Will hybrids surpass pure electrics next year?

![]() 10/28 2024

10/28 2024

![]() 628

628

Introduction

Regardless, the process of "oil to electricity" is accelerating.

This week, there is another controversial opinion in the automotive circle.

On October 24, Beijing time, Luo Jian, General Manager of CATL's Marketing Department, stated at a press conference, "The full electrification of the Chinese passenger vehicle market will be completed within the next two to three years!"

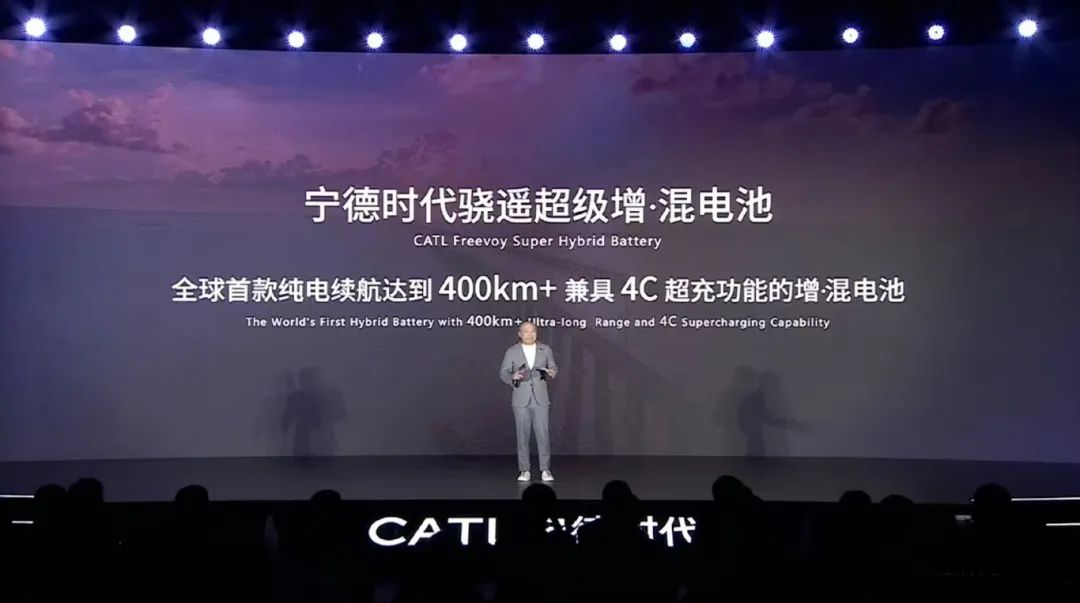

This immediately sparked significant doubts and criticisms. As the absolute cornerstone supporting the above viewpoint, CATL, an industry oligarch, unveiled its latest offering - the Xiao Yao Range-Extended Hybrid Battery.

Behind this somewhat cumbersome name lies a technology tailored specifically for plug-in hybrids and extended-range electric vehicles (EREVs), offering a maximum range exceeding 400 kilometers, a 20% increase in power performance, support for 4C ultra-fast charging (280 kilometers in 10 minutes), and a low-temperature version suitable for northern climates.

It can be said that not only is this technology comprehensively equipped, but it also precisely addresses user pain points. Whether acknowledged or not, CATL's ambition to "shake things up" is undeniably on display.

According to current information, confirmed participants in adopting this Xiao Yao Range-Extended Hybrid Battery include 30 new models from brands such as Lixiang, AVATR, Shenzhen Auto, Qiyuan, Nezha, Geely, Chery, GAC Motor, and Hozon Auto. Undoubtedly, this wave of aggressive moves is becoming increasingly unstoppable.

Given this backdrop, if we consider EREVs as an important subset of plug-in hybrids, it begs the question: can the combined strength of these two categories rival pure electric vehicles in market share? Furthermore, will the transition from oil to electricity truly be completed within three years?

In the following sections, I would like to elaborate on my thoughts.

Radical Opinions as Facts

Do you think the "radical opinion" mentioned at the beginning of the article will come true on schedule? Will there really be no more gasoline-powered vehicles in the market?

In reality, I would add some qualifiers to the answer: "Most likely, there will be no new gasoline-powered vehicles launched in the mainstream passenger vehicle market after three years. However, in certain niche segments, such as hardcore off-road and ultra-luxury, there may still be isolated examples."

Even so, this can still be considered as a near-completion of the overall transition from oil to electricity. The reasons for this confident judgment primarily lie in the following dimensions.

Firstly, the impressive track record speaks for itself.

With the retail penetration rate of new energy vehicles (NEVs) exceeding 50% for the first time in July, and continuing steady progress in August and September, the trend suggests that October will also meet the mark, building confidence in the industry.

After all, more and more end-users are voting with their wallets, as NEVs have surpassed gasoline-powered vehicles in terms of product capabilities, serving as an irresistible and irreversible catalyst for change.

Secondly, even stubborn and inland users are gradually being won over.

Some readers may wonder why these two groups are singled out for emphasis. For a long time, they have been the cornerstone of the gasoline-powered vehicle industry, but they are now rapidly being uprooted in large numbers.

Take two elders who recently purchased cars as examples. They reside in Lanzhou, an industrial hub, and Shanghai, a megacity, respectively, and are both over 50 years old. Previously, they were long-time owners of gasoline-powered vehicles, but this year, they unanimously chose to drive green-licensed Wenjie M7 and BYD Yuan PLUS electric vehicles.

Honestly, upon learning of this, I was quite surprised.

When asked about their reasons, their answers centered around low operating costs, peer influence, the perception that NEVs are now the mainstream (similar to when Volkswagen and Toyota first gained popularity), and the widespread propaganda that gasoline-powered vehicles are outdated. Approaching retirement, they feel it's time to keep up with the times.

Their words evoke a sense of inevitability. The "mind battle" waged by leading automakers this year has indeed yielded remarkable results.

Furthermore, the current mainstream consumer group in China's auto market is gradually shifting to post-85s and post-90s individuals, who tend to embrace NEVs without much persuasion.

Lastly, the "gas tank" is gradually killing the gasoline-powered car.

It might sound ironic, but there's truth to it. While pure electric vehicles were expected to play a leading role in the transition from oil to electricity, it was unexpected that extended-range and plug-in hybrids would unleash far greater energy than anticipated.

Taking a few of my friends in Lanzhou as examples, they also purchased new cars this year for various reasons, all of which had both a gas tank and a green license plate. Vehicles like the Yinhe L7, Lixiang L6, Leapmotor C16, and BYD Song L offer the best of both worlds: no range anxiety, the ability to run on either electricity or gasoline, and affordable pricing with ample space. Compared to gasoline-powered vehicles in the same class, they are clearly superior.

As these three dimensions evolve and accumulate over time, I believe they provide the strongest support for the idea that radical opinions are indeed becoming a reality. Emotionally and logically speaking, it's a somber fact that "gasoline-powered cars are not dying, but fading away, and things will never be the same again."

Parity or Surpassing

Since NEVs represent the future, let's discuss the landscape after addressing the radical opinion.

In my view, as mentioned at the beginning of the article, if we consider EREVs as an important subset of plug-in hybrids, the combination of these two categories is fully capable of rivaling pure electric vehicles in market share, with two possible outcomes: parity or outright surpassing.

As evidence, let's focus on the September sales figures released by the China Passenger Car Association (CPCA). In wholesale sales, pure electric vehicles accounted for 59%, plug-in hybrids for 32%, and EREVs for 9%. In comparison, last September's wholesale sales figures were 68% for pure electric, 23% for plug-in hybrids, and 8% for EREVs.

The rapid rise in certain categories is clearly visible.

Adding the wholesale sales shares of plug-in hybrids and EREVs in September, we arrive at a combined share of 41%. Given the current industry trends and potential consumer demand, this figure is set to continue rising in the remaining three months.

By year's end, it is expected to approach a 50:50 split. Looking ahead to next year, with the announcement of CATL's Xiao Yao Range-Extended Hybrid Battery and the eagerness of many automakers to adopt it, there's an intangible sense that plug-in hybrids and EREVs will gradually take the lead over pure electric vehicles.

As further evidence, let's consider some of the dominant players and popular choices in China's auto market. Whether it's BYD, Lixiang, Hongmeng Zhixing, or the rapidly progressing Leapmotor, their NEVs with "gas tanks" are selling like hotcakes.

Moreover, as more and more brands that once sneered at EREV and plug-in hybrid technologies are now embracing them due to the alluring benefits, the trend is becoming increasingly pronounced.

At this point, readers may wonder, "Why?" As mentioned earlier, the answer boils down to: "They better align with national conditions and address the needs of most ordinary consumers."

It's worth noting that the intention of this article is not to criticize pure electric vehicles blindly but rather to demonstrate that they currently cannot meet the usage scenarios of everyone. This, in turn, provides ample space for plug-in hybrids and EREVs to shine.

"Although our region is still developing, public charging infrastructure can't compare to that in Shanghai. The cold winters are long, and road trips often involve driving thousands of kilometers. The refueling conditions at highway service areas are also less than ideal. After careful consideration, the Lixiang L6 suits me better. I can drive it as a pure electric vehicle in the city with a private charging station at home, and switch to gasoline mode on the highway."

These words from a friend in Lanzhou succinctly articulate the core pain points.

When I informed him that next year, batteries tailored for plug-in hybrids and EREVs, offering a maximum range exceeding 400 kilometers, 4C ultra-fast charging (280 kilometers in 10 minutes), and a low-temperature version suitable for northern climates, will be widely available,

He promptly replied, "Then there's no reason to buy a pure electric car. I barely need to charge it once a week. When I go on occasional trips, the engine only starts up occasionally, acting like a portable battery."

Faced with such a response, I couldn't help but agree. Recognition from real car owners carries significant weight. The productivity enhancements brought about by technological iteration are making plug-in hybrids and EREVs increasingly formidable.

This raises another question: when NEVs with gas tanks routinely achieve a pure electric range of around 400 kilometers, and the engine becomes a mere backup, do automakers still need to obsess over thermal efficiency, series-parallel structures, and fuel economy?

Personally, I believe that as the importance of electricity continues to grow and the role of gasoline diminishes, simplicity, durability, and low cost should suffice.

At this point, revisiting Li Xiang, CEO of Lixiang, and his controversial assertion that "Chinese Self owned brands are still insisting on multiple levels PHEV The car company , We will transition to an extended programming technology roadmap in the next year or two , This judgment can be made 2025 Verified over the years 。" ("Chinese automakers that persist in using multi-gear PHEVs will likely switch to extended-range technology within the next one to two years. This prediction can be verified by 2025."), one can appreciate the underlying significance. A subtle shift is quietly taking place, and many long-held beliefs are being shattered by reality.

As this article draws to a close, I want to emphasize: "The intense three-way competition between plug-in hybrids, EREVs, and pure electric vehicles is leading directly to the realization of the radical opinion mentioned at the beginning. Moving forward, the survival space for gasoline-powered vehicles is destined to be fiercely contested and squeezed."

Perhaps, the entire transition and iteration process won't even take three years...