Reserve $36.3 billion for restructuring! GM may close factories and lay off staff in China again

![]() 12/06 2024

12/06 2024

![]() 629

629

GM has once again "acted" against the Chinese market.

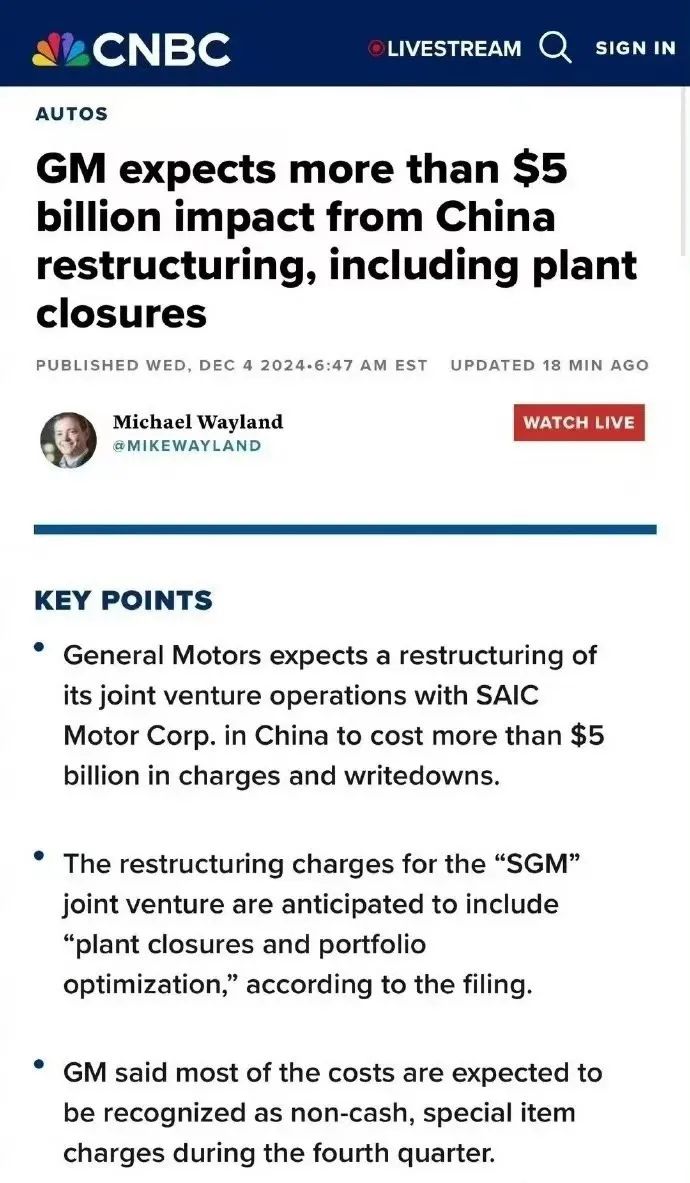

On December 4 local time, GM disclosed in a document submitted to the U.S. Securities and Exchange Commission (SEC) that it plans to incur over $5 billion in expenses and asset impairments in the restructuring of its China operations to regain market share in China. Paul Jacobson, GM's Chief Financial Officer (CFO), stated that this is a "tough decision" but will enable GM to "become profitable on a smaller scale."

The adjustments include GM writing down the value of its shares in the joint venture SAIC-GM by $2.6 billion to $2.9 billion (approximately RMB 18.9 billion to RMB 21.1 billion). Additionally, GM expects to incur an additional $2.7 billion (approximately RMB 19.6 billion) in restructuring costs, encompassing product mix optimization and plant closures. Optimizing the product mix involves reducing the production of unprofitable models, while plant closures may lead to a new round of layoffs.

According to foreign media reports, GM's restructuring efforts in China have entered their final stages. GM is confident in the future of SAIC-GM and believes that SAIC-GM can restructure without additional funding, reverse its China operations, and aim to resume profitability in China by 2025. If this is true, the restructuring in China is not far off.

In response to news of the restructuring of its China operations, GM China issued a statement on December 5 stating, "Our China operations are a valuable asset for our present and future. Our cooperation and communication with our joint venture partner, SAIC Motor, are closer than ever to achieve profitability and sustainable development."

Apart from affirming that cooperation between the two parties will become closer, GM China also mentioned the pursuit of long-term development goals. GM stated that GM China is adopting a series of measures, including reducing inventory, producing on demand, protecting the pricing system, and lowering fixed costs. According to GM China, these measures have resulted in quarter-on-quarter growth in sales volume and market share in China during the third quarter of this year. Additionally, dealer inventory has been reduced by over 50% since the beginning of the year, enabling the company to better manage pricing and cost systems.

GM China's response indicates that GM does not intend to abandon the Chinese market, as it did with markets like Europe, India, and Australia, but will continue to persevere in the Chinese market. However, in the statement, GM China did not directly address the restructuring or disclose details that have garnered public attention.

In fact, in August this year, there were reports that GM planned to carry out a larger-scale structural reform of its operations in China. Shortly thereafter, in September, news emerged of large-scale layoffs at SAIC-GM. In October, GM's Chief Executive Officer (CEO) Mary Barra mentioned that actions would be taken in the fourth quarter to make the business sustainable and profitable. Regarding China operations, Barra stated, "The operating environment in China remains challenging, and GM and its partners have more arduous work ahead."

Regarding the cooperation between GM and SAIC, there were also rumors in August that GM would sell the Buick brand to SAIC and that the Chevrolet brand would exit the Chinese market. In response, Lu Xiao, General Manager of SAIC-GM, stated that the structure of the three major brands under SAIC-GM would remain stable, and that both shareholders had reached a consensus on continuing their cooperative investment in the Chinese market.

China has long been GM's largest global market. However, due to the rise of domestic autonomous brands and the impact of the electrification transition in recent years, GM's sales in the Chinese market have declined significantly, making the US domestic market GM's largest global market. In 2017, SAIC-GM reached a sales peak of 2 million vehicles. However, in 2023, SAIC-GM's sales had halved to 1.17 million vehicles.

Due to declining sales, GM has also incurred losses in China. In the first three quarters of this year, SAIC-GM's cumulative sales were 724,000 vehicles, a year-on-year decrease of 61%. In July, SAIC-GM's sales fell to as low as 15,000 vehicles, which was even less than the monthly sales of its flagship model alone. The company explained at the time that this was due to clearing inventory to lighten its load.

Due to declining sales, GM has also incurred losses in China. In 2017, when SAIC-GM had its highest sales, GM's investment returns in the Chinese market reached $2 billion. However, GM has now incurred losses in the Chinese market for three consecutive quarters. In the third quarter of this year, GM's China operations incurred a loss of $137 million, and in the first three quarters, GM incurred cumulative losses of $347 million (approximately RMB 2.5 billion) in China.

To cope with sales pressure in the Chinese market, SAIC-GM underwent a "leadership change" in August and has been taking continuous actions at the product and marketing levels. The most intuitive change that the market has witnessed among these initiatives is the new "fixed-price" pricing system. Starting with the all-new Cadillac XT5 on September 14, SAIC-GM introduced the "fixed-price" model for the first time.

Subsequently, SAIC-GM adopted the "fixed-price" model across multiple models, including the Envision PLUS, E5, 2025 Buick LaCrosse, GL8, and all-new XT6. This one-step pricing has led to a surge in orders for multiple mainstay models from SAIC-GM. For example, in November, the Buick GL8 family received over 15,000 orders; Envision PLUS sales reached 12,809 vehicles; 2025 Buick LaCrosse sales reached 4,603 vehicles, up 50.5% year-on-year and 215% quarter-on-quarter; and Buick E5 sales reached 3,039 vehicles, up 165% year-on-year.

This has directly contributed to the improvement of SAIC-GM's overall sales. According to SAIC Motor's production and sales bulletin, SAIC-GM sold 56,241 vehicles in November. Its sales this year have exceeded 600,000 vehicles. Although monthly sales in November showed a year-on-year decline of 35%, the decline has slowed. On a month-on-month basis, SAIC-GM's sales have increased for four consecutive months, with a month-on-month growth rate of 55% in November. Of course, for SAIC-GM, this is just the beginning, and sustaining this growth is crucial to turning a profit in the Chinese market.