Chinese automakers are abandoning the fantasy of the middle class

![]() 12/09 2024

12/09 2024

![]() 506

506

Every December, new car prices hit new lows due to automakers' price cuts to boost sales. When Tesla introduced a "5-year 0% interest" offer on top of its official price reductions, the year-end sales push in 2024 became even more thrilling.

However, after nearly two years of price wars, Chinese consumers have become accustomed to the spectacle. Tesla frontline staff told LUKA Auto that many potential customers attracted by promotions chose to "wait and see" after learning that new models would be released next year.

As consumers become more rational, they want to maximize the value of every penny spent... especially when the middle class is also feeling the pinch. "It's now the middle class's turn to live a 'Pinduoduo'-style life," a top securities trader recently went viral for this comment during an internal sharing session, even suggesting "abandoning the middle class."

Before this, luxury brands had already sensed the middle class's consumption downgrade. Blue-blood brands like Hermès and Chanel chose to raise prices, effectively distancing themselves from the middle class. Young people are abandoning Uniqlo for Pinduoduo, a development even the founder, Tadashi Yanai, didn't foresee.

This bifurcated consumption trend plays out daily, making one marvel at the "complexity of China." As economists discuss an M-shaped society with a dwindling middle class, M-shaped consumption polarization is already underway. In the Chinese auto market, automakers are also abandoning the fantasy of the middle class and readjusting their expectations of consumer spending power.

Squeezed premium space

When entry-level BBA models can be bought for just over 200,000 yuan, you can imagine how devastating price wars are to traditional luxury brands' premium space. Admittedly, the overall decline in luxury brands' premium space is directly related to the rapid rise of domestic new energy vehicles. When consumers have more choices, luxury brands also have to stoop to price cuts to stimulate sales.

Setting aside the value of a brand, luxury brands' high premiums give them ample room to transfer value. Even more brutally, more and more non-luxury brands are also actively or passively reducing premiums.

There are countless examples... Many automotive executives have publicly expressed similar views that when so-called "luxury" can be achieved at a lower cost, high-end status no longer equates to high prices. Put simply, once a car is sold cheaply, it becomes difficult to sell it expensively again.

In July this year, BYD's premium brand FANGCHENGBAO announced a price reduction for its first product, the Leopard 5, with the starting price lowered by 50,000 yuan.

Shortly before the Leopard 5's official price reduction, Fangchengbao's General Manager Xiong Tianbo revealed in an interview that while the market capacity for B-segment SUVs, where the Leopard 5 is positioned, has expanded, price points have shifted downward, with more products priced below 200,000 yuan.

This is true. When consumers are no longer willing to pay for the "brand upward" narrative, a new brand must cut its own throat to survive. As a significant consumer item, the auto industry serves as a barometer for the overall consumption environment. When the middle class is also feeling the pinch, the price range above 200,000 yuan is the first to be affected.

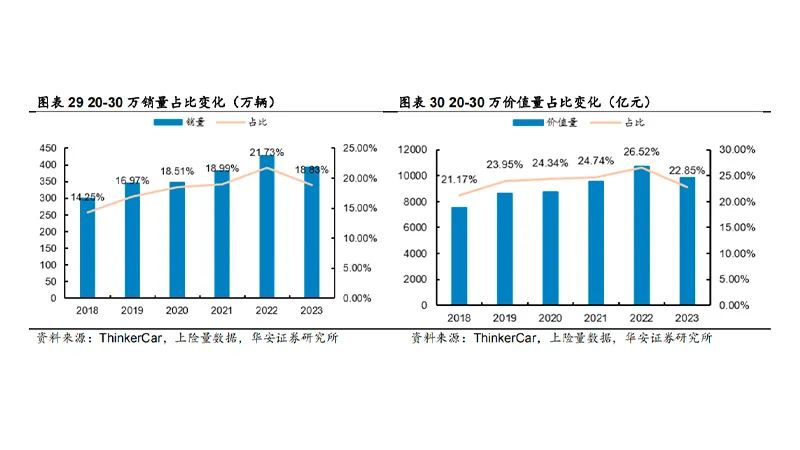

Taking 2023 data as an example, from 2018 to 2022, as the middle class's spending power rose, the automotive market above 200,000 yuan expanded rapidly. In the mainstream 200,000-300,000 yuan range, the proportion of car sales increased from 14.25% to 21.73%. However, the price war in 2023 interrupted this upward trend.

In 2023, the proportion of car sales in the 200,000-300,000 yuan price range fell to 18.83%, returning to 2020 levels. Meanwhile, the total value in this price range declined for the first time in six years, indicating that as new car prices fell, the absolute number of overall market prices also declined. The same was true for the price range above 300,000 yuan, where the market size and total value declined in 2023.

In 2024, this trend is difficult to reverse as new car prices continue to fall. From 2022 to 2023, the 200,000-400,000 yuan price range lost at least 500,000 new car sales. This price range was once the comfort zone for joint venture automakers and luxury brands.

Before the rise of Chinese brands, mainstream joint venture automakers held over 50% of the Chinese market share, contributing over 10 million vehicles. The market space vacated by the collapse of joint venture automakers has not been fully filled by Chinese brands in a short period.

This trend is not counterintuitive. Li Ming (pseudonym) bought an electric SUV, the Yinhe E5, in August this year and found that at least 15% of the group chat in the car club initially considered buying a Model Y.

As Gao Shanwen from SDIC Securities said, for young people, when income expectations and income growth certainty are significantly revised downward, consumption confidence and willingness are significantly suppressed, and the same is true for the middle class. Chinese automakers are also readjusting their expectations of the middle class, either by continuously lowering prices to capture the low-end market or by continuously moving upwards and actively abandoning the middle class.

Upwards or downwards, the abandoned middle class

In October this year, the China Passenger Car Association released data showing that from 2019 to the present, the sales share of high-end models has increased, and the average sales price of domestic automobiles has increased by 31,000 yuan. Admittedly, with the rise of domestic new energy vehicles, the prices of Chinese brands' new cars have continued to rise. Especially when NIO's sales surpassed those of second-tier luxury brands, Li Auto's sales surpassed those of BMW and Audi, and Huawei's Zunjie sold cars for 1 million yuan. Hence the viral internet meme, "If you don't work harder, you'll only be able to drive a BBA."

However, it's easy to overlook structural contradictions due to survivorship bias. While Chinese automakers are constantly setting new price records, they are often selling cars at cheaper prices.

As 2024 draws to a close, some automakers have announced their 2025 sales targets. Zero Run Auto Chairman Zhu Jiangming clearly stated that 500,000 sales in 2025 is the minimum figure. Recently, some media outlets exposed some automakers' 2025 sales forecasts, including 5.5 million for BYD and 350,000 for XPeng Motors. Judging from their model lineups, the main market in 2025 will be the 100,000-200,000 yuan price range. In addition to these three companies, Geely, Changan, Great Wall, and other enterprises will also compete fiercely in this price range.

Even more brutally, many mainstream models of joint venture automakers, whose main business is fuel vehicles, will also enter this price range or even lower after continuous price reductions. For example, models like the Magotan, Passat, Tiguan, LaCrosse, Teana, and Accord were once priced above 200,000 yuan.

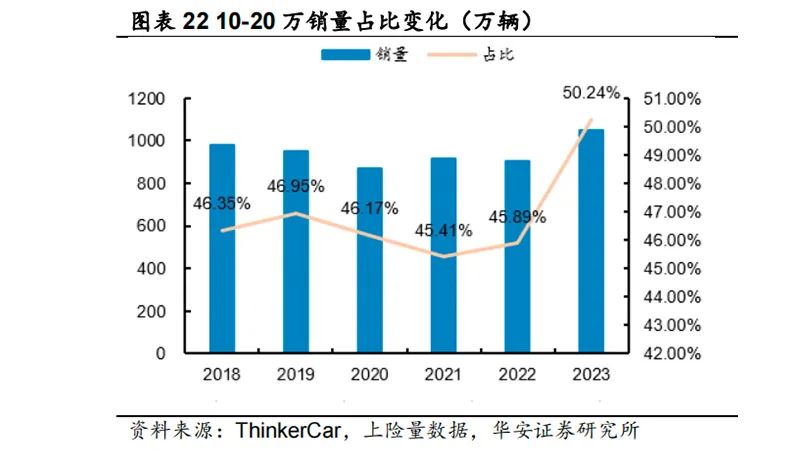

This trend is also evident in sales data. Looking at the passenger car market structure over the past five years, from 2019 to 2022, the sales share of vehicles priced between 100,000 and 200,000 yuan remained stable at around 45%-46% until it suddenly rose to 50.24% in 2023, contributing over 10 million vehicles to the market. Behind this huge consumer demand is fierce competition in this red ocean market. Given the intense price war in 2024, it is boldly predicted that there is still room for expansion in the market below 200,000 yuan.

In the face of fierce competition, quantity and price seem like the two ends of a scale that cannot be achieved simultaneously. Companies still struggling to survive have abandoned the fantasy of storytelling, constantly revising new car prices to trade volume for price. Or, like XPeng, once they discover how much of a stimulus effect "low price, high configuration" has on sales volume, it's hard to break away from this positive feedback loop. Even BYD, which is already the industry leader, needs to maintain high sales growth with low-priced weapons.

Of course, some continue to tell new high-end stories or try to ambush competitors with technological innovations. For example, the Zunjie S800, which was the first to bring L3 technology to mass-produced vehicles, set a starting price of 1 million yuan; the IM L6 Max Guangnian Edition, equipped with semi-solid-state batteries, is expected to be priced above 300,000 yuan; and the NIO ET9, with a pre-sale price of 800,000 yuan, boasts NIO's cutting-edge technology...

When the middle class is no longer willing to pay for premiums, automakers' survival strategies become clear: either continue to engage in price wars, constantly compressing costs and stacking features to gain market share; or gain pricing power in an automotive market where the definition of "high-end" is already blurred by leveraging technological advantages. Upwards or downwards, both are automakers' choices to "abandon the middle class."