Nezha Auto goes public, and Zhou Hongyi still can't let go of Lei Jun

![]() 07/01 2024

07/01 2024

![]() 433

433

Another new force in car manufacturing has gone public.

There are three Hubei natives in Chinese Internet, Lei Jun and Zhou Hongyi are two of the more famous ones, and the other is Chen Yizhou, the founder of Oak Pacific Interactive. Lei Jun is Chen Yizhou's college classmate, and he believes that no one in the industry works harder than Lei Jun, "the average effort level in our industry may only be half of his." Zhou Hongyi is an old acquaintance of Chen Yizhou, who once said that Zhou Hongyi is a successful entrepreneur, as long as he doesn't provoke too many people.

Fate sometimes loves to play jokes, and Zhou Hongyi just happens to have provoked Lei Jun, more than once.

In the security market, Zhou Hongyi used free software to ambush Kingsoft, catching them off guard. Although Lei Jun was no longer at Kingsoft at the time, if it weren't for this "ambush," Lei Jun would have had a better hand when he took over Kingsoft again in the future. In the mobile phone market, when Xiaomi's phone shipments just passed one million (in 2012), Zhou Hongyi began to jointly launch "360 Special Edition" phones with brands like Huawei and Haier, which were one of the earliest internet phones besides Xiaomi's. Since then, Zhou Hongyi has also pushed 360 phones into the market as an independent brand, with a positioning similar to Xiaomi's, but these attempts all ended in failure.

Now, the new battlefield for the two is new energy vehicles. The recently submitted prospectus for Nezha Auto is the card that Zhou Hongyi chose. If the sprint is successful, Nezha Auto will become the sixth independently listed Chinese car manufacturing newcomer after NIO, XPeng, and Li Auto, as well as Zero Run and ZEEKR.

Nezha Auto's ability to go public has a lot to do with Zhou Hongyi's strong support. In 2021, 360 invested in Nezha Auto, changing its embarrassing situation of not being favored by venture capital and providing it with a strong endorsement. Zhou Hongyi investing in Nezha Auto is, to some extent, a "tribute" to Lei Jun. At that time, Nezha Auto had already established a foothold in the market using Xiaomi's cost-effective strategy.

Before the launch of Xiaomi SU7, many netizens hoped that Xiaomi could "make a friend," but Lei Jun repeatedly said it was impossible, and ultimately the starting price of Xiaomi SU7 was set at 215,900 yuan. However, even without making a friend, Xiaomi SU7's sales performance was also very impressive, achieving monthly sales of over 10,000 units in just two months, demonstrating its comprehensive strength.

I. Nezha makes a friend for Xiaomi

At the 2018 Guangzhou Auto Show, Nezha Auto's (hereinafter referred to as Nezha) first model, the Nezha N01, went on sale with a maximum price of less than 70,000 yuan, which was particularly eye-catching among hundreds of new car manufacturing forces. At that time, besides Zero Run, other new car manufacturing forces basically targeted the high-end market, while Nezha chose a different path from the beginning.

New car manufacturing forces are divided into two factions, one is internet cross-border car manufacturing, represented by NIO, XPeng, and Li Auto, and the other is veteran entrepreneurs in the industry. Nezha Auto belongs to this latter category. Nezha's parent company, Hezhong New Energy, was founded by Fang Yunzhou, who once worked at Chery, and CEO Zhang Yong once worked at BAIC BJEV.

Due to the lack of an internet company background in the founding team, before 360 invested in Nezha, Nezha's investors were mainly local governments, lacking participation from market-oriented capital. NIO, XPeng, and Li Auto's investor lineup is just the opposite. After 360 invested in Nezha, Nezha began to receive support from market-oriented capital and introduced shareholders such as Shenzhen Capital Group and Sunrise Capital.

Zhou Hongyi invested in Nezha in 2021, coincidentally, it was also in this year that Lei Jun announced his plan to build cars. When Lei Jun officially announced his plan, many people were not optimistic, and Wang Chuanfu once bluntly said that if the direction was wrong, it would be a waste of money and time.

At that time, Nezha had already started deliveries and even took the top spot in sales among new car manufacturing forces in 2022, allowing Zhou Hongyi to finally regain some face. The last time the two sides crossed paths was ten years ago, when Xiaomi phones swept across China, and Zhou Hongyi, itching for action, entered the market with 360 phones. Zhou Hongyi saw clearly that the internet would move in two directions, one is the combination of the internet and traditional service industries, also known as O2O, and the other is IOT, which is the intelligence, networking, and cloudification of traditional hardware. The success of Meituan, Xiaomi, and NIO, XPeng, and Li Auto validated Zhou Hongyi's judgment.

However, Zhou Hongyi did not deliver on the execution level. First, 360 got caught up in "internal struggles" in its mobile phone business. 360 initially made special edition phones, and later, 360 jointly launched the "QiKu" phone with Coolpad, capturing part of the market. Then it got caught up in a "love triangle" between LeTV, Coolpad, and itself. In 2016, after Zhou Hongyi solved the problems, 360 phones restarted, but by then, Xiaomi phones had already started to expand into the offline market. In the mobile phone industry, the offline market accounts for 70% of shipments, and 360 phones were half a step slower than Xiaomi.

Second, the Chinese mobile phone market entered a recession in 2017-2018, with market shipments declining by more than 10% for two consecutive years. It can only be said that the newly restarted 360 phones were unlucky. At the time, Luo Yonghao lamented, "I didn't expect the decline of mobile phones to come so early."

Finally, Xiaomi phones surged into the top three in the world, while 360 phones became others in the market. Nezha's situation is better than 360 phones, at least for now, it is still at the table.

Before 2022, Nezha's main sales came from the Nezha N01 (launched in 2018, starting at 59,800 yuan) and the Nezha V series (launched in November 2020, starting at 59,900 yuan), which allowed Nezha to take the top spot in sales among new car manufacturing forces in 2022 (with a scale of 152,000 vehicles). In 2023, Nezha's main sales source became the Nezha V series and the Nezha U series. The average vehicle revenue clearly reflects Nezha's cost-effectiveness. In 2021, Nezha's average revenue was 71,000 yuan, rising to 84,000 yuan in 2022 and further increasing to 107,000 yuan in 2023. In the first five months of this year, it was 113,000 yuan.

What is this level? In 2022, NIO, XPeng, and Li Auto's revenue per vehicle had already exceeded 200,000 yuan. If there was a vote for who is the "car industry's Xiaomi," Nezha's vote rate would certainly be the highest.

II. How does Nezha help Zhou Hongyi regain face?

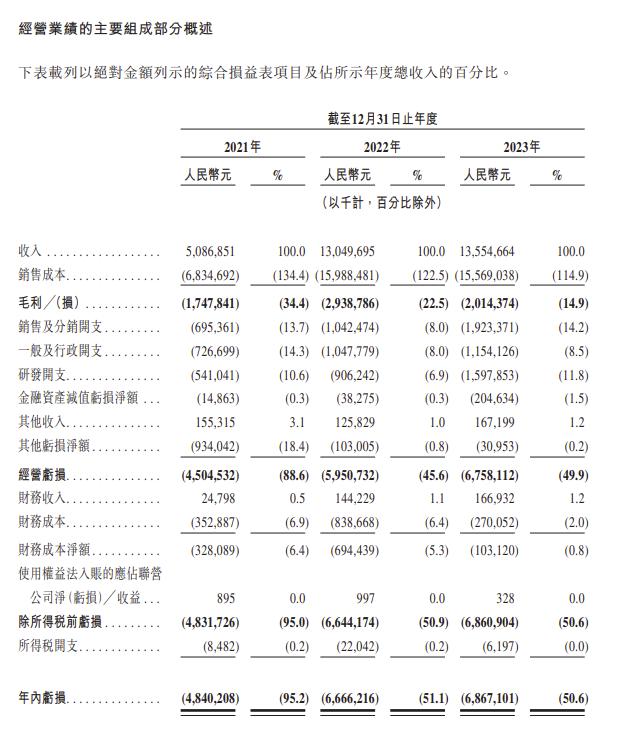

From the perspective of average vehicle revenue, Nezha has already attached the label of cost-effectiveness to itself, which has allowed it to gain a foothold in the market but has also saddled it with the burden of losses. From 2021 to 2023, its losses were 4.84 billion yuan, 6.666 billion yuan, and 6.867 billion yuan, respectively. At the same time, its gross profit margin has always been negative, at -14.9% in 2023, and there is still a long way to go before it turns positive. As of December 31, 2023, Nezha Auto's cash and equivalents were 2.836 billion yuan, but its short-term borrowings were 4.317 billion yuan.

Based on Nezha Auto's loss trend, it will be difficult to survive the next round of competition without external funding. Since it does not yet have the ability to generate revenue on its own, Nezha can only rely on external funding for development. Before submitting the prospectus, Nezha also conducted two rounds of financing, with a total amount of about 12 billion yuan. One of the financings included a clause that Nezha needed to go public as soon as possible.

Faced with this situation, Zhou Hongyi has no panacea, and relying solely on cost-effectiveness cannot solve the problem, and may even dig a deeper hole. To get out of the negative impact of the cost-effectiveness strategy, Nezha has prepared two cards.

The first card is to enter the premium market, which can allow Nezha to achieve better profit performance and thus achieve self-sustainability. In the second half of 2022, Nezha released the Nezha S, which explores prices up to the 300,000 yuan range, marking the beginning of Nezha's brand exploration. In April 2023, Nezha also released the Nezha GT (priced at 178,800 yuan to 226,800 yuan), which is touted as "the best sports car under 2 million yuan," and promised that the Nezha GT "will never be discounted".

Currently, Nezha has four models on sale: the Nezha AYA (an upgraded version of the Nezha U), the Nezha X (an upgraded version of the Nezha V), the Nezha GT, and the Nezha S. Their launch rhythm can be divided into two periods, before 2022, Nezha's sales came from the Nezha N01 (launched in 2018, starting at 59,800 yuan) and the Nezha V series (launched in November 2020, starting at 59,900 yuan). In 2023, the total sales of the Nezha S was less than 25,000 units, the total sales of the Nezha GT was only 5,255 units, and the sales of the Nezha AYA + Nezha U + Nezha V were 86,275 units, contributing 68% of Nezha's total sales. As a comparison, in 2022, the sales of the Nezha U + Nezha V were 149,000 units, accounting for 98.5% of Nezha's total sales.

From the perspective of sales proportion, Nezha's upward exploration strategy is successful, but due to a 16.5% year-on-year decline in sales in 2023, it can only be considered half successful.

The second card is to gain technological and cost advantages through technological research and development. In this regard, Nezha's focus is on the Haozhi technology brand, which has five major technologies covering most of the technical aspects of new energy vehicles and exhibiting characteristics of cost savings and solving industry pain points.

For example, the Haozhi skateboard chassis is a global platform architecture that can be applied to multiple models. Through decoupling development of the upper and lower bodies and hardware and software, it improves production efficiency by 20 times, reduces production space by 50%, and shortens the research and development cycle by 30%, thereby reducing costs and increasing efficiency. Haozhi Thermal Control addresses the problem of significantly reduced winter driving range for electric vehicles.

These two points are what Nezha achieved before 2024. In 2024, Nezha has a new move, which is to change its marketing approach.

As mentioned earlier, Nezha encountered a setback in 2023, and Zhang Yong emphasized marketing issues in his reflection, believing that Nezha's marketing approach is outdated and unable to keep up with the times. To solve this problem, Zhang Yong took on the role of president of Nezha's marketing company. However, according to Xinzhai Business Review's observation, this did not solve the fundamental problem.

In March of this year, Zhou Hongyi and Zhang Yong jointly did a live broadcast, and Zhou Hongyi pointed out Nezha's problems in marketing during the broadcast, advising Zhang Yong to avoid self-indulgent marketing. Zhang Yong is not unjustly accused. After receiving 360's investment in 2021, Nezha had the opportunity to create a label of "most secure," but this point was not thoroughly driven home. When Nezha is mentioned now, the first impression is still cost-effectiveness.

The turning point came after Lei Jun held the Xiaomi SU7 launch event. Since then, Zhang Yong's public image seems to have changed. Before that, not many people knew who Zhang Yong was, and some even mistook him for Alibaba's Zhang Yong or Haidilao's Zhang Yong. After that, Zhang Yong began to frequently update short videos, covering introductions to Nezha's models, new developments at Nezha, and issues raised by car owners.

The climax occurred during the renaming. Zhang Yong initiated a vote on Weibo asking if Nezha should be renamed, and also posted several videos on TikTok discussing the matter, which increased the discussion level of Nezha. It is worth noting that Nezha had previously responded to this issue, and now "rehashing old news" clearly has marketing considerations, indicating that Nezha's marketing strategy has begun to break away from the shackles of traditional marketing methods.

III. Conclusion

Nezha's target sales for 2024 are 300,000 vehicles. As of the end of May, Nezha has only completed 14.5% of its target sales, so the pressure ahead is not small. In this regard, Nezha hopes to open up a second battlefield overseas. Currently, Nezha has established a foothold in the Southeast Asian market. In 2023, Nezha Auto exported a total of 17,019 vehicles, accounting for 13.7% of total sales and contributing 12% of sales revenue. Based on insurance volume, Nezha Auto has become one of the top three brands in Southeast Asian new energy passenger vehicles. In addition to Southeast Asia, Nezha also plans to enter markets such as the Middle East, Latin America, and Africa.

However, the markets chosen by Nezha are all superficially glamorous. Taking Southeast Asia as an example, its new energy sales in 2023 were only 123,800 vehicles, and even by 2028, the scale will only reach 864,300 vehicles. More importantly, this is also constrained by the local economic development level. For example, in the African market, power supply is a problem, and electric vehicles are only suitable for individual countries like South Africa. At the same time, Nezha is playing catch-up in intelligent driving, and the industry's first tier has already started mass-deploying mapless autonomous driving capabilities, and Wenjie is already able to "drive anywhere in China without a map".

At present, a new force with a similar narrative to Nezha has gone public in the Hong Kong stock market, and the market's valuation for it is not high, currently only HKD 35.83 billion, significantly lower than NIO. Therefore, even if Nezha successfully goes public, Zhou Hongyi cannot breathe a sigh of relief. Nezha still needs to continue exploring the brand and maintain its fundamentals.

Similarly, Lei Jun could not relax. Although the sales of the Xiaomi SU7 are currently good, looking back at the past of Tesla and Xiaoli, each one has gone through the gates of death once or even a few times, and it is unknown when Xiaomi cars will reach the gates of death. It is not yet time to open champagne.