Wang Chuanfu's Quest for Partnerships

![]() 12/11 2024

12/11 2024

![]() 673

673

【Tide Business Review/Original】

In November, BYD celebrated its 30th anniversary and marked a significant milestone with the production of its 10 millionth new energy vehicle. Additionally, the company sold approximately 506,800 new energy vehicles this month, marking a 67.87% year-on-year increase.

BYD undeniably reigns as the "king" of China's new energy vehicle market.

This success can be attributed to a pivotal decision made by Wang Chuanfu four years ago: "I will no longer produce gasoline cars; only new energy vehicles."

He strategically positioned BYD ahead of other automakers in battery, electric drive, and electronic control technologies, as well as factory construction. By integrating the industrial chain, BYD established a comprehensive system, achieving standardization, cost reduction, and significant industry influence.

This strategic positioning allowed BYD to be the first automaker to initiate a price war.

Most automakers, especially new-energy vehicle startups, do not possess BYD's industrial chain advantages. They must choose between reducing prices and incurring losses or facing elimination. To survive and keep pace with BYD, they often have no choice but to reluctantly reduce prices.

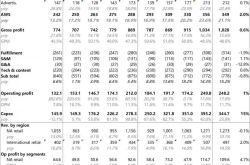

As a result, while BYD's average vehicle price has declined, its market share, revenue, and profits have surged, generating substantial earnings from the price war. In the first half of this year, BYD's semi-annual report showed continued profit growth.

However, automakers that followed suit by reducing prices are struggling, with most incurring losses. Over 80% of Chinese independent brands are expected to face closure, merger, or restructuring in the future.

Under the impact of the price war, component suppliers have also been significantly affected. They are increasingly hesitant to speak up in front of their dominant partner, BYD.

Many self-proclaimed BYD suppliers have revealed issues on social media, such as BYD's extended payment terms, poaching of technical talent from suppliers, and leveraging supply chain finance for additional benefits.

These claims do not seem baseless.

01 Suppliers Daring to Challenge

According to BYD's 2024 semi-annual report, its total liabilities reached 535.6 billion yuan, with a debt ratio of 77.47%. Notably, these are not bank loans or other borrowings but rather payable loans to component suppliers due to increased production and sales, as well as accounts payable for land acquisition and equipment purchases.

As of September 30, 2024, BYD's notes payable and accounts payable amounted to 240.5 billion yuan, of which accounts payable were 237.5 billion yuan. Over the past three years, accounts payable have continuously increased with substantial growth rates.

According to Bloomberg's statistics on the average payment terms for mainstream electric vehicle (EV) manufacturers in China, BYD's payment terms approached 300 days in 2023, while Tesla's have remained around 100 days during this period.

To some extent, BYD has shifted the risks of its price war to its partners. It is understandable why, during Wang Chuanfu's 30th anniversary celebration, some suppliers spoke out against further price reductions.

Not all partners are pushovers or prioritize BYD's sales scale. After all, every large enterprise has its weaknesses.

This year-end, BYD negotiated with suppliers, hoping to reduce prices, primarily targeting electronic control and sensor suppliers, numbering in the dozens.

Traditional automotive component suppliers, such as tire or glass manufacturers, benefit significantly from their partnership with BYD. Due to vehicle body quality concerns, BYD does not heavily pressure prices in these areas. If a component supplier dares to challenge BYD, it indirectly suggests that BYD may have weaknesses in that area, limiting its discourse power.

In fact, this is the case.

02 Partners Competing on Value, Emphasizing Intelligence

In August this year, the launch of the 2025 BYD Seal brought BYD's high-level autonomous driving models into the 200,000 yuan price range. Meanwhile, XPeng has established itself as the "only high-level autonomous driving option under 200,000 yuan" with the XPeng MONA M03.

Another off-road vehicle, the FANGCHENGBAO BAO8, equipped with Huawei's Kunpeng Intelligent Driving ADS 3.0 system, has a starting price of 379,800 yuan. This reflects BYD's inadequate intelligent driving capabilities, implying high product costs.

Admittedly, with rigorous cost control, BYD's sales have continued to set new highs, with expectations of exceeding 4 million sales in 2024.

However, automakers like XPeng and Huawei have shifted their battleground, seeking discourse power in the field of intelligence.

At the 2024 Future Car Pioneers Conference, Yu Chengdong stated that the world's number one in competition should be BYD due to its ultra-low costs. He emphasized that HarmonyOS should compete on value, especially in intelligence.

On November 30, GAC Group and Huawei signed a strategic cooperation agreement on smart cars, deepening their partnership. Currently, Huawei's high-level autonomous driving technology is integrated into 11 automotive brands and over 15 models.

XPeng has also regained confidence through its intelligent driving capabilities. New energy vehicle startups like NIO and Li Auto, as well as established automakers like Great Wall Motors and Changan Automobile, have successively entered the urban NOA competition, each with their unique technologies.

However, BYD does not have an advantage in high-level driving and lags behind competitors in urban NOA.

This stems from Wang Chuanfu's misdirection in intelligence, which has even impacted BYD's premiumization process.

03 One Step Behind in High-Level Autonomous Driving

In early 2023, Wang Chuanfu bluntly stated at BYD's financial report exchange meeting, "Autonomous driving is nonsense. It's all hype. It's like the Emperor's New Clothes."

Six months later, Wang Chuanfu felt the urgency brought by industry trends. He changed his tune at an internal meeting, clearly elevating "intelligent driving" to a core strategy for BYD.

Subsequently, BYD launched its independently developed "Tian Shen Zhi Yan" high-level intelligent driving assistance system, equipped on the Tang EV N7. However, sales of both the N7 and N8 have been mediocre. The main reason is that models in the same price range are equipped with more advanced intelligent driving systems, offering superior intelligence.

In early 2024, BYD proposed vehicle intelligence, introducing the intelligent architecture "Xuan Ji," which integrates multiple electric and intelligent technologies, including Yi Si Fang, Cloud Suspension, body systems, intelligent cockpits, and intelligent driving. However, compared to Huawei's autonomous ecosystem, it is still not comprehensive and lags behind automakers like XPeng and Li Auto.

Last year, Ideal Auto and NIO launched high-level intelligent driving functions, reducing reliance on high-precision maps and enabling more urban NOA implementations.

In early November, XPeng's newly launched P7+ comes standard with high-level intelligent features, freeing itself from high-precision maps and handling complex road conditions. High-speed and urban NOA functions are available upon purchase.

In contrast, BYD only equips its high-end models with high-level intelligent driving functions. To some extent, manufacturers like XPeng and Huawei, leading in high-level intelligent driving technology, may poach some of BYD's users.

This might be a concern for Wang Chuanfu. He later said, "The first half of the automotive game is electrification; the second half is intelligence."

According to iResearch Consulting, the penetration rate of high-level intelligent driving is expected to exceed 25% by 2025. The current market is in its blue ocean phase, a hotly contested area for manufacturers.

Now, intelligent technology is rapidly penetrating lower-priced models. Entry-level electric vehicles priced around 100,000 yuan are also equipped with autonomous driving features, making intelligence no longer exclusive to high-end models.

For example, models like the XPeng G3i, GAC Aion Y, and Chery QQ Ice Cream have "lowered their stance" on basic intelligent driving functions, quickly entering the mass market with features like highway piloting and automatic parking.

For BYD, failing to popularize intelligence in its mainstream 100,000 to 200,000 yuan models will make it difficult to maintain a leading edge in the future market.

04 Challenges in Equipping Mid-to-Low-End Models with High-Level Intelligent Driving

At the shareholders' meeting in June this year, Wang Chuanfu stated that BYD has invested in a research and development team of nearly 5,000 people and plans to invest an additional 100 billion yuan in cutting-edge technologies like generative AI and end-to-end large models to remain competitive in the intelligence wave.

At the 30th-anniversary launch event, Wang Chuanfu reiterated the importance of BYD's intelligent driving technology.

BYD has collaborated with NVIDIA, Huawei, and others, bringing in Liu Yi, the former head of XPeng's parking control business, to lead BYD's in-house intelligent driving control business.

BYD has also established a forward-looking department focusing on end-to-end technology implementation. Simultaneously, the two in-house intelligent driving R&D teams, "Tian Lang" and "Tian Xuan," will merge.

According to Jiemian News, the current core focus of the in-house R&D team is the mass production of high-level intelligent driving on lower platforms, with a new target of adapting 50 models by March next year. Zhang Zhuo, general manager of BYD's Marine Network Sales Division, revealed plans to equip the Seagull with an intelligent driving system, truly achieving technological and intelligent equity.

Wang Chuanfu has publicly stated that popularizing intelligence across a broader price range is essential to further consolidate market share.

However, BYD's transformation path is not easy.

Abundant intelligent driving data drives algorithm progress, with AI computing power being a key driver of algorithm iteration speed. Additionally, the high cost of lidar and light mapping technology, along with the necessity of overcoming pure vision-based networks, poses challenges that BYD needs time to address.

The core consumer group for entry-level models is highly price-sensitive. Even an additional few thousand yuan can affect purchasing decisions, making this transition challenging.

The success of this strategy hinges not only on the adaptability and cost reduction capabilities of intelligent driving technology but also on BYD's ability to quickly adapt to the needs of the mid-to-low-end market, finding a balance between intelligent experience and cost control.

BYD's position in the high-end market is also shaky.

Currently, BYD's high-end models priced above 200,000 yuan face competition from intelligent terminal OEMs like Huawei and Xiaomi, while models priced between 150,000 and 250,000 yuan contend with new forces like Zero Run and XPeng.

If BYD fails to maintain sales of its high-end models priced above 200,000 yuan, it may struggle to support the production scale and rapid cost reduction of solid-state batteries, hindering technological iteration and optimization.

Solid-state batteries, known for their high energy density, long lifespan, fast charging capabilities, and enhanced safety, are considered the next-generation battery technology. However, their high research and production costs necessitate large sales volumes of high-end models to spread costs.

Currently, domestic and international automakers are accelerating solid-state battery research. Foreign automakers like Toyota and Nissan have entered the prototype stage, while domestic companies like Huawei and CATL have announced related patents. Almost all automakers have high hopes for solid-state batteries.

Currently, mainstream domestic battery enterprises have announced solid-state battery mass production timelines, mostly concentrated between 2026 and 2030.

BYD, however, is a step behind other automakers.

05 Giving More Attention to Suppliers

In the rapidly evolving new energy vehicle industry, technological leadership, proper application, and cost-effectiveness determine one's prominence. Even with BYD's current scale and industrial chain position, Wang Chuanfu cannot rest easy.

Enhancing value and upgrading products may be the only option for automakers to survive.

But will suppliers continue to support BYD as it pursues intelligence?

BYD could learn from Toyota by establishing long-term, stable relationships with suppliers based on risk-sharing and benefit-sharing. This encourages suppliers to invest in R&D and process optimization, strengthening BYD's industry position.

References:

1. BYD's Extreme Pressure on Suppliers May Become a Hidden Concern for Internationalization - ECNS

2. Chang'an President: Only 3 of 71 Passenger Car Brands are Profitable; Over 80% of Chinese Brands Face Closure or Merger - Kuaikeji