When the darling of capital enters the era of mass production, Momenta's "humble" push for IPO

![]() 07/02 2024

07/02 2024

![]() 618

618

This article is the 812nd original work of Shenqian Atom

Difficult to establish a closed business loop

Difficult to escape the embrace of large manufacturers

By Xu Tailiang

Edited by Shenqian Atom Studio

The rumors of Momenta's US stock IPO have finally been confirmed.

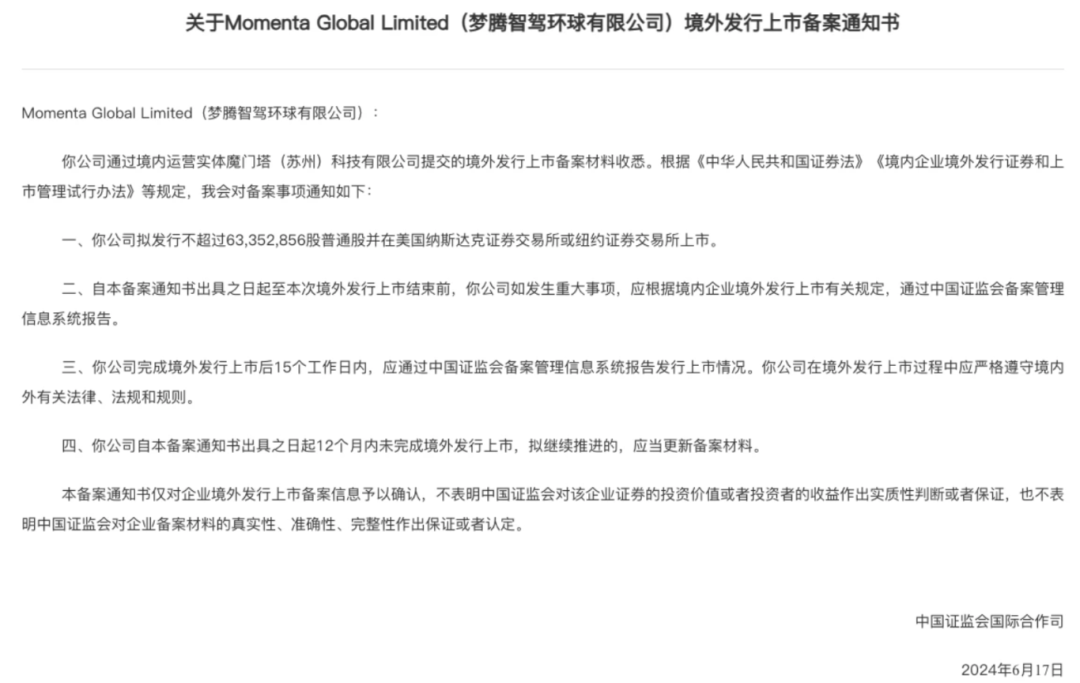

Source: China Securities Regulatory Commission

On June 17, 2024, information disclosed by the China Securities Regulatory Commission showed that Momenta has passed the overseas listing registration process and plans to list on Nasdaq or the New York Stock Exchange, issuing no more than 63,352,900 ordinary shares.

It is worth noting that as early as a month ago, Bloomberg reported that Momenta was communicating with CICC, Goldman Sachs, and UBS to secretly initiate the US stock IPO process, with an expected listing as early as within the year, aiming to raise $200 million to $300 million.

Although Momenta is in a highly growth-oriented intelligent driving sector and the company has passed the US stock IPO registration process, this may not alleviate Momenta's deep-seated anxiety. Currently, major automakers are increasing their investment in self-developed intelligent driving technology. As a third-party intelligent driving solution provider, Momenta's position is becoming increasingly awkward, and it may be difficult to establish a closed business loop and give confidence to the capital market.

Telling the story of "walking on two legs," Momenta is highly sought after by capital

Similar to other intelligent driving-related companies such as Black Sesame Smart, Horizon Robotics, and Pony.ai, Momenta was also founded around 2016. The highly convergent founding times of these companies are not accidental, mainly because the founders saw the imminent explosion of the intelligent driving market.

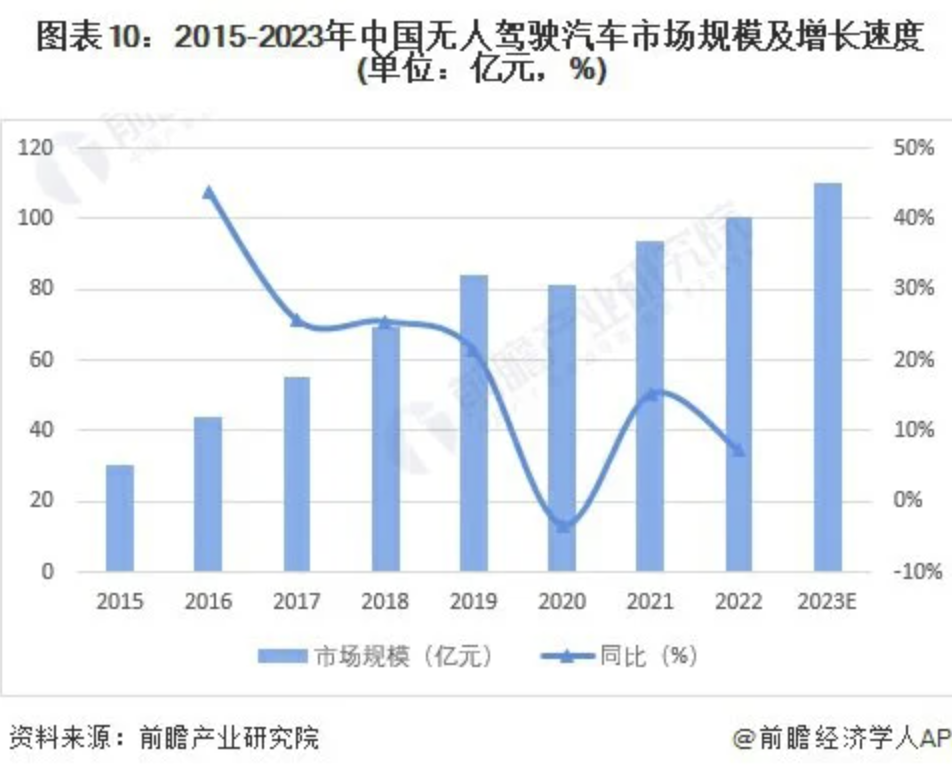

Source: Qianzhan Industry Research Institute

Data disclosed by Qianzhan Industry Research Institute shows that in 2015, the market size of China's driverless cars was only 3.05 billion yuan, but it then soared, growing to 10.04 billion yuan in 2022, with an average compound annual growth rate of 18.55%.

Unlike most companies targeting high-level intelligent driving technology that can only survive by "telling stories," from its inception, Momenta hoped to rely on both mass-produced pre-installed vehicle systems and Robotaxi.

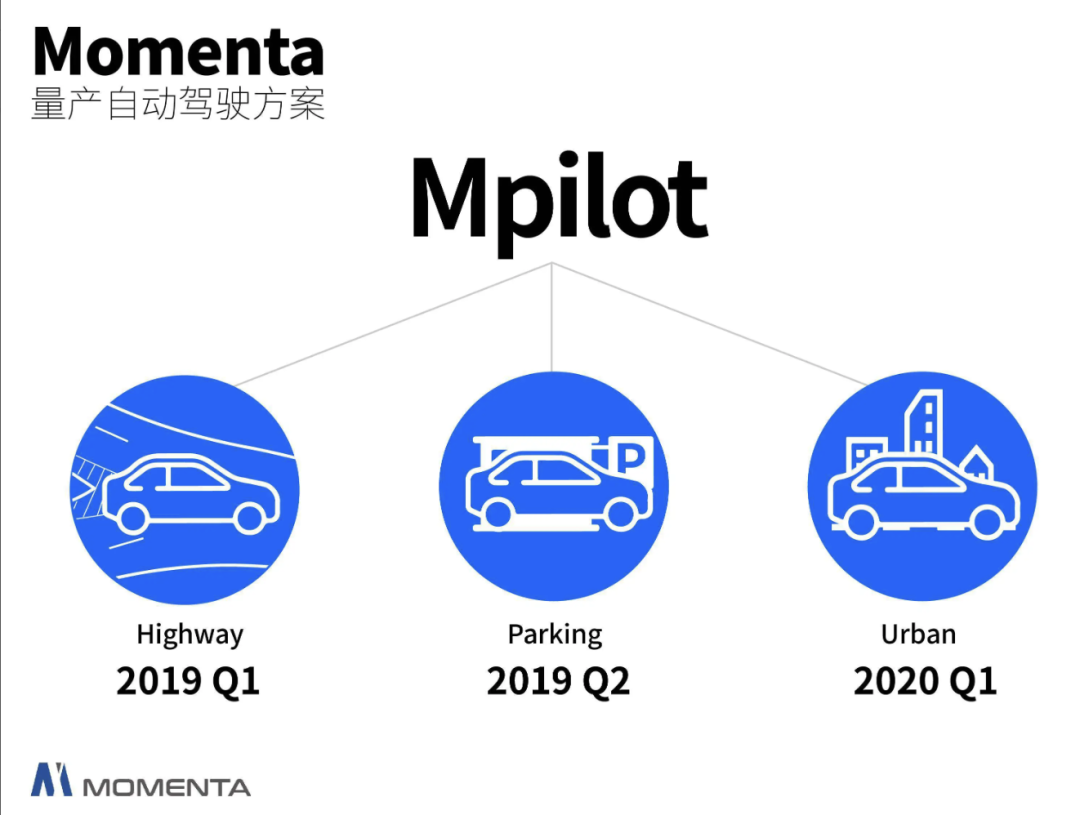

Source: Momenta

For example, in 2019, when Momenta released its L4-level autonomous driving technology MSD, it also simultaneously launched the Mpilot high-speed, parking, and urban autonomous driving solutions that can be mass-produced pre-installed.

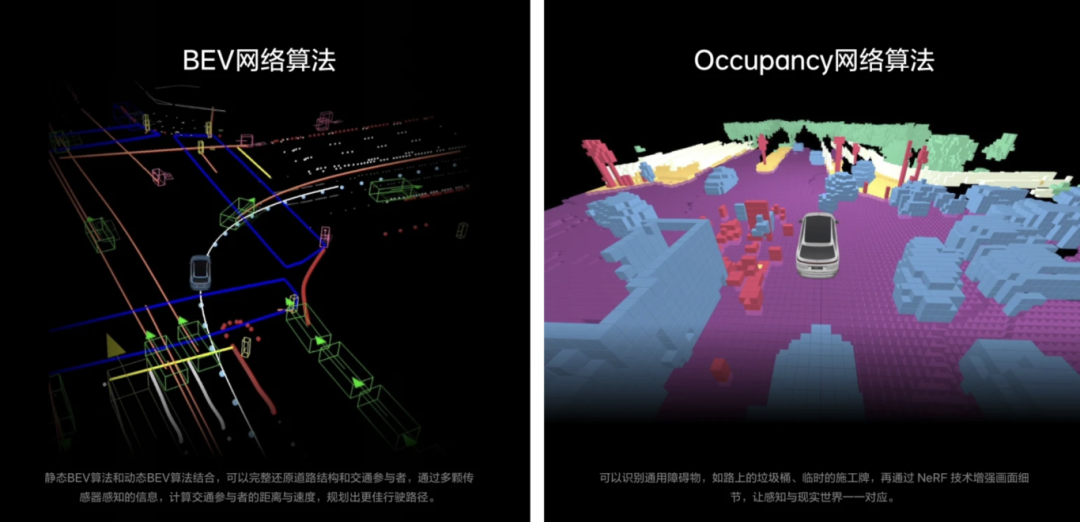

Momenta believes that based on a unified mass-produced sensor solution, Mpilot can provide data for MSD, and MSD can provide technology for Mpilot. The efficient closed-loop automated iteration between the two can obtain massive data through mass-produced autonomous driving products, continuously develop data-driven core algorithms, and build a closed-loop automated engineering system, ultimately achieving fully autonomous driving.

Source: SAIC Motor

The more practical significance of walking on two legs with mass-produced pre-installed vehicle systems and Robotaxi lies in the fact that Momenta can currently rely on selling solutions to generate revenue. According to incomplete statistics, Momenta has currently reached cooperation with well-known automakers such as SAIC Motor, BYD, and Toyota. Among them, the intelligent driving technology of SAIC Motor's latest masterpiece, ZHIJI L6, originates from Momenta.

Precisely because the strategy of walking on two legs with mass-produced pre-installed vehicle systems and Robotaxi combines both practical revenue-generating significance and long-term fully intelligent driving imagination, Momenta is highly sought after by investment institutions.

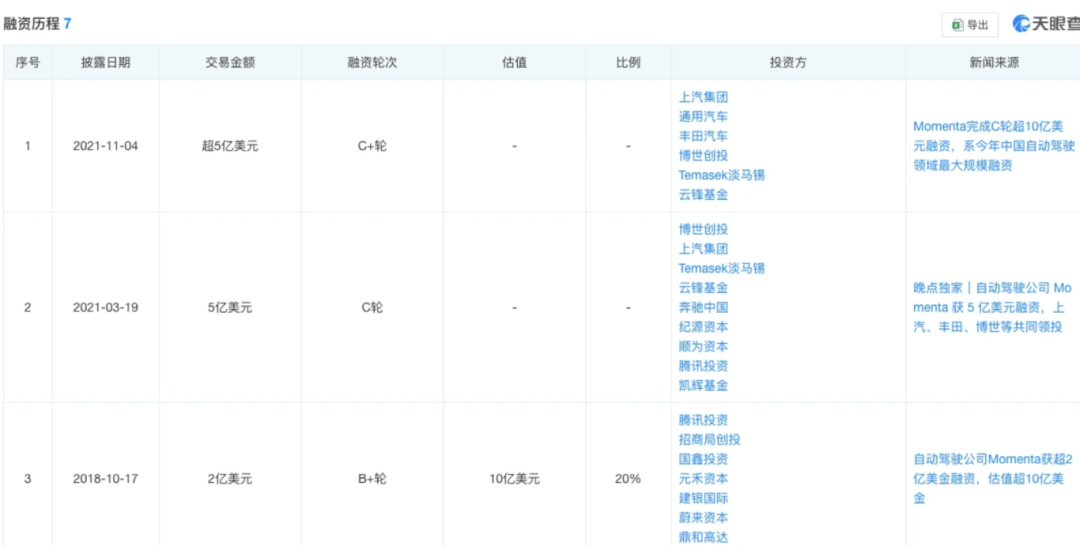

According to data from Tianyancha, since its inception, Momenta has completed 7 rounds of financing, raising a total of $1.26 billion, with investors including leading automakers such as Toyota, SAIC Motor, and General Motors.

Continuous price wars in the automotive industry, intensified losses for intelligent driving companies

Although Momenta's business story is more "sexy," the reality of intensified competition in China's new energy vehicle industry makes it difficult not to weaken Momenta's revenue-generating ability.

As everyone knows, since 2023, competition in the new energy vehicle industry has gradually increased, with continuous price wars. For example, in April 2024, at least 43 automakers in China reduced the prices of 128 models.

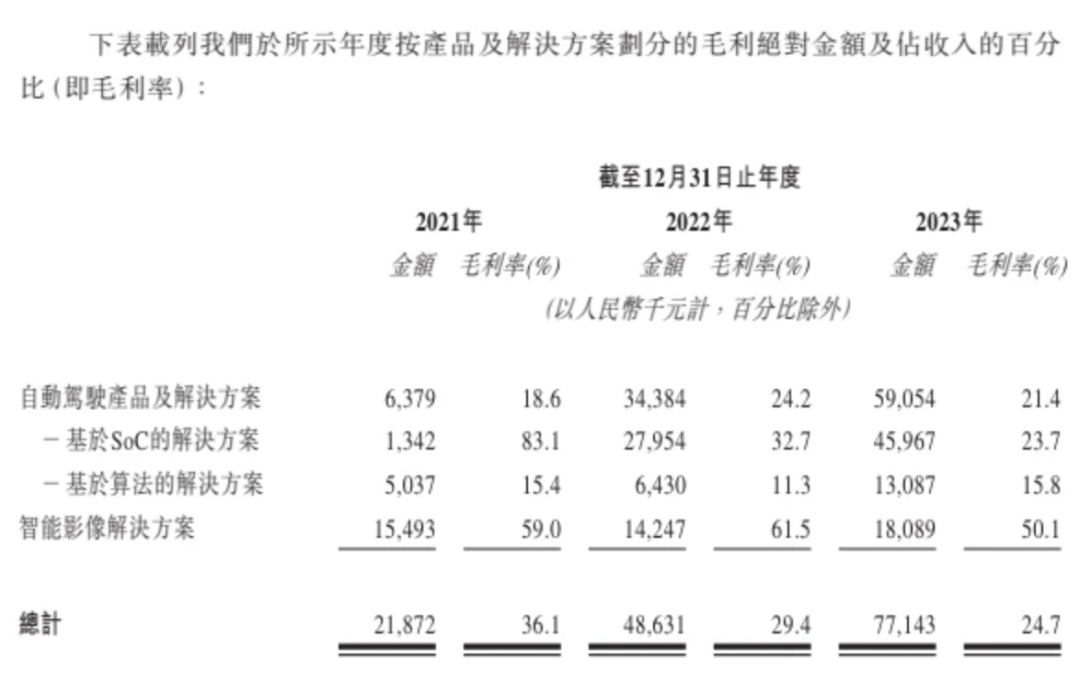

Source: Black Sesame Smart Prospectus

Continuous price reductions by automakers will inevitably weaken the profit margins of upstream supply chain companies. Taking Black Sesame Smart as an example, it is a supplier of automotive-grade intelligent vehicle computing SoC and SoC-based solutions. From 2021 to 2023, Black Sesame Smart's gross profit margins were 36.1%, 29.4%, and 24.7%, respectively, showing a clear downward trend.

Against the backdrop of declining gross profit margins, in order to maintain competitiveness, Black Sesame Smart has continuously invested heavily in research and development of cutting-edge technologies, which naturally leads to huge losses. The prospectus shows that from 2021 to 2023, Black Sesame Smart's equity holders' attributable losses were 2.357 billion yuan, 2.754 billion yuan, and 4.855 billion yuan, respectively, totaling about 10 billion yuan in losses.

Although Momenta has not publicly disclosed its prospectus, considering that it is betting on more technically challenging L4-level autonomous driving technology, and its current mass-produced pre-installed vehicle systems business may face challenges in narrowing profit margins, the company's losses may also be gradually intensifying.

Source: Tianyancha

For this reason, the capital market is becoming increasingly cautious about Momenta. According to Tianyancha data, after completing a C+ round of financing exceeding $500 million in November 2021, Momenta has not received a new round of financing in nearly three years.

Against this background, it is difficult for Momenta to calmly pursue an IPO. In March 2023, Reuters reported that Momenta was considering listing on the Hong Kong or US stock markets, aiming to raise $1 billion. A year later, Momenta's fundraising target has dropped to $200 million to $300 million, a decline of over 80%.

Obviously, compared to higher valuations and fundraising amounts, Momenta is currently more concerned about whether it can quickly enter the capital market and open up financing channels.

Will the "docile" Momenta be difficult to escape the embrace of large manufacturers?

Because intelligent driving technology contains tremendous commercial imagination, not only are third-party startups represented by Momenta increasing their investment in related businesses, but new carmakers, as well as infrastructure and intelligent terminal providers, are also accelerating their layout of self-developed intelligent driving technology.

Source: LIXIANG AUTO

For example, 36Kr reported that after gradually establishing its self-developed capabilities in 2021, LIXIANG AUTO has almost stopped relying on intelligent driving software suppliers to OTA upgrade the intelligent driving capabilities of its high-end products. During the Q3 2023 financial report conference call, LIXIANG AUTO expressed that it would make intelligent driving technology a core strategic goal in the future.

Given the significant shortcomings of traditional automakers' intelligent driving technology, Huawei is committed to deeply empowering traditional automakers through modes such as intelligent selection, Hi, and parts supply.

For example, the new M7 from Wenjie, which was launched in September 2023, supports Huawei's ADS 2.0 intelligent driving system, with NCA intelligent driving pilot coverage of 90% of urban scenarios, whether with or without maps, and AEB maximum braking speed increased to 90km/h.

Source: Wenjie

Facts have proven that high-level intelligent driving technology is indeed a powerful tool to capture consumers. Two and a half months after its launch, the new M7 from Wenjie has accumulated over 100,000 orders, with the intelligent driving version accounting for 60%, and the urban NCA optional rate reaching 75%.

However, not all automakers can accept the strong Huawei. At the SAIC Motor shareholders' meeting held in June 2021, when asked about whether they would cooperate with Huawei, SAIC Motor Chairman Chen Hong said publicly, "It is difficult to accept a single supplier providing us with an overall solution. This would make them the soul, while SAIC would become the body. SAIC cannot accept such a result, and our soul must be in our own hands."

Interestingly, in March and November 2021, SAIC successively led the C round and C+ round of financing for Momenta. Based on this, SAIC's ZHIJI Automobile is equipped with Momenta's intelligent driving solution.

SAIC, which also needs to hand over its "soul," may have chosen to cooperate with Momenta rather than Huawei because the latter is less aggressive, occupying a weaker position in the industrial chain, and is easier to manipulate.

As everyone knows, intelligent driving technology relies on continuously analyzing data generated by vehicle driving for iterative evolution. The business model of Momenta and most intelligent driving suppliers is to sell solutions to automakers, then obtain accurate and desensitized data, and then sell better intelligent driving technology to other automakers.

Since Huawei is a strong independent third-party intelligent driving supplier, SAIC has difficulty preventing Huawei from collecting its own intelligent driving data to benefit others. Although Momenta is also an independent third-party intelligent driving supplier, as a startup, it urgently needs capital infusion. As a shareholder, SAIC may greatly interfere with Momenta's operations.

And this also seems to determine that Momenta will find it difficult to develop independently in the future.

In an interview in April 2019, Momenta founder Cao Xudong said, "There are no companies worth billions of dollars in autonomous driving. Either you are worth tens of billions of dollars, or you will be acquired or eliminated." According to Cao Xudong's view, only by becoming an industry leader can intelligent driving companies survive, and small and micro enterprises are difficult to escape the fate of being acquired or going bankrupt.

Nowadays, Momenta's valuation is not even worth billions of dollars. As automakers such as SAIC continue to attach importance to intelligent driving technology, Momenta, which is continuously losing money, may find it difficult to escape the fate of being acquired.