Driverless Taxis: Challenges and Prospects in the Autonomous Age

![]() 07/04 2025

07/04 2025

![]() 874

874

New Energy View (ID: xinnengyuanqianzhan) original

Full text: 3767 words, reading time: 14 minutes

The landscape of driverless taxis, or Robotaxis, has once again become a focal point of interest.

Musk's nearly decade-old dream of Robotaxis officially commenced pilot operations in Austin, Texas, USA.

However, Tesla's Robotaxis in the pilot phase have fallen short of Musk's previous promotional claims in terms of technical performance and deployment scale, even receiving notices from relevant authorities due to numerous issues within just two days of operation.

Just two days prior to Tesla's announcement of the official launch of Robotaxis, the domestic Robotaxi platform was accelerating its expansion into the Southeast Asian market, announcing plans to launch driverless travel services in Singapore and Malaysia as early as this year to broaden its global reach.

A day after Tesla's announcement, a technology company named "Shanghai Zaofu Intelligence" was registered and established. According to Tianyancha information, the company boasts a registered capital of nearly 1.3 billion yuan, backed by giants such as Hello Bike and Ant Group.

Figure/Basic information of Shanghai Zaofu Intelligence

Source/Internet New Energy View screenshot

The competition among both established and emerging players, along with incremental progress, has ushered in the "first year" of Robotaxis once again.

However, in stark contrast to the vigorous expansion efforts of companies, consumer acceptance of driverless taxis remains low. High R&D and operational investments also mean that this seemingly vibrant sector is far from achieving genuine profitability.

1. Robotaxis Sweep the Globe, with Fierce Competitors Emerging Frequently

Tesla has finally launched its Robotaxi service. However, it is not the previously revealed unmanned taxi that is undertaking this task, but a Robotaxi modified from 10 Model Y vehicles.

Figure/Robotaxi modified from Model Y

Source/Internet New Energy View screenshot

Moreover, contrary to Musk's previously promoted superior FSD technology, Tesla has equipped its driverless taxis with comprehensive safety measures: an offline safety officer is stationed in the co-pilot seat, and there is also an online remote monitoring system.

The service is currently being tested in a small area in southern Austin, USA, and is limited to invited users, with a fixed fare of $4.2 per trip, operating from 6 a.m. to midnight.

Figure/Musk announces Robotaxi fare

Source/Internet New Energy View screenshot

Musk stated that the service will expand to markets outside Austin by the end of the year and plans to deploy hundreds of thousands of autonomous vehicles by the end of next year. Additionally, the first fully autonomous Tesla vehicle was "driven from the production line to the owner's home" on June 28, fully controlled by Tesla's latest FSD (Full Self-Driving) software.

In recent years, the Robotaxi sector has been a hotbed of competition, with major players from both domestic and international markets entering the fray. Domestically, in addition to Baidu, which entered the market with software technology, there are also PonyPilot+, AutoX Antu, WeRide WeRide.ai, and other companies. Additionally, auto companies such as XPeng Motors, and travel platforms like Ruqi Travel and Didi Chuxing have also deployed their services successively.

The competition among foreign players is equally intense, with Waymo, Amazon-owned Zoox, and Tesla among the main contenders.

To stay ahead in the industry, all players are rushing to deploy and open cities. Domestically, Robotaxi has provided official services in over 15 Chinese cities, including Beijing, Shanghai, Guangzhou, Wuhan, Shenzhen, Chongqing, Yangquan, etc.; it has also conducted overseas pilot operations in Hong Kong and the United Arab Emirates.

Figure/Robotaxi

Source/Internet New Energy View screenshot

Baidu founder Li Yanhong once stated that Robotaxi will enter the "year of significant expansion" in 2025, and plans to accelerate the large-scale implementation of its business through cooperation with mobile service operators, taxi companies, and third-party fleet operators.

WeRide (WeRide.ai) and Pony.ai are also intensifying their efforts in terms of city coverage. The former is operating in Guangzhou, Shenzhen, Beijing, Nanjing, and Sharjah (UAE), and has also obtained testing licenses in France and Singapore; the latter is primarily focused on Guangzhou, Beijing, Shanghai, Foshan, etc. Simultaneously, there are also testing projects in Fremont, Irvine, California, and New Jersey, USA.

Official data shows that in March 2025, Pony.ai and ComfortDelGro, which operates a global taxi network of over 29,000 taxis, announced the launch of a joint operation for autonomous driving travel in Guangzhou. Pony.ai CFO Wang Haojun emphasized that the company will prioritize efficient investment and optimized output, focusing resources to accelerate the company's commercialization strategy.

Figure/Pony.ai's cooperation with ComfortDelGro

Source/Internet New Energy View screenshot

WeRide (WeRide.ai) announced in May this year that it would expand its strategic cooperation with Uber, planning to add 15 international cities over the next five years to deploy autonomous Robotaxi services, including international markets in Europe, the Middle East, and other regions.

Figure/WeRide's expanded cooperation with Uber

Source/Internet New Energy View screenshot

For foreign players, Waymo currently provides over 250,000 driverless paid rides per week in Los Angeles, San Francisco, Phoenix, and Austin, with a cumulative order volume exceeding 10 million. On June 18, local time, Waymo announced that it had applied to the New York City Department of Transportation for a permit allowing it to be driven by "trained professionals" in Manhattan for mapping and testing.

Figure/Waymo

Source/Internet New Energy View screenshot

The fierce competition among the big players has also fueled rapid industry development. A Goldman Sachs report points out that the global Robotaxi market is expected to experience explosive growth, with a market size projected to reach $40 billion to $45.7 billion by 2030, boasting a compound annual growth rate of over 60%.

An analysis by industry insiders reveals that among the various players, the technical routes adopted are not uniform. Tesla employs a pure vision strategy, relying solely on cameras and AI, and eschewing lidar. The modified Model Y is equipped with 4 millimeter-wave radars to compensate for the limitations of cameras in inclement weather.

"Robotaxi and Waymo's multi-sensor strategy utilize a comprehensive array of sensors, including lidar, millimeter-wave radars, cameras, and are combined with highly detailed pre-mapped high-precision maps. This multimodal approach offers superior accuracy, redundancy, and reliability, particularly in complex urban environments and challenging weather conditions."

2. Are All Autonomous Driving Technologies Unreliable?

Despite the diverse players and their varying technical advantages, the issues exposed by driverless taxis exhibit a similar trend, which warrants emphasis.

Taking Tesla's Robotaxi as an example, it has encountered numerous problems in a short period after its launch. According to multiple media reports, within two days of providing test rides to invited customers in the South Austin area, the service (Tesla Robotaxi) was exposed to multiple dangerous driving behaviors such as speeding through residential areas, forcibly changing lanes without signaling, and closely approaching other vehicles, and is currently under federal investigation by the U.S. National Highway Traffic Safety Administration (NHTSA).

Figure/Robotaxi is under investigation by NHTSA

Source/Internet New Energy View screenshot

Waymo once also misjudged and braked abruptly due to ponding in heavy rain, causing a rear-end collision, and it took half a year for the insurance company and the auto company to resolve the claim; a driverless taxi of Zoox collided with a passenger vehicle approaching and stopping in front of it from a perpendicular lane on a Las Vegas street, prompting Zoox to initiate a software recall for all its vehicles.

Driverless taxi issues persist abroad, and the situation in China is similar. In June 2024, after the sixth-generation driverless car of Robotaxi was deployed in Wuhan, it also faced a series of complaints from citizens. On the Wuhan City Message Board, complaints about "Robotaxi autonomous driving" vehicles primarily focused on issues such as occupying lanes during rush hours, excessively slow speeds, and sudden stops, with many Wuhan netizens even joking that "Robotaxi" is a "silly radish."

Figure/Complaints about Robotaxi in Wuhan

Source/Internet New Energy View screenshot

Amidst numerous complaints and controversies, "unreliable technology" and "unfriendly experience" have emerged as the two core issues. Many netizens even commented, "Private car intelligent assisted driving is so popular; auto companies might as well first serve private car owners and then extend it to driverless taxis. When private car technology is not mature enough, it is unnecessary to try to displace online car-hailing drivers."

However, in the development of any technology, there are both pros and cons. Despite consumers' complaints about driverless taxis, their advantages are also evident. Taking Robotaxi as an example, it still attracts some young people due to its cost-effectiveness.

A consumer residing in Wuhan who has taken Robotaxi stated that he compared the fares of Robotaxi and Didi and found that for the same distance, although the time taken by Robotaxi is much longer than that of Didi, the payment fee is significantly lower, almost half of Didi's. "So in non-emergency situations, Robotaxi is still very attractive."

Consumer recognition has also propelled the phased development of Robotaxi's business. According to Baidu, as of March 2025, Robotaxi had provided over 10 million travel services, and by May, this number had increased to 11 million. In the first quarter of 2025, Robotaxi provided over 1.4 million travel services globally, a year-on-year increase of 75%, with safe driving mileage exceeding 170 million kilometers.

Figure/As of May 2025, Robotaxi has provided 11 million global travel services

Source/Internet New Energy View screenshot

However, while actively disclosing the number of orders, Baidu seems to avoid discussing profitability issues.

In 2024, Baidu predicted that with the successive commissioning of one thousand sixth-generation driverless cars, Robotaxi would achieve break-even in Wuhan by the end of 2024 and enter a full profit period in 2025, becoming the world's first autonomous driving travel service platform to achieve commercial profitability.

In 2024, Wang Yunpeng, Vice President of Baidu Group and President of the Intelligent Driving Business Group, mentioned in an internal letter on the 7th anniversary of Baidu Apollo that the next mission of Robotaxi is to accelerate the turnaround of gross margin and implement the business model.

"This is an extremely challenging goal. After 100 million kilometers of testing and operating mileage, the next goal is 100 million yuan in revenue and 100 million yuan in profit."

However, it remains to be seen whether its profitability is as optimistic as expected.

3. How Far is Driverless Taxi from Free Travel?

For enterprises, the timing of profitability is uncertain. For consumers, it is unclear when they can hail a driverless taxi like an ordinary online car-hailing service.

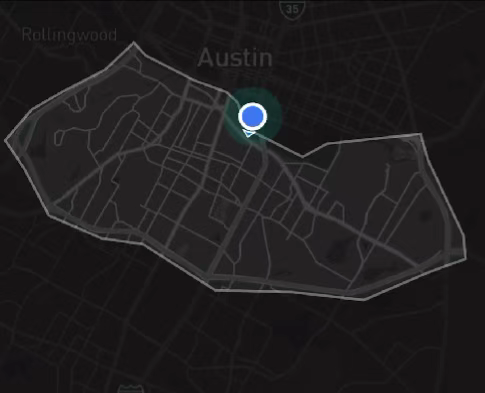

"The immaturity of laws and regulations prevents Robotaxi from achieving free operation (deviating from geographical fences), and consumers or ordinary users cannot experience true point-to-point travel like online car-hailing. Therefore, the government and enterprises need to collaborate to promote the improvement and perfection of Robotaxi industry standards and laws and regulations," said Zhou Xiongfei, a prominent figure in the smart travel industry.

Figure/Robotaxi geographical fence

Source/Internet New Energy View screenshot

Zhou Xiongfei further stated that currently, from an industry perspective, governments of various countries are relatively cautious about Robotaxi. Hence, in the future, it is necessary to wait for the maturity and improvement of laws and regulations to enable large-scale commercialization of Robotaxi.

Apart from the need for improvement and perfection of relevant laws and regulations, the high cost of Robotaxi has also become one of the obstacles to its large-scale implementation.

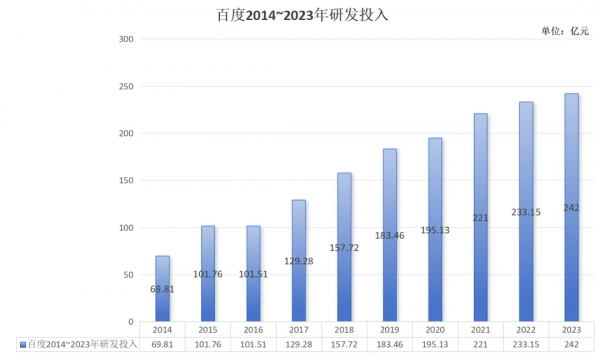

Data indicates that from 2014 to 2023, Baidu's investment in the field of autonomous driving reached 150 billion yuan. By 2024, although the overall R&D investment declined, it was still as high as 22.1 billion yuan. It should be noted that the decline is not due to reduced R&D investment but due to decreased personnel-related expenses.

Figure/Baidu has invested up to RMB 150 billion in autonomous driving over 10 years

Source/Screenshot from New Energy Observer

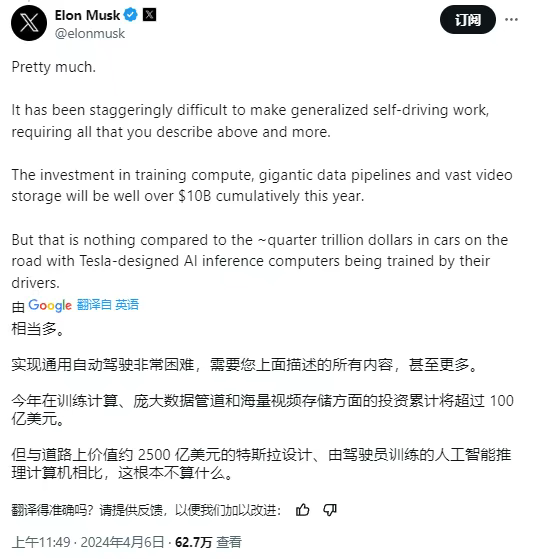

Previously, Musk disclosed that by 2024, Tesla's cumulative investment in autonomous driving technology will surpass USD 10 billion. This figure marks a significant increase, being more than four times the total investment made over the past seven years.

Figure: Musk Announces Cumulative Investment in Autonomous Driving Exceeding USD 10 Billion

Source: Screenshot from New Energy Observer

Additionally, whether consumers will genuinely embrace this technology remains a pivotal concern for the practical deployment of driverless taxis.

From the perspective of intelligent assisted driving in private vehicles, the transition from overhyped promotion to a sudden "braking" phase indicates that consumers have yet to fully accept it. They have been misled by flashy marketing tactics, causing initially interested individuals to become wary and those who were merely observing to disregard intelligent assisted driving altogether.

Similarly, with Didi already adept at meeting consumers' travel needs, the question arises: what advantage do driverless taxis offer? Furthermore, how long can the cost-effectiveness sought by consumers be sustained after successfully educating users? After all, Didi initially attracted customers with low prices.

Xu Lijuan, Director of the Market Research Institute at Beijing Jiaotong University, analyzed that as a prime example of AI empowering the automotive industry, autonomous driving encompasses the development of related industries such as chips, operating systems, the Internet of Things, urban infrastructure, testing, and certification. It represents a crucial pathway for the integration of the digital and real economies.

"Moreover, emerging industries led by autonomous driving and intelligent connected vehicles are also aligning with industrial upgrades in numerous cities, including Wuhan, presenting new opportunities for urban development. As laws, regulations, and relevant policies gradually improve, autonomous driving, as a novel form of productive force, will enable society as a whole to reap the benefits of technological advancements, bringing autonomous driving into the homes of millions."

From this perspective, driverless taxis undeniably embody the future of technology, yet they are still some distance from the vision of "relax and set off immediately."