Taking the 'price war' route, is BYD leaving suppliers with nowhere to go?

![]() 12/11 2024

12/11 2024

![]() 479

479

Text/Guo Chuyu

Editor/Hou Yu

The pricing of new energy vehicles launched in December once again set a new low. In December, new models priced around 100,000 yuan for new energy vehicles emerged in an endless stream. It is worth mentioning that Geely launched the Yinhexingjian 7 EM-i with a limited-time price range of 99,800-132,800 yuan, a reduction of 25,000 yuan compared to the starting price of the Yinhe L7.

The Yinhexingjian 7 EM-i features an engine with a maximum thermal efficiency of 46.5%, the highest among globally mass-produced engines, surpassing the 46.06% thermal efficiency of BYD's fifth-generation DM-i mass-produced engine. Even with technological support, Geely still reduced the price of the new car below 100,000 yuan.

Moreover, other automakers have also reduced prices at the end of the year. In December, ZEEKR introduced price policies such as 'car purchase benefits' and 'interest-free installments'; on December 1, Deep Blue directly reduced prices by 5,000 yuan; BYD lowered the prices of its Dynasty series models; on November 29, Lixiang announced a limited-time 0% interest policy at the end of the year, with a minimum down payment of 69,800 yuan per model.

According to preliminary statistics from the Passenger Car Association on December 4, 1.277 million new energy vehicles were retailed in the Chinese market in November, an increase of 52% year-on-year and 7% month-on-month. Cumulatively, 9.605 million new energy vehicles have been retailed since the beginning of the year, a year-on-year increase of 41%.

The demand for new energy vehicles continues to grow, and major automakers all want a piece of the pie. To attract users, major brands have joined the price reduction strategy, pushing the new energy price war into a white-hot stage in 2024.

Automakers notify dealers to reduce costs on their own

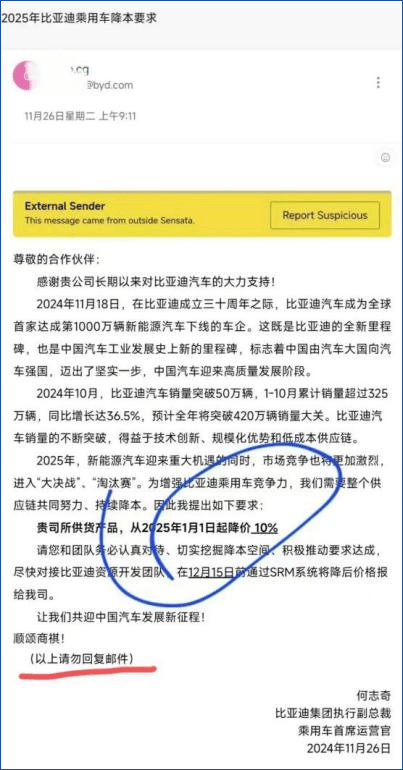

While reducing prices, new energy automakers also hope to maintain profit margins by passing on the lost profits to the supply chain. Recently, an email from BYD circulated online, attracting industry attention. He Zhiqi, Executive Vice President of BYD, stated in this email that he hoped suppliers would actively explore opportunities to reduce costs.

Image: Screenshot of the circulated email

On November 27, Li Yunfei, General Manager of BYD's Brand and Public Relations Department, responded to the online rumor that 'BYD required suppliers to reduce prices by 10%' and stated that this was an industry practice, not a mandatory requirement.

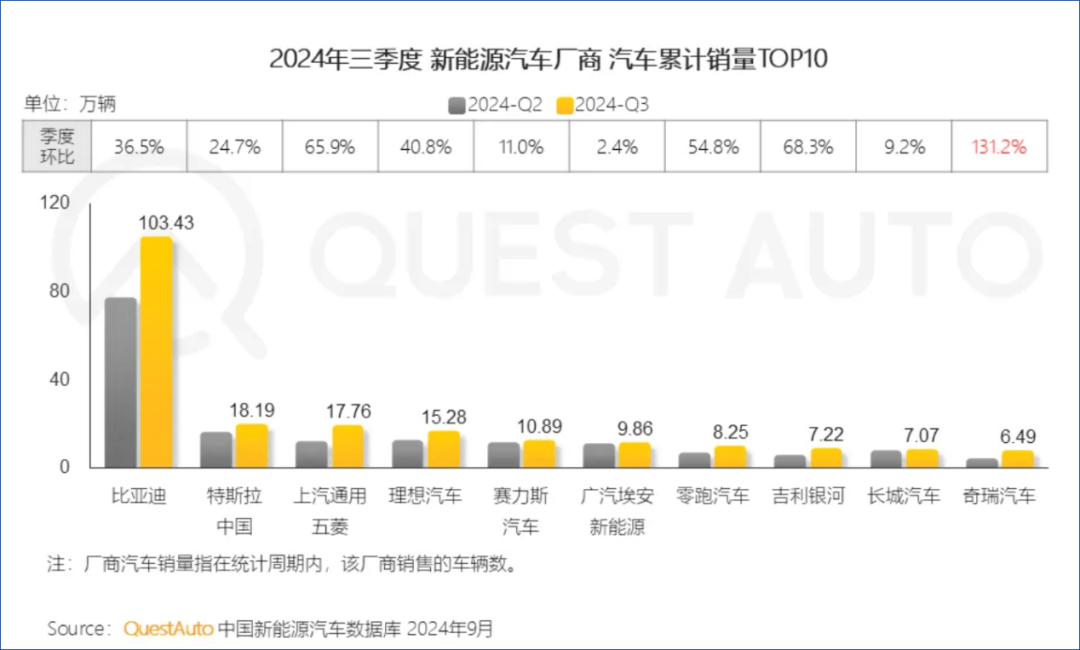

According to official BYD data, BYD sold 502,700 new energy vehicles in October, a record high; from January to October this year, new energy vehicle sales totaled 3.2505 million units, a year-on-year increase of 36.49%. In the third quarter, BYD achieved revenue of 201.125 billion yuan, a year-on-year increase of 24.04%. BYD continued to lead new energy vehicle sales in the second and third quarters.

Despite its outstanding performance and further expansion overseas, BYD has still joined the price war in a high-profile manner. Not long ago, Wang Chuanfu, Chairman of BYD, stated at the China Auto Chongqing Forum that competition is a part of market economy. Entrepreneurs should embrace competition and develop amidst it without getting anxious about it.

According to a report by China Business News, BYD insiders revealed that less than 1% of BYD's more than 8,000 suppliers received the cost reduction notice email. This cost reduction plan is being implemented in a phased manner by sector. Most of the suppliers who have received the email are electronic control and sensor suppliers, numbering in the dozens. In the future, there is no exclusion that this will spread to other sectors.

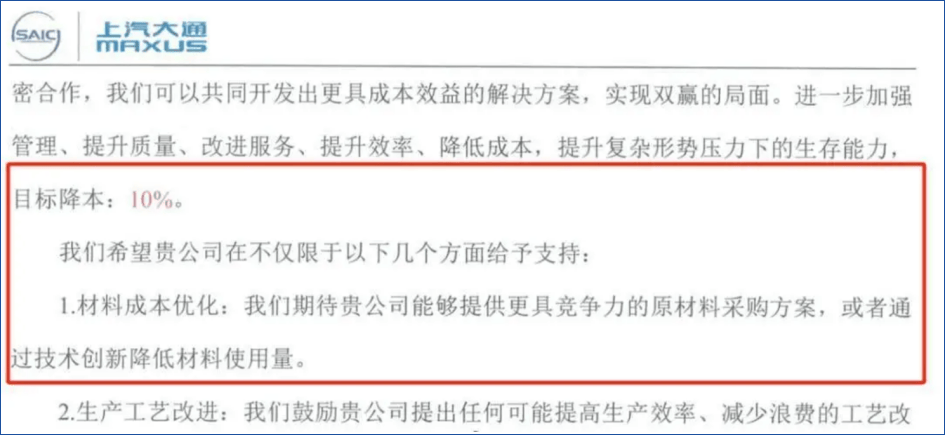

'10% cost reduction' is not unique to BYD. On November 25, SAIC MAXUS informed its suppliers, 'The problem of excess supply over demand in the automotive market is prominent; with the mass launch of new cars, the imbalance between market supply and demand is expected to be difficult to fundamentally improve in the short term, and the price war is difficult to subside.' They also set a target of reducing costs by 10%.

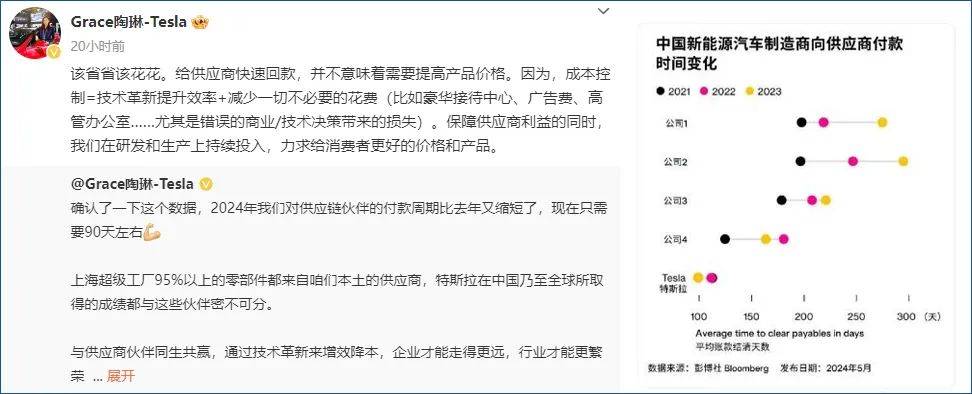

On November 28, Tao Lin, Global Vice President of Tesla, posted on Weibo that 'quickly paying suppliers does not mean that product prices need to be increased' and stated that Tesla's payment cycle to suppliers in 2024 was shorter compared to the previous year.

Unlike BYD's straightforward price reduction, Tao Lin stated that Tesla aims for a symbiotic and win-win relationship with suppliers, increasing efficiency and reducing costs through technological innovation. Quick payment is to safeguard the interests of suppliers. However, netizens were not convinced, directly calling it 'riding the wave of popularity'. Shortening the payment cycle can help enterprises alleviate survival pressure and fill funding gaps. This measure seems sincere but does not truly guarantee the interests of suppliers. The core of technological innovation is also to get suppliers to reduce prices, not to mention that a 90-day payment cycle is not competitive - BMW's payment terms to Chinese suppliers are 30-45 days, while those of automakers like Volkswagen and General Motors are 60-90 days.

It can be seen that Tesla's Tao Lin's response was rather lonely. The statement of 'safeguarding the interests of suppliers' was not only unconvincing but also exposed the long payment cycle. Tesla did not have a good first half of the year, with profit losses in both the first and second quarters. In the third quarter, it achieved revenue of USD 25.182 billion, a year-on-year increase of 8%; net profit reached USD 2.167 billion, a year-on-year increase of 17% and a quarter-on-quarter increase of 46.6%.

On November 25, Tesla reduced the price of the Model Y again. The starting price dropped to 239,900 yuan, with an additional five-year interest-free financial service.

Currently, supply chain enterprises are facing issues such as cost compression, internal cost reduction, and layoffs. This year, some multinational large suppliers, including Bosch, Valeo, Continental, and ZF, have universal undergone large-scale layoffs. In recent years, the auto industry's price war has become commonplace.

Low-priced models continue to stir up the market, affecting even the gasoline vehicle sector. Gasoline vehicle enterprises such as SAIC Volkswagen, FAW-Volkswagen, Guangzhou Honda, and Guangzhou Toyota have further reduced the prices of multiple main sales models of joint venture manufacturers.

Downstream enterprises are intensifying their internal competition, and midstream enterprises are caught between two fronts

The momentum of peak expansion in the new energy industry chain has passed, and market competition has entered a white-hot stage. Currently, prices across all links in the industry chain are at relatively low levels, affecting raw materials, components, and upstream, midstream, and downstream suppliers of complete vehicles to varying degrees.

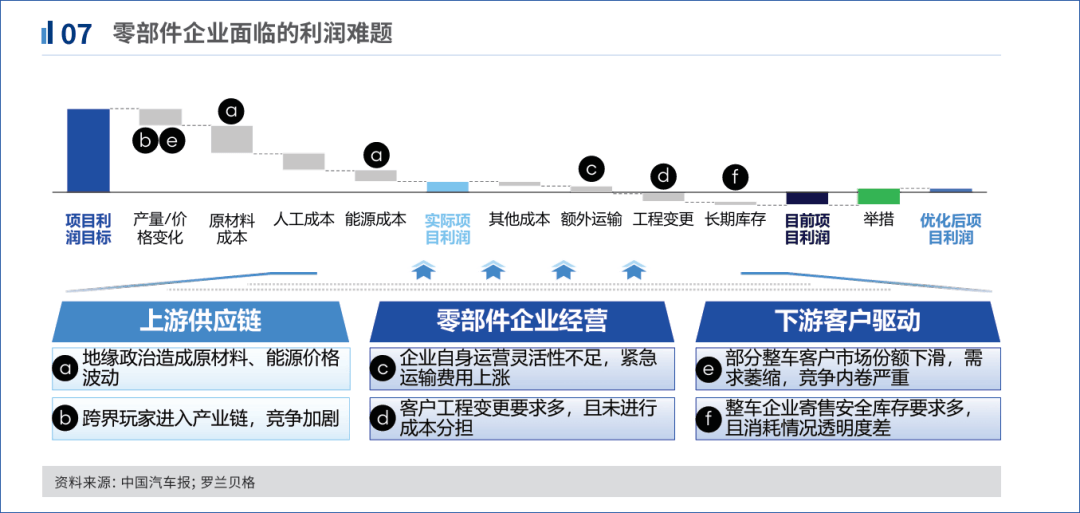

According to data released in the '2024 Global Automotive Supply Chain Core Enterprise Competitiveness White Paper', the overall net profit rate of China's top 100 auto parts enterprises in 2023 was only 7.2%, indicating limited room for cost reduction in the industry.

Image: '2024 Global Automotive Supply Chain Core Enterprise Competitiveness White Paper'

Upstream supply chain raw material prices fluctuate continuously, and the entry of many cross-border enterprises has enhanced industry competition. The diversification and self-supply of downstream OEM suppliers have intensified competition for market share, exacerbating internal competition.

Midstream enterprises are 'caught between two fronts.' Taking power batteries as an example, battery cathode material enterprises face issues such as overcapacity and reduced downstream demand. Anode and electrolyte shipment prices have fallen, putting pressure on enterprises to bear costs. At the same time, new materials such as semi-solid batteries and sodium-ion batteries have emerged as formidable competitors, with costs and resources superior to lithium batteries. They are currently becoming a new focus for major battery enterprises.

Furthermore, automakers are accelerating the launch of new products, shortening product development cycles, and putting pressure on the technological innovation of midstream enterprises. Among them, while major auto parts enterprises continue to 'reduce costs and increase efficiency,' they still need to respond to the diverse requirements and changes of automakers.

E-One Moli Energy and EEStor responded that the impact was not significant, and their cooperation with BYD has decreased. Relevant personnel from EEStor said that there is a situation of 'increased volume without increased revenue' in the industry, which is an issue of production capacity structure and stage.

Among them, E-One Moli Energy's third-quarter report for 2024 showed that the company's main operating income was 5.525 billion yuan, a year-on-year decrease of 55.95%. The company's main operating income for a single quarter was 1.984 billion yuan, a year-on-year decrease of 52.1%.

In the first three quarters of 2024, SAIC's revenue and profit declined to varying degrees, with revenue reaching 430.482 billion yuan, a year-on-year decrease of 17.74%; net profit was 6.907 billion yuan, a year-on-year decrease of 39.45%. In October this year, Jia Jianxu, the new head of SAIC Group, emphasized in an internal exchange, 'Auto parts enterprises should temporarily shelve profit considerations and fully support the development of the vehicle business.' He called on auto parts suppliers cultivated within the group to 'give up profits' and unconditionally prioritize the growth of vehicle enterprises.

An research report released by Orient Securities stated that the profitability of vehicle companies declined in the third quarter, and the performance of auto parts was relatively better than that of complete vehicles, but the company's gross profit margin still declined year-on-year. Specifically, in the third quarter, the net profit attributable to shareholders of A-share vehicle companies was 16.736 billion yuan, a year-on-year decrease of 21.5% and a month-on-month decrease of 21.1%; the net profit attributable to shareholders of auto parts companies was 18.468 billion yuan, a year-on-year increase of 0.2% and a month-on-month decrease of 6.5%.

When will the vicious 'price war' end?

The overall price system of the new energy industry is severely convoluted. This year's price war has continued from the beginning to the end of the year, and the continuous compression of costs has led to a continuous decline in the profit per vehicle for automakers. Data from the Passenger Car Association shows that in the first nine months of this year, the profit per vehicle in the domestic auto industry has dropped to 16,000 yuan. Affected by this, the overall profit rate of the new energy automobile industry has declined, and companies such as NIO, XPeng, and Li Auto are still in a state of loss.

Industry insiders have different opinions on the price war. On November 25, 2024, Li Bin, founder, chairman, and CEO of NIO, sent an internal letter to all employees on the company's tenth anniversary, stating that NIO is in the most intense and brutal stage of the qualification race in the smart electric vehicle industry: 'In two or three years, only a few excellent companies will survive.'

In an interview with Sina Finance CEO Deng Qingxu in October 2014, Wei Jianjun, Chairman of Great Wall Motors, stated that Chinese electric vehicles have not yet established a clear advantage in core technologies but only have a leading position in the industrial chain. Moreover, he warned in a live broadcast that the aftereffects of the 'price war' may last for six or seven years.

A decrease in supply chain costs may also bring hidden dangers to product quality, thereby affecting customer satisfaction. On December 4, the evaluation results released by the China Quality Association pointed out that the 2024 China New Energy Vehicle Industry Customer Satisfaction Index (NEV-CACSI) was 79 points (out of a full score of 100), a year-on-year decrease of 1 point, marking a decline for the second consecutive year.

However, the market capacity is still unsaturated. In 2024, China's new energy passenger car sales accounted for more than 60% of the global market. Meanwhile, industry demand is still growing. According to the latest registration data released by CleanTechnica, global electric vehicle registrations in September this year increased by 33% year-on-year to 1.7 million units, a record high.

Faced with the continuous growth of market demand, new energy automakers are also exploring new development paths beyond price wars. In the current new energy market, traditional automakers such as BYD, SAIC, and Geely continue to make efforts in technological research and development and product exports. BYD cooperates with OPPO and Huawei on intelligent driving. New forces in automobile manufacturing such as NIO, XPeng, and Li Auto are also increasing investment in infrastructure, intelligent driving, and corporate promotion: NIO is expanding into Abu Dhabi and Azerbaijan, XPeng is entering the UK market, and Li Auto is adding supercharging stations and intelligent driving to parking spaces. At the same time, cross-border automakers Huawei and Xiaomi are also leveraging their strengths to seize market share. Huawei is collaborating with GAC Group on intelligent vehicle manufacturing. Xiaomi is winning more consumers for its cars through 'Mi-style marketing' and a strong brand effect.

It can be seen that faced with the continuous growth of market demand, various forces are eager to seize more market share in order to solidify their position in the industry. Therefore, in the long run, price wars may not be the core of competition among new energy enterprises but will gradually evolve into an elimination round, a 'reshuffle' of new energy automakers. This may also mean that in addition to price advantages, comprehensive services, intelligent technology, and industrial internationalization will become greater bargaining chips.