Who will not survive next year?

![]() 12/10 2024

12/10 2024

![]() 494

494

Introduction

Many auto brands are facing a lack of sales.

As the year draws to a close, looking back at the Chinese auto market over the past year, while it is likely that sales will increase for the whole year, there is a huge cost behind this growth. From the internal competition that began at the beginning of the year to the promotion of various promotional policies in the middle of the year, it ultimately led to a good result. However, insiders understand the intricacies, and many auto company executives have already seen the crisis within this.

Li Bin, founder of NIO: The most intense and brutal stage of the qualification race for the smart electric vehicle industry has arrived, and only a few outstanding companies will survive in two or three years.

Deng Chenghao, Vice President of Changan Automobile and CEO of Deep Blue Automobile: Next year, the price war will become even more intense, and only auto companies with a gross margin of 15% can basically survive, while brands that lose money on every vehicle sold are likely to not survive.

He Xiaopeng, CEO of XPeng Motors: 2024 is the first year that Chinese auto brands will enter the "bloody" competition, also known as the first year of the elimination round. I firmly believe that in the next three years, China's new energy vehicles will enter the elimination stage.

Guan Haitao, CMO of Zeekr Motors: Next year, with the layout of various power forms and product forms by mainstream brands, the next 2-3 years will be the most difficult two years. "Surviving" is the only proposition, and even "surviving with quality" is a luxury.

In just November alone, four industry leaders made such warnings consecutively. For all participants, this is both a test and an opportunity. Only those companies that can accurately grasp market trends, continuously innovate, and optimize can stand out in this fierce competition.

Are these the ways to survive?

Although these are the opinions of various individuals, and each executive has expressed their views based on their own company's stance and perspective, as core executives of their companies, the statements of these four industry leaders undoubtedly bring profound and valuable enlightenment to the entire auto industry. Facing such frank predictions from industry leaders, the entire auto industry is feeling an unprecedented sense of urgency and pressure.

Li Bin's comments reflect the intense competition stage that the electric vehicle industry is about to enter. His words reveal a deep insight into the future of the industry and emphasize the survival rule of "a few outstanding companies." This is not only a warning about the cruelty of market competition but also a profound reminder to companies in the industry.

In this critical period, companies need to examine themselves and clarify which core values and core competitiveness must be upheld and which strategies and models need to be flexibly adjusted according to market changes. Persistence and innovation will become the wings for companies to navigate through storms and move forward steadily.

Deng Chenghao directly pointed out the dual challenges posed by the price war and subsidy policies. He emphasized that while these measures may stimulate sales in the short term, over-reliance on them will overdraw market potential in the long run and intensify industry competition. A gross margin threshold of 15% is not only a rigid requirement for a company's profitability but also a measure of its health.

Amidst the smoke of the price war and the backdrop of rising costs and compressed profit margins, maintaining a reasonable gross margin has become the key to a company's sustainable operation. This requires auto companies to adopt refined management, optimize their supply chains, improve production efficiency, and at the same time, continuously innovate to find differentiated competitive advantages and avoid falling into the quagmire of pure price competition.

He Xiaopeng views 2024 as the beginning of the "bloody" competition for Chinese auto brands. During the three-year elimination stage, it means that during this period, the industry will experience a large-scale consolidation, and only those companies with core competitiveness and the ability to quickly adapt to market changes will survive, further promoting the maturity and concentration of the new energy vehicle industry.

In addition, he predicts that the penetration rate of new energy vehicles in China will reach over 85%, indicating that new energy vehicles will be fully integrated into people's daily lives and become the mainstream mode of transportation. The transformation of AI technology will serve as a powerful driving force for increasing the penetration rate of new energy vehicles. This prediction not only showcases the broad prospects for industry development but also indicates that market competition will become even fiercer.

Guan Haitao's comments further emphasize the formidable challenges facing the auto industry in the coming years. He mentioned that with the comprehensive layout of major mainstream brands, the auto industry will enter an unprecedented "Warring States period." In this battle, "surviving" has become the common goal of all companies, and "surviving with quality" has become a higher aspiration pursued by companies.

A protracted war will become the norm that every auto brand must face. This means that companies can no longer have a mindset of short-term behavior but must prepare for a long-term battle. They must endure loneliness, resist temptation, make continuous investments, and accumulate experience. Only in this way can they remain invincible in future competition.

It can be seen that the electric vehicle industry is facing unprecedented challenges and opportunities. The challenges lie in the intensification of market competition, the test of profitability, and the pressure of technological iteration. The opportunities lie in the market redistribution brought about by industry reshuffling, the continuous growth of the new energy vehicle market, and new opportunities brought about by technological innovation.

Which brands will be eliminated?

In fact, every year is an elimination round. Every year, the market changes, consumer demand upgrades, technology continues to advance, and the policy environment is also adjusted. In this rapidly iterating market, there are no eternal winners, and only companies that continuously adapt and innovate can gain a foothold in fierce competition.

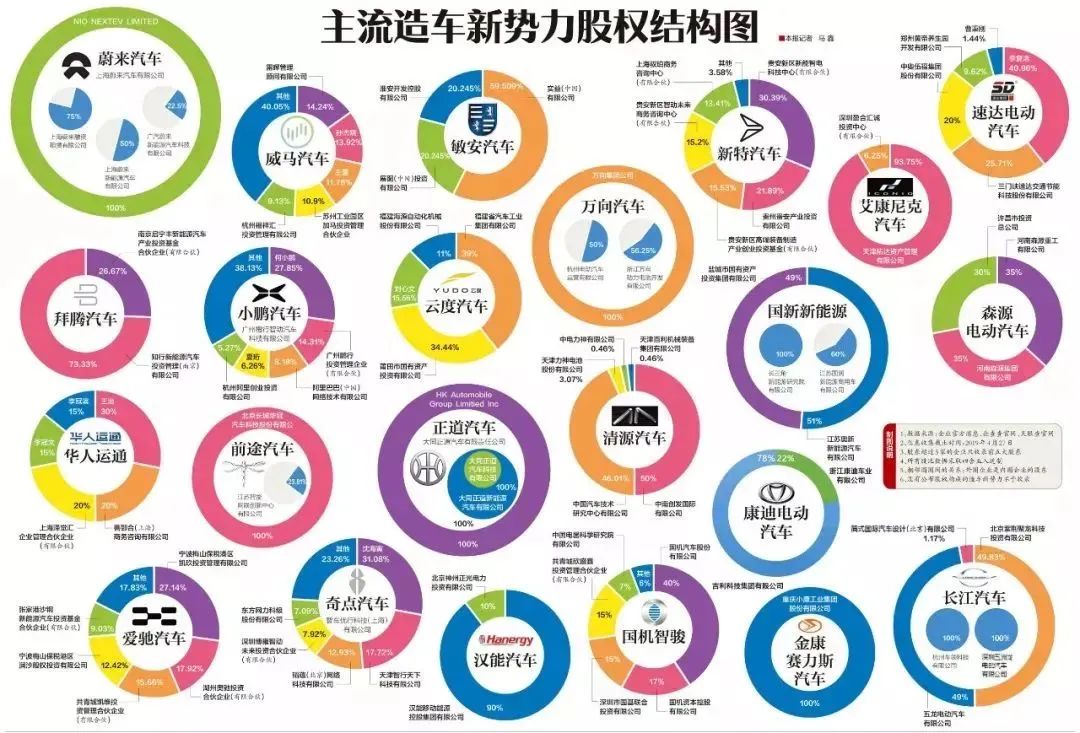

According to incomplete statistics, in 2018, there were as many as 487 new energy vehicle companies in China. This data not only reflects the vibrant vitality and huge potential of the industry at that time but also indicates that the new energy vehicle market is about to usher in an unprecedented feast. However, times have changed, and by the end of 2023, the number of normally operating new energy vehicle companies had sharply decreased to just over 40.

This dramatic change is not only shocking but also thought-provoking.

In the early stages of industry development, driven by both policy support and market demand, a large number of companies flooded into the new energy vehicle sector, leading to a mixed market. However, as the market gradually matured and competition intensified, only those companies with real strength, technology, and market insight survived and even became industry leaders.

This is true for both the new energy vehicle market and the gasoline vehicle market. Taking the recently concluded Guangzhou Auto Show as an example, compared with previous editions, it is not difficult to find that some familiar auto brands were absent. They are Genesis, HIPHI, Chery Jaguar Land Rover, Subaru, FAW-Volkswagen Jetta, Chevrolet, Polestar, Hozon Auto, Voyah, Venucia, Blue Power, Rolls-Royce, and Mansory.

This series of absent brands not only reflects the subtle changes in the current automotive market competition landscape but also reveals the profound adjustments and reshuffling occurring within the industry. Behind each absent brand, there may be its own story and considerations – some may be adjusting their market strategies and choosing to temporarily fade from the public eye, while others may be struggling in the fierce market competition and having to re-examine their market positioning and future development path.

So, returning to the topic that everyone loves to discuss, who will not survive next year or in the next 2-3 years?

According to the cumulative sales data of auto brands from January to October compiled by the China Passenger Car Association, the brands that had sales last year but have had no sales this year are Volkswagen Anhui, GAC Mitsubishi, Guojin Automobile, Southeast Motor, AITO, and ENOVATE. The brands with cumulative sales of less than 10,000 units in the first ten months of this year are BAONENG, Yema Auto, Haima Automobile, HIPHI, Foton Motor, Hozon Auto, CNHTC VGV, and Skywell.

When discussing which auto brands may face an existential crisis in the next 2-3 years, we must not only pay attention to the current sales data but also conduct an in-depth analysis of the underlying market trends, technological innovations, policy orientations, and the company's strategic adjustment capabilities. From the aforementioned brands with low sales, we can discern several key points and analyze accordingly.

First, the reshuffling in the new energy sector is still accelerating. The difficulties faced by new car companies such as AITO, ENOVATE, and HIPHI partly reflect the high capital threshold, rapid technological iteration, and fierce market competition in this sector. These companies often face multiple challenges such as tight capital chains, insufficient product competitiveness, and low brand recognition.

In the future, as the new energy vehicle market further matures and consumer demand becomes increasingly diverse, those new energy brands that cannot quickly respond to market changes and lack core technological competitiveness will find it even harder to gain a foothold.

Second, the transformation of traditional auto companies is not easy. The decline in sales of traditional auto companies reflects their difficulties in the process of transforming to new energy. These companies need to face the shrinking market for traditional fuel vehicles while also competing with emerging forces in the new energy sector. Under the dual pressure, companies that transform slowly or adopt inappropriate strategies may face the risk of elimination.

Furthermore, while local background support can provide some cushioning, it is not a long-term solution. Companies relying on local background support, such as Yema Auto, Haima Automobile, and even the recently troubled NIO, may be maintained by policy support in the short term. However, in the long run, if they cannot achieve self-sufficiency, improve product competitiveness and brand influence, they will also struggle to escape the fate of market elimination.

Regardless, while elimination is an inevitable phenomenon in the development of the auto industry, it also brings purification and reshaping of the industry, redistribution of resources, reshuffling of the landscape, better satisfaction of consumer demand, as well as warnings and reflections on industry development.