Falling for five consecutive months year-on-year, with only 25% of KPI achieved, "The Holy Body of Online Car-hailing" is not working

![]() 07/04 2024

07/04 2024

![]() 689

689

Starting to accelerate the launch of new products

Last year, it was a dark horse, but this year, it has fallen into the question of lagging behind.

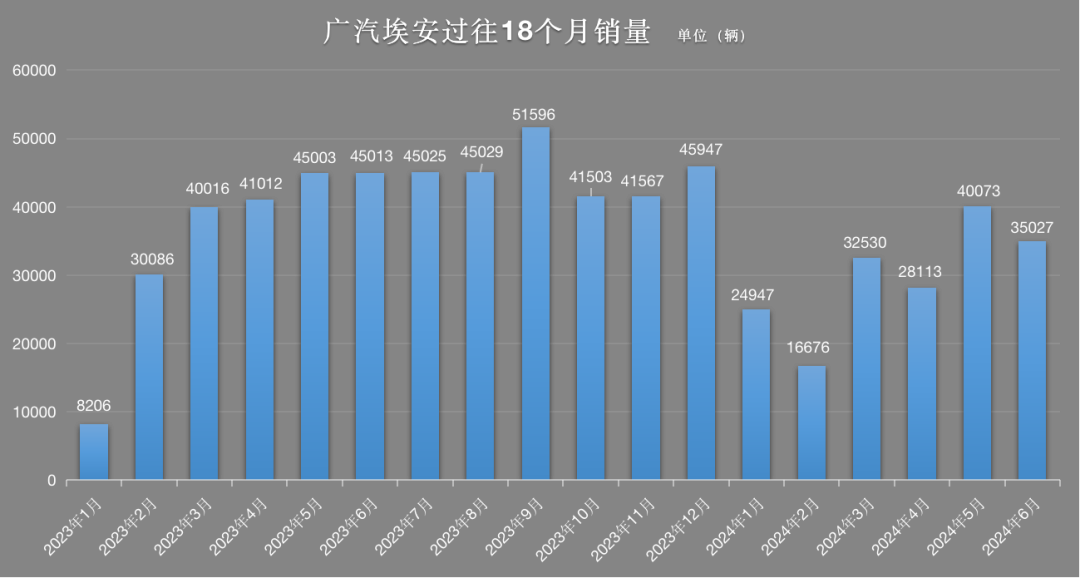

In June, GAC AION sold 35,027 vehicles. Although this figure is much stronger than many new players, it is not optimistic from the overall sales trend.

This is also the fifth consecutive month of negative growth this year, with sales down 12.59% month-on-month and 22.18% year-on-year in June. Cumulative sales in the first half of this year were 177,366 vehicles, down 15.3% year-on-year.

Nowadays, the automotive industry is in close combat, with new rankings emerging every week, and companies are constantly finding ways to rank higher. Against this background, declining sales and rankings are undoubtedly a dangerous signal.

In fact, from a strength perspective, GAC AION is not bad, and it is even a potential stock. For example, its all-solid-state battery technology is ready to launch, and L4 unmanned mass-produced vehicles are also being developed in full swing. It can be said that it has both technology and talent. What happened to GAC AION?

01 Sales continue to decline year-on-year

Unlike other new energy vehicle companies that have made a comeback from the bottom, in 2017, GAC AION was born with a golden key, backed by GAC Group, and was not short of money or resources.

In 2018, the annual sales volume was 20,045 units, exceeding the annual sales target of 15,000 units. From 2019 to 2022, sales have been on the rise, with annual sales reaching 42,000, 60,000, 123,700, and 271,000 units respectively.

By 2023, GAC AION had seized the opportunity in the online car-hailing market, achieving an annual sales volume of over 480,000 units with AION Y and AION S, an increase of 77% year-on-year, making it the fastest pure electric car brand in the world to exceed one million units in production and sales. Last year's new energy retail sales ranking of the China Passenger Car Association ranked it second only to BYD and Tesla China.

After six years of smooth sailing, the situation has taken a turn for the worse this year. The data speaks for itself:

As can be seen, from February to June, GAC AION's sales were 16,676, 32,530, 28,113, 40,073, and 35,027 units, respectively, down 44.5%, 18.7%, 31.45%, 10.95%, and 22.18% year-on-year.

This is already the result of GAC AION participating in the price war. In April, GAC AION successively announced price reductions of 10,000 yuan for the entire line of AION Y Plus, AION S MAX, and AION V Plus. Although the data showed a temporary improvement month-on-month, it failed to return to last year's peak.

This year, GAC AION's sales target is "at least 700,000, striving for 800,000." Half a year has passed, and GAC AION has only sold 177,366 vehicles. Calculating based on the minimum target of 700,000 vehicles, the progress bar has only reached a quarter.

This speed is obviously lagging behind the overall market. According to the TOP 10 ranking of new energy vehicle retail sales in May released by the China Passenger Car Association, BYD, Geely, Changan, SAIC-GM-Wuling, GAC AION, Seres, Chery, and Great Wall all have traditional OEM backgrounds. Among these eight traditional automakers, GAC AION is the only one with declining sales, with a decline of up to 17.5%.

At present, GAC AION's highly anticipated Hyper Hyperion brand is also facing unsatisfactory sales. Currently, Hyperion has three models on sale, namely Hyperion HT, Hyperion GT, and Hyperion SSR. The cheapest model, Hyperion GT, starts at 189,900 yuan, while the top price of Hyperion SSR reaches 1,686,000 yuan.

The third platform shows that the sales of Hyperion HT and Hyperion GT, which are priced in the 200,000-300,000 yuan range, have been lukewarm in the past six months, and the monthly sales of each vehicle rarely exceed 1,000 units. In comparison, Tesla's Model Y sells over 20,000 units per month. Even the up-and-coming Xiaomi SU7 has delivered over 10,000 units per month.

02 Success and failure due to the same factor

Reviewing GAC AION's rise, the assistance of online car-hailing cannot be ignored.

According to data released by the China Passenger Car Association on new online car-hailing vehicles nationwide in 2023, there were a total of 850,000 new online car-hailing vehicles in China in 2023, an increase of 18% year-on-year. Among them, GAC AION ranked first with 219,000 units.

This means that the online car-hailing market contributed about 45% of GAC AION's sales last year, and one out of every four new online car-hailing vehicles last year was a model from GAC AION.

In cities like Guangzhou, Shenzhen, Sanya, and Beijing, GAC AION's online car-hailing vehicles are particularly common, especially in Guangzhou and Shenzhen, where AION S online car-hailing vehicles can be seen everywhere.

However, the B-end market will not always be stable, and the online car-hailing market is gradually becoming saturated.

As of May 31, 2024, a total of 351 online car-hailing platform companies have obtained operating licenses nationwide, an increase of 2 companies month-on-month; a total of 7.033 million online car-hailing driver certificates and 2.948 million vehicle transport certificates have been issued nationwide, representing an increase of 1.0% and 0.7% month-on-month, respectively. The online car-hailing regulatory information interaction system received a total of 944 million order information in May, an increase of 5.2% month-on-month.

Subsequently, many places issued risk warnings for the online car-hailing industry and suspended the issuance of vehicle transport certificates for local online car-hailing vehicles. The reason is simple: the online car-hailing capacity has become saturated or far exceeds the actual demand, which has led to a decline in GAC AION's sales.

While sales declines can perhaps be compensated for through other means, the label of online car-hailing is not easy to shake off in the eyes of private users.

Gu Huinan, General Manager of GAC AION Brand, once said that online car-hailing is not a synonym for low-end, after all, being able to be used for online car-hailing means that both quality and reliability have good performance.

GAC AION's high-end model Hyperion is also trying to shake off the label of online car-hailing and strive for the 200,000-300,000 yuan high-end pure electric vehicle market.

From a product perspective, Hyperion is indeed capable. Take Hyperion HT, priced at 213,900-329,900 yuan, as an example. Positioned as a mid-to-large SUV, it adopts technologies such as gull-wing doors and super-fast charging and is equipped with top-tier hardware such as a new generation of solid-state variable-focus lidar and Orin-x chips.

It can be seen that many configurations exceed those of competitors in the same class, such as gull-wing doors, which are often used in million-level products like the Tesla Model X.

Currently, models that can be called blockbusters, such as Xiaomi SU7, Ideal L series, and Model Y, all have their own characteristics. For example, Xiaomi SU7 takes full advantage of traffic dividends and has a very eye-catching design, while Ideal aims at families with a full range of comfort configurations in the L6. Model Y is an industry benchmark with blockbuster potential.

In comparison, Hyperion HT has strong comprehensive product strength, but the terminal market seems to be less than ideal.

Of course, from a product layout perspective, GAC AION has not launched plug-in hybrid products and has not benefited from the hybrid market. Data from the China Association of Automobile Manufacturers shows that in the first four months of this year, sales of pure electric models were 1.824 million units, an increase of 12.8% year-on-year, while sales of plug-in hybrid models were 1.115 million units. Although still inferior to pure electric models, the growth rate reached 84.5%.

Compared to other competitors that walk on multiple legs with extended-range, plug-in hybrid, and pure electric vehicles, GAC AION is more dependent on the pure electric market at this stage.

03 Entering a period of intense product launches

To regain its sales peak, GAC AION has been working hard.

In April this year, the new car AION V Tyrannosaurus Rex launched at the Beijing Auto Show began to change its logo and styling. In the second half of this year, GAC AION will release new models intensively:

A new model will be launched every two months, covering the range of 100,000 to 700,000 yuan. Among them, the second-generation AION V, which was released at the Beijing Auto Show, will be launched in July; the all-new A-class sedan codenamed AY3 will be launched in September; the all-new model codenamed AY2 will be unveiled at the Guangzhou Auto Show in November; and the first large six-seater SUV codenamed AH8 from the Hyperion brand will be launched in September.

The previous dealer-led sales model will also change, and the number of GAC AION domestic direct stores will be expanded to 100.

GAC AION will also expand its product layout and plans to launch plug-in hybrid models next year. In the hybrid vehicle market, GAC Group is considered an experienced player. If GAC AION launches hybrid products, it may boost sales to some extent.

At the same time, GAC AION is also expanding into overseas markets. In the past six months, GAC AION has opened up 19 new overseas markets. Next, AION will enter countries like Qatar and Mexico, and the Hyperion brand will also expand overseas.

In July this year, GAC AION's first overseas factory - the Thailand Smart Eco-Factory - is expected to be completed and put into production, with an expected annual production capacity of 50,000 vehicles. The overseas market may become a breakthrough point for its sales recovery.

At present, the competition in the new energy market is still fierce. Although Zeng Qinghong once called for "stop the competition," given the current situation where GAC Toyota and GAC Honda are no longer popular, GAC AION has no choice but to compete. Whether domestic or overseas, GAC AION has to fight a tough battle.