"Rolling Price" VS "Rolling Value", Panic without Rolling

![]() 07/01 2024

07/01 2024

![]() 410

410

CATL's "896" initiative circulating online has once again become the focus of media attention. With the intense competition in the domestic automotive industry, as the world's leading lithium battery manufacturer, what kind of impact will CATL have on the battery industry?

Not only are vehicle manufacturers rolling, but component manufacturers are also getting more involved.

CATL's "896" initiative, which refers to working from 8 am to 9 pm, six days a week, for 100 days starting from June 12, has recently caused a stir in the industry. In response, at the Summer Davos Forum on June 25, CATL's Chairman and CEO, Zeng Yuqun, stated that "striving for 100 days is a call to strengthen our basic skills. We are not forcing anyone." Zeng also emphasized that in the current environment where the new energy industry is "rolling prices," value is the most important.

Occupying the leading position in lithium batteries

Almost simultaneously with CATL's advocacy of "896," the American Automotive News released its Top 100 Global Automotive Component Suppliers list for 2023, with CATL ranking fifth in its first appearance. This is the highest ranking for a domestic component company in the American Automotive News' annual rankings. Companies that rank ahead of CATL are giants like Bosch and Denso. It is a great honor for CATL to outperform suppliers like Mobis, Hyundai's preferred supplier, and Aisin, a global transmission giant.

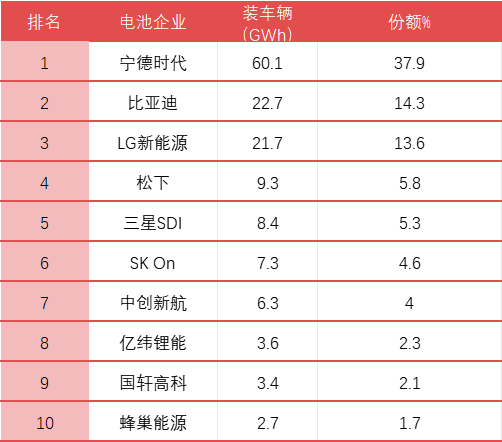

In the battery field alone, CATL's advantage is even more apparent. According to the first quarter of 2024 global battery installation rankings released by China Automotive Technology and Research Center, CATL accounts for nearly 40% of the market share. Although this is a decline from the previous 50% share, considering the current global electric vehicle sales, CATL's achievements are still very impressive. Compared to Northvolt, a European battery company strongly supported by Europe, CATL can be considered a model student.

For the foreseeable future, electric vehicles will remain a major development direction globally, unless the US takes unwarranted measures to block Chinese battery manufacturers, including CATL, from the US market. Otherwise, CATL will continue to maintain a high-speed development phase.

Pursuers behind

For CATL, although it has an advantage in the global automotive power battery field, the strong rise of competitors is also an indisputable fact.

In the field of lithium iron phosphate batteries, BYD's Blade Battery is gaining more and more orders in the entry-level electric vehicle market in the domestic market. Previously, if not for BYD's own reluctance, Tesla would have introduced Blade Batteries in the domestic market in addition to its Berlin plant. Additionally, battery companies such as Guoxuan High-tech, Zhongchuang Xinhang, and EVE Energy are also actively expanding their market share. BYD's new generation of Blade Battery will further increase its energy density to 190Wh/kg, a significant improvement compared to the 140Wh/kg of the first-generation Blade Battery. Geely's self-developed Shield Short Blade Battery, as its latest generation of "blade-type" lithium iron phosphate battery product, will even increase its energy density to 192Wh/kg.

△ Domestic automakers and battery companies are actively introducing competitive new products.

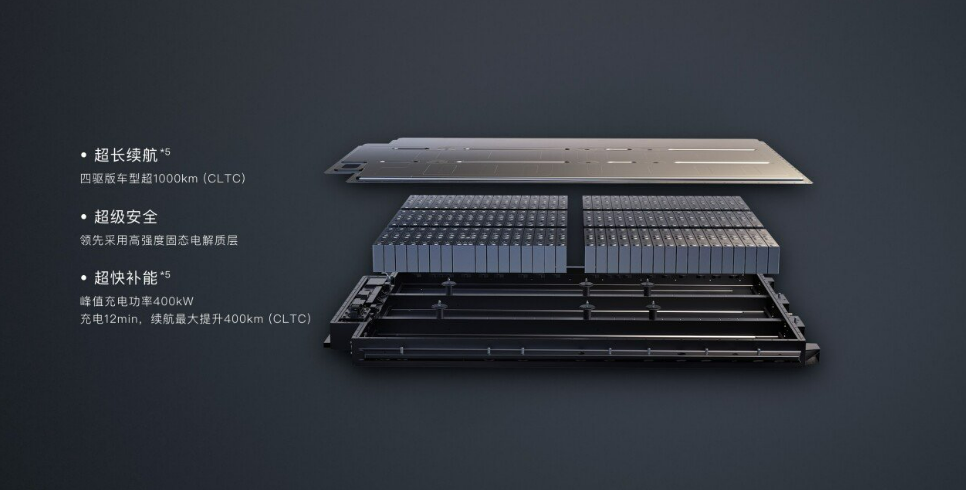

In the field of solid-state batteries, CATL also faces considerable challenges. After GAC Aion and SAIC IM Motor officially announced their progress in solid-state batteries, CATL was "forced" to follow suit. However, compared to the aggressive strategies of its competitors, CATL aims to achieve small-scale production of all-solid-state batteries by 2027. Compared to other domestic and international battery companies, CATL's strategy in the battery field is not aggressive.

△ CATL does not have an advantage in the field of solid-state batteries.

Even in the field of energy storage, in addition to competing with other domestic battery companies, Tesla's construction of a super energy storage factory in Shanghai will also have a certain impact on the domestic energy storage market. As Tesla's first energy storage super factory outside the US, this factory will produce large-scale electrochemical commercial energy storage systems called Megapack. Currently, Tesla's Megapack prices are not low, but once Tesla begins to utilize the domestic supply chain to produce Megapack, it is difficult to imagine that it will not gradually erode the existing market share of the domestic energy storage market.

Considering all these factors, it is understandable for CATL to maintain a sense of crisis and encourage employees to strengthen their basic skills.

△ Tesla is building a super energy storage factory in Shanghai.

Winning with Value is the Key

Zeng Yuqun advocates "rolling value."

Today's Chinese automotive component companies are no longer what they were 30 years ago. China's entire automotive industry is now considered a formidable force in the eyes of European and American countries, not only having a significant cost advantage but also becoming increasingly strong in terms of product capabilities. Looking at globally renowned automotive brands, it is rare to find one that does not use Chinese components. The recent EU anti-subsidy investigation into Chinese electric vehicles is more of an attempt to force European automakers like BMW, Tesla, Volvo, Renault, and Volkswagen to shift more production capacity to China rather than blocking BYD and SAIC from the EU market.

△ European automakers' models are the main force in China's electric vehicle exports to Europe.

In this context, if prices continue to roll down, importing countries can easily block Chinese components by imposing higher tariffs. At this point, even with China's significant cost advantage, it will be difficult to open the door to overseas markets. However, if a product is significantly ahead in performance and irreplaceable, European and American countries will have to turn back to seek cooperation with China.

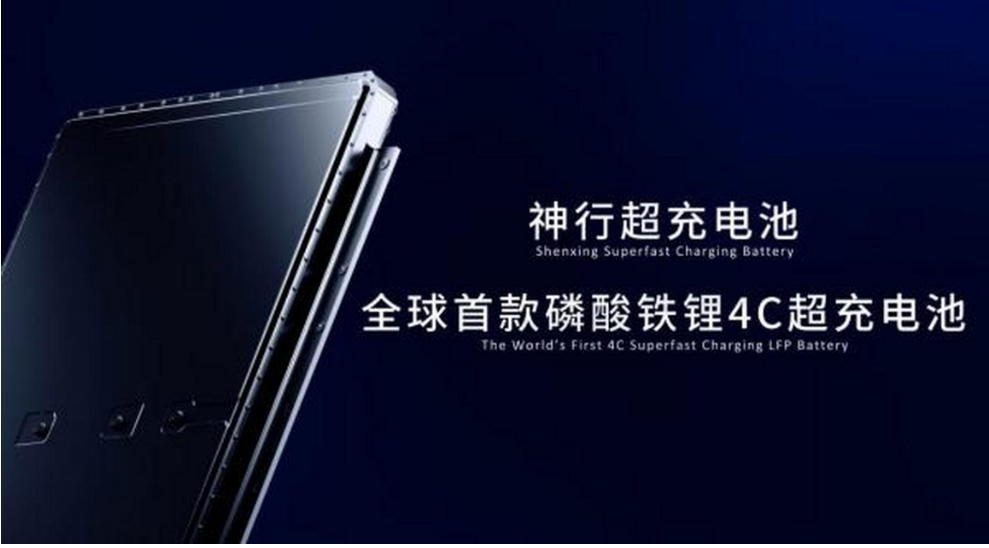

Taking electric vehicles as an example, currently, major automakers worldwide are constrained by the high cost of electric vehicles, making continuous promotion difficult. China's lithium iron phosphate batteries have become a sought-after product by major European and American automakers. Although their energy density is lower than that of ternary lithium batteries, through technological innovation in later stages, electric vehicles equipped with lithium iron phosphate batteries can fully meet users' daily requirements for electric vehicle range, and they have more significant advantages in terms of cost and safety. Even in the US market, where anti-monopoly laws prevent the use of domestic batteries, companies like Ford and Tesla are still very interested in CATL and BYD's lithium iron phosphate battery products. In the future, if we can form the same advantage in solid-state batteries/sodium-ion batteries as we have in lithium iron phosphate batteries, unless European and American countries collectively abandon electric vehicles, Chinese battery manufacturers will definitely have global value dominance. This is similar to Bosch's ESP and ZF/Aisin transmissions, which are not cheap but are products that global OEMs, including Chinese automakers, have to choose.

△ Shenxing Supercharge Battery is CATL's representative in the field of lithium iron phosphate batteries.

Commentary

Both Chinese vehicle manufacturers and component manufacturers can achieve overtaking through hard work and exploration. However, as the advantages of Chinese vehicle manufacturers and component manufacturers in the field of new energy vehicles become increasingly apparent, if prices are rolled down overseas, the risk of trade sanctions will increase. Rolling technology or rolling value is the key to establishing a foothold in the global market.