In the midst of great defeats, a major turning point for Lixiang Auto

![]() 07/01 2024

07/01 2024

![]() 652

652

Author | Simon

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

"The key to judging whether a company is stable and mature lies in its performance during economic crises and industry crises, as well as how it overcomes traps and crises during the growth process." Financial writer Wu Xiaobo wrote in his famous book "The Great Defeat," which is renowned for depicting many companies' rise from obscurity to their peak and eventual downfall.

The book also states that failure is not only a lesson learned later but also a nourishment for growth, and勇敢面对失败和挫折是个人坚强的体现.勇敢面对 failure and setbacks is a manifestation of personal resilience.

Today, each of these two paragraphs has a footnote — Lixiang Auto and its Chairman and CEO, Li Xiang.

In one week, on July 5, Lixiang Auto will hold its Intelligent Driving Summer Launch Event.

Based on official information, during this event, Lixiang will focus on promoting its mapless NOA, announcing the latest progress of its intelligent driving products, and releasing the technical solution for achieving autonomous driving.

A few days ago, on June 24, Lixiang announced the recruitment for the OTA 6.0.0 experience version, with no limit on the number of participants. The estimated push time is around June 30.

Obviously, Lixiang is currently focusing on a full-scale attack on the technical front, with increasingly rapid steps.

The background of these two events is the typhoon-like impact brought about by the failure of Lixiang's Mega, which is more severe than expected.

Mega went on sale on March 1st this year, and due to well-known reasons, its sales figures have been far from "ideal." Sales in the first month were 3,229 units, dropping to 1,145 units in April and further falling to 614 units in May.

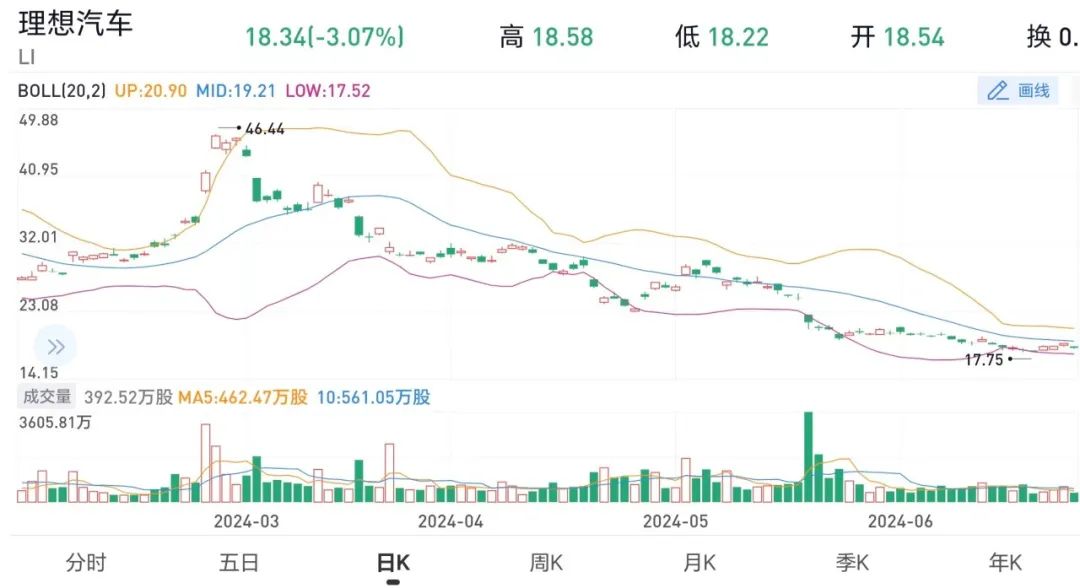

▲ Lixiang Auto's Hong Kong stock market performance this year (Image source/Xueqiu)

▲ Lixiang Auto's U.S. stock market performance this year (Image source/Xueqiu)

This has led to a flood of information on social media since March about Lixiang's former employees cutting their cards, resigning, and bidding farewell. Lixiang's stock price has been declining continuously, now down about 60% from its peak.

The persistently low stock price indicates that the failure of Mega has not only led to the defeat of one car model but has also plunged Lixiang's entire M series, or its pure electric strategy — originally planned as the second growth curve — into a great defeat, even putting pressure on Lixiang's product logic, profitability logic, and operational system capabilities, which are the foundation of its existence.

As a leading force among new car manufacturers, Lixiang has always been regarded as a growth company and a darling in the eyes of capital. Since the fourth quarter of 2022, it has been profitable for six consecutive quarters, making it one of the better-performing and continuously profitable new forces in China.

However, now, Li Xiang and his Lixiang Auto are in a predicament, experiencing the biggest challenge since their inception.

In the short term, Lixiang's pure electric strategy cannot be advanced as scheduled, which will prevent it from quickly recovering its investments in the energy replenishment field, and the path to recovery has become uncertain.

In the medium to long term, without the support of pure electric vehicles, Lixiang will be forced to operate within the small circle of extended-range vehicles. Even more不利的是, in this field, its unique advantages are no longer present.

Before Mega, Lixiang's L9, L8, L7, and the earlier One models achieved success, and their opportunities and first-mover advantages were greatly amplified. However, the failure of Mega has weakened Lixiang Auto's operational capabilities and product definition abilities.

As a serial internet entrepreneur, Li Xiang began revolutionizing the traditional automotive market 10 years ago. However, when technology giant Huawei entered the automotive industry, Lixiang's shortcomings in product, user perception, marketing capabilities, brand strength, and organizational capabilities were exposed, and the gap with top players gradually emerged.

Huawei's systematic capabilities, innovation, strategic execution, and the ability to mobilize public sentiment have all dealt a crushing blow to Lixiang. In the extended-range market, with Huawei's entry, Lixiang's days of being the sole favorite are gone.

What makes Lixiang even more uncomfortable is that it cannot make up for these shortcomings in the short term; it has no countermeasures against this situation.

The capital market is also undoubtedly expecting Lixiang to fight a beautiful comeback and regain user confidence.

Therefore, after the pure electric strategy fell into a great defeat, seeking a new second growth curve has become a top priority for Li Xiang and Lixiang Auto.

They have set their sights on intelligent driving.

In the past, Lixiang Auto's main selling point was "a happy home, a mobile home," with a clear product positioning. Many people focused more on its product sales and some topics triggered by Li Xiang himself, ignoring its investment in technology.

In fact, Lixiang Auto's self-developed intelligent driving technology, continuous hardware and software upgrades, and generous R&D investment have provided it with strong technical support. This automotive force, with its self-developed large model MindGPT, has become the first Chinese automotive company to possess a self-developed large model, successfully implement it, and obtain national certification. Additionally, it is also at the forefront in the field of mapless intelligent driving NOA.

Han Ling, the head of Lixiang Auto's intelligent driving products, stated that currently, Lixiang Auto's mapless NOA experience users have covered 315 cities, with a penetration rate of 97.2% among users in prefecture-level (including county-level) cities. In the past week, the average mileage of the top 10 users of mapless NOA reached 523 kilometers per week (within the city).

Converted into an annual figure, this number exceeds 25,000 kilometers — exactly the annual mileage of moderate car users, demonstrating the strong stickiness of Lixiang's mapless NOA among these users.

After this OTA update, Lixiang's AD Max platform models have added mapless NOA functionality, supporting NOA travel from point A to point B within the range navigable by the car's map. AD Pro platform models have added capabilities such as LCC traffic light crossing and NOA defensive strategies for merging and exiting.

These have created the first opportunity for Lixiang to build intelligent driving — a new second growth curve.

Another opportunity is that Lixiang Auto has a user base of 800,000, which supports its entry ticket for the promotion of intelligent driving across the board. For the intelligent driving sector, which is based on scale effects, while 800,000 users is not a large number, with Lixiang's current delivery speed, surpassing one million should not be too far away.

After the pure electric strategy fell into a great defeat, in addition to actively seeking intelligent driving as a new second curve, Li Xiang has also made rapid adjustments to address the decline in its core business (including extended-range and pure electric vehicles).

The first move was to shift the focus of the sales team back to the L series. In May, the sales of Lixiang L6 were 12,965 units, accounting for 37%; L7 sold 9,540 units; L9 sold 6,579 units, accounting for 18.79%; and L8 sold 5,322 units. The overall sales of Lixiang for that month were 35,020 units, with MEGA accounting for only 1.75%. However, the L series quickly regained momentum, significantly making up for the losses caused by the mistake in the pure electric strategy.

Immediately after, in terms of the pure electric strategy, Lixiang has adjusted Mega to a conservative 0-to-1 posture, emphasizing that it will not release any pure electric SUV products this year and will instead wait until the first half of next year. Taking advantage of this window period, Lixiang will accelerate the layout of its charging network, focusing on 17 core cities this year and releasing the number of newly added charging piles on a weekly basis, laying the foundation and preparing for the revival of pure electric vehicles next year.

First secure the core business, then actively seek a new second growth curve — this is Lixiang's self-rescue plan after the great defeat in pure electric vehicles. Although the road ahead remains bumpy, Li Xiang's pace of self-rescue is compact, rapid, determined, and resolute.

The greatest lesson from the book "The Great Defeat" is that failure always comes unexpectedly, but companies and entrepreneurs must learn to view failure correctly and minimize the losses caused by it.

For new car manufacturers, regardless of whether they are profitable or not, they are actually hovering on the edge of life and death. On the other hand, no one is perfect, and almost everyone makes mistakes. In the face of errors, whether corporate decision-makers can quickly stop the losses, shift their focus, and seek new growth curves is one of their essential qualities.

Quick like Li Xiang, this time he quickly delivered his answer.

Whether his major turning point will succeed and whether the market will buy into it remains to be seen. After all, in the field of intelligent driving, there are also many strong players.