The "first tier" of intelligent driving is blurry, and car companies hope for the "soul" to return

![]() 10/30 2024

10/30 2024

![]() 534

534

Author | Yang Lu

Editor | Li Guozheng

Produced by | Bangning Studio (gbngzs)

Lixiang Auto launches end-to-end intelligent driving; XPeng offers a full suite of software as standard; IM Motors upgrades its system, declaring the era of intuitive driving...

The "October hope" of the automotive industry undoubtedly belongs to intelligent driving. In this October, multiple automakers held technology days and other events centered on intelligent driving, heating up the field like never before.

Lixiang Auto was the latest among the "new forces" trio to embark on intelligent driving, but its development pace has been swift this year. "We have entered the first tier of the intelligent driving industry," said founder and CEO Li Xiang, "Hongmeng SmartRide is our strongest competitor in the market."

"Even compared to our peers in Shenzhen, our intelligent driving capabilities are competitive, and we firmly stand in the first tier," said XPeng's founder and CEO He Xiaopeng, subtly referring to Huawei, as he introduced his company's intelligent driving capabilities and standards at the global premiere of the XPeng P7+.

While the new forces emphasize their status in the "first tier," traditional automakers are also actively challenging for a place among the top tier of intelligent driving.

Recently, the term "first tier of intelligent driving" has emerged from the mouths of many automakers:

On October 23, after the launch of the Zeekr MIX, Zeekr Vice President Chen Qi stated that since the launch of the Zeekr 007 last year, Zeekr has solidified its fundamentals in parking and highway intelligent driving, positioning itself in the first tier of the industry.

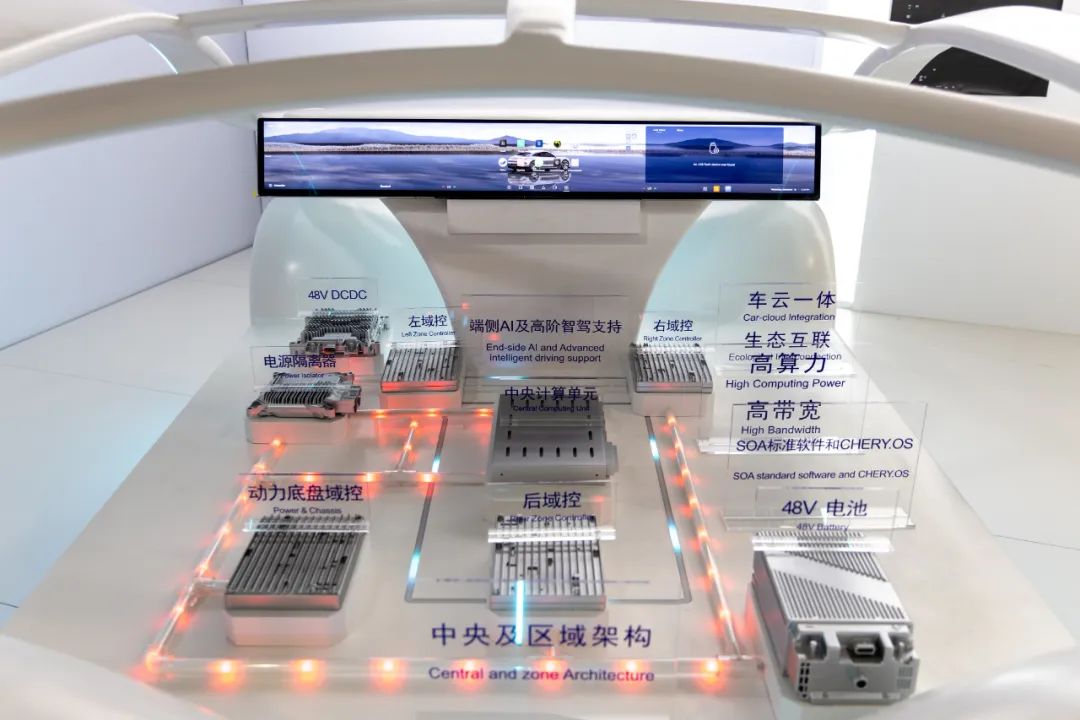

On October 18, at Chery's 2024 Global Innovation Conference, Chery Executive Vice President and President of the Automotive Engineering and Technology Research Institute Gao Xinhua confidently declared that Chery had completed a decade's worth of intelligent driving development in just five years, officially entering the first tier of intelligent driving.

In September, at the AION RT pre-sale launch event, GAC AION Vice President Xiao Yong expressed his hope that the AION RT would become a first-tier player in advanced intelligent driving and a popularizer of the technology.

In August, the launch of the WEY Blue Mountain intelligent driving version saw Great Wall Motors Chairman Wei Jianjun take the stage for the first time in six years to promote the new model. He stated that both the intelligent driving and intelligent cockpit of the WEY Blue Mountain are first-tier, adding that the term "tier" could even be dropped – "it's simply the best."

The core of competition in the second half of the new automotive era is intelligence, with intelligent driving and intelligent cockpits as its primary application scenarios. The hardware differences among automakers are readily apparent, but software capabilities are difficult to quantify, making it challenging to determine superiority.

Specifically for intelligent driving, despite the widespread use of the term "first tier," no one can clearly define what constitutes the "first" standard.

"First Tier" Standard Remains Unclear

When asked about the standard for the "first tier" of intelligent driving, Great Wall Motors CTO Wu Huixiao responded, "This is difficult to answer because the industry is changing very quickly."

IM Motors CMO Li Weimeng also tactfully avoided answering this question from Bangning Studio. She said, "Media and users have begun to spontaneously spread the word, making me truly feel that IM AD3.0 is already at the level of the industry's first tier." Quoting a third-party perspective, she noted that intelligent driving development has been phased, and anyone could potentially lead in a particular period.

In the view of Bangning Studio, the current criteria for defining the "first tier" of intelligent driving remain unclear.

On the one hand, at the industry policy level, there is a lack of systematic evaluation standards for intelligent driving.

However, both the industry and enterprises are working to improve the relevant documents on automotive intelligence standards. On October 9, China released its first automotive intelligent safety evaluation system, including the Automotive Intelligent Safety Assessment Program (AI-SAP) and the Automotive Intelligent Cockpit Assessment Program (AI-CAP).

The former focuses specifically on the safety of autonomous vehicles and innovatively proposes a set of intelligent safety evaluation procedures covering over 50 key evaluation points. The latter, based on intelligent cockpit interaction capabilities, designs over 200 test parameters.

Zhu Xichan, Professor at Tongji University's School of Automotive Studies and Director of the Automotive Safety Technology Research Institute, believes that this system not only fills the gap in engineering implementation for autonomous vehicle system development and safety assessment but also sets a new safety benchmark for the global automotive industry.

On October 24, at XPeng's technology sharing conference, XPeng Vice President Li Liyun discussed the need for a fair and objective intelligent driving evaluation standard in the industry. To this end, XPeng has open-sourced its 10 years of intelligent driving evaluation experience.

On the other hand, the evaluation of intelligent driving capabilities is relatively subjective in terms of user experience.

Users' perception of usability is undoubtedly the gold standard, but this subjective feeling is often difficult to quantify and lacks authoritative data for ranking.

An autonomous driving practitioner told Bangning Studio that the difference in intelligent driving capabilities can be discerned after just two hours of driving experience.

The same applies to intelligent cockpits. Li Tao, General Manager of Baidu Apollo's Intelligent Cockpit Business, told Bangning Studio, "For cockpits, a 30-minute drive is enough to experience the difference, or even just stepping into the cockpit can provide an initial impression."

Precisely because of this, all automakers are aware that they can aspire to join the "first tier," and the times have given everyone an opportunity.

From High-End to Mainstream

"On weekends, I always take my 7-year-old daughter with me for test drives. Every time she gets into the car, she asks me to turn on autonomous driving and not to drive myself," said Lu Fang, CEO of Voyah Motor. "Children of her generation have grown up with smart technology products and are naturally comfortable with intelligent driving. They don't feel nervous about it; they think cars are supposed to be like that."

One car owner said, "Nowadays, if a car doesn't have intelligent driving capabilities, it's almost not worthy of being called a new energy vehicle."

In the end-user market, the importance of intelligent driving in purchasing decisions has significantly increased.

Baidu has made projections on the penetration rate of intelligent driving: Level 2 capabilities will become standard in 2025, while advanced intelligent driving will exceed a 15% penetration rate that year. Among all factors influencing car purchases, intelligent driving accounted for less than 2% of decision-making factors in 2021 but is expected to exceed 30% by 2025.

"A car priced above 300,000 yuan without advanced intelligent driving capabilities will have limited appeal. This trend is gradually infiltrating the 200,000 yuan price range," said Li Liyun.

What were once luxurious and showy features are now becoming standard across vehicles, especially this year, as intelligent driving systems are being integrated at a rapid pace. According to data from the China Passenger Car Association (CPCA), in 2022, the penetration rate of Level 2 intelligent driving in domestic new energy passenger vehicles was 26.6%, while that in conventional fuel passenger vehicles was 11.5%. From January to June 2024, the rates rose to 54.4% and 50.6%, respectively.

In an interview with Bangning Studio, Shan Jizhang, Founder and CEO of Black Sesame Technologies, said that vehicles with less than Level 2 capabilities are rapidly declining in the automotive industry, while those above Level 2 have been rapidly increasing since last year.

Behind the transition of intelligent driving technology from the premium to the mainstream market lie several key drivers, and domestic automakers see opportunities for overtaking in these drivers.

Firstly, the explosion of end-to-end large models.

Tesla, which has always led the way, adopted an end-to-end large model architecture in its FSD V12 version of its intelligent driving system. This architecture encompasses the entire pipeline from perception to decision-making within a single model, responsible for the entire input-to-output chain.

The benefit of end-to-end models is improved performance and reduced human intervention. As a result, Chinese automakers are accelerating their study of end-to-end large models.

The Xiangjie S9, launched in August, utilizes Huawei's ADS 3.0 system, which is an end-to-end intelligent driving solution.

Lixiang Auto pushed out its self-developed "end-to-end + VLM" dual-system intelligent driving solution on October 23.

However, at its technology day on October 24, XPeng once again emphasized that it is one of only two companies globally and the only one in China to achieve mass production of end-to-end large models.

Secondly, costs have declined.

The price war in the end market has spilled over to upstream industries, driving down the costs of intelligent driving systems from hardware to software. This cost reduction is both inevitable due to industrial processes and necessary due to external pressures.

In terms of hardware, according to Hesai Technology, a lidar company, the average price of its products was $17,400 (approximately RMB 120,000) in 2019. By 2023, the average price had dropped to $448 (approximately RMB 3,200), a staggering 95% decrease.

In software, suppliers have engaged in intense price competition.

DJI's subsidiary Zhuoyu Technology proposed last year that the cost of intelligent driving solutions should account for 3-5% of the total vehicle cost. Therefore, for a RMB 150,000 vehicle equipped with intelligent driving, the cost must be reduced to RMB 4,500-7,500. This year, Huawei's ADS intelligent driving system, which previously cost tens of thousands of yuan, has been integrated into vehicles priced below RMB 200,000.

While suppliers' profits are being continuously compressed, automakers pursuing in-house development are more willing to invest heavily.

Lixiang Auto initially offered permanent free access to its advanced intelligent driving capabilities. XPeng has also made advanced intelligent driving standard across its entire P7+ lineup, eliminating the need for optional upgrades.

Increasing user acceptance, the prevalence of technological capabilities, and declining mass production costs have made it impossible for automakers to ignore intelligence, with intelligent driving at its core, as the key to victory in the next phase of competition.

The "Soul" is Returning

During the heyday of autonomous driving capital concepts, autonomous driving companies harbored visions of "freeing hands" and "disrupting the industry." However, they now face the challenge of mass production.

As a result, autonomous driving companies have turned to partnerships with automakers, but the industry trend has shifted. Automakers are now embracing in-house development and abandoning suppliers.

Chery has previously collaborated with multiple intelligent driving suppliers, including Huawei, Zhuoyu Technology, and Hodo Auto. However, last year, Chery spun off its Xiongshi Intelligence division and established a separate company, Dazhuo Intelligence, which is now independently operated.

At the same time, Chery has over 1,000-2,000 in-house intelligent engineers and has invested heavily in intelligent cockpits. Chery plans to invest RMB 20 billion over the next five years to advance its intelligent strategy.

When asked about the choice between in-house development and collaboration, Dazhuo Intelligence CEO Gu Junli believes that while some suppliers may offer more cost-effective products, products involve more than just price. There are five other dimensions to consider, including differentiation, functionality, performance, interactivity, and internationalization. "In the long run, mid-to-high-end products can only be designed in-house," she said.

On October 21, Changan Automobile spent a considerable portion of its technology ecology conference introducing its self-developed intelligent driving capabilities. In addition to collaborating with suppliers like Zongmu Technology and Huawei, Changan's sub-brand Qiyuan's new model, the Qiyuan E07, is Changan's first product with entirely self-developed intelligent driving core hardware and software.

Great Wall Motors embarked on its intelligent path earlier. Its Vice President Liu Yanzhao recalled that Wei Jianjun told him in 2011 that Great Wall Motors was like the floor-sweeping monk in intelligent driving (a metaphor for someone who appears inconspicuous but reveals extraordinary abilities when the occasion arises).

Great Wall Motors also incubated the intelligent driving company Homa Tech, which once dominated the industry with its "Te Xiao Chang" (Special Small Long) moniker.

Recently, Wu Huixiao stated that half of Great Wall Motors' current R&D investment is allocated to intelligent driving, amounting to at least RMB 1 billion annually.

The goal of automakers' in-house development is to gain autonomous control over core technologies. Three years ago, the former Chairman of SAIC Motor Chen Hong raised the concept of the "soul," sparking ongoing debates within the industry and supply chain. Today, it appears that automakers still prefer to retain control over the "soul" of intelligent driving technologies.

The fundamental reason is that in the near future, intelligence will determine the survival of automakers.