This woman made Musk's second attempt to claim his salary fail again

![]() 12/04 2024

12/04 2024

![]() 621

621

Sky-high salary continues to soar

Author | Wang Lei

Editor | Qin Zhangyong

The second season of Musk's 'salary claim saga' has officially concluded, and the result is another failure.

What frustrates Musk even more is that it was rejected by the same woman again.

On December 2, Judge Kathaleen McCormick of the Delaware Chancery Court once again rejected the Tesla compensation plan awarded to Musk in 2018, upholding the original ruling made in January this year.

Not only that, Judge McCormick also ordered Tesla to pay $345 million in legal fees to the plaintiff's lawyers.

Now, not only did Musk's huge salary go down the drain, but he also had to pay legal fees out of his own pocket.

01 The salary remains elusive

Before delving into the main text, it's important to note that Musk's Tesla compensation package is noteworthy not just because it is the highest compensation plan for an executive of a listed company in American history.

Its value has also soared along with the surge in Tesla's market capitalization, from $2.6 billion in 2018 to $56 billion when the first ruling was made in January this year.

Based on the closing price on December 2, it has soared to $101 billion (approximately RMB 740 billion).

Truly an astronomical figure.

Even as the world's richest man, Musk has had to fight hard to 'defend his rights.'

Back in January 2024, the Delaware Chancery Court ruled for the first time that Tesla's $56 billion compensation package awarded to Musk was invalid.

Angered, Musk directly criticized the ruling on his platform, saying, 'Never register a company in Delaware!' He even threatened to move Tesla's headquarters to Texas.

However, the Delaware Chancery Court in the United States is no small player.

This state court is renowned nationwide for its expertise in corporate law and corporate governance, especially its Chancery Court, which specializes in handling complex commercial disputes without a jury, making the judgment process faster and more professional.

As a result, since the early 20th century, Delaware has attracted a large number of businesses to register there. According to statistics, more than half of the Fortune 500 companies choose Delaware as their headquarters or place of registration.

The presiding judge at the time was Kathaleen McCormick, who ruled that Musk's compensation plan was 'too large and unconvincing' and that the Tesla Board of Directors had failed to prove that the compensation plan was fair, thus revoking the plan.

In other words, the Board of Directors was too obedient to Musk, with insufficient transparency in information disclosure and unfair negotiation processes, making the compensation less clear and justified.

Fast forward to December, the same location, the same people, and even the same reasons led to the rejection of Musk's compensation plan once again.

Judge McCormick believed that the Tesla Board of Directors was too close to Musk and failed to prove that the compensation plan was fair to shareholders. She supported the plaintiff's claim, representing Tesla's major shareholders, arguing that Musk and the Board of Directors should bear the responsibility of proving the fairness of the compensation plan, but they failed to fulfill this responsibility.

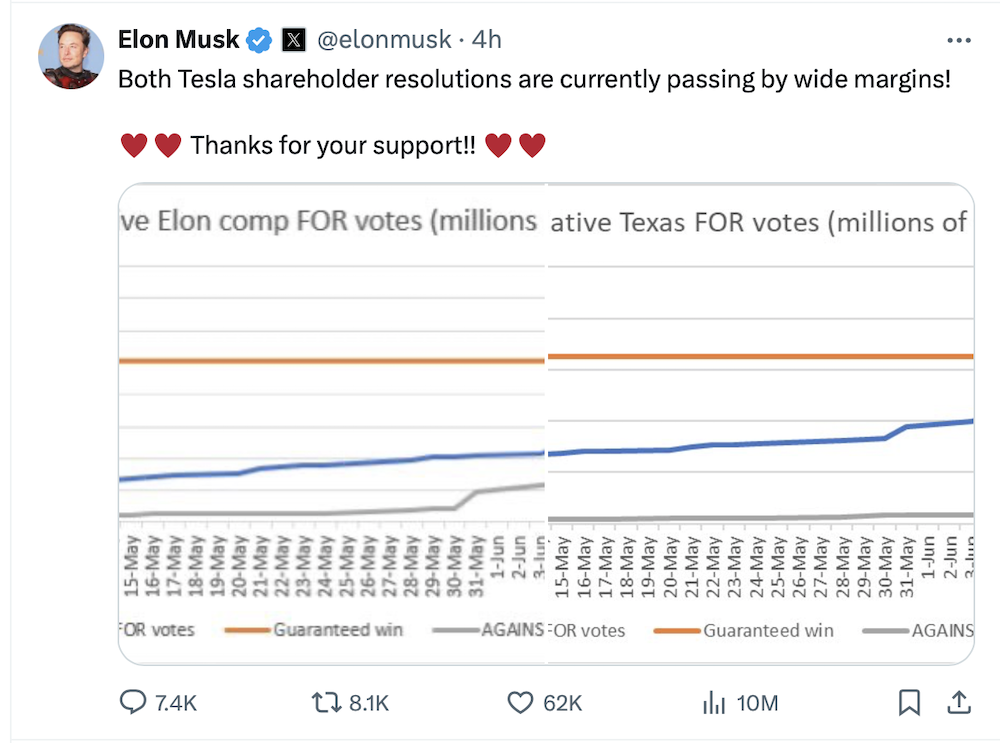

Although Tesla shareholders voted to approve this compensation plan again in June with 84% support (excluding shares held by Musk and his brother Kimbal Musk), this does not mean that Musk's sky-high salary is in the best interest of shareholders. Musk's control over Tesla can affect the independence of the Board of Directors and lead to conflicts of interest when reviewing compensation plans.

Due to Musk's relationship with Tesla, this vote was considered a controlled transaction subject to the 'entire fairness' review standard.

McCormick believed that Tesla's 'shareholder approval vote' should have been conducted before the trial. She also pointed out that Tesla made several material misrepresentations in the proxy statement for the shareholder vote, so the vote results could not be used as a 'panacea' to restore Musk's compensation.

In other words, even if the compensation package was approved by Tesla's shareholder meeting, due to the court's revocation order, it must be resubmitted to the court for reconsideration and the previous ruling must be overturned before the plan can be implemented.

McCormick also criticized the defense team (Musk's lawyers) for proposing innovative arguments that violated several fundamental principles of established law.

Finally, Judge McCormick wrote in her latest ruling: 'The motion for modification is denied, and the shareholder vote cannot produce an approving effect. If the court indulges the losing party in fabricating new facts to modify the judgment, litigation will become endless.'

After the judge's statement, Musk immediately responded on social media platform X, saying, 'It should be the shareholders who control company votes, not the judges.'

Tesla also issued a statement on platform X, saying, 'The ruling is wrong, and we will appeal.' She added that the judge had overturned the opinions of the vast majority of shareholders.

02 Musk's Salary Claim Saga

Looking back at the entire incident, even the richest man in the world has his troubles when it comes to 'claiming his salary.'

The story dates back to 2012 when Tesla was far from its current glory. To boost Tesla's market value and profit growth, Tesla announced a long-term equity incentive plan for CEO Musk.

From 2012 onwards, Musk stopped receiving any salary or cash bonuses from Tesla and could only receive rewards by achieving performance and market value management targets set by the Board of Directors; otherwise, he would receive nothing.

In 2018, Musk successfully increased Tesla's market value to $50 billion as scheduled and expanded into new business segments such as solar energy, enabling him to smoothly receive the equity incentives previously approved by the Board of Directors.

Tasting success, the Tesla Board of Directors formulated a new compensation plan, offering Musk the largest option check in history.

In simple terms, this plan is based on Tesla's market value over the next decade. When Tesla's market value target reaches $650 billion and relevant revenue and profit targets are met, Musk will receive 303 million Tesla stock options.

However, the Tesla Board of Directors set quite stringent prerequisites for this compensation plan. Each performance target consists of a market value target and an operational target. There are 12 market value targets, each worth $50 billion; and 16 operational targets, 8 based on revenue and 8 based on adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Based on this calculation, if Tesla's market value target reaches $650 billion, Musk will be able to unlock about 12% of Tesla's total share capital, with a total value of approximately $55.8 billion. Given that Musk already owns 13% of Tesla's shares, his shareholding ratio after cashing in the compensation will reach 25%.

Of course, if Musk fails to meet the targets, he will end up with nothing, effectively working for Tesla for free. Undoubtedly, the rewards and risks of this 'bet' are significant.

However, no one expected that after the compensation plan was announced, it would trigger a 'david and goliath' scenario.

In December 2018, a shareholder named Richard Tornetta accused Musk, arguing that six board members had good relationships with Musk, effectively making Musk the one who dominated the formulation of the entire compensation plan, thus compromising the board's independence.

Interestingly, Richard Tornetta only held 9 shares of Tesla stock, which, at the time of the lawsuit, were worth enough to buy only two Model S car models.

Nevertheless, it was this accusation by a retail investor that prompted the Delaware Court to intervene in the review. The case was accepted in 2022 and reached a climax on January 30 this year with a ruling by Judge Kathaleen McCormick of the Delaware Chancery Court.

The Delaware Court rejected Tesla's option incentive plan for Musk, criticizing Tesla for not accurately describing the process of formulating the plan in the compensation plan documents disclosed in 2018.

In her 101-page ruling, the court found that the Tesla Board of Directors relied too heavily on Musk when approving the compensation plan in 2018, resulting in a conflict of interest.

The proxy statement for shareholders misrepresented certain directors as independent, whereas they had extensive personal and professional relationships with Musk, which could affect their independence.

McCormick believed that the Tesla Board of Directors, under the influence of Musk, reached this compensation plan at an unfair price and ordered Musk to return the benefits he had already received from the plan.

At this point, the issue is no longer just about money but also about whether the local legal system can override the decisions of Tesla shareholders.

Musk himself has also said that he needs more Tesla shares to maintain control over the electric vehicle manufacturer and further expand into the AI field.