Luxury cars are hard to sell, causing anxiety in both China and France

![]() 10/17 2024

10/17 2024

![]() 603

603

The French are under immense pressure as automotive executives feel helpless in addressing the future competition from three Chinese automakers.

These automakers include the quiet BYD, NIO, and Aion. The reason is that after comparing prices and configurations, Chinese cars have continuously caught up in design, range, and features. With the advantage of having the world's strongest industrial chain, the prices offered by these Chinese automakers make European automakers feel overwhelmed.

The 2024 Paris Motor Show largely replicated the scene at the 2023 Munich Motor Show. With many automakers choosing not to participate, such as Mercedes-Benz, Toyota, and Honda, the show mainly drew attention to domestic brands and Chinese automakers, which were less familiar to the media before.

Nine Chinese automakers participated in the show, each with different goals. Some aimed to sell cars, some sought to enter international markets, and others aimed for a stronger international presence. Despite cultural and usage habit differences, China and Europe share more consumer commonalities. Four clear conclusions emerged from the show: first, Chinese new energy vehicles have a strong impact in the low-cost consumer segment; second, the Chinese luxury model faces significant challenges in the European market; third, Chinese automakers' strength in intelligence is a drag in Europe; and fourth, wealthy individuals are not particularly interested in new energy vehicles.

Cheap doesn't necessarily mean easy to sell

One peculiar point is that despite the buzz around Chinese brands at the Paris Motor Show, many of them cannot currently sell in Western Europe. However, boosting sales is not their primary goal at this stage; rather, they aim to raise awareness among Europeans.

The strong impact in the low-cost consumer segment is evident from the EU's double taxation policy on Chinese new energy vehicles. The tax rates are 17% for BYD, 19.3% for Geely, and 36.3% for SAIC Motor. Other Chinese automakers that did not participate in the EU's sampling survey but cooperated with the investigation will be subject to a 21.3% countervailing duty, while those that did not cooperate will face a 36.3% duty.

Despite the tariff decisions, it has not deterred Chinese automakers from continuing to explore the European market. Nine Chinese automakers participated in the Paris Motor Show, with BYD introducing the Sea Lion 07 EV, a direct competitor to the Tesla Model Y. With a top speed of 215 km/h and a battery capacity upgradable to 91.3 kWh for longer range, its price is only 35,000-40,000 euros, compared to over 50,000 euros for the Model Y. BYD's European version of the Song PLUS DM-i, known as the Seal U DM-i, starts at less than 40,000 euros.

European media commented that at the same price point, no other car can match the Seal U DM-i in terms of electric range and space, except for products from MG.

NIO and BYD follow a similar strategy. When announcing their European launches on September 25, NIO's C10 started at 36,400 euros, while the T03 was priced at 18,900 euros. The B10, which debuted in Europe this time, is positioned slightly below the C10 and is expected to have a similar or slightly lower price.

In comparison, Volkswagen's ID.4 starts at over 40,000 euros in Europe. GAC Motor announced its international expansion plans in Europe, and while the Aion V's price was not disclosed, as a competitor to BYD and NIO in China, European automakers will find it difficult to compete.

In addition, other automakers have diverse goals.

Maxus is already a European brand, and its participation was to sell cars. Hongqi is stepping up its presence in Europe, with the Hongqi EH7 and Hongqi EHS7 SUV now accepting pre-orders at prices of 49,999 euros (approximately 386,000 RMB) and 53,999 euros (approximately 417,000 RMB), respectively. Dongfeng Fengxing is entering the European market with the Xinghai S7, a pure electric sedan. The remaining three brands—Wenjie, Skyworth, and Xpeng—are testing the European market with their smart features, refrigerators, TVs, and large sofas.

Wenjie showcased a fleet consisting of the Wenjie M5, Wenjie M7, and Wenjie M9, traveling through 12 countries over 38 days and using intelligent driving features for over 58% of the journey, showcasing its advanced driver assistance systems to European consumers. Skyworth emphasized its refrigerator, TV, and large sofa features, while Xpeng highlighted its AI technology and the Xpeng P7+.

However, European consumers' perceptions differ significantly from domestic ones. For example, due to privacy concerns, the appeal of intelligence is limited. The attraction of connected cars is also limited because of concerns about personal data and privacy. Similarly, the appeal of intelligent driving is constrained by regulations and vehicle insurance issues. Moreover, the Xpeng P7+, designed specifically for Chinese needs, is considered too large and lacks driving dynamics for European tastes. The AI features are likely more appealing to Americans, as evidenced by the lack of FSD in Europe.

While this round of new vehicles are priced lower than local new energy vehicles in Europe, such as the Xpeng P7 starting at 49,600 euros in Germany (the P7+ is even cheaper) and offering more features than the Tesla Model 3 at a similar price point, only a few have piqued local consumer interest.

Do wealthy individuals prefer gas-powered cars over new energy vehicles?

Ultimately, the lively Paris Motor Show showcased not only Chinese automakers' strong interest in entering the European market but also the challenges faced by new energy vehicles globally.

The vigilance and pressure felt by Europeans, especially in Western Europe, towards BYD and NIO, indirectly validate their initial breakthroughs. NIO will collaborate with Stellantis to initially produce the A-Series (NIO T03) in Europe to avoid tariffs. Meanwhile, BYD maintained a low profile at the show, avoiding overhyping sales or its global leadership position.

However, BYD has plans for small vehicles suitable for the European market, including the Dolphin and Yuan UP, which will be launched in 2025. Its Hungarian plant will commence production of new vehicles by the end of 2025 with an initial annual capacity of 150,000 units, which will be expanded to 300,000 units. A 100 million USD investment in a Turkish plant will commence production in late 2026, giving BYD an annual production capacity of over 300,000 units in Europe within two years, while avoiding corresponding restrictions.

BYD's initial breakthrough in the European market follows the maturation of policies, battery, electric drive, and vehicle control technologies, as well as cost control, energy efficiency optimization, and charging infrastructure development. However, for luxury automakers, the situation faced by Chinese and European consumers is similar. Unlike the significant penetration in the consumer segment, acceptance of new energy vehicles in the premium market remains relatively low.

Mercedes-Benz reported revenue of 72.616 billion euros and net profit of 6.087 billion euros in H1 2024, down 4% and 20%, respectively, year-on-year.

BMW reported revenue of 63.009 billion euros and pre-tax profit of 8.023 billion euros in H1 2024, with profits down 14.2% year-on-year.

Audi reported revenue of 30.939 billion euros and operating profit of 1.982 billion euros in H1 2024, down 9.5% and 33.59%, respectively, year-on-year.

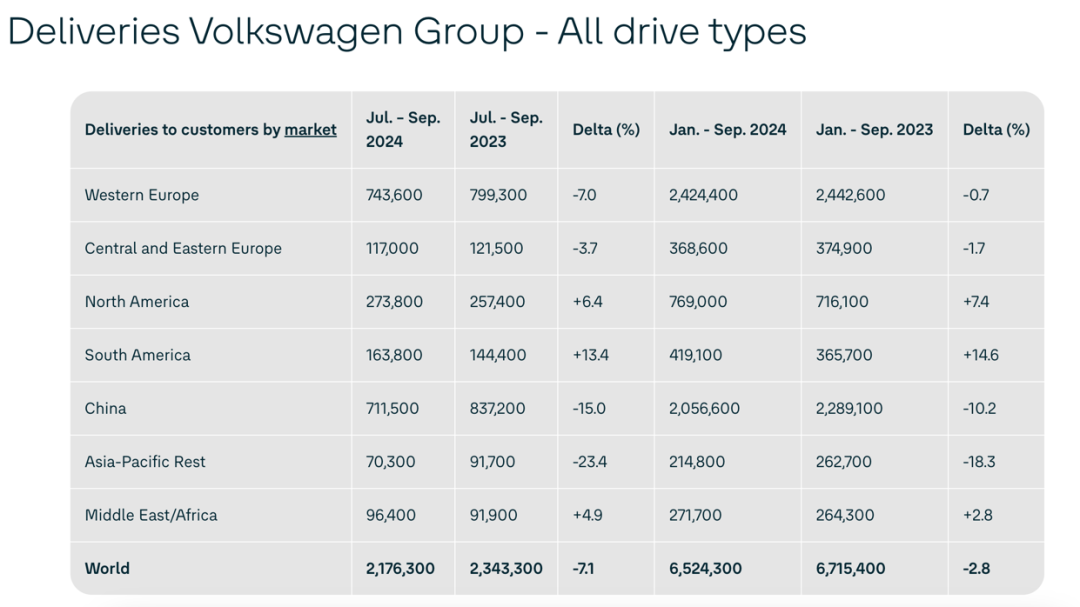

In terms of sales, Mercedes-Benz saw a 1% year-on-year decline in Europe in H1 2024, while BMW's European sales grew by 2.6%, but declined by 3.3% in the German market. Audi's European sales fell by 10% in the same period. Even global leaders face significant pressure, partly due to the global economic downturn, reduced income expectations, job cuts (such as Volkswagen's unprecedented consideration of closing factories in Germany), and waning consumerism (e.g., premature spending and luxury consumption).

Additionally, the development path of new energy vehicles plays a role. The rapid penetration of new energy vehicles in both China and Europe is attributed to technological advancements in the internet and new energy sectors, which have democratized many premium features previously exclusive to gas-powered cars. For example, in the Chinese market, vehicles like the Wenjie M9 and Lixiang L9 offer space, acceleration, and comfort comparable to those of much more expensive models like the BMW X5, X7, and Mercedes-Benz GLS.

Furthermore, advanced features like CDC and FSD suspensions are now standard in many mid-range vehicles priced around 200,000 RMB, while air suspensions are standard in vehicles priced around 300,000 RMB. This significantly stimulates demand in the mass market. However, the contrast is less pronounced in the premium and luxury segments.

For instance, the Wenjie M9 is considered a game-changer in the luxury market in China. However, sales data in the 500,000-1,000,000 RMB segment showed a marginal 0.18% year-on-year increase in H1 2024, with 223,800 units insured, despite the Wenjie M9 selling 50,000 units in the same period. Traditional automakers can maintain sales figures by forgoing profits, unlike the dominance of new energy vehicles priced below 400,000 RMB.

The cases brought by NIO and LIXIANG AUTO are similar, with both automakers experiencing relatively significant sales growth in the Chinese automotive market from 2022 to the present.

LIXIANG AUTO: 133,000 vehicles in 2022, 376,000 vehicles in 2023, and an adjusted sales target of 480,000 vehicles for 2024;

NIO: 122,400 vehicles in 2022, 160,000 vehicles in 2023, and a sales target of 230,000 vehicles for 2024.

Behind this sales growth, LIXIANG AUTO's main model has shifted from the L7, priced above 300,000 yuan, to the L6, while NIO's average price in the second quarter of 2024 is 273,000 yuan, lower than the previous years' average of over 320,000 yuan.

It is worth noting that during the Paris Motor Show, Wei Jianjun of Great Wall Motor also publicly expressed his view, giving a score of 3 out of 10 (out of 10) for Chinese automakers' overseas expansion. One justification for this score is that Chinese automakers are currently selling more products than brands, with insufficient brand premium.

In other words, a significant conflict faced by automotive consumers in the past was how to define luxury. Previously, luxury meant constant progress, offering higher limits and experiences, and generating trust through long-term market testing. However, today, the term "luxury" has been used in marketing promotions for vehicles priced as low as 150,000 yuan, leading to confusion in definition.

Closing Thoughts

There are currently no particularly effective methods for automakers to successfully sell luxury vehicles. In pursuit of sales and market share, automakers such as Mercedes-Benz, BMW, NIO, Wenjie, and LIXIANG AUTO have all reduced their price points in specific market competitions. For example, BMW has been rumored to be returning to a price war due to discounts exceeding 500,000 yuan for the i7 at 4S stores. Additionally, an increasing number of automakers are turning to extended-range electric vehicles to further explore cost and pricing reductions.

True autonomous driving technology and regulations have not yet been substantially promoted globally. In-car intelligence has fallen into the same logic as smartphones, focusing on chip competition, details, and UI design. Meanwhile, AR and VR have not been substantially promoted globally. Luxury and non-luxury vehicles in the new energy sector do not have a significant price difference, leading to confusion in the definition of luxury. As a result, wealthy individuals who are less sensitive to cost have shown limited interest in new energy vehicles, which is understandable.

Therefore, the goals of participants at the current Paris Motor Show are clear. Some aim to truly expand overseas, while others seek to influence domestic perceptions, establish factories, or simply explore new markets.