Can Huawei's Zunjie S800 help JAC Motors become a top-tier automaker worth tens of billions?

![]() 12/02 2024

12/02 2024

![]() 653

653

Author

Chexingyun

Can Huawei's BU today help Chinese automakers climb higher and go further?

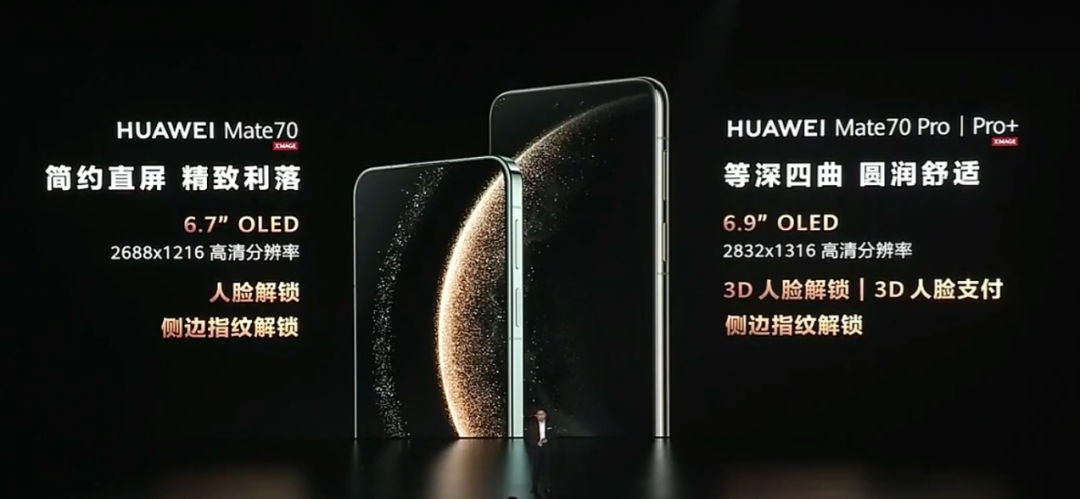

On November 26, 2024, Huawei's press conference was held as scheduled. When introducing the Mate70, Huawei used Andy Lau's 1995 song "Today" as the ending.

The lyrics emphasize, "Waited so long, finally today has come, dreamed for so long, finally the dream came true," and "Longed for so long, finally today has come, endured for so long, finally the dream came true."

Since "My Dream," Huawei has entered its ninth year, with its flagship model evolving from the Mate8 to the "far ahead" Mate40, and now to the Mate70, worthy of the phrase "those four words," with a public call for "no future in copying."

In nine years, Huawei has been included in the Entity List. Compared to ZTE, which was also included in the Entity List during the same period, this domestic phone manufacturer, once on par with Huawei in the high-end market, has retreated from the market's forefront under successive suppressions. Huawei's flagship models, however, have emerged stronger from the mud with their strong corporate resilience.

Huawei has resumed in-house chip research and development and 5G communication for its mobile products, gradually adding satellite communication functions. The Mate70 series and MateX6 series released by the company on November 26 were hailed by Yu Chengdong as "the strongest ever." Along with the Mate series launch, Huawei also pulled automotive supply chain enterprises out of the mud. One notable case is O-Film, which was excluded from Apple's supply chain and nearly went bankrupt but achieved rebirth by entering Huawei's supply chain.

Another case worthy of market attention is Xiaokang Corporation , which was once lost and unsure of its development path. After partnering with Huawei to launch the Wenjie series of models, which sold well, the company's net profit surged from a loss of 3.832 billion yuan in 2022 to a profit of 4.038 billion yuan in the third quarter of 2024.

On October 22, 2024, Xiaokang Corporation , now renamed Thalys, announced the "Announcement on the Use of Self-Owned Funds to Purchase Wealth Management Products," with an investment amount not exceeding 15 billion yuan, and the quota can be reused. According to the company's financial statements, Thalys' net increase in cash and cash equivalents at the end of the third quarter reached 10.559 billion yuan, and the balance of cash and cash equivalents at the end of the period reached 15.038 billion yuan.

As the first automaker to deeply collaborate with Huawei in vehicle manufacturing, Thalys' turnaround has encouraged more automakers to partner with Huawei. At the press conference on November 26, 2024, after announcing the new AITO S7, Yu Chengdong unveiled the long-anticipated JAC "Zunjie" S800, priced between 1 and 1.5 million yuan, to the public.

After the press conference, Yu Chengdong posted on social media, "A friend directly transferred 60,000 yuan to me via WeChat and wanted to order three Zunjies!" along with a pre-order link.

However, after the market opened on November 27, 2024, JAC Motors' share price fell by over 8% in the morning but did not recover with the broader market. In contrast, BAIC BluePark, which also launched high-end sedans, saw its share price turn positive around 9:50 AM.

Judging from share price performance, the capital market seems to favor the cooperation between BAIC BluePark and Huawei over that of JAC Motors, despite the latter's higher pricing. However, in terms of sales, there is no conflict between Zunjie and Xiangjie.

01

With the entire industry engaging in price wars, why are Huawei's partner models becoming increasingly expensive?

To understand why Huawei's partner models are becoming more expensive, it is not difficult to see the answer in the market: "disruptive competition."

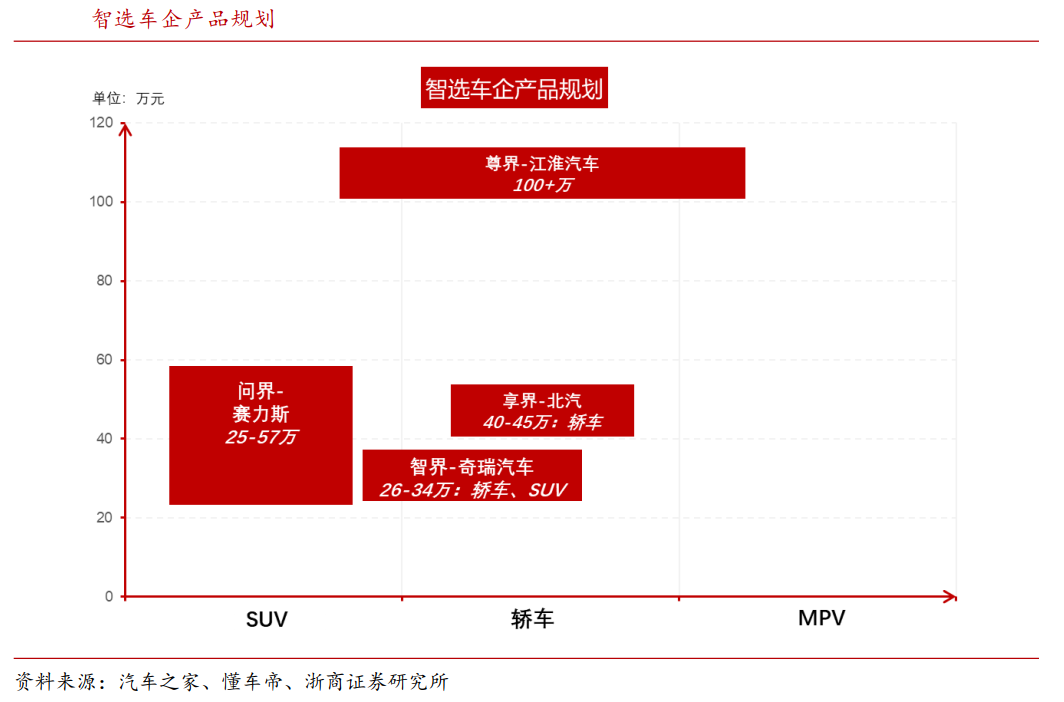

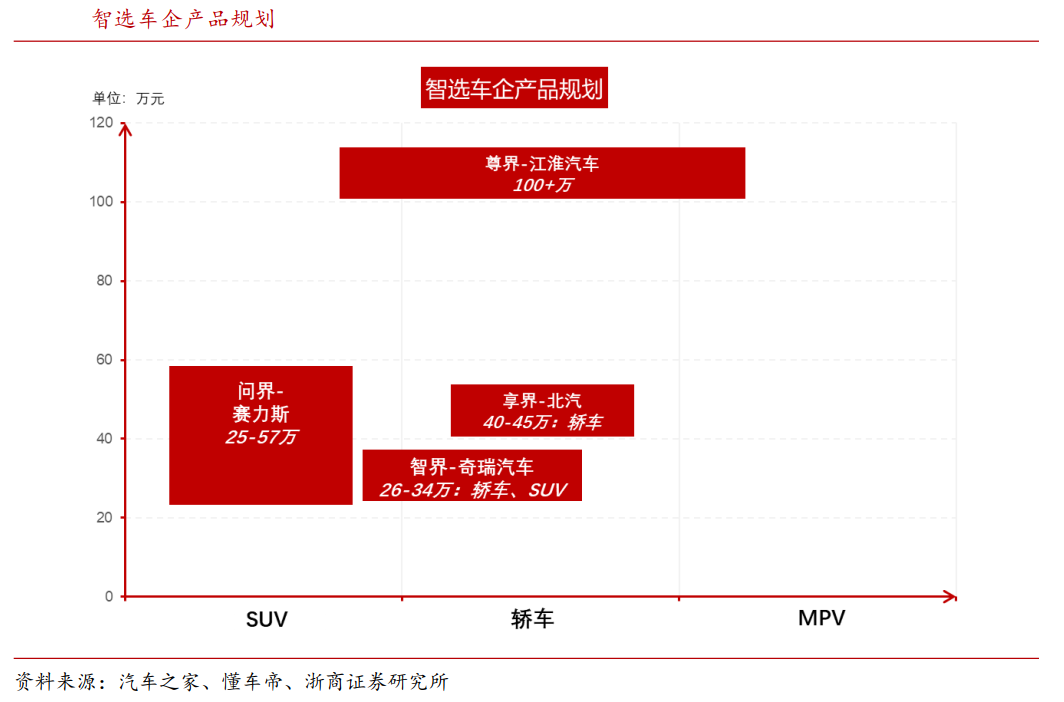

To date, Huawei has launched four brands in the smart car sector: Wenjie, AITO, Xiangjie, and Zunjie. Wenjie, AITO, and Xiangjie are brands launched in collaboration with Thalys, Chery, and BAIC, respectively, focusing on SUVs, sedans, and mid-to-large pure electric sedans.

Zunjie is a brand collaboration between Huawei and JAC Motors, targeting the ultra-premium market segment worth millions, competing with ultra-luxury brands such as Maybach and Rolls-Royce. With this, Huawei's full-vehicle layout has achieved full coverage of models above the B-segment.

Unlike the price increases seen in Huawei's partner models, the entire automotive industry is witnessing intensifying price wars. On November 27, 2024, BYD once again made headlines by demanding a 10% price reduction from its suppliers. Li Yunfei, general manager of the company's brand public relations department, responded that "annual price negotiations with suppliers are common practice in the automotive industry. Based on large-scale procurement, we propose price reduction targets to suppliers, which are not mandatory but can be negotiated."

Against this backdrop, why are Huawei's full-vehicle plans setting increasingly higher prices? And what gives JAC the confidence to enter the million-yuan premium electric vehicle segment?

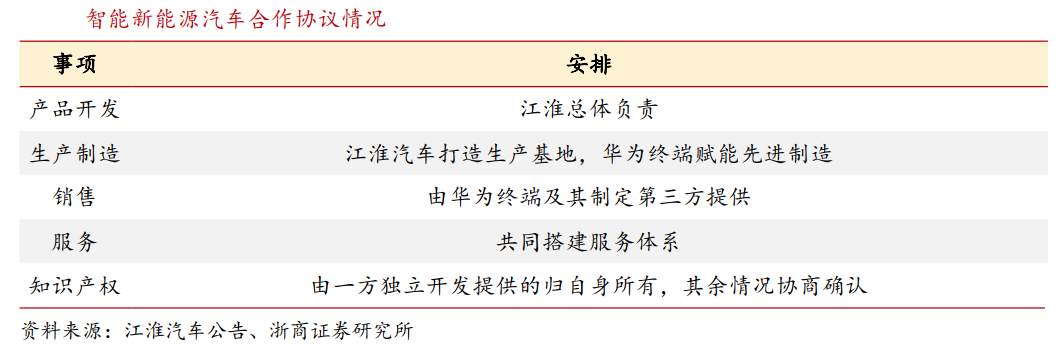

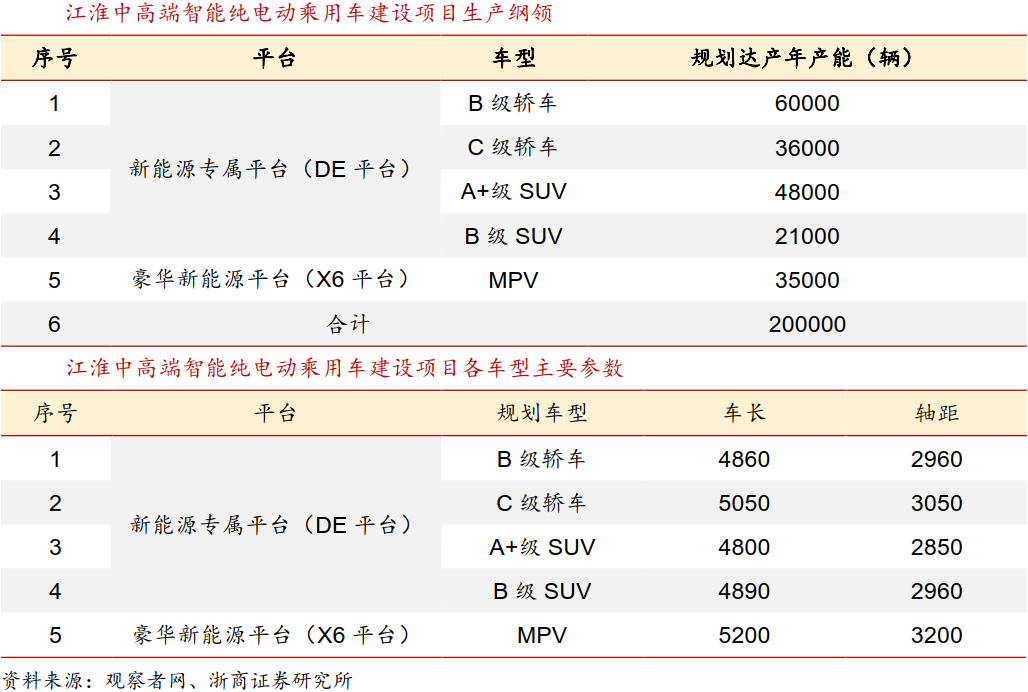

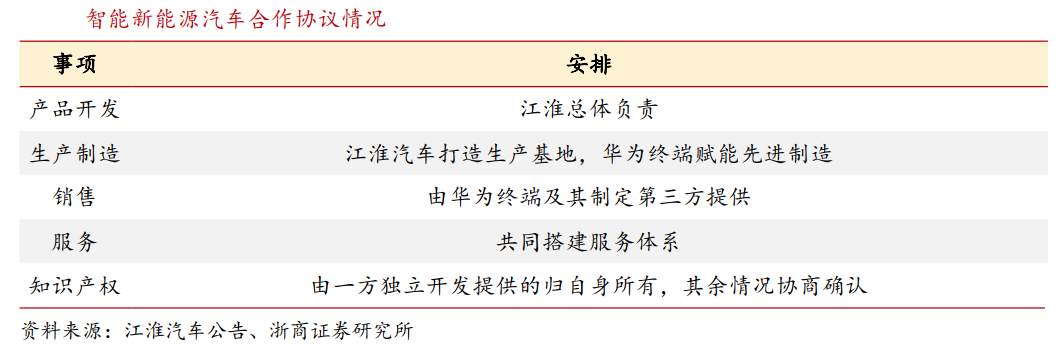

In December 2023, Anhui JAC Motors Group Co., Ltd., and Huawei Device Co., Ltd., signed the "Intelligent New Energy Vehicle Cooperation Agreement," revealing details of their collaboration. Both parties will leverage Huawei's technological and channel advantages along with JAC's manufacturing prowess to jointly develop smart cars. The Zunjie models launched through this collaboration will be based on JAC's X6 platform, integrated with Huawei's intelligent driving and power technology, with an estimated annual production capacity of 35,000 units.

Note: The Maybach S480, priced around 1.5 million yuan, sold 12,700 units in 2023.

Within 48 hours of opening pre-orders, over 2,100 Zunjie S800s were pre-ordered. Assuming a starting price of one million yuan, JAC's potential revenue could exceed 2 billion yuan, making the Zunjie S800 a potential new revenue growth pillar for the company, marking another successful empowerment of an automaker by Huawei.

In April 2024, the Anhui Provincial Department of Ecology and Environment published the "Environmental Impact Assessment Report on the Construction Project of JAC's Annual Production of 200,000 Mid-to-High-End Smart Pure Electric Passenger Vehicles." JAC's new factory will invest approximately 4 billion yuan in a new energy-dedicated DE platform and a luxury new energy X6 platform empowered by Huawei's intelligent technology. In October 2024, the company announced a private placement plan to invest 587.459 million yuan in the development of a high-end smart electric platform.

According to public information, the X6 platform is a luxury new energy platform built by JAC Motors, aiming to capture the domestic high-end market through Huawei's intelligent technology. In addition to the MAEXRTRO Zunjie, JAC will launch more models based on this platform, covering the B-segment to D+-segment.

Leveraging its intelligent advantages, Zunjie is not only expected to capture a share of the existing luxury car market but also create incremental demand by driving the replacement of existing luxury cars. Currently, with annual sales of ultra-luxury cars estimated at 200,000 units, Zheshang Securities estimates a stock size of approximately 2 to 3 million units based on a 15-year replacement cycle. This round of intelligent driving technology innovation is expected to drive a wave of replacements in the stock market, thereby increasing overall sales in the luxury car market.

Drawing inspiration from Thalys' successful partnership with Huawei through the Wenjie series, Thalys, positioning itself in the mid-to-high-end market, has achieved significant sales growth with the Wenjie M9, focusing on extended-range technology. Since 2024, Wenjie M9 sales have surged, resonating with the company's performance and model sales, turning net profits positive.

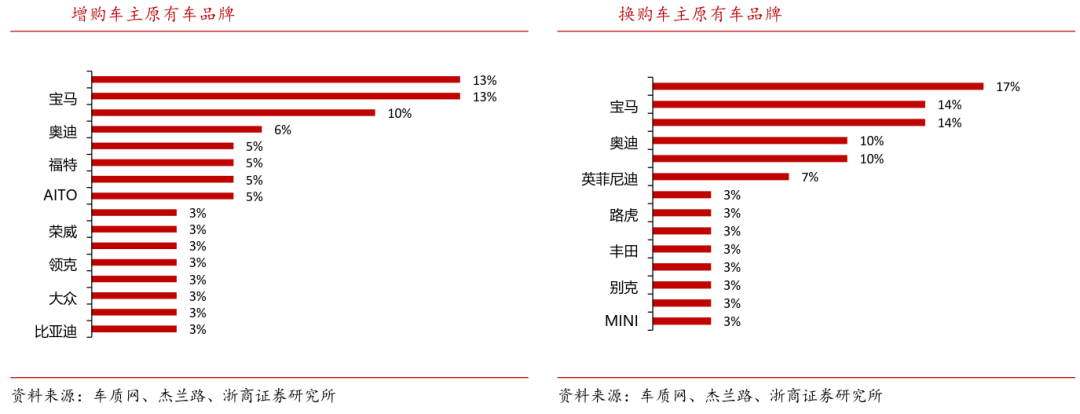

According to the results of the first survey of Wenjie M9 owners conducted by well-known research firm JLRoad, the primary buyers of the Wenjie M9 are married middle-aged men in first-tier cities, with an average age of 37.3 years and an average annual household income after tax of 920,000 yuan. Among them, 48% are replacement buyers, 35% are additional buyers, and only 17% are first-time car buyers. The replaced models are mainly luxury brands such as Mercedes-Benz and BMW, with 59% of replacement buyers originally owning a luxury brand.

In the auto market above the 500,000 yuan price point, the BMW X5 holds a significant position in the luxury SUV segment, known as the "King of the Road SUV." The Wenjie M9 differentiates itself through extended-range technology, Huawei's intelligent cockpit, and intelligent driving technology, leading in maximum power and 0-100 km/h acceleration.

In terms of intelligent driving, Huawei's ADS is the core of the Wenjie M9's intelligent driving system, which is continuously upgraded to optimize the user experience. It currently offers various features, including adaptive AEB, lateral collision avoidance, and automatic parking route generation, making the vehicle safer, more efficient, and more convenient for users.

The intelligent cockpit features a tri-screen design integrated with HarmonyOS 4.0, enabling multi-screen interaction. The rear cabin is equipped with zero-gravity seats for enhanced passenger comfort. The Huawei tablet can connect to the HUAWEI MagLink interface, interacting with the HarmonyOS cockpit. For example, children can watch videos or listen to music on the tablet in the back row, while parents can control content playback and adjust the volume through the vehicle's central control screen. The tablet can also access the internet via the vehicle's hotspot.

In terms of market performance, Wenjie produced 33,624 units in October, with a cumulative production of 331,661 units for the year, up 514.12% year-on-year, and sales of 33,921 units, with cumulative sales of 326,878 units, up 495.46% year-on-year.

Inspired by Thalys' strong market performance, JAC's Zunjie S800, targeting ultra-luxury brands like Maybach and Rolls-Royce and aiming at the high-end market, is expected to achieve differentiated competition through intelligence. Drawing from Wenjie's success in the 500,000 yuan market segment with electric vehicles and Huawei's intelligent driving technology, JAC's Zunjie is poised to adopt a similar approach to achieve disruptive competition.

02

How Huawei Empowers Automakers

The underlying logic of whether JAC's Zunjie S800 will succeed lies in the feasibility of Huawei's approach to empowering enterprises. Judging from Huawei's past collaborations with automakers, Huawei's current modes of cooperation with automakers are diverse, with an increasing number of automakers choosing to partner with Huawei for vehicle manufacturing.

Today, Huawei positions itself as a supplier of incremental components for intelligent and connected vehicles in the automotive industry. Since its initial foray into the automotive industry in 2009, Huawei's business and products in the automotive sector have continued to mature.

In 2009, Huawei initiated the development of in-vehicle modules; in 2013, it launched the in-vehicle module ME909T and established the Connected Vehicle Business Unit, officially embarking on the layout of connected vehicles and autonomous driving. The following year, Huawei set up a connected vehicle laboratory, introducing multiple solutions in the three major areas of connected vehicle terminals, pipes, and clouds, and collaborating with automakers such as Dongfeng, Changan, Audi, Toyota, BMW, and Daimler in connected vehicles and smart cars.

In 2018, amid the burgeoning trend of electric vehicles and the gradual rise of automotive intelligence, Huawei released chips and a connected vehicle cloud platform for in-vehicle terminals. However, due to various factors such as strategic choices and resource investments, Huawei had not yet gained significant influence in the automotive industry at this time.

In October 2020, Huawei unveiled its first full-stack intelligent vehicle solution, HI (Huawei Inside), comprising a new digital platform for intelligent vehicles, three computing platforms and operating systems, as well as five intelligent systems: intelligent driving, intelligent cockpit, intelligent electric, intelligent connectivity, and intelligent vehicle cloud. Additionally, it included over 30 intelligent components such as LiDAR and AR-HUD, providing a comprehensive layout in the automotive field.

In April 2021, Huawei and Thalys jointly launched the Thalys Huawei Smart Selection SF5, marking the initial formation of the Smart Selection model. The form of cooperation with automakers was basically determined. In December of the same year, AITO Wenjie was officially launched, and Huawei's automotive business has since continued to expand, with a gradually rich variety of cooperative models.

In November 2023, Huawei's Smart Selection model was upgraded to Harmony SmartRide. In April 2024, Huawei officially launched the "Qiankun Intelligent Driving" series of solution brands, focusing on intelligent driving, alongside "Harmony Cockpit" as the two core brands of Huawei's intelligent vehicle solutions.

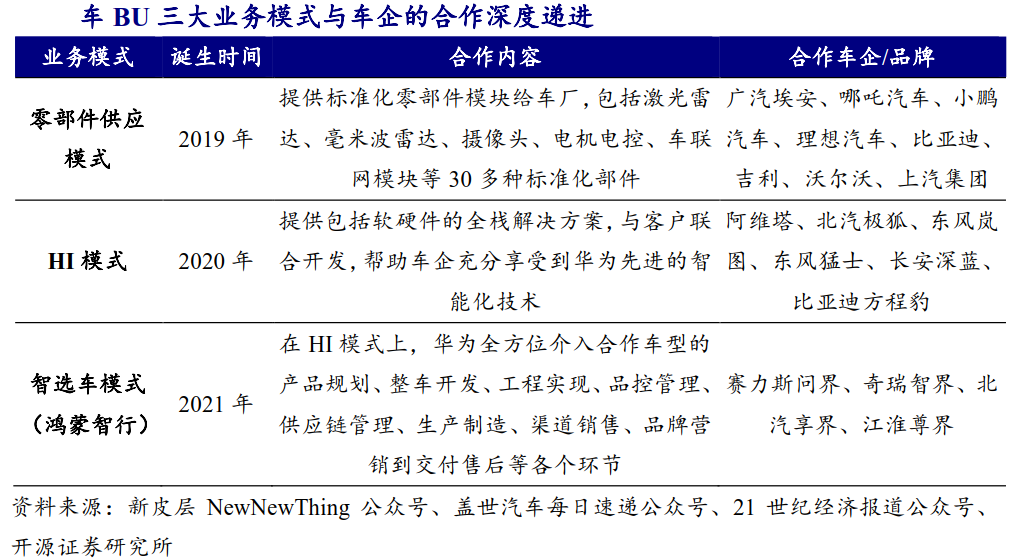

To date, Huawei has three models in its automotive business, covering a variety of solutions. The first is the components model, where the BU serves as a Tier 1 supplier in the traditional automotive supply chain, providing standardized component modules to automakers, including over 30 standardized components such as LiDAR, millimeter-wave radar, cameras, motor controllers, and connected vehicle modules.

The HI mode provides a full-stack solution including both hardware and software, helping automakers fully leverage Huawei's advanced intelligent technology. Compared to the component mode, the HI mode involves a deeper level of cooperation with automakers, particularly enabling continuous iterative upgrades in areas such as smart electric vehicles, smart cockpits, and smart driving.

HarmonyOS Intelligent Travel Mode: Building upon the HI mode, HarmonyOS Intelligent Travel involves Huawei's comprehensive involvement in the lifecycle of cooperative models. Leveraging Huawei's accumulated experience in the consumer sector, it provides technical and service support to help enhance product competitiveness.

From a business perspective and scope, the component mode and HI mode are primarily focused on providing components and solutions to automakers by the Vehicle BU, with Huawei not participating in the overall vehicle design. In contrast, the HarmonyOS Intelligent Travel mode is primarily managed by Huawei's Terminal BG. Specifically, the relevant departments of the Terminal BG are responsible for product planning, vehicle development, engineering implementation, quality control management, supply chain management, production and manufacturing, channel sales, brand marketing, and after-sales delivery. The Solution Department of the Vehicle BU is responsible for stationing at automakers.

Focusing on five solutions, Huawei possesses core intelligent technologies encompassing chips, hardware, software, and cloud services. Based on this foundation, the Vehicle BU has successively launched a series of innovative solutions such as the MDC intelligent driving platform, LiDAR, 4D imaging radar, AR-HUD, HarmonyOS for vehicles, HUAWEI HiCar human-vehicle-home full-scenario smart interconnection, in-vehicle smart screens, in-vehicle charging, DriveONE electric drive, C-V2X, and autonomous driving cloud services. These solutions collectively form five major solutions: Kunlun ADS, Kunlun Vehicle Control, Kunlun Vehicle Cloud, Kunlun In-Vehicle Lighting, and HarmonyOS Cockpit, covering various aspects of intelligent connected electric vehicles. Huawei boasts strong technical prowess in the field of automotive intelligence, driving the transformation and upgrading of the automotive industry.

In addition, Huawei's AITO brand has also attracted investments from automakers. Xu Zhijun stated that by the end of 2024, he hopes to load all assets and personnel into AITO to achieve independent operation. AITO attracting investment partners from automakers is expected to alleviate financial pressure, and automakers investing in AITO are expected to gain more technical empowerment and longer-term benefits. Huawei is expected to collaborate with more automakers.

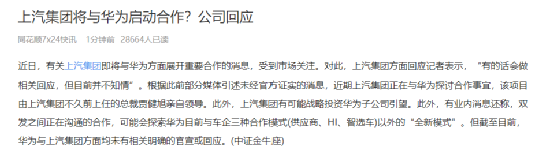

On November 27, 2024, there were reports in the market that SAIC Motor, which once claimed to "keep the soul in its own hands," would also cooperate with Huawei. However, SAIC responded that they were "unaware" of such plans.

In fact, regardless of how enterprises choose, the establishment of Huawei's Kunlun brand has already marked the official entry of China's entire vehicle industry into the era of "intelligent" competition. Intelligent driving is the top priority in "intelligent" competition. With solutions such as Kunlun ADS, Kunlun Vehicle Control, and Kunlun Vehicle Cloud, Huawei has formed a relatively clear leading advantage in the field of intelligent driving. In addition to the four major brands of the HarmonyOS Intelligent Travel lineup, there are also Dongfeng's RDI and MARS, Changan's Deep Blue and AITO, GAC Trumpchi, BAIC ARCFOX, BYD Fangchengbao, and more. If Jianghuai's Zunjie S800 becomes a hit in the future, it may attract more automakers to collaborate with Huawei in vehicle manufacturing.

© THE END

All materials are sourced from official and publicly available information

This article does not constitute any investment advice.

This article is originally created by Baker Street Detective. Please do not reprint without permission.