Sprinting to IPO: Nezha Auto's Three-Pronged Strategy

![]() 07/02 2024

07/02 2024

![]() 701

701

Source: Bohu Finance (bohuFN)

Recently, Nezha Auto (hereinafter referred to as "Nezha"), a leading company in the new wave of automotive manufacturing, formally submitted a prospectus to the Hong Kong Stock Exchange, with an estimated valuation of approximately 42.4 billion yuan. If all goes well, Nezha will become the sixth independent IPO in the new wave of automotive manufacturing after NIO, XPeng, and Li Auto, as well as Zero Run and Zeekr.

Since 2020, Nezha has intended to impact the IPO, but after many years, its long-time rivals Zero Run and WM Motor, who also announced plans to go public in 2022, one succeeded and the other failed, with WM Motor on the verge of bankruptcy. However, Nezha's "road to listing" has been fraught with twists and turns.

During this period, Zhang Yong, CEO of Nezha, responded to the reason why the company has not been able to enter the capital market, stating that "the current capital market is cooling off, and the probability of breaking through the listing price is relatively high." However, the capital market has not yet seen significant recovery, and there have been cases of new automotive companies breaking through the listing price after going public. In this "not so good" timing for an IPO, the urgent need for "blood transfusion" may be the most important reason.

01 Nezha Falls Behind, Struggling to "Reach Higher"

As early as 2020, Nezha announced that it had initiated the listing application process on the STAR Market, but coincidentally, new policies were introduced requiring increased scrutiny of the "technological content" of enterprises, ultimately leading to the failure of its listing plans.

Since then, in 2022 and 2023, there have been repeated rumors that Nezha's parent company, Hozon New Energy Automobile, would rush to the Hong Kong Stock Exchange for an IPO, but all were denied by Nezha.

Zhang Yong's statement that "the timing is not right" may be one of the reasons, but everyone has witnessed the capital market environment over the past few years. Since 2023, 70% of Chinese concept stocks have broken through their listing prices, and it is not an exception for companies to "bleed" to go public, such as Zero Run, which broke through its listing price on the first day of listing in 2022.

Therefore, from a deeper perspective, Nezha's delay in rushing to an IPO may also be due to its lack of confidence in its own products and financial data. It is not only concerned about breaking through the listing price but also fears failing like WM Motor in its IPO rush.

Nezha was once a "top student" among the new forces in automotive manufacturing. In 2022, as a "dark horse" of the new forces, Nezha defeated NIO, XPeng, and Li Auto with an annual sales volume of 152,073 units, becoming the "sales champion" of that year.

This year was also Nezha's most glorious year, not only achieving two major milestones of delivering 100,000 and 200,000 vehicles within the year but also becoming the first new force brand with an annual sales volume exceeding 150,000 units. It also secured a D-round financing of 3 billion yuan.

To this end, Nezha boldly announced that it would achieve an annual sales target of 300,000 vehicles in 2023 and strive to achieve a global sales target of 1 million vehicles by 2026. However, things did not go as planned. Nezha's total sales volume in 2023 was only 127,400 units, not only far from the 300,000-unit target but also 20,000 units less than in 2022.

Even more embarrassingly, although the overall growth rate of the new energy vehicle market slowed down in 2023, among the top ten new force brands in sales, only Nezha experienced negative growth, while brands like Lixiang, Shenlan, and LANTU even exceeded 100% in sales growth.

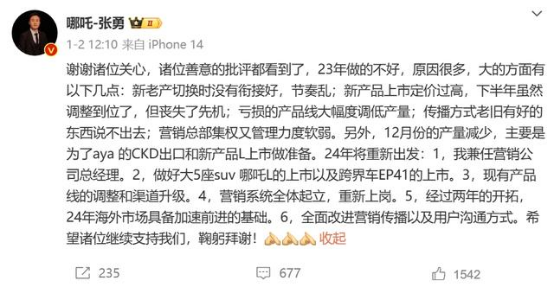

With Nezha "falling behind instead of advancing" in 2023, Zhang Yong had to issue a "self-reflection," stating that Nezha did not perform well in 2023, mainly due to issues such as new product rhythm, product strategy, and marketing communication.

From an outside perspective, Zhang Yong's comments indeed hit Nezha's "soft spot." On the one hand, Nezha's low-price positioning is like a "double-edged sword," allowing it to find a breakthrough opportunity and quickly open up the market in 2022, when the new energy vehicle industry was severely "chip-short."

However, in 2023, the "chip shortage crisis" in the new energy vehicle industry has passed, but Nezha's established low-price positioning is difficult to adjust quickly. Against the backdrop of price wars in the automotive industry, Nezha does not have much room for price maneuvering.

According to a report by Phoenix Net, in 2023, Nezha's gross profit margin on vehicles was only around 5%. For reference, NIO was 11%, XPeng was 22.2%, and BYD was 20%.

On the other hand, Nezha has many models under its brand but lacks a best-selling model. The reason why Nezha was able to stabilize its position as the "sales champion" among the new forces in 2022 was because of the support of two major models, Nezha V and Nezha U, which together accounted for 98.48% of Nezha's annual sales.

However, in 2023, the only model that Nezha slightly stood out was the Nezha GT, but this product began to enter a bottleneck period a few months after its launch. Zhang Yong even issued a post asking netizens how such a good product could be sold as a best-seller with monthly sales of 5,000 units.

The Nezha GT carries Nezha's determination to transform to the high-end market, but the market apparently does not buy it. After all, "reaching higher" cannot just mean higher prices; brand experience and user experience must also be improved simultaneously. In addition, Nezha only announced the initiation of research on intelligent driving functions in 2021, failing to keep pace with the current level of intelligence in the automotive industry.

Finally, as Nezha shifts from being primarily "B-end focused" to "C-end focused," its sales strategy also needs to be replaced accordingly. For example, when NIO and XPeng first entered the high-end market, they put a lot of effort into user experience, providing consumers with "emotional value" in plain language.

In contrast, although the Nezha GT and Nezha S have higher prices, their promotional selling points overly emphasize features such as coupe design, fast acceleration, and gull-wing doors. Before addressing the damage to brand value caused by the low-end market, overly emphasizing "performance" may be difficult to convince consumers.

02 Market Cooling Off, Nezha in Need of Funds

Zhang Yong has publicly stated that the monthly sales volume of the Nezha S needs to reach 10,000 units to reach the "passing line," and over 20,000 units to be considered an "excellent student." Currently, Nezha is barely "passing."

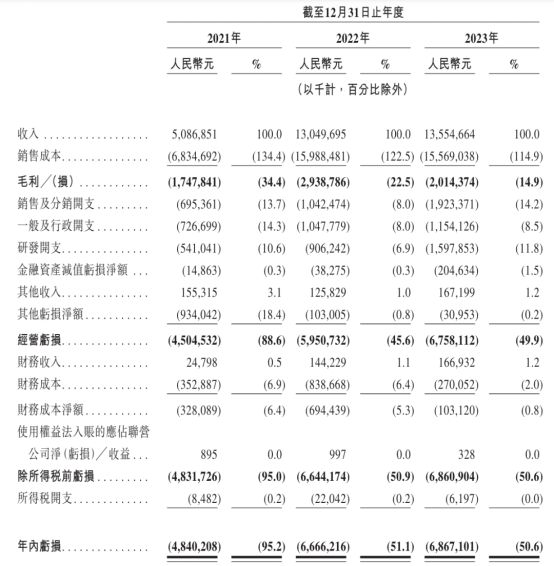

However, even with sales barely maintaining a "passing grade," Nezha's biggest problem is that it cannot make money by selling cars. According to Nezha's prospectus, its net losses in 2021, 2022, and 2023 were 4.84 billion yuan, 6.67 billion yuan, and 6.87 billion yuan, respectively, totaling 18.4 billion yuan.

Losses are not uncommon for new energy vehicle companies, but the key is why they are losing money. For example, NIO, XPeng, and Zero Run have also lost over 10 billion yuan in the past three years. High marketing costs for NIO and excessive R&D investment for XPeng are some of the reasons for their losses.

However, the gross profit margins of NIO, XPeng, and Zero Run were all positive in 2023, at 9.5%, 1.5%, and 0.5%, respectively, while Nezha is truly "selling cars at a loss," with a gross profit margin that has always been negative, standing at -14.9% in 2023.

Nezha's inability to turn its gross profit margin positive means that it has not yet crossed the "line of life and death," failing to achieve a balance between market sales scale and automobile production costs.

Li Xiang, CEO of Lixiang, once said that the automotive industry is an industry that emphasizes economies of scale, and sales volume largely determines the profits of automakers. If Lixiang can only sell 5,000 to 6,000 vehicles per month, the company's gross profit margin would become negative.

This is why major automakers have launched price wars in the past year. Even if automakers do not make money selling cars, they must maintain economies of scale. Zhang Yong once stated that when sales reach 300,000 to 500,000 vehicles, Nezha will initially form a scaled capability and achieve break-even, with stronger blood-making ability. However, currently, Nezha is still far from the "safety line."

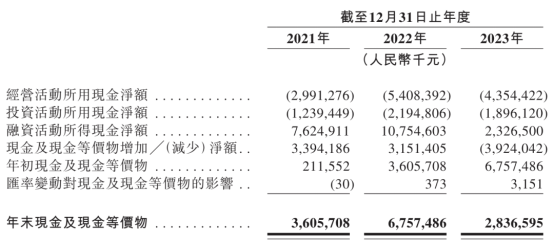

As sales fail to pick up, Nezha's cash flow pressure is also increasing. As of December 31, 2023, its year-end cash and cash equivalents were 2.84 billion yuan; as of the end of April this year, it still had 5.75 billion yuan in loans. Given its loss speed over the past few years, this amount of money is not enough for Nezha to "burn through."

At the beginning of this year, a netizen claiming to be a Nezha employee revealed on social media that the year-end bonus promised by Zhang Yong for the first week after the new year was not fulfilled. Later, Zhang Yong responded with a post stating that the delayed bonus had been notified to employees. In March this year, media also exposed online that Nezha Auto's Nanning factory had been shut down for more than half a month, to which Zhang Yong responded that it was "for export purposes."

In the face of various online质疑, Zhang Yong responded to each one. Even in June last year, Zhang Yong stated that Nezha had sufficient cash reserves to应对 future market competition for the next two to three years. However, Nezha's urgency in raising funds inevitably revealed its true situation.

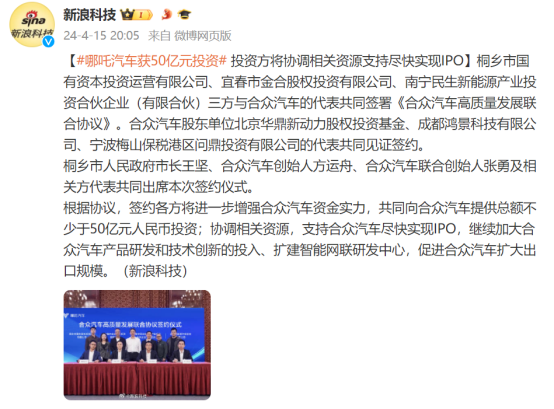

This year, Nezha has supplemented its cash through various means. For example, in April this year, Nezha officially announced that it had signed agreements with multiple institutions to secure investment of not less than 5 billion yuan. In March this year, Zhang Yong also revealed in an interview that Nezha's actual capital increase reached 1.6 billion yuan, led by an industrial capital.

It is evident that for Nezha, which is still unable to "self-finance," listing and financing is an important way to replenish its corporate capital pool. After all, against the backdrop of declining sales and continuous losses, Nezha still needs to complete product iterations, brand transformations, and overseas factory construction goals, as well as cope with the ongoing price wars in the automotive industry. Without capital "blood transfusion," Nezha may truly become the next new force in automotive manufacturing to implode.

03 Can Nezha "Change Its Fate" After the IPO?

In fact, from an outside perspective, Nezha has become a precarious new force brand. In an online poll conducted by netizens in February this year on "the next new energy vehicle brand to collapse," Nezha ranked first with nearly a quarter of the total votes.

However, Zhang Yong is obviously not satisfied. While actively raising funds, Nezha is also actively initiating internal reforms. The first step was for Zhang Yong to take on the role of President of Nezha Marketing Company in January this year, personally getting involved in marketing, but the results have been mixed so far.

For example, in March this year, Nezha launched an official live broadcast, visiting the Tongxiang factory in Zhejiang for an on-site inspection and inviting Zhou Hongyi to join. During the live broadcast, Zhou Hongyi suggested that company executives learn more from Xiaomi.

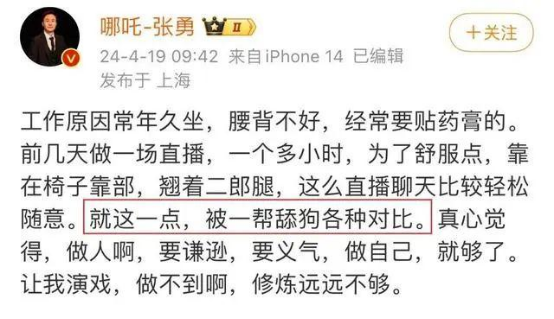

Later, when responding to a netizen's question about whether he would open the car door for them if they bought a Nezha, Zhang Yong said that as long as he had time, he would bow 90 degrees to open the car door. However, netizens felt that Zhang Yong's tone and body language were arrogant, and Zhang Yong directly responded and used the term "lickspittle."

Although Zhang Yong has apologized for this incident, against the backdrop of new energy vehicle company founders and executives actively engaging in marketing on social media and live broadcasts, Zhang Yong seems to have failed to grasp the "degree" of traffic, unaware that too much traffic and gimmicks can also be overkill.

In April this year, Zhang Yong again called on netizens on social media to vote on whether Nezha Auto should change its name. Only 22% of people supported Nezha not changing its name, but Zhang Yong said, "Seeing the results of the online vote, I don't want to change the name."

Many netizens believe that Zhang Yong's move is undoubtedly a marketing gimmick and not very clever. After all, a brand has been operating for several years, and it is impossible to change its name without special circumstances. Zhang Yong's move is just to grab attention.

For this reason, many netizens believe that the best marketing reform for Nezha is to keep Zhang Yong away from it. In fact, despite Nezha's high exposure this year, its sales in the first five months are still down 42%, indicating that the root cause of Nezha's poor sales is not just marketing.

Therefore, the second step of Nezha's reform is to focus on R&D. In April this year, Nezha issued a company-wide announcement stating that it would optimize and adjust the organization and responsibilities of departments related to the R&D system. At the same time, Zhang Yong will also serve as General Manager of the Product R&D Center.

In the past few years, under the strategy of sprinting to the market with low-cost products, Nezha's three-electric technology was almost entirely "piecemealed" together. However, in January this year, Nezha stated that it would have at least four global models in 2024 to support overseas markets, including the Nezha L and another all-new category model (EP41).

Zhang Yong further stated that the EP41 would embody the latest technology and design concepts, and Nezha would accelerate the mass production of its next-generation electronic and electrical architecture platform, intelligent driving and cockpit integration platform, integrated intelligent chassis, and air suspension.

Currently, the sales performance of the Nezha L is good, with cumulative orders exceeding 30,000 units within 35 days of its launch, becoming an important support for Nezha's sales this year. The outside world believes that the positioning of the Nezha L as a family mid-size SUV has finally hit the market demand.

The last move was Nezha's resolute departure from the sea. For the sales target for 2024, Nezha did not easily make bold statements this time, but once again emphasized that Nezha Motors will shift from manufacturing to technology services in 2026, achieving millions of sales in the global market.

Compared to other new energy vehicle companies, Nezha has always been very firm in "going global" and began researching right-hand drive models as early as 2021. According to Nezha's prospectus, in 2023, the Nezha AYA series had a high market share of 52% in the small pure electric vehicle market in Southeast Asia; Last year, Nezha exported a total of 17019 vehicles, accounting for 13.7% of total sales and contributing 12% of sales revenue.

It is not difficult to see that Nezha's low price and small car positioning, coupled with its advantage of going global early, have enabled it to take the lead in overseas markets. Perhaps this is also why Nezha can maintain a certain level of confidence even in the face of a significant decline in domestic sales.

But overall, whether it's domestic coil prices and products, or foreign coil markets and factories, all of this cannot be achieved without funding.

The IPO of Nezha is imminent. If it goes public smoothly, Nezha will have the opportunity to use "three major strategies" to improve its business situation. However, the IPO is only the beginning, and the road ahead is long and arduous. It may take time for Nezha to give an answer on how far it can go.