Can the M03 Create the Hit Myth that Xpeng Desires?

![]() 07/01 2024

07/01 2024

![]() 486

486

Will the annual delivery volume reach a minimum of 100,000 units? The results of Xpeng's collaboration with Didi in car manufacturing will be unveiled.

Xpeng's latest MONA series' first model, M03, will be officially unveiled on July 3rd. Starting in June, Xpeng has already launched a promotional offensive surrounding this new series.

According to He Xiaopeng, Chairman of Xpeng Motors, after this car goes on sale, it will be even more popular than Xiaomi's SU7.

Every automaker hopes to create a hit model, but unfortunately, since the new car manufacturing wave in 2014, only three companies have achieved this: NIO, Huawei, and Xiaomi.

With its L series of products, NIO has emerged as a leader among new car manufacturers, while Huawei and Xiaomi have redefined automotive marketing. The Wenjie M9 received over 10,000 orders within two hours of its launch, and Xiaomi's SU7 garnered 50,000 orders within half an hour of its launch, leaving people astonished.

These feats have left many automakers like Xpeng, NIO, and Nezha envious, all dreaming of pulling off a big move and making a splash. Especially Xpeng, which has been making big moves but has yet to receive much of a response.

So, will MONA be Xpeng's killer weapon? Does M03 have the potential to be a hit?

01

Does the Xpeng M03 have the potential to be a hit?

On April 25th, at the 2024 Beijing Auto Show, Xpeng Motors officially unveiled its new product series, MONA.

Shortly after, Xpeng revealed that the first model in the MONA series would be named M03, with an estimated price range of 100,000 to 150,000 yuan. It will be equipped with Xpeng's intelligent driving system and is scheduled to go on sale in the third quarter.

He Xiaopeng, Chairman of Xpeng Motors, boldly stated: "In the second half of this year, we will have better sales than Lei Jun's Xiaomi SU7."

On June 13th, the Xpeng M03 was listed in the 384th batch of new vehicle announcements. According to the announcement, the Xpeng M03 has a body size of 4780*1896*1445mm and a wheelbase of 2815mm, making it a medium-sized pure electric sedan.

Based on the announcement, it seems that the Xpeng M03 has two versions, one with a tail logo of M03 and the other with a tail logo of D03. It is speculated that the M03 is aimed at C-end consumers, while the D03 may be aimed at the online car-hailing market.

The motor for this car comes from two suppliers. The M03 motor is from Feishilüneng, with a motor power of 160kW. The company's main customers for its electric drive system include BAIC BJEV and Hezhong Auto.

The D03 motor comes from Suzhou Inovance, with a motor power of 140kW. Xpeng has previously used its motor products, and other OEM customers include NIO and GAC.

Both the power batteries are lithium iron phosphate batteries from BYD. It has been revealed that the car's range will exceed 500km.

D03 version optional configuration diagram

From the optional configuration diagram, it can be seen that the D03 has a lower configuration. Not only does it have a lower motor power, but even some cameras, radars, and hidden door handles are optional. Therefore, it is reasonable to speculate that it is a version aimed at the online car-hailing market.

Entering June, Xpeng gradually began promoting the M03, and Xpeng began proactively releasing some model information.

Xpeng Motors stated that the M03 has a drag coefficient of Cd 0.194, will come standard with an electric hatchback tailgate, has an opening width of 1136mm, and a trunk capacity of 621 liters.

Combined with the single-motor configuration, it is expected that this car will follow an energy-efficient and spacious family car route.

Another noteworthy point is that Xpeng's styling and design have always been heavily criticized by netizens. Xpeng currently has a total of 6 models on sale, and it can be said that each one looks quite different.

The Xpeng M03 adopts a new design language, giving a certain degree of refinement and design sense to the exterior. Although it is not eye-catching, it is still quite pleasing to the eye. In terms of exterior color, colors such as Xinghan Mi and Xingyao Blue have been revealed.

What people are most looking forward to about this car is its software, which will be equipped with the X-EEA3.0 electronic and electrical architecture, as well as XNGP full-scenario intelligent assisted driving.

He Xiaopeng once said that he wanted to bring high-level intelligent driving to models in the 150,000 yuan price range. We know that full-scenario high-level intelligence relies on a large computing power platform and strong sensors to achieve, and cost reduction has always been a pain point. Therefore, most models capable of urban navigation are priced around 300,000 yuan.

Xpeng Motors' capabilities in intelligent driving are commendable. Although it has been under pressure from Huawei recently and has been pursued by a group of new car manufacturers, intelligent driving can still be considered Xpeng's core competitiveness.

Therefore, whether it can achieve high-level intelligent driving while effectively controlling costs is the biggest attraction of this car and will also be its greatest competitive advantage.

02

How is the market competitiveness of the Xpeng M03?

Xpeng MONA officially stated that it is the best in its class among similar models. Let's take a look at the medium-sized pure electric sedan market segment and see what competitors it will encounter.

According to previous information disclosed by Xpeng, the starting price of the M03 should be around 150,000 yuan, and some people have speculated that it will be between 100,000 and 150,000 yuan.

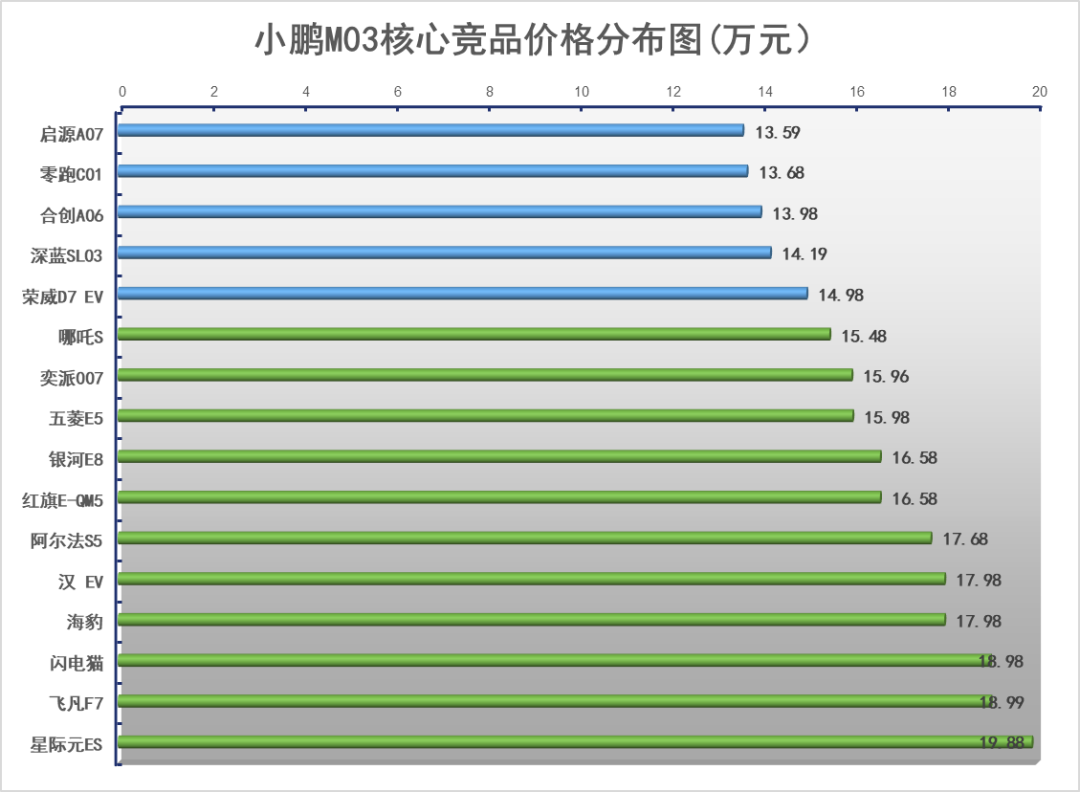

In the 100,000 to 200,000 yuan price range, there are nearly 20 models of medium and large pure electric sedans to choose from, indicating that this market segment is also highly competitive.

Regardless of energy type, according to Dongchedi data, in the May sales rankings, the Mercedes-Benz C-Class was the top-selling mid-size car with a monthly sales volume of 17,000 units, and fuel-powered cars were still the mainstay among the top 10 models.

Among the top 10 competitors, there were only two new energy vehicles, one being the Tesla Model 3 with sales of 15,230 units and the other being the Hongqi E-QM5 with sales of 7,760 units.

It can be seen how difficult it is to compete in the mid-size car market segment. The competition that Xpeng M03 faces is not only within the new energy sector but also from traditional fuel-powered cars.

Among these products, some rely on strong brand influence, some on product reputation, and some on significant price reductions for a limited time.

Car purchasing decisions often involve a comprehensive comparison of product strength, brand strength, and price.

Xpeng Motors does not have an advantage in brand strength, as evidenced by the underperforming market performance of models like the Xpeng G9 and Xpeng G6.

Although Xpeng Motors, along with NIO and LI Auto, has been known as the "Wei Xiao Li" trio, representing new car manufacturers. Unlike NIO and LI Auto, Xpeng Motors has never established a high-end brand tone and therefore cannot enjoy the premium brought by the brand.

Looking at product strength, automotive products are becoming increasingly competitive, especially in the new energy sector. Recently launched models have good product strength, with plenty of features and excellent basic qualities.

Take the recent in-depth test drive experience of the YIPAI 007 as an example. This car comes in both an extended-range version and a pure electric version. The starting price of the extended-range version is 159,600 yuan, and the starting price of the pure electric version is 166,600 yuan, with a limited-time discount of 30,000 yuan, bringing the price down to 136,600 yuan.

At this price point, the car boasts a wheelbase of over 2.9 meters, a front MacPherson and rear multi-link independent suspension, a 160kW motor, and a CLTC range of 530 kilometers. It also comes with features like 360-degree panoramic imaging, a transparent chassis, and standard configurations like an 8155 cockpit chip and 20 speakers.

However, despite all these features, the car's sales performance has remained average due to its low brand awareness.

Looking at the basic configuration of the Xpeng M03, it may not differ significantly from the YIPAI 007, and from a cost control perspective, Xpeng may not be able to offer much more.

Therefore, to become a hit, firstly, the price of the Xpeng M03 cannot be unreasonable. Secondly, the basic configuration must keep pace with or even exceed that of its core competitors. Finally, the killer feature is Xpeng's latest electronic and electrical architecture and intelligent driving capabilities.

If the Xpeng M03 can simultaneously satisfy these three conditions, it may have a certain degree of competitiveness after its launch. Otherwise, it will also be lost in the fierce competition among many models.

03

Will a new brand be established separately for the B-end market?

As mentioned earlier, the Xpeng M03 has two products registered in the Ministry of Industry and Information Technology's new vehicle announcement, one being the M03 and the other being the D03.

Since the Xpeng MONA series originates from Xpeng Motors' acquisition of Didi's electric vehicle project, the two companies have also signed a procurement agreement. Therefore, it is reasonable to speculate that the D03 is likely to be a model aimed at the online car-hailing market.

Xpeng and Didi reached a cooperation agreement in August 2023, with Didi selling related assets and R&D capabilities of its smart electric vehicle project to Xpeng.

In return, Xpeng Motors will issue A-class ordinary shares representing 3.25% of the total share capital after the transaction is completed, with a maximum total consideration of approximately HK$5.835 billion.

However, for Didi to receive the full payment from Xpeng, it needs to achieve the four-stage gambling agreement targets, which are the initial delivery, SOP mass production of new vehicles, reaching the first 100,000-vehicle sales target, and reaching the second 100,000-vehicle sales target.

In a media interview, He Xiaopeng also stated that the gambling agreement with Didi is based on Didi's platform achieving an annual delivery volume of over 100,000 units and completing the target for two consecutive years, which will entitle Xpeng to 3.25% of the shares. If the delivery volume reaches over 180,000 units for two consecutive years, the maximum shareholding can reach 5%.

Therefore, it is expected that the collaboration models between the two companies will be launched in the B-end market.

However, Xpeng Motors recently organized some media outlets to test drive the new car, and some media outlets heard that:

Although the D03 has also been declared, it will not be launched in the online car-hailing market, and the online car-hailing version will be launched next year.

Some netizens speculated that this may be Xpeng's latest product strategy, and the strategy of separating BC-end products had not been decided upon when the product was declared.

Whether or not to launch a car into both the B and C markets simultaneously must have been a difficult decision for Xpeng Motors.

Xpeng's brand tone is not high to begin with, and if it were to enter the online car-hailing market, it would undoubtedly further drag down the brand. Also, some netizens expressed that no one wants to buy a car that is used as an online taxi everywhere.

Currently, Xpeng has not made a clear statement, but there are rumors that Xpeng and Didi are collaborating to develop models aimed at the B-end market, which are planned to be officially launched in the first half of 2025. The new models may be equipped with a new brand logo and named "Xiangwang".

However, according to the minimum expected target of the two companies, the annual delivery volume is 100000 vehicles. This also means that the monthly sales are over 8000 units. If we rely solely on the C-end market, can M03 achieve this?

Do you think Xpeng will be able to create a hit this time? Please leave your comments below.