang Hezhong New Energy Automobile Company. Sales of this model reached 30,769 vehicles in September 2021, completing the 30,000-vehicle task assigned by the Nanning municipal government ahead of schedule.

Local industry funds are not only shareholders of Nezha in deep cooperation, but their regions have also become important markets for Nezha. For example, Tongxiang District of Jiaxing City has repeatedly purchased Nezha vehicles in bulk for official use; the Nanning municipal government has also purchased a large number of Nezha U models for police patrols. In addition, Nezha has also signed vehicle procurement contracts with companies in Guangxi, including Guangxi Electric Vehicle Company and Guangxi Lvdun Cloud Company.

However, with the increasing saturation of the B-end market and fierce price competition in the market, Nezha's如意算盘 (如意算盘: a metaphorical expression for a well-planned scheme) in the sinking market is starting to falter.

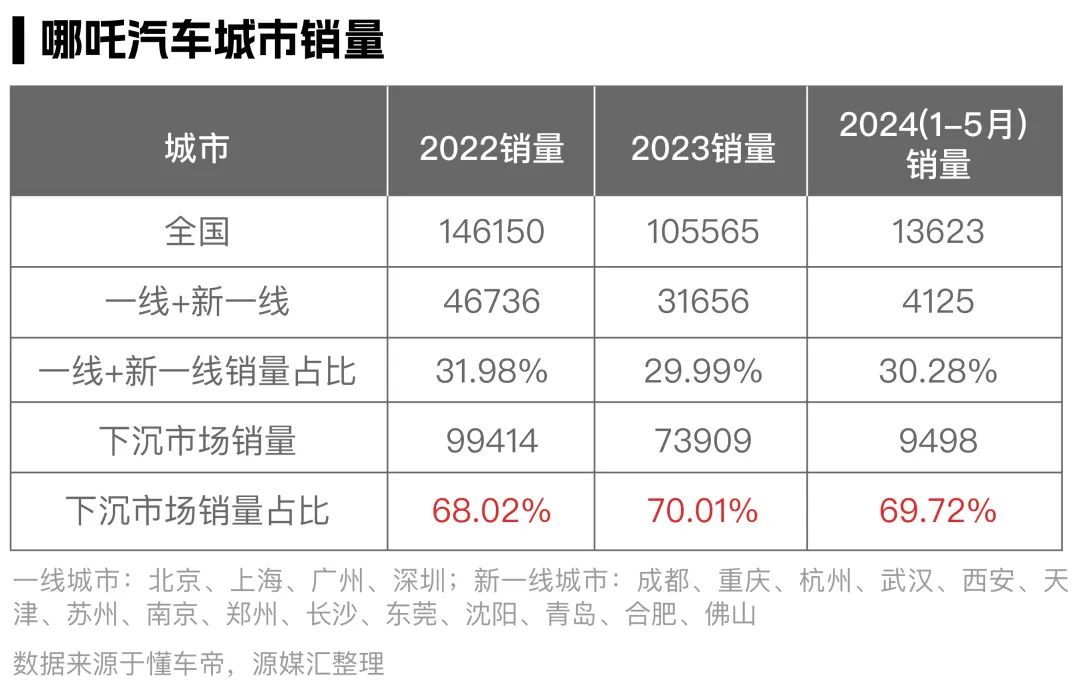

According to a compilation by Yuanmeihui, from 2022, 2023, and January to May of this year, Nezha's sales in 15 first-tier cities such as Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu, Chongqing, and Hangzhou have long fluctuated around 30%. In other words, sales in second-tier and below cities accounted for 70%.

Meanwhile, overall sales have been shrinking continuously. In the first five months of 2024, Nezha delivered approximately 43,600 vehicles, a year-on-year decline of 13.3%, with sales in the first five months falling short of 20% of the preset sales target. To open up an incremental market, Nezha has begun to focus on the price range above 100,000 yuan.

"Since the launch of the Nezha L, current orders are in short supply, and the factory is working overtime to ensure supply." The Nezha L, which was launched in April this year, is the first step for Nezha to move upmarket. According to co-founder and CEO Zhang Yong of Nezha and official Nezha news, this model, a five-seat extended-range mid-size SUV with a starting price of 129,900 yuan, has received over 30,000 orders. This year, Nezha will also launch the Nezha S Shooting Brake version, which, combined with the starting price of 154,800 yuan for the regular Nezha S sedan version, is expected to become the most affordable mid-to-large new energy shooting brake on the market.

In October 2023, regarding rumors about Nezha's listing, Zhang Yong said, "The current market is not ideal, so it doesn't matter much whether or not we go public." Now that half a year has passed, neither the overall market environment nor Nezha itself can be described as recovering. This submission to the Hong Kong Stock Exchange perhaps indicates that Nezha doesn't have many cards left in its hand.

Some images are referenced from the internet. Please inform us if there is any infringement for deletion.