Tesla's Next Chapter: Is an Acquisition of xAI on the Horizon?

![]() 09/16 2025

09/16 2025

![]() 686

686

In the dynamic realms of technology and finance, rumors often originate as faint whispers in enthusiast forums, escalate into speculative discussions in financial media, and eventually find their way onto the most critical agendas, demanding undivided attention.

The potential merger between Tesla and xAI, another AI startup under the expansive umbrella of Musk's ventures, is precisely such a scenario that is gradually transforming from speculation into reality.

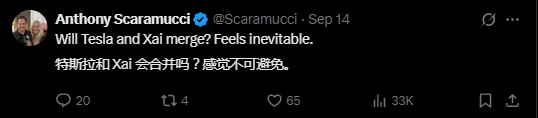

Last Sunday, a tweet from Anthony Scaramucci, the founder of SkyBridge Capital, added fuel to the already simmering expectations. He stated candidly: As Musk accelerates the integration of AI into his business empire, a Tesla-xAI merger 'feels inevitable.'

This was not an isolated comment. When a shareholder proposal urging Tesla to invest in xAI was formally submitted, and when Morgan Stanley uncovered hidden 'merger clauses' in Musk's potentially trillion-dollar new compensation package, it became evident to all: An AI behemoth straddling the digital and physical worlds, with a valuation potentially reaching $8.5 trillion, is on the rise.

Is this the wild imagination of capital or a strategic masterstroke by Musk? Today, Silicon Rabbit, leveraging insights from its expert team, will dissect the possibilities of this merger, which could define the century, and the AI future it heralds.

Merging a $100 billion-valued rising star (xAI) into a trillion-dollar giant (Tesla) is no impromptu decision. Through four key signals, we can clearly see how this path is being meticulously laid out.

1. A Formal Proposal: From Grassroots Demand to Official Agenda

It all began with Stephen Hawk, a retail shareholder of Tesla. His formal proposal suggested that the company invest in xAI and would be put to a vote at the annual shareholder meeting on November 6.

This seemingly small step carries immense symbolic weight. It marks the first time that the 'capital union between Tesla and xAI' has transitioned from public discussion to formal corporate governance.

As Hawk himself stated, his inspiration came from Musk's hints on social media. He believes that 'formally establishing this partnership is crucial for ensuring clear mutual interests.' This sentiment echoes the voice of the most loyal investors: We invest in Tesla because we invest in Musk's AI vision, and we don't want to miss out on xAI's massive success.

2. Trillion-Dollar Compensation: Hidden 'Merger Clauses' in the Fine Print

If the shareholder proposal was a 'bottom-up' push, then Musk's new decade-long compensation package represents a 'top-down' strategic design. Top-tier investment banks like Morgan Stanley view this package as the 'key' to unlocking the merger mystery.

Morgan Stanley analyst Adam Jonas keenly pointed out that a supplementary clause regarding acquisitions in the package is crucial to solving the puzzle:

'Market capitalization and adjusted EBITDA milestone targets may be adjusted to account for Tesla acquisitions deemed to have a significant impact on milestone achievement.'

In simpler terms: If Tesla undertakes a 'significant' acquisition (e.g., xAI) in the future, Musk's performance targets can be adjusted accordingly.

Wall Street's interpretation is straightforward: This is the most flexible institutional framework reserved for future xAI integration. It indicates that this potential merger has long been part of Tesla's strategic toolkit, awaiting the right moment.

3. Musk's 25% Control

Musk has been transparent about his stance on the merger. He not only solicited fan opinions publicly on the X platform but also told investors directly that he would 'act according to shareholders' wishes.'

Behind this lies his deeper consideration of Tesla's control. Musk has repeatedly expressed his desire to hold at least 25% of Tesla's equity to maintain veto power in control changes. However, simply increasing his stake through secondary markets is prohibitively expensive.

Merging xAI offers a perfect solution. Musk holds significant shares in xAI; if xAI is acquired by Tesla, his xAI stake would convert into new Tesla shares. This would substantially boost his ownership while addressing investor concerns about his divided attention, consolidating all core businesses onto Tesla's main platform—a win-win situation.

4. Wall Street's Exuberance

Capital markets are relentless in chasing narratives. When Gene Munster, a renowned analyst at Deepwater Asset Management, proclaimed that 'the Tesla-xAI combination could help the former reach an $8.5 trillion valuation,' Wall Street erupted.

This view stems from a fundamental reevaluation of Tesla's business model—it would no longer be seen merely as an electric vehicle or energy company but as a true, end-to-end, hardware-software integrated AI platform company. Such a company deserves an 'AI valuation premium' far exceeding traditional manufacturing.

Market frenzy must be grounded in solid commercial logic. The Tesla-xAI merger is considered a 'match made in heaven' because they occupy opposite poles of the AI world, each providing what the other desperately needs.

1. The Final Piece of the Puzzle

Musk has repeatedly emphasized that Tesla is a 'real-world AI company.' Its core mission is to enable AI to understand and interact with the physical world, exemplified by:

Autonomous Driving (FSD): Teaching cars to perceive, understand, and make decisions in complex physical traffic environments. Humanoid Robots (Optimus): Enabling robots to perform tasks in unstructured physical spaces like factories and homes.

xAI, meanwhile, focuses on 'digital-world AI.' Its core product, the Grok large language model, strives to understand and generate human language, code, and logic.

For hardware carriers like Optimus, physical-world perception and execution capabilities form its 'body,' while language models' cognitive and reasoning abilities constitute its 'soul.'

Only through deep integration can it comprehend complex instructions and translate them into actions. The Tesla-xAI merger aims to create such a 'unified mind-body' general artificial intelligence entity.

2. The Ultimate Closed Loop: From 'Seeing' to 'Understanding'

AI competition ultimately boils down to data competition. Tesla possesses the world's largest and exponentially growing dataset of real-world driving videos—the most valuable resource for training physical-world AI.

However, this data was previously used mainly for 'perception' tasks, such as identifying vehicles, pedestrians, and lane markings. After merging with xAI, Grok's powerful multimodal capabilities can deeply 'annotate' and 'understand' this vast video data, forming an unparalleled data flywheel:

Tesla's fleet collects massive video data → Grok models deeply understand and logically annotate the videos in the cloud → Train smarter FSD and Optimus models → Deploy to fleets and robots, improving performance and incentivizing more users to generate higher-quality data → The cycle repeats, driving exponential evolution.

Once this flywheel spins, its barriers will be so high that competitors will struggle to keep up.

3. Deep Hardware-Software Integration

The ultimate showdown in large model competition will be vertical integration of hardware and software. You need not only the best algorithms but also custom-designed, highly efficient chips and data center architectures tailored to your algorithms.

Tesla has its self-developed Dojo chips; xAI has the Grok model. Post-merger, they can achieve extreme optimization from bottom-layer chip design to data center construction and upper-layer model training, converting every watt of energy into effective computing power.

In fact, collaboration between the two companies is already quietly happening: Grok has been integrated into some Tesla vehicles and Optimus prototypes; xAI's computing center relies on Tesla Energy's Megapack industrial storage batteries for stable power supply.

When all logic points toward a merger, the remaining questions are: When and how?

For Tesla shareholders, this is an urgent issue. Watching xAI's valuation soar from billions to seeking $200 billion in new financing while being unable to directly share in this AI revolution's greatest dividends as Tesla investors is undoubtedly torturous.

The Tesla-xAI merger is no simple 'left hand to right hand' capital game. It represents Musk's inevitable step toward building an unprecedented AI vertical integration empire—spanning from foundational energy and custom chips to supercomputing power and cutting-edge algorithms, ultimately landing on automobiles and robots as physical carriers.

The November 6 shareholder meeting will be a critical juncture in this drama. Regardless of the vote's outcome, what we may be witnessing is not merely a corporate restructuring but the dawn of a new AI era.

When your team debates technical roadmaps endlessly, when investment decisions hang in the balance, when product strategies are shrouded in fog... remember: The confusion you face may have already been navigated by experts. At Silicon Rabbit, we believe: Authentic firsthand experience always comes from those driving industry transformation themselves.