Facing “Market Anxiety”, Lotus Only Attacks, Never Defends

![]() 12/06 2024

12/06 2024

![]() 505

505

At this pivotal moment, which is both a milestone and a turning point, it is crucial for Lotus to focus on its gradual transformation towards electrification and its globalization strategy.

Recently, Lotus announced its shift to the plug-in hybrid market and plans to introduce a new “Super Hybrid” power system in 2026. This news has caused widespread concern and heated discussion in the industry.

In response to online comments such as “Lotus bows to the gas tank” and “due to poor sales performance”, Lotus Group CEO Feng Qingfeng recently emphasized in an interview with BusinessCars, “Hybrid power is merely a change in power form. Lotus has never given up on electrification. According to our plan, Lotus’s hybrid technology still emphasizes electricity and will not change its positioning due to changes in power form.”

Based on market demand forecasts, Lotus introduced the “Lotus Beyond Range” super hybrid technology at this year’s Guangzhou Auto Show. However, Feng Qingfeng admitted that Lotus’s super hybrid technology is still in the development stage, and the market launch date has not yet been determined. However, all future products, including sports cars, will move in this direction.

In Feng Qingfeng's view, Lotus's current actions regarding technological innovation and transformation outcomes demonstrate some new development possibilities for an “ultra-luxury electric” brand in the context of the new energy explosion.

Breaking Sales Bottlenecks with Hybrids

As everyone knows, Lotus was the first luxury supercar brand to fully embrace electrification.

In October 2018, Lotus launched the “Vision80” brand rejuvenation plan, announcing a transition to full electrification and intelligence. In 2019, Lotus quickly introduced its first pure electric supercar, the EVIJA, and expected to achieve a 100% pure electric vehicle product portfolio by 2027.

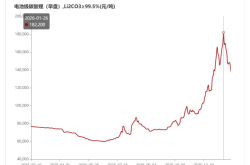

However, this also brings three major challenges for Lotus: battery technology, driving range, and market acceptance.

The current bottleneck in battery technology is one of the main difficulties faced by pure electric vehicles. Although battery technology has made some progress, there is still room for improvement in driving range, charging efficiency, and safety.

“I believe hybrids are also a direction for electrification. They are a solution that better meets user needs. Currently, electric vehicles do have some pain points, such as the long-tail effect,” said Feng Qingfeng.

Take China as an example. Although China has the highest number of charging piles globally, there are still many inaccessible areas, undoubtedly causing some anxiety among consumers. Looking at the global charging pile market, the development is even more uneven. For example, South Korea's charging pile layout is very fast, while Japan is relatively slow, and the Middle East, Asia-Pacific, and Africa are even slower.

In his view, this is an important reason why Lotus needs to find a better technical route.

On the other hand, it is necessary to meet users' high-performance needs on this basis.

It is reported that in the high-end automobile market, customers are not very enthusiastic about pure electric models, mainly because the performance of current electric vehicles has not yet reached a level that attracts consumers. Many consumers who seek a luxury car experience have a special preference for the power response and driving pleasure provided by traditional 8-cylinder and 12-cylinder gasoline engines, which pure electric vehicles cannot yet match.

In addition to acceleration and precise handling, high-end market requirements for vehicle performance also include the charm of engine sound, smoothness of power output, and reliable driving range. Therefore, abandoning pure electric drive at this stage and developing hybrid models using the advantages of gasoline engines seems to be a reasonable compromise to Feng Qingfeng.

It is reported that Lotus's Lotus Beyond Range super hybrid consists of high-performance and efficient motors, batteries, and turbocharged engines. The characteristics of this super hybrid technology can be summarized with the numbers “1”, “2”, and “5”:

“1” represents a comprehensive driving range of over 1,100 kilometers;

“2” represents industry-leading dual flash charging technology, including plug-in flash charging and autonomous flash charging during driving;

“5” represents the autonomous flash charging technology during driving, which is realized by the turbocharged engine continuously fast-charging the battery during driving. The charging speed provided is more than five times the normal driving power consumption speed. This also ensures that users can enjoy uninterrupted high-performance electric experience in any scenario, completely eliminating the problem of “power depletion”. Especially during secondary acceleration on highways or in extremely cold weather conditions, high-performance electric experience will not be compromised.

However, Feng Qingfeng emphasized, “It's a hybrid, not a plug-in hybrid.”

Regarding the difference between a hybrid and a plug-in hybrid, Feng Qingfeng said, “A plug-in hybrid is mainly driven by an engine with electricity as a supplement. What Lotus does is called a hybrid, which is mainly driven by electricity with the engine as an auxiliary. This is the difference between the two.”

The reason why Lotus did not choose the extended-range electric vehicle (EREV) preferred by the Chinese market, Feng Qingfeng explained, “Lotus does not do EREVs because they have a significant weakness: when the battery is depleted, performance is lost. Lotus uses hybrid solutions to provide both the experience of electricity and high-performance needs. Lotus's strategy has two main points: first, as long as there is fuel, there will definitely be electricity; second, even if there is no fuel left and the battery is only 5% charged, Lotus still maintains high-performance output. This is the advantage of our over 900V architecture, which enables fast charging and discharging.”

Regardless of the power form, Feng Qingfeng believes that Lotus's future development direction is still to pursue the ultimate vehicle performance, which is also Lotus's core competitiveness in the new energy sector.

How to “Strive for the Top”

In the past decade, the Chinese market has successively become a global key market for multiple ultra-luxury brands. In 2015, China became Porsche's largest single market globally and has maintained this position for the following seven consecutive years. In 2016, China was the second-largest market for Maserati, with its flagship model, the Quattroporte, being the top-selling model globally.

However, according to statistics, sales of ultra-luxury brands such as Bentley, Lamborghini, and Ferrari have declined in China since last year, with year-on-year declines of 17.76%, 16.99%, and 4.07%, respectively, in 2023.

From another perspective, actions regarding technological innovation and transformation are also Feng Qingfeng's breakthroughs in addressing “market anxiety”.

In addition, for the first three quarters of 2024, Lotus also delivered a remarkable financial report. In the third quarter of 2024, Lotus's total revenue was $255 million, a year-on-year increase of 36%; for the first nine months of 2024, its total revenue reached $653 million, a year-on-year increase of 105%.

Despite significant revenue growth, Lotus is still incurring losses. Its net loss for the first three quarters of 2024 was as high as $459 million. At the same time, Lotus's gross profit margin also decreased by 2 percentage points to 9% from 11% in the same period of 2023.

Regarding gross margin fluctuations, Feng Qingfeng said, “The current fluctuation in gross margin is due to the relatively small absolute volume. As the volume increases in the future, gross margin fluctuations will decrease. Achieving a 20% gross margin by 2026 is guaranteed.”

Currently, Lotus has also proposed a new “Win26” strategy to further optimize internal processes and structures, readjust product plans to cater to the globally diversified market, and achieve positive EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and operating cash flow by 2026.

Although Lotus still has shortcomings in terms of gross margin and profit, its continuous growth demonstrates its uniqueness and specialty, distinguishing it from other ultra-luxury brands.

From sales data in the first three quarters, sales in overseas markets were the main driver of Lotus's sales growth. The European market is becoming the sales center. In the first three quarters of this year, the proportions of the European and North American markets increased by 17 and 22 percentage points, respectively, while the proportion of the Chinese market decreased by 37 percentage points year-on-year.

Specifically, in the first three quarters of this year, Lotus delivered 2,683, 1,880, and 1,664 vehicles in the European, Chinese, and North American markets, accounting for 35%, 25%, and 22% of total deliveries, respectively.

Among overseas revenues, service revenue is also a category that Lotus has maintained high growth. “Lotus has always adhered to intelligence and full-stack independent research and development since its inception, and is now beginning to see returns. Intelligence not only serves Lotus but also serves others,” Feng Qingfeng revealed. In the first three quarters of this year, Lotus's service revenue was $29 million, a year-on-year increase of 129%.

Regarding Lotus's investment in intelligence, Feng Qingfeng also shared his insights. He believes, “The competition in the automotive industry is not about distinguishing between power forms but about intelligence. Intelligence is the soul of a car. When intelligence truly arrives in the future, it will be the moment to decide the winner on the racetrack.”

Maintaining an upward trend is not easy, especially in the highly competitive automotive market. It tests an enterprise's sensitivity to environmental changes, decision-making ability, and execution efficiency. Of course, a profound brand heritage is also indispensable. Especially as the price war enters deeper waters, Feng Qingfeng clearly stated that Lotus does not want to engage in price competition and still wants to highlight product value.

Following the release of the Taizhou Declaration, Geely Automobile has continuously promoted multiple internal integration initiatives. In Feng Qingfeng's view, the core of Geely's integration strategy is to achieve stronger resource sharing.

“The benefit for Lotus is that in addition to maintaining its traditional strengths in lightweighting, aerodynamics, and handling, it can also do what it should in new technological fields, such as full-stack independent software research and development, intelligent cockpits, intelligent driving, and intelligent chassis.”

Feng Qingfeng believes that Lotus should focus on and maintain its core competencies while being more “reliant” on resource collaboration in some areas.

“For example, the main role of the architecture is data transmission for the entire vehicle. Developing an architecture requires an investment of at least 10 billion yuan. It is not cost-effective for Lotus to invest alone. In this case, it can be shared throughout the Geely system.”

Now, Lotus has reached a critical stage in its journey to break through and is expected to usher in a new round of acceleration. At this pivotal moment, which is both a milestone and a turning point, it is crucial for Lotus to focus on its gradual transformation towards electrification and globalization strategy.

Therefore, Lotus's next goal is to capture over 50% of the market share in China's entire ultra-luxury segment by the end of this year. If it can obtain support from the Chinese market, Lotus's goal of capturing 4% of the global luxury car market by 2028 may be achieved ahead of schedule, which is also what Feng Qingfeng hopes for.