Zhou Hongyi Takes the Stage, Nezha Motors Stirs up the Sea

![]() 07/03 2024

07/03 2024

![]() 490

490

Is Zhou Hongyi selling Mercedes-Maybach to help sell more cars for Nezha Motors, which he invested in? It seems we were too narrow-minded.

Last week, Hezhong Auto, the parent company of Nezha Motors, submitted an application to the Hong Kong Stock Exchange, taking an important step towards the capital market.

Amidst the extreme competition in the domestic new energy vehicle market, Hezhong Auto presented investors with a story of "Nezha Stirring the Sea," depicting a vast ocean spanning Southeast Asia, Latin America, the Middle East, and Africa.

However, this story is not just about Nezha Motors. A group of powerful competitors will continuously become the new "hero" of the story.

Currently, Hezhong Auto urgently needs to continue raising funds through listing. The money on the company's books is running low.

Hezhong Submission

Hezhong Auto is one of the first batch of new auto forces in China, founded in Tongxiang, Zhejiang in 2014 by Dr. Fang Yunzhou, a new energy vehicle expert, and his team. This is also the birthplace of the World Internet Conference.

Fang Yunzhou is a veteran of the Chinese automotive industry. In 1998, after graduating from the Automotive Engineering major at Hefei University of Technology, he joined Chery Automobile, which had just been established for one year. In 1997, Yin Tongyue started building the Chery myth from scratch with 3 million yuan in startup funds allocated by the local government.

During his 16 years at Chery, Fang Yunzhou was responsible for R&D and was one of the important contributors to Chery's new energy products.

Soon after the founding of Hezhong Auto, Peng Qingfeng and Zhang Yong joined consecutively, forming the "iron triangle" of Nezha Motors along with Fang Yunzhou. Among the new auto forces starting at the same time, Nezha Motors has a super-strong professional "automotive" team, familiar with the path of car manufacturing and not lacking in technology. The biggest difficulty lies in funding. After all, car manufacturing is an extremely money-consuming business, with billions of yuan barely enough to enter the market, and hundreds of billions necessary to have confidence in entering.

Unlike "NIO, Xpeng, and Li Auto," whose founders have long been immersed in the entrepreneurial and capital circles, enjoying fame and proficiency in marketing, they can more smoothly obtain tens of billions of yuan in financing to support their companies' bloody expansion. These advantages are not possessed by Fang Yunzhou, who comes from a technical background.

In the early stages of entrepreneurship, Nezha Motors struggled and was extremely tight on funds. It was not until after 2017 that a significant turning point emerged.

According to the prospectus, since 2017, the company has completed 10 rounds of financing, with a total financing amount exceeding 22.8 billion yuan. Among the investors are private equity funds, local funds, and other professional and strategic investors. 360 and CATL are also important shareholders of Hezhong Auto.

As early as 2020, Hezhong Auto had already initiated listing work on the Science and Technology Innovation Board, planning to complete the listing in 2021. However, due to the strengthened review of "technological content" on the Science and Technology Innovation Board, Hezhong Auto and other automakers had to terminate their listing plans.

This wait lasted for three years, until this time, when the application was submitted to the Hong Kong Stock Exchange.

Continuous Losses

In November 2018, Hezhong Auto launched its first model, the Nezha N01, priced at 59,800 to 69,800 yuan after subsidies. Positioned as a small pure electric SUV, its price is close to that of mini cars, appealing to many young users. In 2019, sales exceeded 10,000 units, and Nezha Motors ranked fourth in sales among new auto forces that year.

This model fully embodies Nezha Motors' manufacturing philosophy of "technology equalization," with the brand positioning locked in the low to mid-end market.

Capitalizing on the market heat of the N01, Hezhong Auto launched the Nezha V in 2020, priced starting at 59,900 yuan after subsidies, repeatedly setting new sales records.

In 2021 and 2022, the Nezha V delivered 49,646 and 98,847 units respectively. In 2022, Nezha Motors topped the sales chart with an annual sales volume of 152,000 units, surpassing a host of new auto forces.

Subsequently, Nezha quickly introduced new models, moving into the 100,000 to 200,000 yuan price range for new energy vehicles. Currently, it has formed a product matrix consisting of the AYA series, X series, L, S, GT, and others.

With the increase in product pricing, the average selling price of Nezha Motors' products has rapidly increased, from 71,000 yuan in 2021 to 113,000 yuan in the first four months of this year.

However, the rapid growth in Nezha Motors' sales has not been sustained. In 2023, deliveries dropped to 127,496 units, making it the only brand among new auto forces to experience negative growth.

This year, Nezha Motors set an annual sales target of 300,000 units, but from January to May, it only delivered a cumulative total of 43,564 units, achieving only 14.52% of its target. If no miracles occur in the second half of the year, the annual target will once again become a blank check.

With the adjustment of the product mix and the overall increase in sales, Hezhong Auto's revenue has increased significantly.

From 2021 to 2023, the company's total revenue was 5.089 billion yuan, 13.05 billion yuan, and 13.555 billion yuan, respectively; during the same period, the overall gross margin improved from -34.4% to -14.9%; operating losses were 4.505 billion yuan, 5.951 billion yuan, and 6.758 billion yuan, respectively, and it still cannot escape the state of continuous losses in the short term.

The speed of financing could not keep up with the speed of money burning, leading to a sharp decline in Hezhong Auto's "health bar." As of the end of 2023, the company's cash and cash equivalents were only 2.837 billion yuan. By the end of April this year, it had plummeted to 400 million yuan, urgently needing fresh blood to sustain it for much longer.

Listing is undoubtedly the best path.

Nezha Stirring the Sea

The new energy vehicle market is a continuously growing blue ocean market, but it is also an extremely残酷 bloodbath market.

Since the second half of last year, the competition in the domestic new energy vehicle market has reached unprecedented levels, with price wars erupting one after another, and the bloody battle will continue.

With this listing, Nezha Motors has carefully crafted a story of "going overseas." In the prospectus, the company uses a significant amount of space to描绘a wonderful overseas blueprint. Especially in some countries in Southeast Asia, Nezha Motors has already preempted a certain market share in advance.

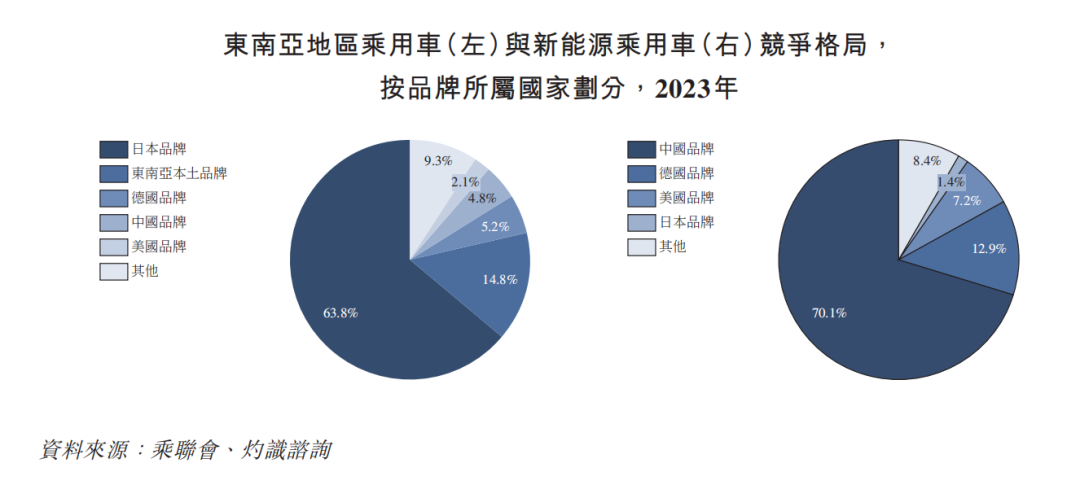

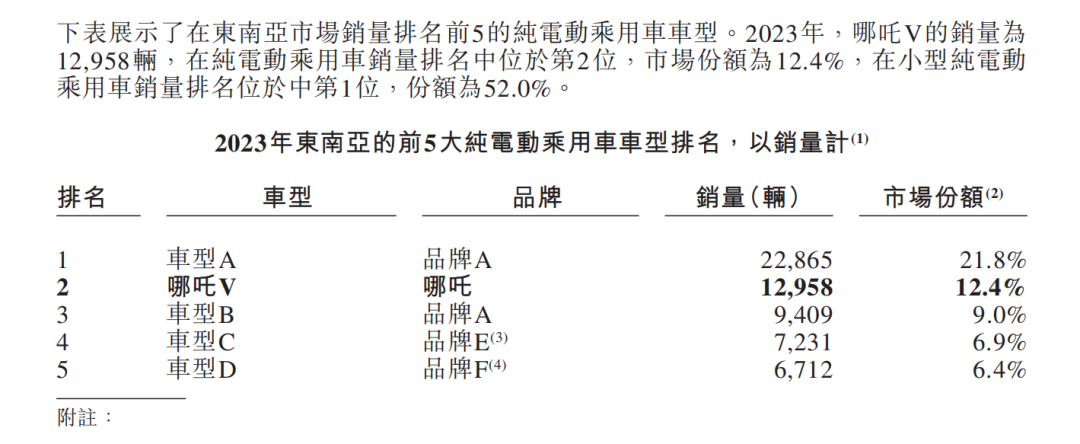

The prospectus reveals that the sales volume of the Nezha V in Southeast Asia was 12,958 units, ranking second in sales among pure electric passenger cars in the region, with a market share of 12.4%; and ranking first among small pure electric passenger cars, with a market share of 52.0%.

The company's factories in Thailand and Indonesia have started production in the first half of this year, and the Malaysian factory has started construction in January this year.

Nezha Motors has made it clear that it will further increase its presence in Southeast Asia and simultaneously expand into markets in Latin America, the Middle East, Africa, and other regions.

This year, Nezha Motors has set a target of 80,000 to 100,000 units for the overseas market. In the first five months of this year, the completed figure was 16,458 units. There is still tremendous pressure to achieve the annual target.

The path planning is very clear, and the layout is relatively solid, but Nezha's "stirring the sea" is not without challenges.

Overseas, its foundation is still unstable and it also faces fierce competition. It not only has to compete with international peers but also encounter Chinese brands head-on in overseas markets. The Thai market, which Nezha Motors attaches great importance to, is also being strongly deployed by leading companies such as BYD and Great Wall Motors.

Operating on both domestic and foreign fronts tests not only the team's operational capabilities but also requires money.