Detroit giant in a hurry, $5 billion overhaul, clutching onto the Chinese market for production on demand

![]() 12/06 2024

12/06 2024

![]() 409

409

China business is a quality asset

Written by | Liu Yajie

Edited by | Qin Zhangyong

Facing the Chinese market, GM has embarked on drastic reforms.

GM is willing to spend $5 billion to restructure its Chinese operations.

Paul Jacobson, CFO of GM, admitted that this was a "tough decision," but it was only a temporary pain, and GM would become "profitable on a smaller scale."

GM China also responded, stating that the China business is a quality asset for GM's present and future. To achieve long-term development goals, measures are being taken to reduce inventory, produce on demand, protect the pricing system, and reduce fixed costs. Due to these effective measures, sales and market share have achieved continuous growth.

In other words, the Chinese market is crucial, and GM will not only continue its operations there but also believes it will get better and better.

01 Spending heavily to restructure China operations

First, let's see how the $5 billion is being spent.

On December 4, GM disclosed in a filing with the U.S. Securities and Exchange Commission (SEC) that due to poor performance in the Chinese market, it would restructure its joint venture with SAIC Motor. In this process, non-cash expenses and write-downs in China exceeded $5 billion.

On the one hand, during the three months ending December 31, 2024, its equity in the Chinese joint venture will record non-temporary impairments of $2.6 billion to $2.9 billion.

On the other hand, approximately $2.7 billion in additional equity losses will be recognized due to the restructuring of SAIC-GM, including costs related to plant closures, product line eliminations, and restructuring of the company's operating structure.

Simply put, it involves optimizing product lines, such as cutting unprofitable models.

According to GM, most of the restructuring costs will be recorded in the fourth-quarter financial report. These non-cash expenses will reduce the company's net profit but will not affect adjusted pretax earnings.

Before announcing the value write-down, GM valued its stake in the joint venture with SAIC Motor at $6.4 billion as of the end of 2023.

The current write-down of SAIC-GM's value also indicates that GM's business in China is currently facing significant obstacles.

While GM has not disclosed specific details about plant closures, it has already laid off thousands of employees in the second half of this year to reduce losses.

As early as August, there were rumors that GM would soon meet with SAIC to discuss larger-scale structural reforms for its business in China, including production capacity reductions.

Moreover, the cooperation agreement between GM and SAIC expires in 2027. The current situation is urgent, coupled with the aggressive encroachment of Chinese brands on market share. GM's business in China is currently under tremendous pressure.

Fortunately, these measures have begun to take effect. GM China stated that in the third quarter of this year, GM's sales and market share in China both achieved quarter-on-quarter growth. For the first time, sales of new energy vehicles, including pure electric and plug-in hybrid vehicles, surpassed those of traditional fuel vehicles. In November, GM's sales in China achieved month-on-month growth for the fifth consecutive month. Since the beginning of this year, dealer inventory has been reduced by more than 50%.

GM stated in its announcement that it would focus on capital efficiency and cost discipline and has been working with SAIC-GM to turn around its China operations to achieve sustainable development and profitability in the market. "We are about to finalize the restructuring plan with our partners, and we estimate that our performance in China in 2025 will improve compared to the same period last year."

02 L2+, 6C, 900V...

Once upon a time, GM could be said to have made easy money in China.

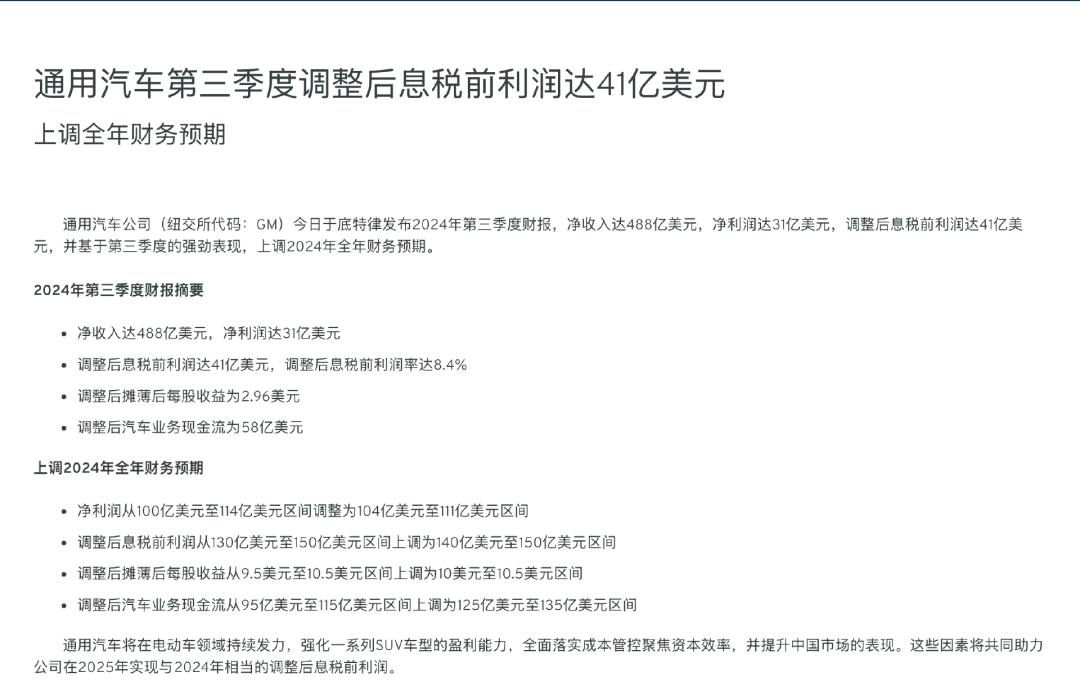

In 2017, its profits reached $2 billion, but profitability has since declined, and the Chinese market has become a weakness for GM. In the third quarter of this year, GM's overall performance was remarkable, but it stumbled in the Chinese market.

Financial reports show that in the third quarter of this year, GM generated global revenue of $48.8 billion, a year-on-year increase of 10%; net profit was $3.1 billion, and adjusted automotive business cash flow was $5.8 billion. Based on the performance of the first three quarters, GM once again raised its full-year financial targets.

However, focusing on the Chinese market, sales in China fell by 18% in the first nine months of this year, with cumulative losses reaching $340 million.

The reasons for the setback largely lie in the rise of Chinese auto brands, which are fiercely competing in terms of price and product strength, making it increasingly difficult for GM to expand or even maintain its market share in China.

Mary Barra, CEO of GM, admitted during the third-quarter earnings call that the market environment in China was tough and that some Chinese auto brands did not seem to prioritize profitability but absolutely prioritized production volume.

It's not just GM; with the increasing penetration of new energy vehicles, the competition in intelligence and electrification is fierce, and it is difficult for some joint venture brands to regain their past glory.

GM clearly understands this and is preparing for the upcoming competition.

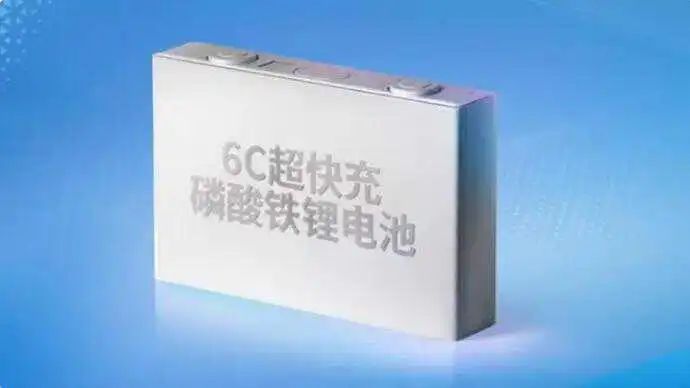

In September, SAIC-GM and CATL jointly launched a 6C ultra-fast charging LFP battery, which can add more than 200 kilometers of range with just 5 minutes of charging. The new battery will be installed in a pure electric vehicle model next year.

We all know that the currently prevalent highest charging rate on the market is 5C, which means it takes 1/5 of an hour to fully charge. SAIC-GM has directly increased the speed to 6C, ranking at the forefront not only among joint ventures but also in the entire new energy industry.

GM is also jointly developing the 900V Ultium electric platform with SAIC-GM, which can accommodate new technologies such as solid-state batteries, 6C rate cells, and silicon carbide electric drives. The 6C ultra-fast charging battery mentioned above will be available on this platform next year.

In July this year, SAIC-GM launched the NOP intelligent pilot assistance system, which can cover high-speed roads, viaducts, urban expressways, and other road conditions, equivalent to L2+ level advanced intelligent driving. It is currently equipped on models such as the Buick Century and Buick GL8 PHEV.

Although the effectiveness of some measures has not yet been evident, GM has consciously aligned itself with the industry's top technology, and its sales have also been boosted.

Taking the GL8 as an example, Buick GL8 family orders exceeded 15,000 units in November, setting a new monthly order record for 2024. GL8 PHEV sales and orders maintained double-digit month-on-month growth in November, with GL8 Luxuria PHEV orders rising by 108% month-on-month. Cumulative sales in the first half of this year reached nearly 20,000 units.

In November, GM's retail sales in China exceeded 200,000 units, with a month-on-month increase of 18%, marking the fifth consecutive month of month-on-month growth. New energy vehicle sales accounted for 58% of total monthly sales in October.

As a seasoned player in the automotive industry, GM has been deeply rooted in China for many years. Facing the aggressive advancement of domestic auto companies that "spare no expense," the Detroit giant has to invest heavily to preserve its market share in China. Whether this restructuring plan can succeed will be up to the market to verify.