NIO lost nearly RMB 100 billion in a decade. Whose money did Li Bin lose after all?

![]() 12/05 2024

12/05 2024

![]() 536

536

Author | Meng Xiao For more financial information | BT Financial Data Pass The main text consists of 2996 words, with an estimated reading time of 8 minutes

"Many investors have a question in mind: Who actually lost money in NIO's loss of over RMB 100 billion in ten years?"

On NIO's 10th anniversary, Li Bin failed to fulfill the 'ten-year promise' of achieving profitability. When NIO was founded, Li Bin anticipated making 20 billion yuan in car manufacturing and becoming profitable within ten years. Judging from NIO's latest financial report, Li Bin may have issued a 'bad check' as it is not only failing to turn a profit but is also continuously losing money, with losses exceeding RMB 5 billion for four consecutive quarters. NIO's younger rival, Li Auto, achieved full-year profitability in 2023 with a net profit of RMB 11.7 billion. NIO was officially established on November 25, 2014, becoming the first new-energy vehicle startup in China. A year later, Li Auto and XPeng were founded, forming the 'NIO-Li Auto-XPeng' new-energy vehicle startup landscape. On NIO's 10th anniversary, Li Bin sent a letter to all employees and another to users. In the letter to employees, Li Bin stated, 'There is still a significant gap between our system capacity building and our goals.'

The letter to users expressed gratitude to car owners for their unwavering support. As the eldest brother among new-energy vehicle startups and the first to be listed on the US stock market, NIO rang the opening bell at the New York Stock Exchange on September 12, 2018, nearly two years earlier than Li Auto and XPeng. NIO's market value was consistently the highest among the three startups, peaking at USD 140 billion. However, as of the US stock market close on December 2, the share price had dropped from a high of USD 66.99 to USD 4.40, a decline of 93.4%, with a market value of only USD 9.198 billion, a sharp decrease of over USD 130 billion. During the same period, Li Auto's US market value was USD 24.19 billion, and XPeng's was USD 12.05 billion.

NIO, previously considered the leader among new-energy vehicle startups, has become a concern in the market. Why is that?

1

A Decade of Change: How Many New-Energy Vehicle Startups Remain?

Some say Elon Musk is the godfather of China's new-energy vehicles, and it certainly seems that way. In late April 2014, Tesla founder Elon Musk handed over the keys to the first batch of Model S cars to eight Chinese customers, including Li Xiang, the founder of Autohome, and Yu Yongfu, the chairman and CEO of UCWeb. Li Xiang later founded Li Auto, while Yu Yongfu was a key figure in the success of He Xiaopeng, who, inspired by Musk's speech after achieving financial freedom with a wealth of USD 4 billion, embarked on his own car manufacturing venture. Inspired by Li Bin, Li Xiang, and He Xiaopeng, a wave of new-energy vehicle manufacturing emerged in China, with brands like LeTV's car venture by Jia Yueting, WM Motor by Shen Hui, and Singulato Motors by Shen Haiyin springing up like mushrooms after rain. Real estate companies and even home appliance industries also entered the race, with Evergrande Auto and Dongmingzhu's Yinlong Auto joining in. According to a set of data from Xinhua News Agency, the number of new-energy vehicle startups reached 487 in 2018.

Now, as the tide recedes, most new-energy vehicle entrants have been left stranded on the shore. With new players like Lei Jun and Huawei entering the race, the new-energy vehicle sector has officially entered a brutal phase of survival of the fittest. According to media analysis, only '4+1' startups remain from the first batch after just a few years. The '4' refers to NIO, Li Auto, XPeng, and Zero Run, while the '1' is Nezha. NIO is fortunate in this regard, as brands like WM Motor, Gofun, and Leiding, as well as lesser-known ones like Youxia Auto, Singulato Motors, and Ludiangfangzhou, have fallen by the wayside. Who will be the next automaker to exit the race?

Li Bin's previously mentioned RMB 20 billion was essentially the initial stake to enter the game, with subsequent stakes requiring more 'ammunition.' The initial investments by NIO, Li Auto, and XPeng far exceeded RMB 20 billion. NIO, with a total loss of RMB 96.013 billion over ten years, must find a solution.

2

Whose Money Did NIO Lose in Its RMB 100 Billion Loss?

On November 20, NIO released its Q3 2024 financial report, showing revenue of RMB 18.674 billion, lower than market expectations and a year-on-year decrease of 2.1%. The net loss was RMB 5.06 billion, compared to a net loss of RMB 4.557 billion in the same period last year, marking NIO's fourth consecutive quarter with losses exceeding RMB 5 billion. In the first three quarters of this year, NIO's revenue was RMB 46.03 billion, a year-on-year increase of 19.51%, with a net loss attributable to shareholders of RMB 15.53 billion, a year-on-year increase of 0.18%. The net losses for the three quarters were RMB 5.258 billion, RMB 5.126 billion, and RMB 5.142 billion, respectively.

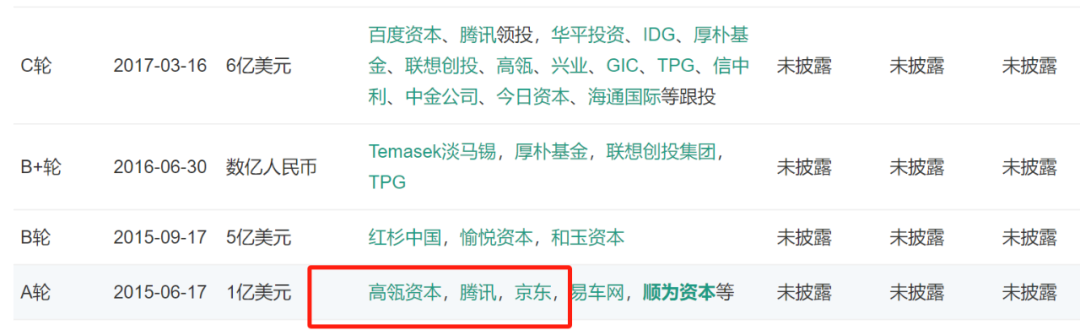

In 2010, Li Bin successfully listed BitAuto, with a market value of up to USD 581 million. Based on Li Bin's 18.94% shareholding at the time, his net worth exceeded USD 100 million. However, this was far from the RMB 20 billion needed for car manufacturing. Despite Li Bin describing car manufacturing as 'a worthwhile endeavor worth dedicating one's life to,' NIO's start-up funds relied heavily on investments. Li Bin received strong support from Lei Jun, who said, 'When you pull the trigger, just come to me directly.' Li Bin even convinced Liu Qiangdong to say 'Yes' in just 15 minutes. Li Bin also approached Li Xiang, who was interested and became an early investor in NIO but could not join due to disagreements over reporting structures.

In 2019, Li Bin was dubbed 'the unluckiest person of the year' by the media as NIO, which had just been listed on the US stock market for a year, was experiencing growing pains, including spontaneous combustion of the ES8, recalls, a sharp drop in share price, and financing difficulties. NIO was on the brink of survival. Li Bin admitted on CCTV's 'Meet the Masters' that 'I've talked to everyone in my network... I'm willing to accept any conditions, but I haven't found a cent. Cash flow was calculated daily; if funds weren't in place one day, there would be news the next day.' To find funding, Li Bin traveled to 18 cities across China but to no avail. Crucially, Hefei, known as the city of venture capital, stepped in with a RMB 7 billion investment, saving NIO. Later, an investment of over USD 2.2 billion from the Abu Dhabi Investment Authority further stabilized NIO's finances. Li Bin has repeatedly delayed NIO's profit timeline. He previously predicted that NIO would become profitable in Q4 2023 and achieve break-even in 2024. However, he later withdrew this prediction, pushing back the break-even timeline by a year. Now, he has delayed the profitability target to 2026. However, the cash flow of RMB 38.6 billion during the reporting period has been continuously decreasing.

3

How Did Li Bin Lose RMB 100 Billion?

Since 2016, NIO has averaged a loss of over RMB 10 billion per year. Based on 2023 sales and net losses, NIO sold 160,000 vehicles with a net loss of RMB 21.15 billion, resulting in a net loss of RMB 132,200 per vehicle. This means the more cars NIO sells, the more it loses, with the RMB 21.15 billion loss being the highest annual loss for NIO. NIO delivered its first new car in May 2018, selling 11,348 vehicles that year. From the first new car delivery to the first ten months of this year, NIO has sold approximately 615,000 vehicles. Based on NIO's total loss of RMB 100 billion, the overall loss per vehicle is approximately RMB 163,000. NIO's significant losses may be related to Li Bin's heavy investments in various areas, including smartphone production, self-developed batteries, lidar chips, and battery swapping stations. As of the end of November 2024, NIO had established 2,714 battery swapping stations nationwide. According to previous disclosures, each station costs at least RMB 3 million to build, meaning NIO has invested nearly RMB 10 billion in battery swapping stations alone.

Excessive salaries may be another significant factor in NIO's losses. In 2023, employee compensation totaled approximately RMB 10 billion, with R&D personnel alone accounting for RMB 8.998 billion, or an average salary of RMB 600,000 to 800,000 per employee. This is just NIO's annual expenditure on salaries.

Sales expenses are also a significant cost. The lower the proportion of R&D and sales expenses to total revenue, the more benign the enterprise's development. In 2023, Li Auto's total R&D and sales expenses accounted for 16% of revenue, while Zeekr and XPeng accounted for around 30%. NIO's proportion was 47%. It's not surprising that Li Auto is profitable under these circumstances. When NIO's share price peaked in 2021, Li Bin's net worth reached RMB 45 billion. According to the latest 2024 Hurun China Rich List, Li Bin's wealth has shrunk to RMB 8 billion, a decrease of RMB 37 billion from three years ago, representing an 82% drop. His ranking also fell from 137th in 2021 to 656th in 2024, a drop of 519 places. Even so, his personal wealth is still much higher than when BitAuto was listed. Currently, NIO's new businesses focus on battery manufacturing, chip research and development, and battery swapping station construction, all of which require significant financial support. With continuous losses, NIO must carefully plan for the future during its year-end summary meeting. Returning to the initial question, who has borne the brunt of NIO's RMB 100 billion loss over ten years?