Listing is not the end for Nezha

![]() 07/01 2024

07/01 2024

![]() 617

617

After a successful listing, can Nezha truly stir up the sea?

On June 26, Hezhong Auto, the parent company of Nezha Auto, officially submitted an IPO document to the Hong Kong Stock Exchange, marking the imminent arrival of the sixth listed player among independent new forces. (The first five are NIO, Lixiang, XPeng, Zero Run, and ZEEKR).

In the general environment where new energy vehicle companies are "losing money on every sale," IPO is indeed a necessary medicine for new forces to survive. However, from the prospectus that holds Nezha's hopes for a turnaround, it inevitably reveals some inadequacies of this second-tier player.

Founded in October 2014, with the first car launched in November 2018, the 100,000th car rolled off the production line in January 2022, and the prospectus was officially submitted in June 2024. Nezha Auto has now reached its tenth anniversary.

From an underappreciated second-tier new force to the current threshold of listing, Nezha has actually outperformed many competitors.

However, as I mentioned in previous articles, "For new forces to survive, they must not only brutally raise funds to extend their lives but also achieve sustainable self-financing." Therefore, the current IPO leap over the Dragon Gate is far from the end of Nezha's carmaking journey but rather a new starting point with even more intense competition.

Losing 18.3 billion yuan in three years, Nezha lacks hard power

From the prospectus, it can be seen that the current Nezha, which boldly went public in Hong Kong, is not as confident as imagined.

The prospectus shows that Nezha Auto currently has five models on sale, with vehicle deliveries increasing from 64,230 units in 2021 to 124,189 units in 2023, representing a compound annual growth rate of 39.0%.

However, compared to its situation of several times topping the new force sales chart in 2022, Nezha Auto's sales declined by 16.16% year-on-year in 2023. From January to May 2024, Nezha's domestic sales decline intensified, with cumulative sales of only 24,943 units, down 41.3% year-on-year.

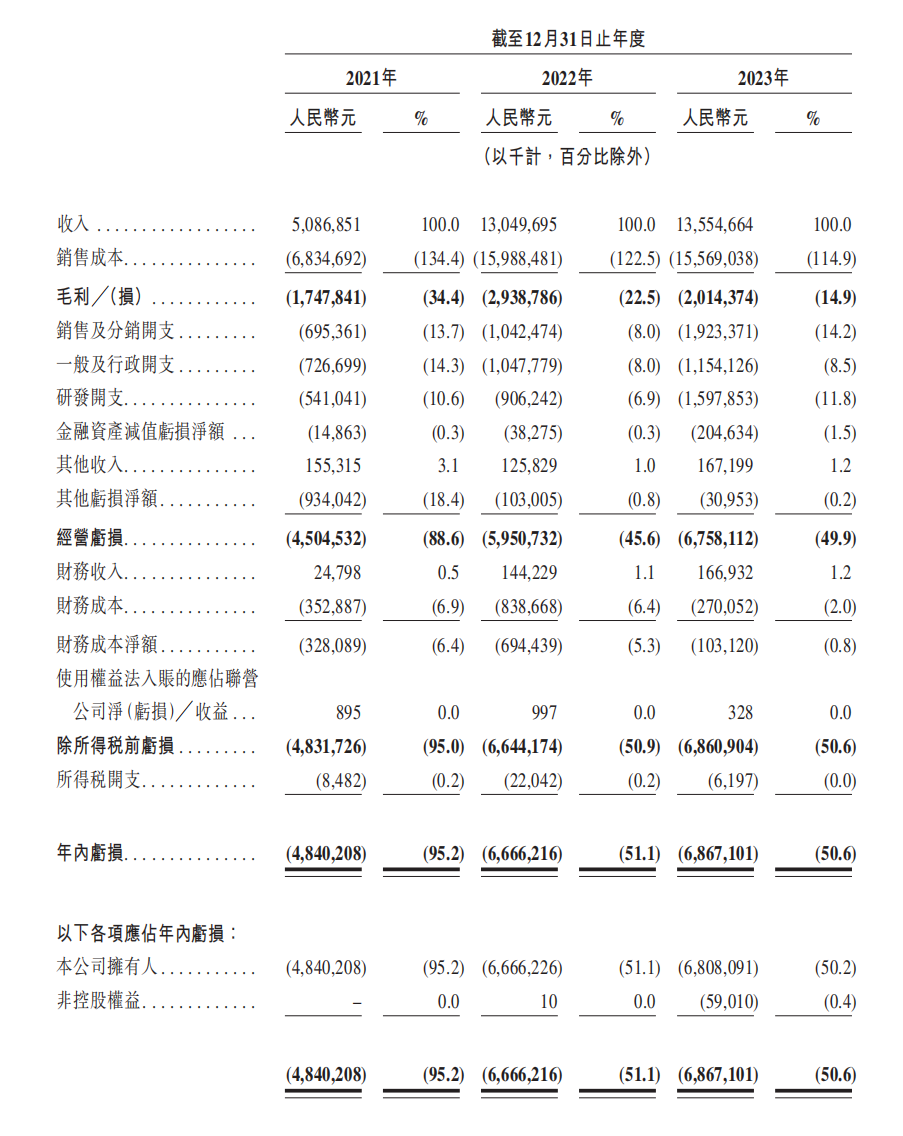

Financially, Nezha Auto's revenue from 2021 to 2023 was 5.087 billion yuan, 13.05 billion yuan, and 13.555 billion yuan, respectively, showing a continuous growth trend. However, its losses continued to expand, with losses of 4.84 billion yuan, 6.666 billion yuan, and 6.867 billion yuan in 2021-2023, respectively, totaling 18.3 billion yuan in losses.

The prospectus shows that Nezha Auto's operating cash flow from 2021 to 2023 was -2.99 billion yuan, -5.41 billion yuan, and -4.35 billion yuan, respectively. At the same time, as of the end of 2023, Nezha Auto had only 2.84 billion yuan in cash and cash equivalents on its books.

This means that with Nezha's current cash reserves, without new financing, it can at most cover half a year's losses.

In addition, in terms of R&D investment, Nezha's R&D expenditures from 2021 to 2023 were 541 million yuan, 906 million yuan, and 1.597 billion yuan, respectively, with a cumulative investment of 3.046 billion yuan. Although R&D investment continues to expand, it still lags significantly compared to NIO, XPeng, and Lixiang, which have R&D expenditures of up to 4-5 billion yuan annually. This suggests, in a sense, that Nezha's competitiveness in independent technology is still behind its competitors.

Overall, among the new forces in carmaking, Nezha does not possess a strong technological moat and relies more on the cost-effectiveness positioning of its products to compete for market share.

Overseas surge, Hong Kong government investment, stable listing

However, there is also good news.

On the one hand, the significant growth in the overseas market has brought new vitality to Nezha. From January to May this year, Nezha Auto exported 16,458 new energy vehicles, ranking fifth among Chinese automakers in terms of new energy vehicle exports and first among new force automakers, approaching the export sales volume for the entire year of 2023.

In 2023, Nezha Auto achieved exports of 17,019 units, accounting for 13.7% of its total sales and contributing 12.0% of its sales revenue for the same year. Sales from January to May this year of 16,458 units accounted for 39.7% of Nezha Auto's total sales.

The prospectus states that Nezha Auto will rapidly expand into markets with similar high growth potential, such as Latin America, the Middle East, and Africa, and subsequently expand into Europe at an appropriate time. In terms of supply, Nezha adopts a light asset cooperation model, cooperating with local OEMs with high-quality production capabilities. Currently, Nezha Auto's factories in Indonesia and Thailand have started production in March and May this year, respectively, while the Malaysian factory has also started construction in January.

According to Nezha Auto's plans, the company will expand its product matrix in overseas markets to at least 5 models this year and plans to cover 60 countries and regions with its global sales network, establishing 300 overseas sales and service outlets.

It can be seen that the overseas market is a crucial incremental source for Nezha at the current stage.

Along with the expansion of the overseas market and the increase in sales of mid-to-high-end models such as the Nezha S and Nezha GT, Nezha Auto has now extended into the mid-to-high-end market with higher profit margins. The overall average selling price has risen from 71,000 yuan in 2021 to 113,000 yuan in the first four months of 2024, and the gross margin has also risen from -34.4% in 2021 to -14.9% in 2023.

This means that Nezha Auto is actively developing towards profitability.

In addition, in terms of financing, Nezha's current financing progress remains smooth.

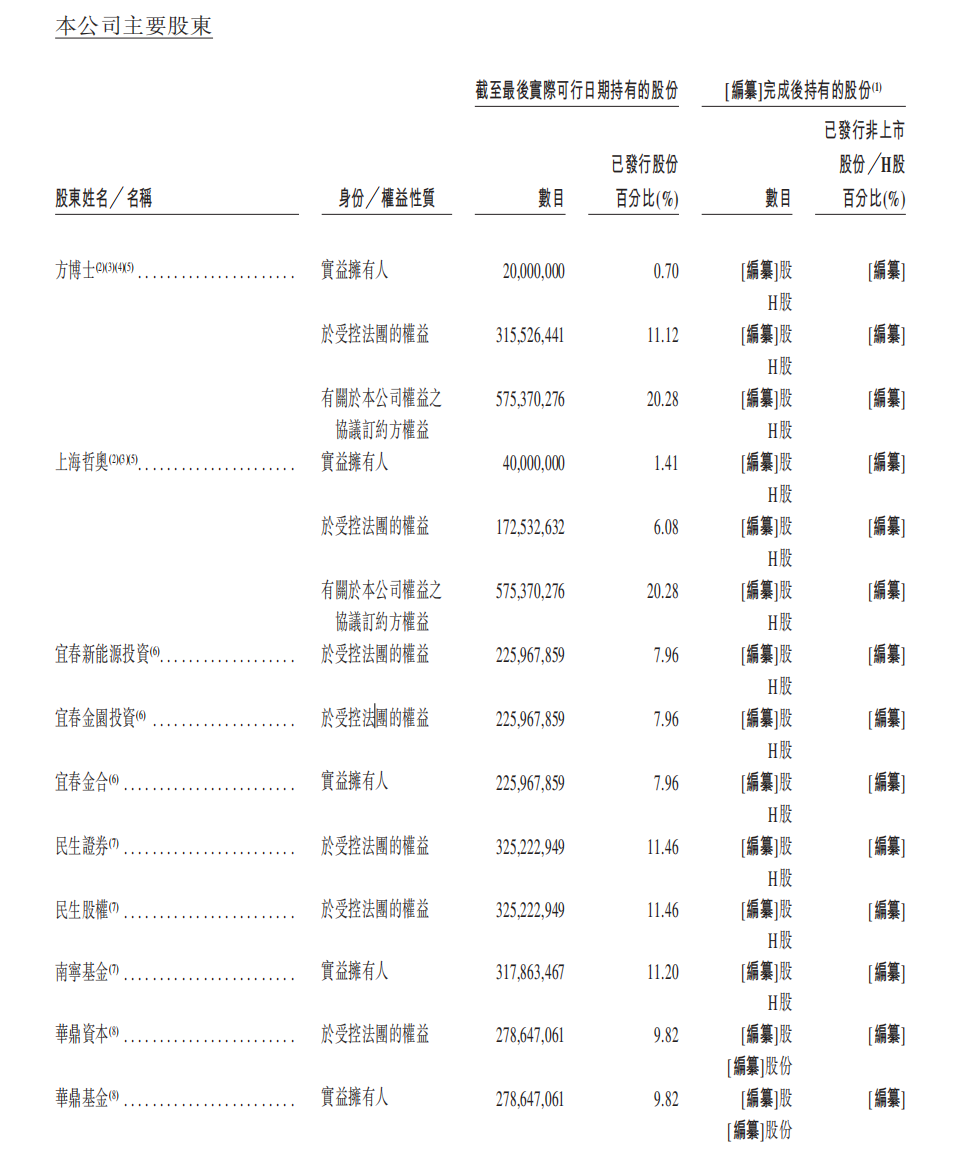

The prospectus shows that since 2017, Nezha Auto has raised funds nearly 10 times (including convertible bonds), totaling 22.844 billion yuan. In addition to the support of leading enterprises such as 360, CATL, CRRC Capital, and Shenzhen Venture Capital, it has recently received the backing of state-owned capital.

On April 15, Tongxiang Municipal State-owned Capital Investment and Operation Co., Ltd., Yichun Jinhe Equity Investment Co., Ltd., and Nanning Minsheng New Energy Industry Investment Partnership (Limited Partnership) signed a "Joint Agreement on High-quality Development of Hezhong Auto" with Hezhong Auto. According to the agreement, the signing parties will jointly provide an investment of no less than 5 billion yuan to Hezhong Auto/Nezha Auto.

The prospectus shows that Yichun Local State Investment is Hezhong's largest shareholder, accounting for 20.28%. The founder Fang Yunzhou and his team own 11.82% of the shares, while Zhou Hongyi, who frequently interacts with Nezha Auto, manages 360 Security, which actually holds only 9.82% of the shares. In other words, Nezha is currently a new force backed by state-owned capital.

In March this year, Nezha Auto also signed a contract with the Hong Kong government to become a key enterprise partner. The Hong Kong government will provide Nezha Auto with a subsidy of 200 million Hong Kong dollars and assist in cornerstone round investment of 200 million US dollars. This move sends a clear positive signal and brings high certainty to Hezhong Auto's sprint to the Hong Kong stock market.

How will Nezha build its mountains and seas?

However, it should be noted that successfully listing in Hong Kong does not mean that Fang Yunzhou and Zhang Yong can achieve financial freedom once and for all.

This year, the share prices of new forces including NIO, XPeng, Lixiang, ZEEKR, and Zero Run have generally shown a continuous decline, with many experiencing significant drops. Moreover, whether it is a new force or a brand backed by a traditional automaker, selling cars at a loss is now a common phenomenon in the entire industry.

Therefore, in the current new carmaking field entering the final round, listing is not a get-out-of-jail-free card for automakers. Achieving profitability as soon as possible and achieving sustainable self-financing is the long-term solution.

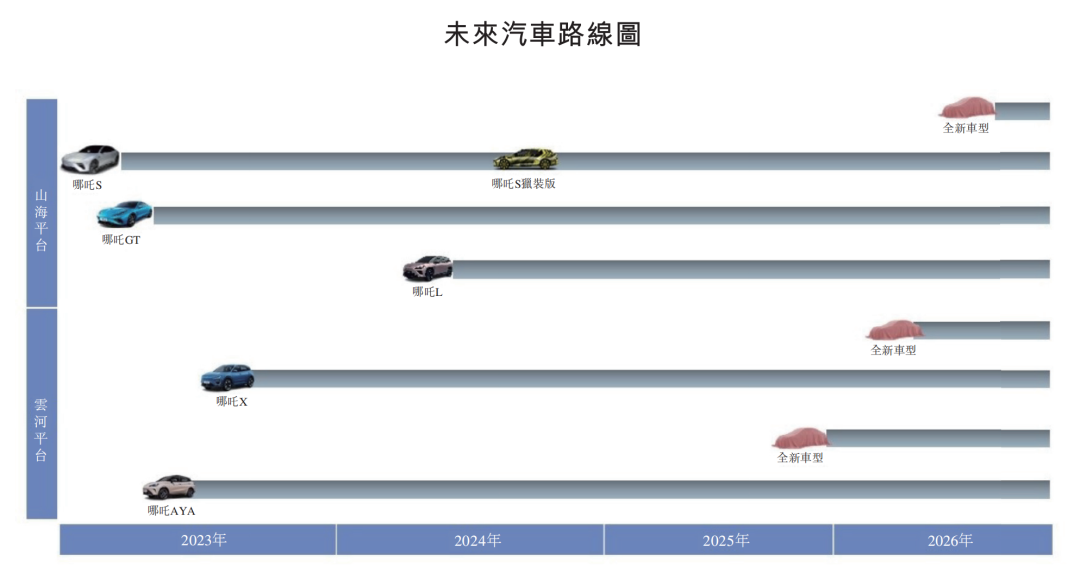

The prospectus shows that Nezha Auto will launch the Nezha S Shooting Brake version in the second half of this year, and there are still 3 new models to be launched within the next two years, including a Yunhe platform model in 2025 and two models based on the Yunhe platform and Shanhai platform in 2026.

The Yunhe platform was previously mainly used to build low-priced entry-level models such as the Nezha X and Nezha AYA, while the Shanhai platform is mainly used to build mid-to-high-end models such as the Nezha L and S.

The prospectus states, "Our overall gross margin has improved mainly due to (i) product portfolio optimization, with a greater focus on smart new energy vehicle models with increased average selling prices, (ii) increased international sales, and (iii) improved cost-effectiveness through our cost control measures."

However, from this product plan, it can be seen that the main sales force of Nezha in the next two years will still rely on the low-price market, which is somewhat contrary to the current measure of "focusing on smart new energy vehicle models with increased average selling prices" and may not bode well for improving gross margins.

Therefore, for Nezha to achieve positive growth in gross margins in the next two years, it will largely depend on effective expansion in overseas markets.

In terms of intelligent driving, the prospectus states that Nezha is developing the NETA AD MAX system, which supports point-to-point intelligent driving functions, as well as the NETA AD PRO system, which supports seamless point-to-point driving on highways and urban expressways.

Currently, several independent automakers, including ZEEKR, Haopai, Zero Run, and Zhiji, have announced plans to launch city NOA this year. However, Nezha has not yet disclosed any city launch plans, suggesting that Nezha's technological layout in intelligence is still slightly behind.

As I mentioned in previous articles, "2024 will be the year with the greatest opportunity for Nezha to turn the tide." The current IPO in Hong Kong once again validates this view. However, turning the tide does not mean smooth sailing, but rather likely a series of challenges.

Listing is not the end for Nezha but rather a new starting point with even more intense competition.