Upgrading of Involution: Who Is the Sales King Among New Energy Vehicle Companies in the First Half of the Year?

![]() 07/03 2024

07/03 2024

![]() 696

696

Blue Whale News, July 2 (Reporter Li Zhuoling) As July begins, the half-year performance reports of automakers have been released one after another.

Among the new energy vehicle companies that have disclosed sales data, "the leader of new energy" BYD continues to maintain a significant lead, with cumulative sales of passenger cars exceeding 1.6 million in the first half of the year; Hongmeng Zhixing and Lixiang Auto lead the new forces, with cumulative deliveries of 194,207 and 188,981 vehicles, respectively.

Looking back at the automotive market in the first half of the year, price reductions persisted throughout, with "price wars" raging from the beginning to the middle of the year. According to Cui Dongshu, secretary-general of the China Passenger Car Association (CPCA), the price reductions in 2024 reached an extraordinary level in March and April. In February, 29 models saw price reductions, 49 models in March, and 54 models in April. The number of price-reduced models from February to April was also astonishing compared to historical levels.

Looking ahead to the automotive market trend in the second half of the year, Lang Xuehong, deputy secretary-general of the China Automobile Dealers Association, told Blue Whale News on July 2 that after automakers hit their semi-annual targets in June, the overall promotional efforts in July will be somewhat reduced. Relatively speaking, the price system in the automotive market in July will be more stable, but it will not last for too long, and there will still be continuous price wars in the second half of the year.

"July is usually when companies take high-temperature vacations, and production schedules will also be slightly reduced. In normal years, July sales are generally slightly lower than in June. This year's automotive market is neither as weak as the off-season nor as strong as the peak season, and seasonal patterns have weakened somewhat. July sales are expected to be roughly the same as in June," Lang Xuehong analyzed.

Changes in the New Forces Landscape: Hongmeng Zhixing Wins the Championship in the First Half

Amid the escalating involution, the automotive market is undergoing increasing reshuffling, and the Matthew Effect is becoming more apparent. Taking the new forces as an example, the trend of the strong getting stronger is becoming more prominent. At the same time, under the continuous efforts of new players such as Hongmeng Zhixing and Xiaomi Auto, the landscape of the new forces is also quietly changing.

Image source: Blue Whale News

Specifically, in the first half of this year, Hongmeng Zhixing topped the delivery volume of Chinese new force brands, with a cumulative delivery of 194,207 vehicles. Among them, its June deliveries reached 46,141 vehicles, with the Wenjie M9 and Wenjie New M7 as the best-selling models, delivering 17,241 and 18,493 vehicles in June, respectively.

Lixiang Auto followed closely, ranking second in the delivery rankings of new forces in the first half of the year, with a cumulative delivery volume of 188,981 vehicles.

From a competitive perspective, Lixiang Auto, which also focuses on extended-range hybrids, is fiercely competing with Hongmeng Zhixing for the top spot. In June, Lixiang Auto continued to outperform Hongmeng Zhixing, delivering 47,774 vehicles compared to 46,141 vehicles for Hongmeng Zhixing.

"The sales momentum of the Lixiang L series continued to increase in June, with deliveries successfully exceeding 20,000 vehicles. The monthly delivery volume of the entire product line exceeded 40,000 vehicles. Since the second quarter, under the dual effects of the launch of the new model Lixiang L6 and the improvement of store efficiency, Lixiang Auto has returned to the top of Chinese new force brand sales," said Li Xiang, chairman and CEO of Lixiang Auto.

In the pure electric segment, several automakers have also performed well. ZEEKR, ranking third, delivered a total of 87,870 vehicles from January to June, representing a year-on-year increase of 106%. During ZEEKR's Q1 earnings call, CFO Yuan Jing emphasized, "ZEEKR focuses on high-end pure electric vehicles, which is a huge market that has not yet been fully developed."

Nio, which also focuses solely on the pure electric market, though falling out of the top three in the first half of the year, achieved a new high with its latest monthly delivery results exceeding 20,000 vehicles. Official data shows that in June this year, Nio delivered 21,209 new vehicles, representing a year-on-year increase of 98%. In the first half of 2024, Nio delivered a total of 87,426 new vehicles, representing a year-on-year increase of 60.2%.

In the industry's view, in the first half of this year, automakers engaged in price wars, and sales of many automakers fluctuated. The pure electric market was particularly malignantly downgraded, but pure electric brands such as ZEEKR and Nio maintained a steady upward trend in sales, which is indeed rare. Ma Lin, assistant vice president of brand and communications at Nio, went so far as to say that every step in high-end pure electric vehicles is a leapfrogging challenge.

It is worth noting that Xiaomi Auto, which began deliveries in April, also has considerable market appeal. The latest data shows that its June deliveries exceeded 10,000 units. Based on this calculation, its cumulative deliveries for the year are approximately 25,700 units, representing 25.7% of its annual delivery target of 100,000 units.

However, XPeng Motors, which once occupied the first tier of new forces, is at the bottom of the "Wei-Xiao-Li" (referring to Nio, XPeng, and Lixiang) trio, delivering a cumulative total of 52,028 new vehicles from January to June. Taking the latest June data as an example, behind the many new forces such as Hongmeng Zhixing, Lixiang Auto, Nio, Leapmotor, and ZEEKR that have surpassed the 20,000-unit delivery mark, XPeng Motors delivered 10,668 new vehicles that month.

Currently, XPeng Motors is also focusing on overseas markets. It is reported that in June this year, XPeng Motors entered the Egyptian market and launched the XPeng G9 and XPeng P7. In addition, the AI Tianqi system will receive a significant OTA update in the third quarter of this year and officially launch overseas.

Price Wars Will Continue in the Second Half

Returning to the industry as a whole, in addition to the new forces, the efforts of traditional automakers are also contributing to a higher penetration rate in the new energy market.

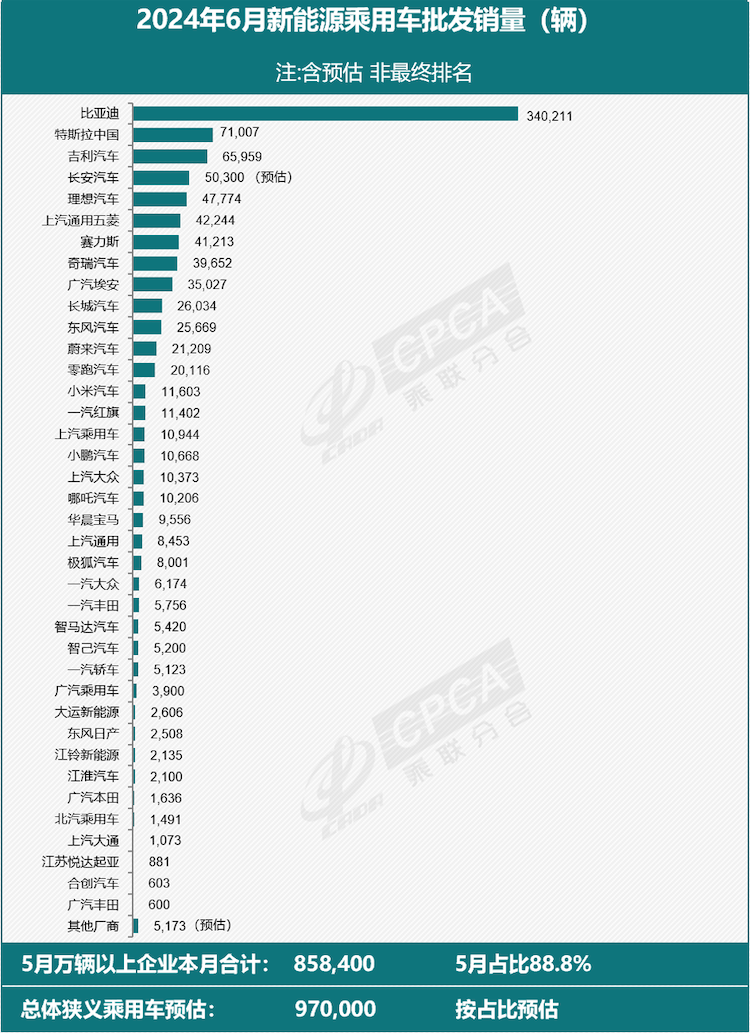

According to the new energy passenger car wholesale sales (including estimates) list released by the CPCA on July 2, BYD ranked first in June with sales exceeding 340,000 vehicles. It was followed by Tesla China, Geely Auto, and Changan Auto, with sales of approximately 71,000, 66,000, and 50,300 vehicles, respectively.

Image source: CPCA

The CPCA pointed out that the market advantages of leading new energy companies have continued to expand recently, market differentiation under different oil and electricity rights has intensified, and the penetration rate of new energy has continued to increase. According to preliminary data, the sales of new energy passenger car manufacturers with wholesale sales of over 10,000 vehicles in May 2024 accounted for 88.8% of the total new energy passenger car sales in May. These companies are estimated to sell 860,000 vehicles in June. Based on the structural proportion of the previous month, the national new energy passenger car sales in June are predicted to be around 970,000 vehicles.

It is worth noting that in the industry's view, price wars in the automotive market may continue in the second half of the year.

Taking Tesla as an example, it kicked off the "first gun" of discounts in the second half on the first day of July. According to Tesla China's official Weibo on July 1, it will provide "triple benefits" to consumers purchasing cars in July: first, offering a maximum of 5-year 0% interest and low-interest car purchase policies for the Model 3/Y Standard Range Edition, with a minimum daily payment of 85 yuan; second, offering a maximum of 5-year 0% interest and low-interest car purchase policies for the Model 3/Y Long Range All-Wheel Drive Edition, with a minimum daily payment of 107 yuan; third, limiting the annual interest rate to 0.5% (equivalent to an annualized interest rate starting at 0.93%) in July.

It is reported that during this promotional event, a down payment of 79,900 yuan can choose a "5-year 0% interest" plan: the daily payment for the Model 3 Rear-Wheel Drive Edition is as low as 85 yuan, and the daily payment for the Long Range All-Wheel Drive Edition is as low as 107 yuan; the daily payment for the Model Y Rear-Wheel Drive Edition is as low as 95 yuan, and the daily payment for the Long Range All-Wheel Drive Edition is as low as 118 yuan. Compared with the previous standard annual interest rate of 2.5%, Model Y can save up to over 26,000 yuan in interest.

Cui Dongshu pointed out that the core reason for the intensifying involution in the Chinese automotive market is the increase in concentration, with stronger performance from advantageous automakers. The number and scale of automakers will be significantly reduced, and the structure of various products relying on high premiums in the past has undergone relative differentiation. Consumers' choices have also become increasingly diversified. The high premiums and profits of some luxury mainstay automakers in the past have brought corresponding profit differentiation to other automakers, achieving a price gradient distribution and providing consumers with more diverse choices.

"After electrification, the situation will change significantly. Leading automakers will utilize their scale advantages to achieve greater comprehensive cost reductions and maximize sales of their flagship models, marginalizing the sales of other automakers. This is a characteristic of involution, reflected in the intensification of competition at all levels. In the future, not many companies will be able to survive smoothly under such differentiated competition on the margins," said Cui Dongshu.