China's Electric Vehicles Going Global - Southeast Asia Market Status and Outlook

![]() 11/13 2024

11/13 2024

![]() 485

485

Southeast Asia has always been a popular destination for Chinese automakers to expand overseas. This article is a translation and compilation of a monthly report from the Mitsui Global Strategic Studies Institute this year, analyzing sales, major brands, penetration rates, and related automotive industry policies in key electric vehicle markets in Southeast Asia. It also presents an outlook for the development trends of new energy electric vehicles in the Southeast Asian market. Of course, this report analyzes the situation from a Japanese corporate perspective, and the data is rich and detailed. It shares the strides made by Chinese automakers in Southeast Asia and predicts price reductions for Chinese electric vehicles. It is an excellent overview of the electric vehicle market, competition, and policies in Southeast Asia. Especially with Trump's presidency, Southeast Asia has become exceptionally important for Chinese automakers and even the manufacturing industry, making it well worth reading and studying.

Abstract:

In Southeast Asia, the expansion of sales of new energy electric vehicles (EVs) led by Chinese automakers is mainly driven by subsidies and tax incentives in Thailand and Indonesia.

The adoption strategies for new energy electric vehicles in Thailand and Indonesia focus on establishing these countries as production and export bases for EVs and batteries. Although Chinese companies have made rapid progress in building production capacity, policies to promote domestic EV penetration rates remain limited.

As Chinese automakers fiercely compete to enter the Southeast Asian market, an area historically dominated by Japanese companies, their new energy electric vehicle penetration rate may be faster than expected. Japanese automakers face challenges.

1. Trends in the new energy electric vehicle market in Southeast Asian countries

1-1. Sales trends by country

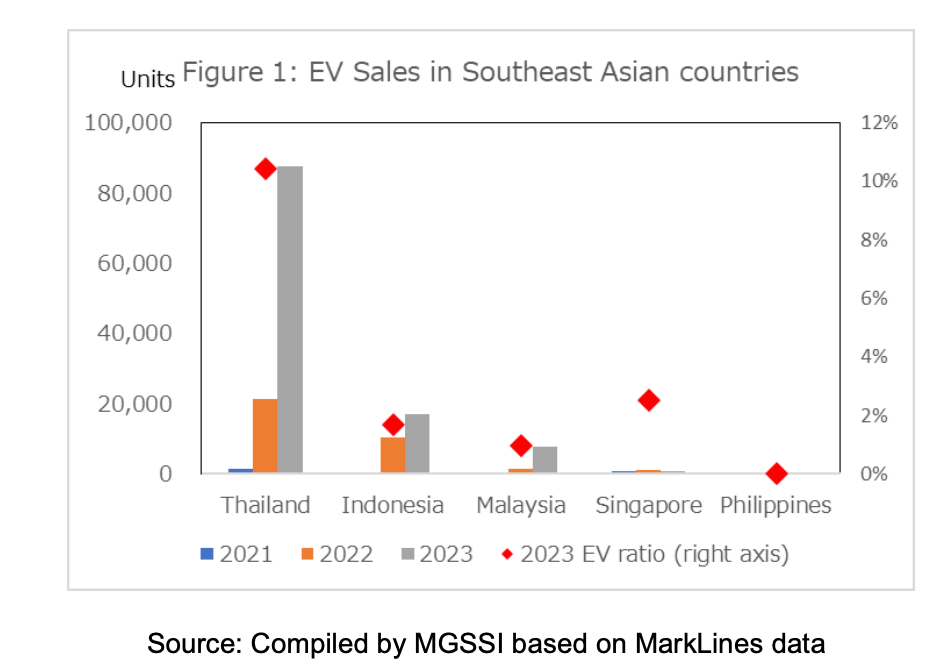

Sales of new energy electric vehicles are beginning to increase in Southeast Asia. In Thailand, over 87,000 units were sold in 2023, accounting for over 10% of new car sales (see the figure below). Although this figure is lower than the 30% in China and 18% in Europe, it is higher than the 8% in the United States. Indonesia follows with 17,000 units, accounting for 1.7% of new car sales. Sales in other countries in the region are limited, and the trend towards electrification appears to be concentrated in these two countries.

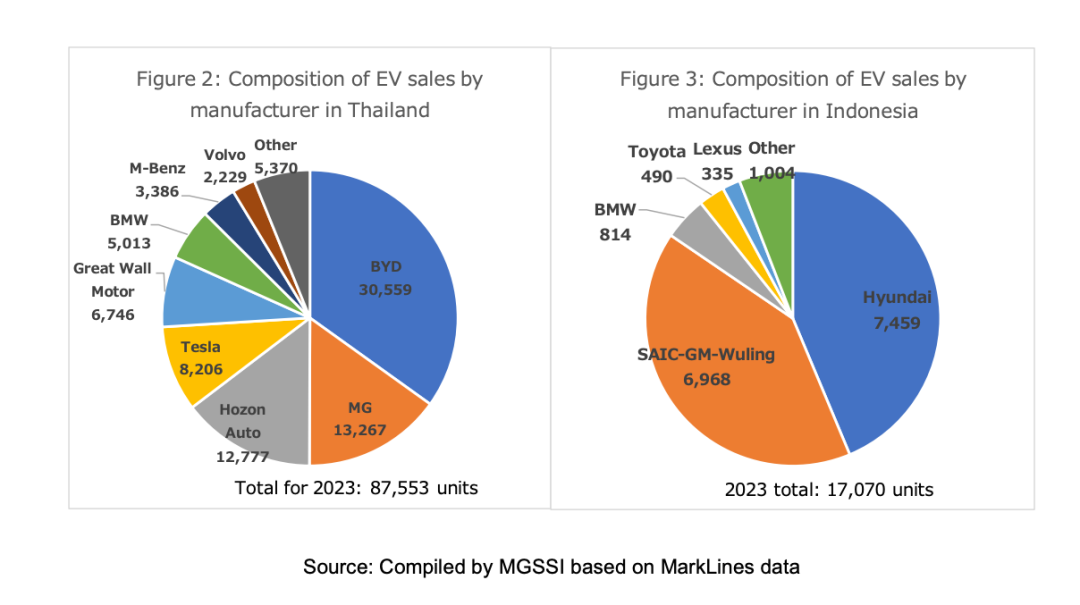

1-2. Market share by companyFrom the perspective of company market share, BYD, which began full-scale sales in 2023, is far ahead of other companies in Thailand. Followed by MG (SAIC Motor), Hozon Auto, Tesla, and Great Wall Motors (see the figure below). Four of the top five companies in sales in 2023 were Chinese, with a combined market share of 72%. In Indonesia, the market leaders are Hyundai Motor and SAIC-GM-Wuling Automobile, which are already locally produced and mainly divide the market, with shares of 44% and 41%, respectively (see the figure below). However, with BYD and several other companies beginning sales in 2024, this power structure may soon change.

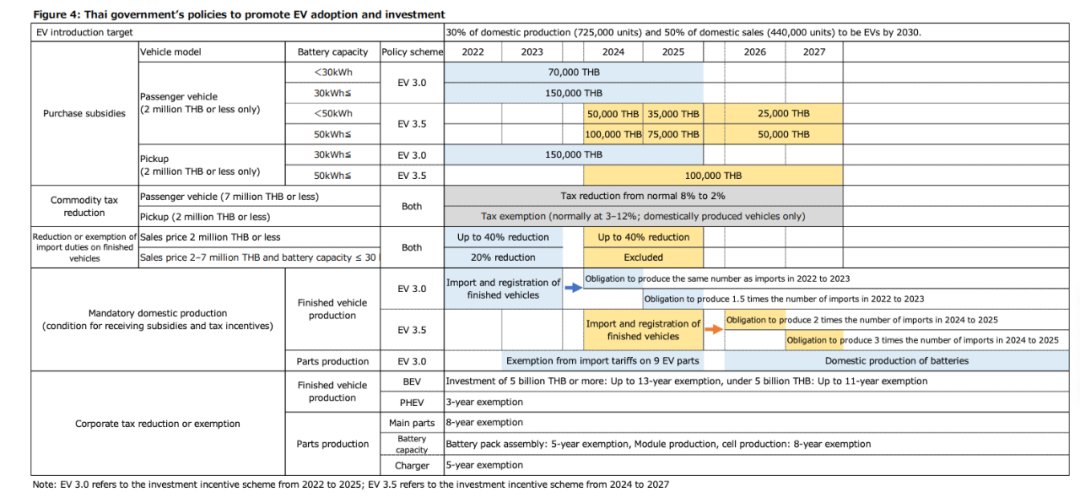

2. Policies for introducing new energy electric vehicles in Southeast Asian countries2-1. ThailandThailand has long been the largest automotive manufacturing base in Southeast Asia. Now, against the backdrop of the global shift towards electrification, Thailand is pursuing policies to establish itself as an EV production hub within and beyond the ASEAN region. The Thai EV Committee has proposed the "30@30" policy, requiring EVs to account for 30% of domestic automobile production by 2030 and increasing the share of EVs in sales to 50% in the same year. To promote EV penetration, the government provides subsidies for EV purchases and reduces excise taxes on sales. On the production side, there are tariff reductions for imports of EVs and their components, and companies investing in EV production facilities and charging infrastructure are offered corporate tax exemptions for 5 to 13 years (see the figure below).

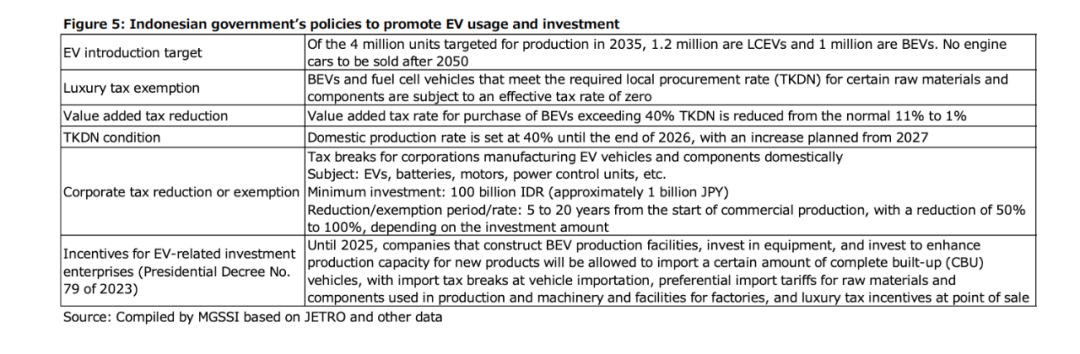

However, it is important to note that many of these policies have expiration dates. Companies that import and sell EVs between 2022 and 2025 and receive subsidies will be required to produce in Thailand based on cumulative sales starting from 2024. This will incentivize companies to begin production earlier, with the required production volume increasing as the production years progress. After 2026, the import of finished vehicles will no longer be allowed, and domestic production of key components such as vehicle batteries will be required.2-2. IndonesiaIndonesia has set a target for 30% of domestically produced four-wheeled vehicles to be low-emission vehicles (LCEVs) by 2035, with 1 million of these being battery electric vehicles (BEVs).

To stimulate EV production, the government offers tax exemptions on purchases, conditioned on local assembly of vehicles and a certain percentage of raw materials and components sourced locally (a policy known as "TKDN"). Additionally, companies producing EVs or their components domestically can benefit from corporate tax exemptions ranging from 5 to 20 years. Indonesia places even greater emphasis than Thailand on domestic production and sourcing in EV-related goals and measures. However, starting from the end of 2023, the government began to relax the conditions for local sourcing of components, allowing the import of finished vehicles and equipment under preferential conditions to facilitate early market entry for companies investing in domestic BEV production (see the figure below). Meanwhile, policies aimed at promoting and using EVs domestically remain limited. For example, purchase subsidies are only granted for two-wheeled EVs, not four-wheeled EVs, and incentives for installing charging stations are limited.

2-3. Similarities and differences between Thai and Indonesian policies and other regionsBoth Thailand and Indonesia have focused on building production capacity for electric vehicles (EVs) and their components (such as on-board batteries) and emphasized transforming these industries into export industries. However, neither country has fuel efficiency or zero-emission vehicle (ZEV) regulations that could promote domestic EV penetration. In regions like Europe and China, EV penetration rates are higher due to subsidies and related regulations that serve as both incentives (carrots) and mandates (sticks). Without such regulations, especially in early markets, there is a lack of momentum for domestic EV purchases, and the available subsidies are relatively low, potentially insufficient to significantly boost demand.

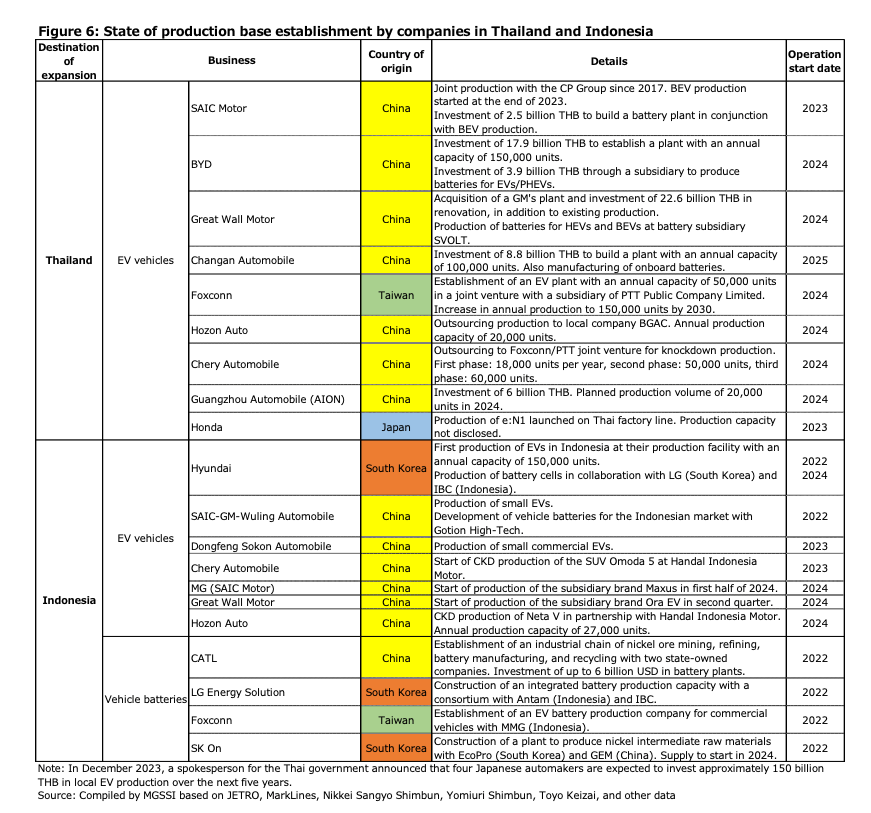

3. Trends in company expansion3-1. ThailandChinese automakers are increasingly announcing expansions in production, leveraging subsidies and various tax incentives (see the figure below). Leading EV manufacturer BYD plans to bring its first overseas production base outside of China online in the first half of 2024, while Changan Automobile and other companies also plan to begin EV production. By 2030, the annual production capacity is expected to exceed 600,000 units, significantly surpassing domestic sales targets. In contrast, Japanese companies with long-standing production bases in Japan and historically accounting for over 80% of the local market share have been cautious and are maintaining a wait-and-see attitude. Honda has started some production but has not disclosed other specific local production plans.

3-2. IndonesiaFollowing Thailand, Indonesia has also seen an influx: Hyundai Motor, SAIC-GM-Wuling Automobile, Dongfeng Xiaokang Automobile (DFSK), and Chery Automobile have already begun production. Starting in 2024, BYD, MG (SAIC Motor), Ora (Great Wall Motors), Hozon Auto, and Vietnam's Vinfast have announced the commencement of production. Additionally, with a focus on battery production – a priority for the Indonesian government – Hyundai Motor has started working with Korean LG Energy Solution and IBC to produce battery cells domestically for the first time. Chinese companies are also leading the wave of entry into the battery market: SAIC-GM-Wuling Automobile is jointly developing with Gotion High-Tech. China's CATL is advancing supply chain plans from nickel mining to battery manufacturing and recycling in collaboration with local enterprises such as IBC.

4. Outlook for the electrification of automobiles in Southeast Asia4-1. ThailandThe rapid growth in EV sales in 2023 can be attributed to the entry of Chinese companies into the market and a buying spree ahead of the reduction of subsidies and other preferential policies in 2024. Although some EV prices have dropped to levels comparable to Japanese hybrids due to these preferential policies, buyers are mainly limited to urban youth and early adopters due to cost performance and charging convenience. Furthermore, pickup trucks, which account for nearly half of the Thai market, are not suitable for electrification because carrying more batteries would reduce cargo capacity, making commercialization difficult. Additionally, Chinese companies are currently leveraging temporary tax exemptions to promote the import of finished vehicles, but production costs may increase significantly when mandatory local production begins in 2026. As subsidies decrease, it may become increasingly difficult to compete on price with gasoline and hybrid vehicles. If production capacity expands and exceeds domestic demand, the surplus may be exported. However, distinguishing these locally produced EVs from those manufactured in mainland China and already exported worldwide will be a challenge.

4-2. IndonesiaIndonesia's EV market is less mature than Thailand's. The primary demand comes from individuals seeking a second vehicle or those affected by license plate regulations in urban areas. The price difference between popular small MPV gasoline vehicles and EVs is significant, being two to three times higher, making this an area facing challenges in electrification. Tax exemptions for luxury goods and value-added tax alone are insufficient to significantly increase adoption rates, making a significant expansion of the EV market unlikely in the short term. However, similar to Thailand, allowing the import of finished vehicles to enter the market before local production begins is expected to intensify sales efforts by Chinese manufacturers.

4-3. Impact on Japanese companiesDue to the active entry of Chinese companies into Thailand and Indonesia with the support of local EV promotion policies, EV sales have surged, capturing market share from Japanese brand automobiles. This has surprised many, although this trend seems unlikely to continue at the same pace. However, due to the accumulation of EV production capacity, an increase in supply pressure is inevitable, and competition from Chinese companies based in mainland China may reduce EV prices, potentially accelerating an unexpected rise in penetration rates.

Hybrid vehicles are performing well in the local market, and Japanese manufacturers remain vigilant. However, even if EVs do not dominate, they are expected to occupy a certain share of the market, requiring Japanese companies to strategically consider how to protect their key markets from further erosion.

*Reproduction and excerpts are strictly prohibited without permission - Reference materials: