13 emerging auto brands saw sales surge, but Zhiji and Nezha were left out?

![]() 10/09 2024

10/09 2024

![]() 612

612

After a flurry of new car launches in September, sales figures for October are even more eagerly anticipated.

On the first day of the National Day holiday, as the outside world was still basking in the joy of the stock market rally, emerging auto brands delivered good news one after another, offering a satisfactory report card to celebrate the country's birthday. This September was also seen as the most valuable "Golden September" of the year.

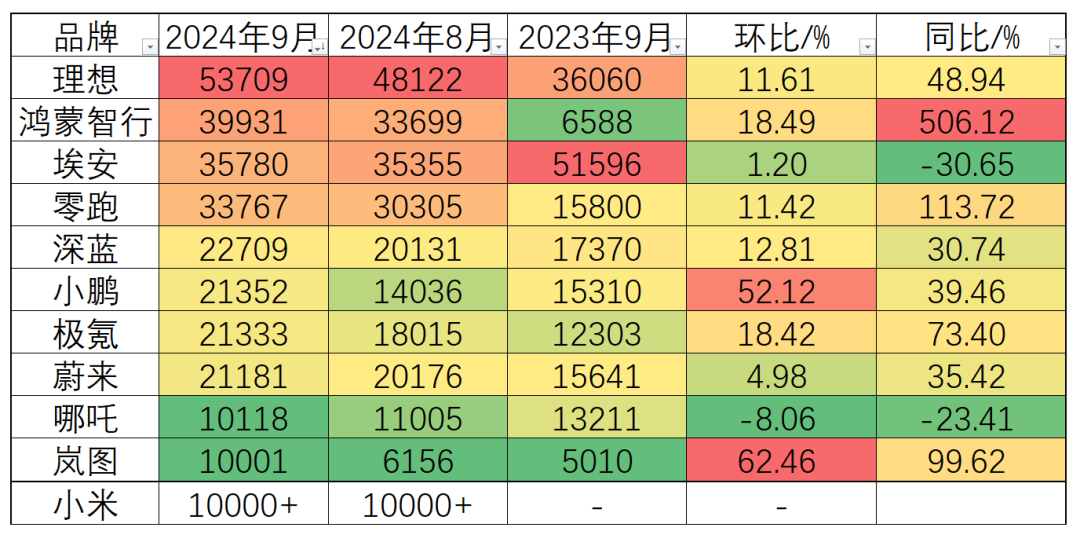

Overall, most emerging auto brands achieved high monthly delivery volumes, with record-high delivery numbers reported by NIO, Leapmotor, Xpeng, and ARCFOX. Among the 15 emerging brands, 13 recorded month-on-month growth in September sales, with only Zhiji and Nezha experiencing declines compared to August.

Additionally, year-on-year sales figures for emerging brands in September were mostly positive, with only GAC Aion, Denza, and Nezha experiencing declines compared to the same period last year.

After a decade in the auto industry, emerging brands have grown from PowerPoint presentations to become an indispensable force in the domestic auto market, accounting for nearly 10% of the market share with an average monthly sales volume of 250,000 vehicles.

Lixiang reaches one million sales, Huawei faces a bottleneck

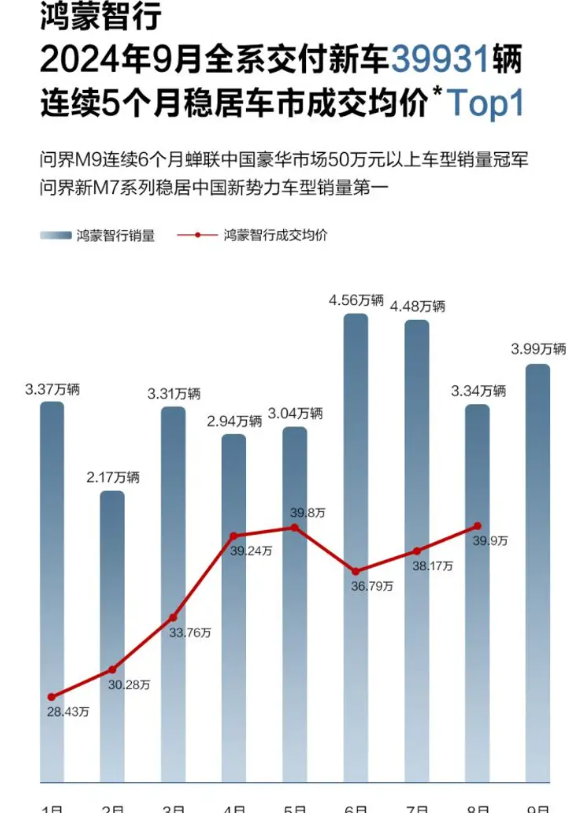

Huawei's HarmonyOS Smart Mobility family achieved another milestone in September, with total vehicle deliveries reaching 39,931, an increase of 18.49% month-on-month. Specifically, the WENJIE M9 series delivered 15,496 vehicles in September, maintaining its position as the top-selling luxury model priced above 500,000 yuan in China for six consecutive months. The new WENJIE M7 series also delivered 16,805 vehicles in September, maintaining a strong momentum.

It is worth noting that the newly launched XIANGJIE S9, which debuted on August 6, only delivered 2,169 vehicles. While this is a respectable figure for a self-developed luxury sedan priced at around 400,000 yuan, it still lags behind the WENJIE M9 and M7 series.

Furthermore, the second model from Zhijie, the Zhijie R7, which was launched in September, did not significantly contribute to HarmonyOS Smart Mobility's sales figures. Although official data showed that orders for the Zhijie R7 exceeded 20,000 during the National Day holiday, sustained growth will require additional momentum.

It is evident that the WENJIE series accounts for over 90% of HarmonyOS Smart Mobility's total sales, with the other models contributing negligibly.

From WENJIE, Huawei's in-house brand, to XIANGJIE (a collaboration with Beijing Automotive Group) and Zhijie (a collaboration with Chery Automobile), Huawei's influence seems to have been effectively replicated only within the WENJIE brand. As the first automaker to partner with Huawei, SERES' WENJIE brand has long been associated with Huawei's name.

On the bright side, thanks to the popularity of the WENJIE M9 and M7 series, the average transaction price of HarmonyOS Smart Mobility vehicles in the first nine months of this year reached 399,000 yuan, significantly higher than that of traditional luxury brands such as BMW, Mercedes-Benz, and Audi. To some extent, Huawei has disrupted the existing domestic luxury vehicle market.

The ambitious goals set by Richard Yu are gradually becoming a reality. With multiple models joining Huawei's sales system in September, October will usher in the first full delivery month, and sales of HarmonyOS Smart Mobility are expected to further increase.

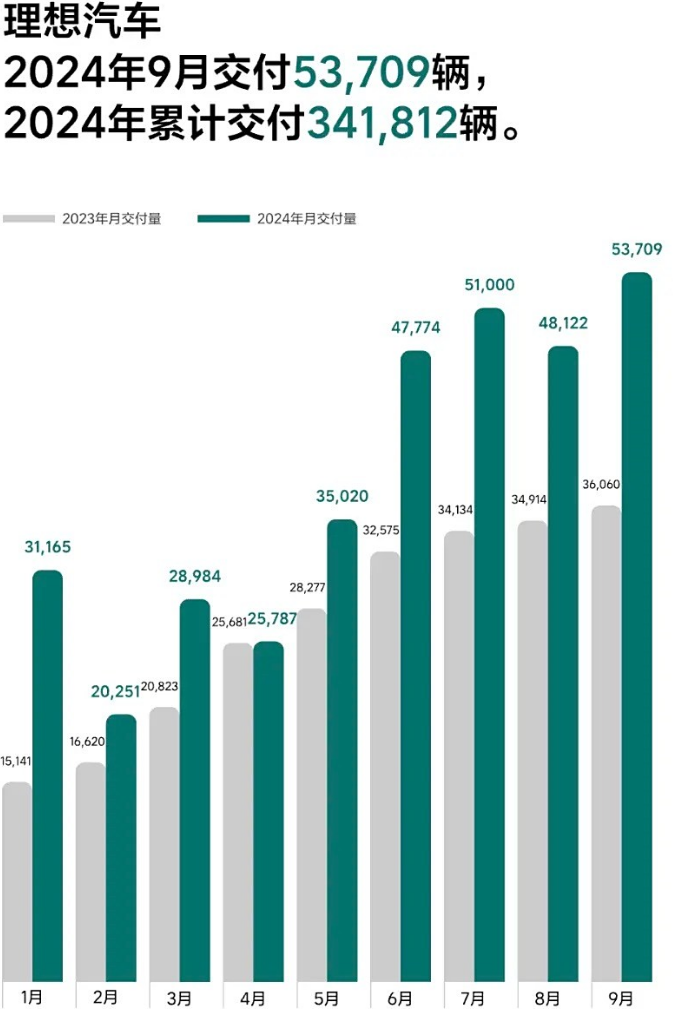

If HarmonyOS Smart Mobility owes its success to Huawei, Lixiang's achievements may offer more valuable insights for the majority of emerging auto brands.

In September 2024, Lixiang delivered 53,700 vehicles, representing a year-on-year increase of 48.9%. In the third quarter of this year, Lixiang delivered 152,800 vehicles, up 45.4% year-on-year. The Lixiang L6, which has been on the market for five months, has achieved 100,000 deliveries. Although the Lixiang L6, priced from 249,800 yuan, accounts for a significant portion of deliveries, recent transaction prices for Lixiang vehicles have remained above 300,000 yuan, according to terminal sales data.

As of September 30, Lixiang had delivered a cumulative total of 975,200 vehicles. This means that after this "Golden September and Silver October," Lixiang will achieve its first million-vehicle milestone since its inception.

Li Xiang noted that reaching one million sales is not just a numerical milestone but also signifies a new stage in the development of intelligent new energy vehicles, particularly in terms of smart driving technology.

It is remarkable that these one million vehicles were delivered by Lixiang's four extended-range models: the Lixiang L9, L8, L7, and L6, all of which share a similar design language.

Despite various opinions about extended-range vehicles in the past, consumers have ultimately voted with their feet. As long as users are willing to pay, the technical route becomes less significant, and the market will provide the answer.

In 2024, the extended-range market is no longer dominated by a single player. With various new energy automakers entering the fray, "Lixiang" is no longer synonymous with extended-range vehicles alone. By September, newly launched extended-range models included the ARCFOX L07, QIYUAN E07, MAXUS M917 JIAOLONG, and AITO 07.

It is foreseeable that the extended-range segment will become even more crowded in the near future.

At this juncture, not only WENJIE and Lixiang are leveraging extended-range technology to gain prominence. Leapmotor has successively launched five extended-range models: the Leapmotor C11, C16, C01, C10, and T03. Thanks to the combined efforts of these models, Leapmotor has achieved an average monthly sales volume of over 30,000 vehicles for four consecutive months. It is noteworthy that Leapmotor's sales volume was less than 10,000 vehicles in February this year, marking a significant turnaround.

In a late-night post on October 1, Zhu Jiangming, Chairman of Leapmotor, wrote on his WeChat Moments, "Today, Leapmotor's stores were flooded with orders, exceeding 3,000 bookings in a single day, marking a red-letter start to October and setting a new record for daily bookings!"

In terms of price range, Leapmotor's models are primarily positioned between 120,000 and 200,000 yuan, perfectly complementing WENJIE and Lixiang and creating a unique extended-range market segment.

While Leapmotor targets affordable family cars, Lixiang caters to young fathers, and Huawei appeals to government and business leaders. All three brands share a commonality in leveraging extended-range technology and form the first tier of sales rankings among emerging auto brands, leaving pure electric vehicle brands to compete amongst themselves.

Xpeng and NIO join forces, dipping toes into the lower-tier market

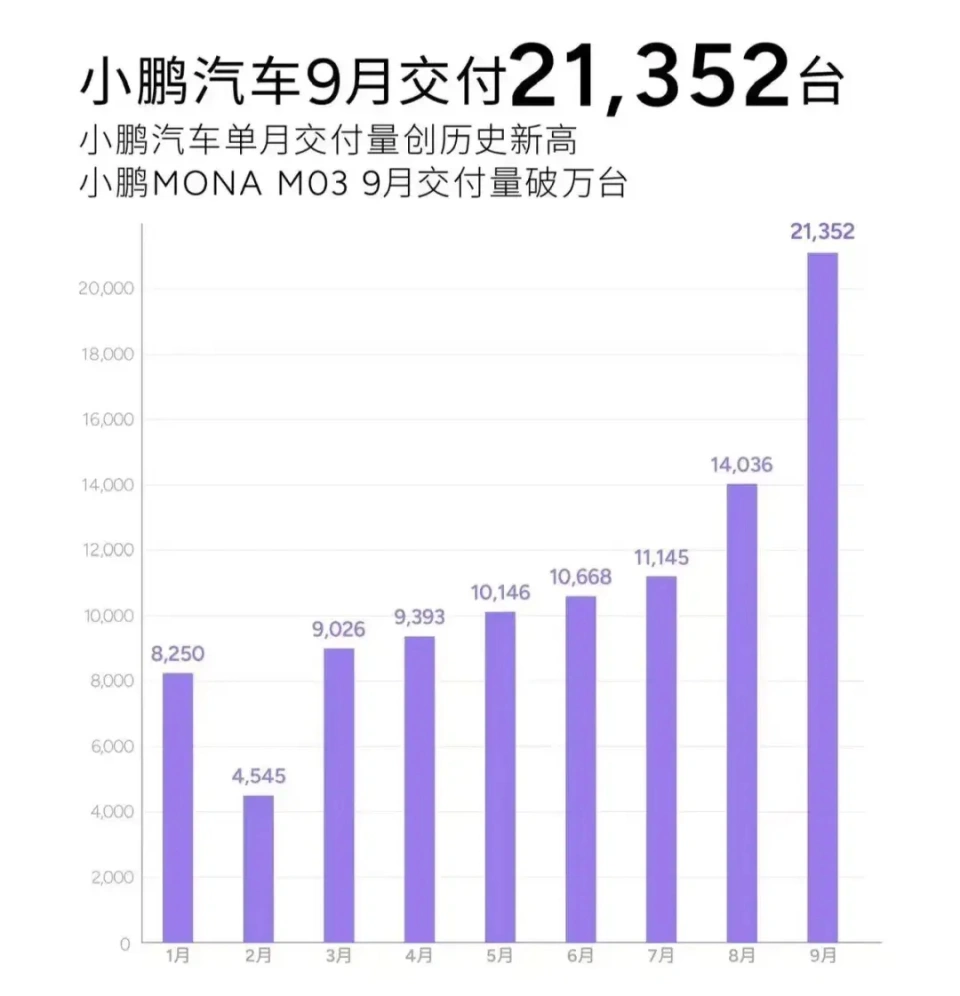

In September 2024, four brands delivered between 20,000 and 30,000 vehicles: ARCFOX, Xpeng, ZEEKR, and NIO. Notably, Xpeng delivered over 20,000 vehicles for the first time in the year, marking a significant increase of 52.12% month-on-month with 21,352 deliveries in September.

Fundamentally, Xpeng boasts a diverse lineup, but its sales growth is primarily driven by the launch of the new MONA M03. Priced from 119,800 yuan, the M03 completed its first full delivery month after launching on August 27. Although specific sales figures for each model were not disclosed, Xpeng stated that M03 deliveries exceeded 10,000 units, accounting for nearly half of its total sales.

The M03, Xpeng's most affordable model currently on sale, is viewed as the company's "firefighter," though it remains unclear why Xpeng does not disclose specific sales figures. Perhaps for Xpeng, this model is one that must succeed at all costs, and creating a successful narrative is paramount.

Meanwhile, ZEEKR also delivered over 20,000 vehicles for the first time in September, achieving a record-high delivery volume of 21,333 units, up 77% year-on-year and 18% month-on-month. In the first nine months of the year, ZEEKR delivered a cumulative total of 142,873 vehicles, up 81% year-on-year, bringing its cumulative deliveries to nearly 340,000 units.

The new ZEEKR 7X model has shown strong momentum, with orders exceeding 58,000 units within 20 days of its presale launch. Following its official launch, ZEEKR embarked on a large-scale delivery campaign, delivering over 5,000 units in just 10 days, ahead of the National Day holiday.

Although ZEEKR has faced several crises since its inception with the ZEEKR 001, many users still believe in its strengths. With the support of the ZEEKR 007 and 7X models, ZEEKR is finally on track to success.

In contrast, NIO has enjoyed a smoother ride. In September 2024, NIO delivered 21,181 vehicles, marking the fifth consecutive month of delivering over 20,000 vehicles, albeit with a modest month-on-month increase of 4.98%. In the first three quarters of 2024, NIO delivered a cumulative total of 149,281 new vehicles, up 35.7% year-on-year, bringing its cumulative deliveries to 598,875 units.

On September 19, NIO's sub-brand NIO Life launched its first model, the NIO Life L60, with two variants priced between 206,900 and 235,900 yuan. Deliveries of the L60 began on September 28, with 832 units delivered.

In recent years, NIO has been labeled as a "10,000-unit club" member. However, following the introduction of its new Battery as a Service (BaaS) scheme this year, NIO's prices have significantly dropped, with entry-level models now priced in the 200,000 yuan range. Consequently, sales have soared.

With accelerated production and delivery of the NIO Life L60, the sub-brand is expected to achieve higher delivery volumes in October. Over the coming months, NIO's sales are anticipated to increase significantly. It is undeniable that NIO's current market strategy is relatively clear. While NIO itself maintains a mid-to-high-end market positioning, its new sub-brand targets the mid-to-low-end segment, allowing it to cover a broader consumer base and enhance its survival capabilities.

Third-tier brands gain momentum in September, leaving Nezha and Zhiji behind

Amidst the general prosperity, Nezha stands out as the only brand to experience year-on-year and month-on-month declines in sales. Both its monthly and cumulative sales figures declined, with September deliveries totaling 10,118 units, down 23.41% year-on-year and 8.06% month-on-month. As a result, Nezha finds itself at the bottom of the pack, and it may only be a matter of time before it is surpassed by up-and-coming brands like Xiaomi.

Although the Nezha L initially enjoyed strong sales, its popularity did not last. While 5,628 units were sold in July, sales plummeted to 3,842 units in August, marking a steep 31.7% month-on-month decline.

It has been nearly four months since Nezha submitted its IPO application, and the company recently replaced its Chief Financial Officer. According to Nezha's previously disclosed prospectus, the company had cash and cash equivalents of 2.837 billion yuan as of the end of 2023. Based on its previous loss rate, Nezha's financial reserves may be dwindling.

In September, Xiaomi's SU7 delivered over 10,000 units for the fourth consecutive month. Although specific figures have not been disclosed, delivery trends suggest that Xiaomi is deliberately controlling its delivery pace. This is likely due to the significant time gap before the launch of its next model.

As more competitors enter the market, maintaining the SU7's advantage will become a challenge for Xiaomi. Starting in October, Xiaomi's auto plant will increase production, aiming for a monthly output of 20,000 vehicles. Xiaomi Automobile's official Weibo account stated that the company expects to deliver 100,000 vehicles by the end of the year, ahead of schedule.

Among the emerging auto brands, two have yet to join the "10,000-unit club." Coincidentally, on September 26, these two brands launched competing models on the same day.

As SAIC Motor's flagship project, Zhiji seems to have lost touch with market trends. In September 2024, Zhiji delivered just 4,516 new vehicles, marking a 26.2% month-on-month decline, or almost a 30% drop.

At a time when many emerging auto brands in China are experiencing year-on-year and month-on-month sales growth, Zhiji's sales have unexpectedly declined on a month-on-month basis.

On September 26, following the launch of the new Zhiji LS6, the company announced that it had received over 11,000 large orders. It remains to be seen if this will translate into increased sales next month.

Meanwhile, AITO delivered 4,537 new vehicles in September, up 47% year-on-year.

AVATR said that behind the strong sales performance is not only due to the continuous efforts of its two flagship models, AVATR 11 and AVATR 12, but also the explosive launch of the new entrant AVATR 07, which received 11,673 orders within 20 hours of its debut and has since begun nationwide deliveries. In the fourth quarter, AVATR will also introduce extended-range versions of AVATR 11 and AVATR 12, continuing to propel AVATR into a new phase of sales growth.

Objectively speaking, AVATR's booking numbers are accurate and detailed, making them far more realistic compared to other brands.

While the newly launched AVATR 07 appears to be targeting the Tesla Model Y, it inevitably finds itself in competition with models like Letao L60, Zeekr 7X, and ZM-I's all-new LS6.

After the flurry of new car launches in September, the sales figures for October are all the more anticipated.