The Auto Market in Flux: Auto Dealers Seek New Horizons

![]() 12/11 2024

12/11 2024

![]() 563

563

Lead

Luxury brand dealerships like those for BBA were once a safe bet. However, with the rise of new automakers, even Mercedes-Benz and BMW have had to offer substantial discounts to maintain market share. Traditional auto dealers are feeling the chill from the deep adjustments in the automotive market.

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | Hezi

2582 words in full text

4 minutes to read

As the end of the year approaches, dealers are scrambling to boost sales.

Yet, many domestic auto dealers are currently struggling. According to the China Automobile Dealers Association, in the first half of this year, 50.8% of domestic dealers reported losses. In particular, the collapse of Pangda, once the largest domestic dealer group, and the delisting of Guanghui have cast a shadow of pessimism over the entire market.

However, domestic auto dealers are not sitting idly by. It is rumored that Zhongsheng will obtain authorization to sell 50 Huawei Smart Selection vehicles, replacing its first-tier luxury brands, including BMW, Mercedes-Benz, and Audi. Subsequently, Zhongsheng Holdings issued a statement confirming that it has signed a preliminary consultation agreement with Thalys, agreeing to further negotiate on the cooperative distribution of its new energy vehicles. Zhongsheng's move will not only impact its own performance but also serve as a benchmark for the future development trends of domestic auto dealer groups. Securing sales agency rights for leading domestic new automakers has become a strategic measure for dealer groups to boost their performance.

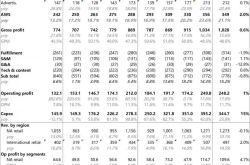

△ Zhongsheng to enter Thalys dealer system

Traditional auto dealer groups urgently need transformation

In China, Zhongsheng has been known for its cooperation with luxury brands. As of June 2024, out of Zhongsheng's 419 dealers in China, 269 were luxury brands, and 150 were mid-to-high-end brands. In previous years, Zhongsheng benefited from the wave of domestic automotive consumption upgrades, rapidly climbing the domestic rankings. However, as BBA sales have hit a low point in China over the past two years, Zhongsheng's financial reports have come under pressure. According to Zhongsheng's 2024 interim report, in the first half of this year, Zhongsheng's revenue was 82.421 billion yuan, an increase of 0.63% year-on-year; however, its net profit attributable to shareholders was 1.580 billion yuan, a decrease of 47.50% year-on-year.

Currently, Zhongsheng and other dealer groups face a challenging situation: new car sales are often unprofitable. According to data from the China Automobile Dealers Association, in the first half of this year, dealers' new car sales profit contribution was -26.5%. What sustains dealers, apart from manufacturer rebates for meeting targets, is the customer traffic brought by new car sales for after-sales business. For Zhongsheng, continuing with its past strategy will lead to significant performance pressure in the short term. Therefore, transforming from its focus on traditional luxury brands is crucial for Zhongsheng's survival. Several domestic dealer groups have already collapsed before Zhongsheng.

△ Dealers currently selling new cars at a loss

To this end, Zhongsheng has turned its attention to Thalys. Fully empowered by Huawei technology, Thalys is now a rising star among domestic new automakers, with its AITO M7 and AITO M9 ranking among the top models of new automakers. Especially the AITO M9, which has the potential to challenge BBA's dominance in the 500,000 yuan range, has earned Thalys and Huawei substantial profits, becoming the biggest contributor to Thalys' turnaround from loss to profit. In this scenario, if Zhongsheng can sell AITO models, its profits may surpass those from Mercedes-Benz and BMW models.

△ The AITO M9 has been highly profitable for Thalys

New automakers need to expand their networks as soon as possible

Is the transformation of Zhongsheng and other auto dealer groups wishful thinking? The answer is no. New automakers previously adopted direct sales for both objective and subjective reasons.

Subjectively, direct sales helps automakers reach users directly, understand first-hand customer data, and use it to guide vehicle development and design. It also avoids price wars among dealers and enables manufacturers to provide high-standard, uniform services to customers.

However, direct sales can lead to capital precipitation during the sales turnover process, a burden that traditional automakers pass on to dealers. When new automakers emerged, traditional dealer groups had little confidence in them and were reluctant to invest. To some extent, many new automakers were forced to adopt direct sales out of necessity.

△ Overstocking by vehicle manufacturers is a looming threat to dealers

However, as new automakers gradually gain a foothold in the domestic market, they are no longer averse to dealer involvement to further expand sales. Taking XPeng as an example, after Wang Fengying joined, XPeng has made significant efforts to eliminate unprofitable self-operated stores, handing over the vacated market to auto dealers. For new automakers, traditional dealer groups can reduce the pressure of opening stores and speed up store layout. Additionally, these dealers can provide more convenient after-sales maintenance and repair services, improving customer satisfaction.

△ New automakers are gradually transitioning from direct sales to a mixed model

Only by diversifying can one walk steadily

For auto dealer groups, reversing the current unfavorable situation requires more than just partnering with new automakers and building more stores. Among domestic new automakers, only Lixiang and Thalys have achieved profitability. These unprofitable automakers have many variables, but one thing is certain: acting as sales agents for these brands may not necessarily yield significant revenue.

Building 4S stores for these brands requires initial investment. Even if not starting from scratch, annual personnel salaries, venue rental fees, and interest payments due to manufacturers' "overstocking" are unavoidable expenses. Therefore, these new brand 4S stores are unlikely to achieve profitability in the short term. To solve the current profitability issue, tapping internal potential is necessary. Taking Zhongsheng as an example, it has recently ventured into the used car and vehicle maintenance businesses, independent of manufacturers. Laying out more profitable after-sales businesses is a shortcut for Zhongsheng to earn "quick money."

△ Zhongsheng begins to layout the used car and after-sales business to earn 'quick money'

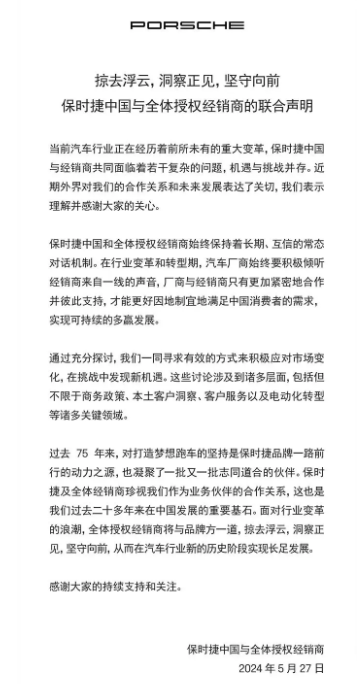

Of course, Zhongsheng cannot completely alienate brands like BBA. It is still uncertain who will prevail in the domestic auto market. In the future, BBA could launch competitive models to turn the situation around. Simultaneously, brands like Audi and Nissan have begun seeking cooperation with Huawei in intelligent driving and intelligent cabins. If two models of the same level are equipped with Huawei's technology, it's unclear whether consumers will choose Thalys or Audi, or Thalys or Nissan.

△ Whether BBA can reverse the current domestic situation with the next generation of models

Commentary

There are no permanent friends or enemies, only permanent interests. This saying aptly describes the relationship between auto dealer groups, traditional automakers, and new automakers. Currently, some powerful new automakers clearly have the upper hand, and dealer groups' scales naturally tilt towards these new aristocrats. But if BBA regains momentum in the future, it's hard to guarantee the scales won't find a new balance. The domestic auto market pie is finite, and any party's growth requires seizing share from others. For dealer groups like Zhongsheng, maintaining a balance between new and traditional automakers and using some new stores to hedge potential risks is a prudent approach. However, going all-in on new automakers is a difficult decision for Zhongsheng at present. The future holds many variables, and Zhongsheng is far from desperate.