Xia Yiping, the Blame Shifter, Leaves Shareholders, Employees, and Suppliers to Bear the Brunt

![]() 12/16 2024

12/16 2024

![]() 681

681

The apparent reason is "lack of funds," but the truth lies in "incompetent management."

By Wan Tiannan

Edited by Chen Jiying

GeeYue Automobile CEO Xia Yiping might as well be a master at the game of "Werewolf," adept at disguising himself as the "Werewolf" – portraying innocence and skillfully shifting blame, while covertly aligning with the "civilians."

In this game of "Werewolf," Xia Yiping, who personally drove GeeYue into a deep hole, always appears "very naive, deeply wronged, and full of injustice and grievance." He claims to have been working tirelessly and then shifts the blame for the company's sudden collapse entirely onto shareholders' refusal to "renew" their investment.

However, in reality, investors who lost their money, employees who were laid off on the spot, and suppliers whose payments are in arrears are all victims and scapegoats of this crisis.

Especially the two major shareholders, Baidu and Geely, not only lost billions in real investments but are also owed billions in service fees. They even had to take responsibility and deal with the aftermath of this mess, making them the ultimate "patsies"!

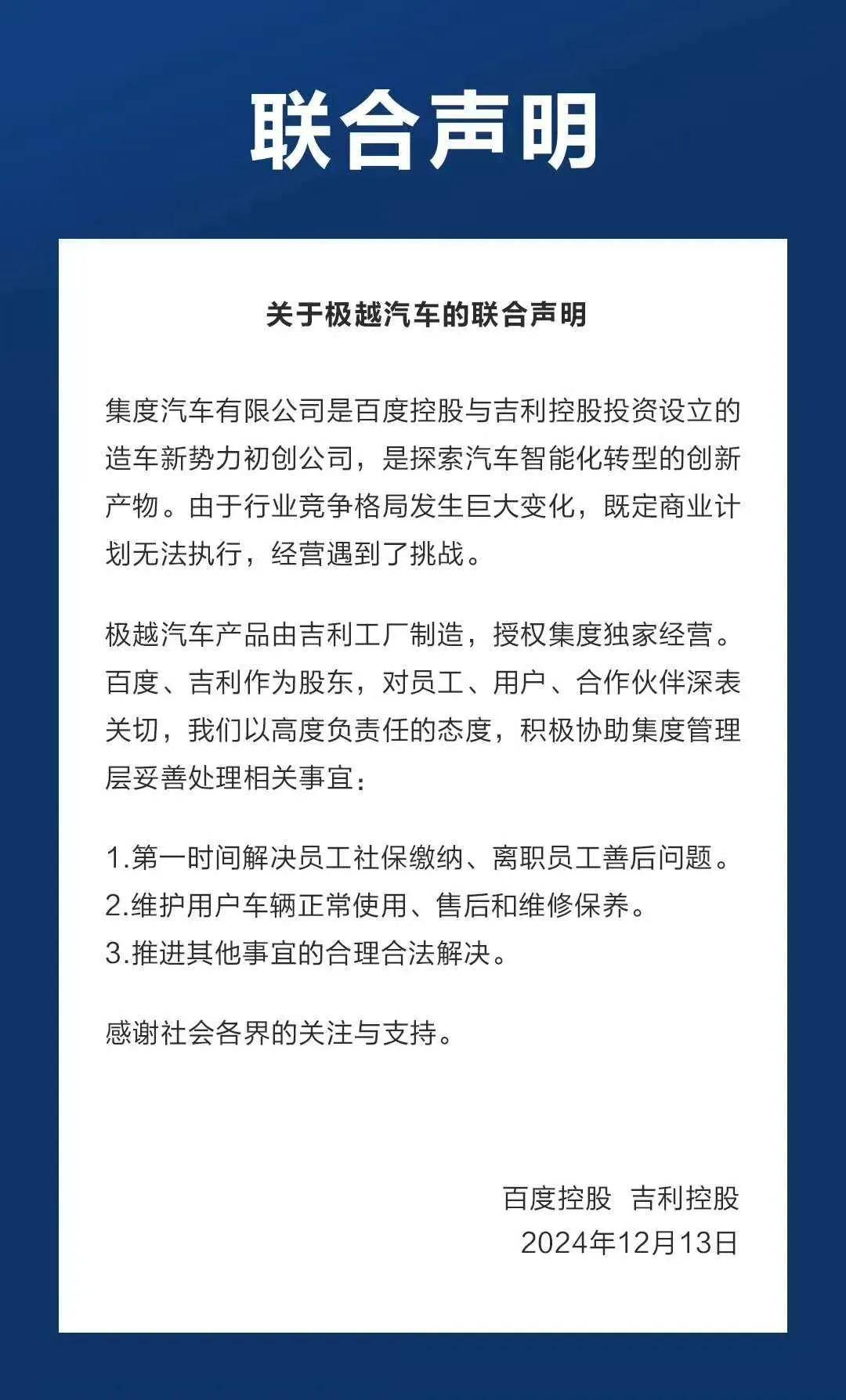

On the afternoon of the 13th, Baidu and Geely, who had previously been blamed by Xia Yiping, proactively stepped forward and issued a joint statement: They have resolved the issues of employee social security contributions and severance payments for laid-off employees in a timely manner; they promised to be responsible for maintaining the normal use, after-sales service, and maintenance of user vehicles in the future.

Reflecting on the lessons learned from GeeYue's crisis, which cost tens of billions, shareholders' "lack of money" is merely a superficial issue; the real problem lies in the team's "incompetence."

1. A 7 billion hole: Shareholders no longer want to be patsies

Regarding the company's sudden collapse, GeeYue revealed that it was due to Baidu's "withdrawal" of 3 billion yuan in investment. However, according to a Baidu insider quoted by LatePost, there was no such investment.

Typically, investment decisions are made after thorough auditing and accounting. According to Caixin, Baidu sent a financial team to conduct due diligence at GeeYue in October this year and found that GeeYue was facing a financial hole of up to 7 billion yuan.

It's worth noting that Xiaomi Automobile, another new entrant in the industry, aims to deliver 130,000 vehicles this year with a monthly loss of only 500 million yuan. In contrast, GeeYue Automobile has delivered only 14,000 vehicles cumulatively and is set to lose 7 billion yuan in a year.

Not only are the losses substantial, but the financial situation is also a mess that is difficult to unravel. Liu Jining, the CFO who once frequently represented GeeYue, has been out of contact for several months. Rumors suggest he has "escaped" to Singapore and taken the company's account books with him, causing investigations and audits to stall.

It was this chaotic financial performance that scared away shareholders – Baidu and Geely refused to renew their investments to avoid further losses, which was a rational choice.

How did this 7 billion hole form?

According to a GeeYue insider quoted by 21st Century Business Herald, 3 billion yuan was spent on R&D, 3 billion yuan on marketing, and 1 billion yuan on administrative expenses. Based on these calculations, the marketing cost per vehicle averages over 200,000 yuan, which is outrageously wasteful for GeeYue!

In terms of marketing, even profitable companies like Li Auto are quite "stingy." Its CEO, Li Xiang, once stated that the market expense ratio for the Li brand was only 0.6%, and he personally approved expenses of tens of thousands of yuan. Tesla even cut its advertising expenses to zero and does not even have an advertising team.

In contrast, GeeYue's high marketing and other expenses did not translate into substantial sales.

Previously, Xia Yiping claimed that his weekly live streams, combined with store live streams, generated over 100 million natural views in August alone, without any paid promotion. However, a combined demand letter for nearly 40 million yuan from Tech Planet and Zhejiang Xingtang Culture publicly refuted Xia Yiping's claim. According to insiders, GeeYue spent over 50 million yuan on third-party operating and promotional expenses for live streams and short videos this year, which only resulted in a mere 400,000 followers on its Douyin account.

Even from November to December this year, when employees' social security was still uncertain, Xia Yiping's personal appearances continued unabated, including live streams, auto show speeches, and TED talks, using the company's last lifeline to polish his personal image.

Not only were marketing expenses high, but wasteful spending on channel construction was also astonishing.

An employee revealed that in August 2022, GeeYue invested heavily to acquire a store in Taikoo Li, Sanlitun, Beijing, as a user experience center, with a monthly rent of over 2 million yuan. However, due to a lack of supporting decoration, layout, and marketing promotion, the opening was delayed by over three months, resulting in a loss of 6 million yuan in rent.

The above waste is not an isolated case. The GeeYue Intime image store located in the western part of Hangzhou has a monthly rent of approximately 700,000 yuan, while the rent for a similarly sized store next door is only 300,000 yuan, more than double the cost.

Similarly, administrative expenses were also spent lavishly. In comparison, XPeng Motors, with over 10,000 employees, incurred sales and administrative expenses of approximately 4.59 billion yuan in the first three quarters of this year, delivering 100,000 new vehicles. In contrast, GeeYue, with fewer than 5,000 employees and sales of over 10,000 vehicles, incurred sales and administrative expenses of up to 4 billion yuan, with a per-vehicle cost nearly 10 times that of XPeng.

Furthermore, GeeYue owes payments to multiple other suppliers. The cumulative financial hole of up to 7 billion yuan is an unbearable burden for shareholders. As shareholders, Baidu and Geely made a rational choice to stop investing further and cut their losses rather than continue pouring money into a losing venture.

In this game of "Werewolf," shareholders are the biggest victims. According to PingWest, insiders revealed that GeeYue currently owes Baidu 1 billion yuan in cloud service fees and Geely over 3 billion yuan in manufacturing costs. Coupled with previously announced investment amounts, the cumulative losses for these two shareholders alone amount to over 10 billion yuan.

Moreover, Baidu and Geely have already committed to paying for employee social security contributions, severance payments for laid-off employees, and maintaining the normal use, after-sales service, and maintenance of user vehicles. These compensation costs will also be significant.

2. The apparent reason is 'lack of funds,' but the truth is 'incompetent management'

As a startup, why did GeeYue spend so extravagantly, eventually leading to a depletion of funds? In fact, the shortage of money is only a superficial issue; the real problem lies with the people.

The company's business model could include To C, To B, and To G, but Xia Yiping seems justified in targeting 'To VC.' Instead of blaming himself for his own inadequacies, he blames shareholders for not "renewing" their investment.

Although GeeYue is invested in by Baidu and Geely, it operates independently of both. As the CEO of an independent company, Xia Yiping should bear the responsibility of fundraising. When NIO faced a financial crisis, Li Bin actively sought funding and ultimately led the company out of the quagmire.

However, Xia Yiping spends money freely but does not seem enthusiastic about fundraising, instead choosing to be passive and negligent. He once told his colleagues, "Baidu is our major shareholder, so everyone should have confidence." His implication seemed to be, "It's okay to spend recklessly because Baidu will cover it," and after shareholders were unwilling to continue investing, he appeared to morally coerce them, questioning why the old shareholders were not contributing.

Apart from fundraising, there were also some clues in specific matters.

For example, Xia Yiping claimed to be a minor shareholder with no decision-making power. However, as the CEO, he dominates the company's operational authority. According to PingWest, Xia Yiping's management style tends to be authoritarian, with him personally making decisions for marketing, product research and development, hardware, and software departments.

In particular, billions were spent on the marketing system. In January this year, Xia Yiping overhauled the company's marketing and sales system, taking the lead role and personally overseeing it.

However, despite spending 4 billion yuan on sales and administrative expenses, the company's organizational structure was in disarray. An insider revealed, "The company's personnel structure changes very frequently, including the sales director to the head of marketing on the market platform, with a new set of standards being implemented every few months. For example, the marketing director from Zeekr came over recently, overturned everything that was done before, but left after only a month."

Moreover, as a startup established just two or three years ago, GeeYue has numerous factions, and its internal management is not transparent. The reason why GeeYue ultimately collapsed, unable even to pay employee social security contributions, is that Xia Yiping did not seem to trust his team and therefore did not disclose the truth, resulting in functional departments failing to anticipate the financial crisis or develop corresponding contingency plans. According to an insider responsible for GeeYue's external relations, "Xia Yiping never shares information from board meetings; the people around him are more like his hands and feet."

In live streams, Xia Yiping often refers to himself as a product manager, but GeeYue's product design is equally perplexing. He boasts about spending huge sums to eliminate door handles, shift levers, and central consoles, featuring a full LCD screen, but these self-indulgent, unconventional, and counterintuitive designs do not appeal to consumers because they do not align with their usual driving habits. Furthermore, GeeYue moved the A-pillar back by 65mm merely to "make the body lines look better," a seemingly insignificant change that cost 300 million yuan.

At this year's Guangzhou Auto Show, GeeYue's performance was even more disappointing. While most automakers were busy introducing their new products and development plans, GeeYue spent over 20 minutes of its presentation launching a short video ranking for auto industry executives, focusing on praising the short video data of executives and polishing Xia Yiping's personal image, completely putting the cart before the horse.

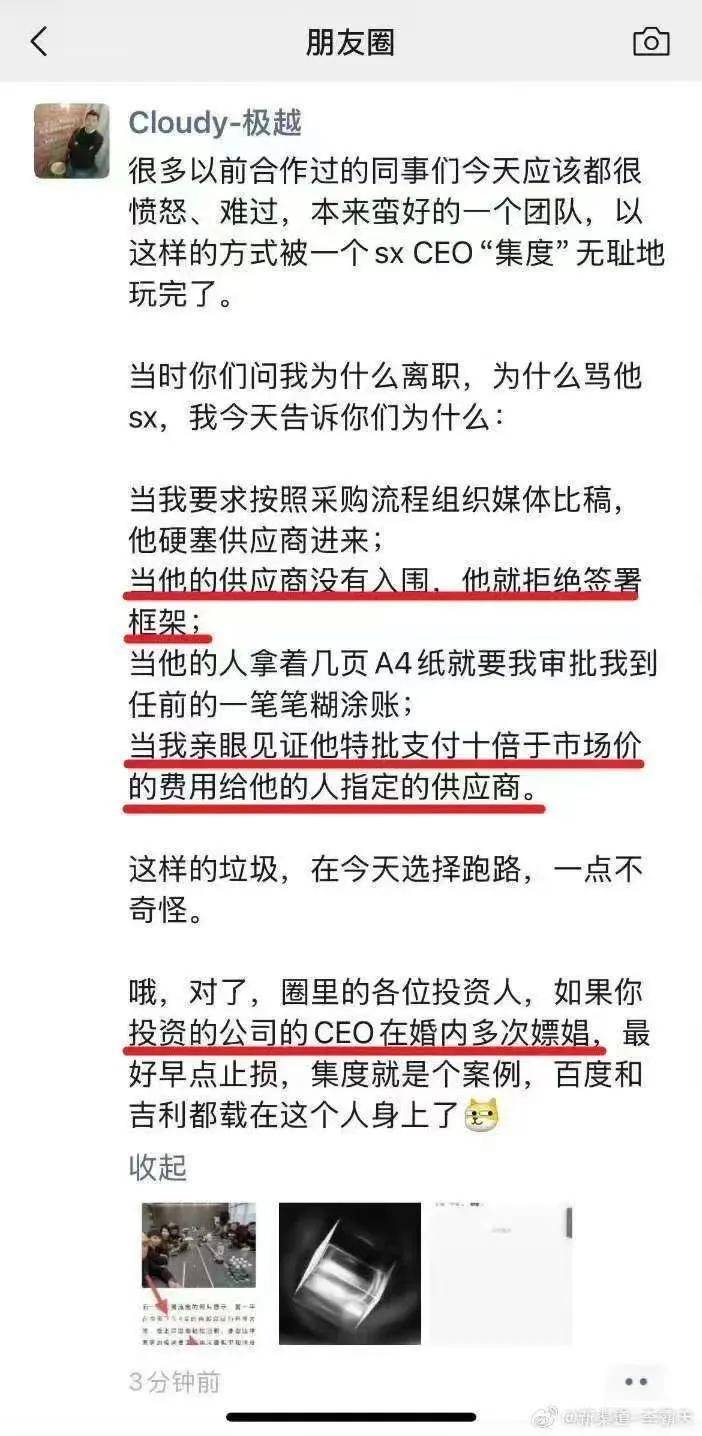

As for why GeeYue has been spending large sums of money on small tasks, wasting money on difficult tasks, and burning through cash with few deliveries, a former GeeYue marketing department employee publicly accused Xia Yiping of suspected corruption on WeChat Moments.

"Colleagues should be furious today." "When I asked to organize a media bidding process according to procurement procedures, he forcibly inserted a supplier. When his supplier did not make the cut, he refused to sign the framework. When his people presented me with a few pages of A4 paper and asked me to approve a mess of unclear accounts from before I took office, I witnessed him personally approving the payment of fees ten times the market rate to him."

Although the above allegations have not been verified by judicial authorities, they are corroborated by GeeYue's financial performance. Moreover, since the above individuals dared to make real-name accusations, it is unlikely that they are baseless.

3. Who will deal with the aftermath of GeeYue's collapse?

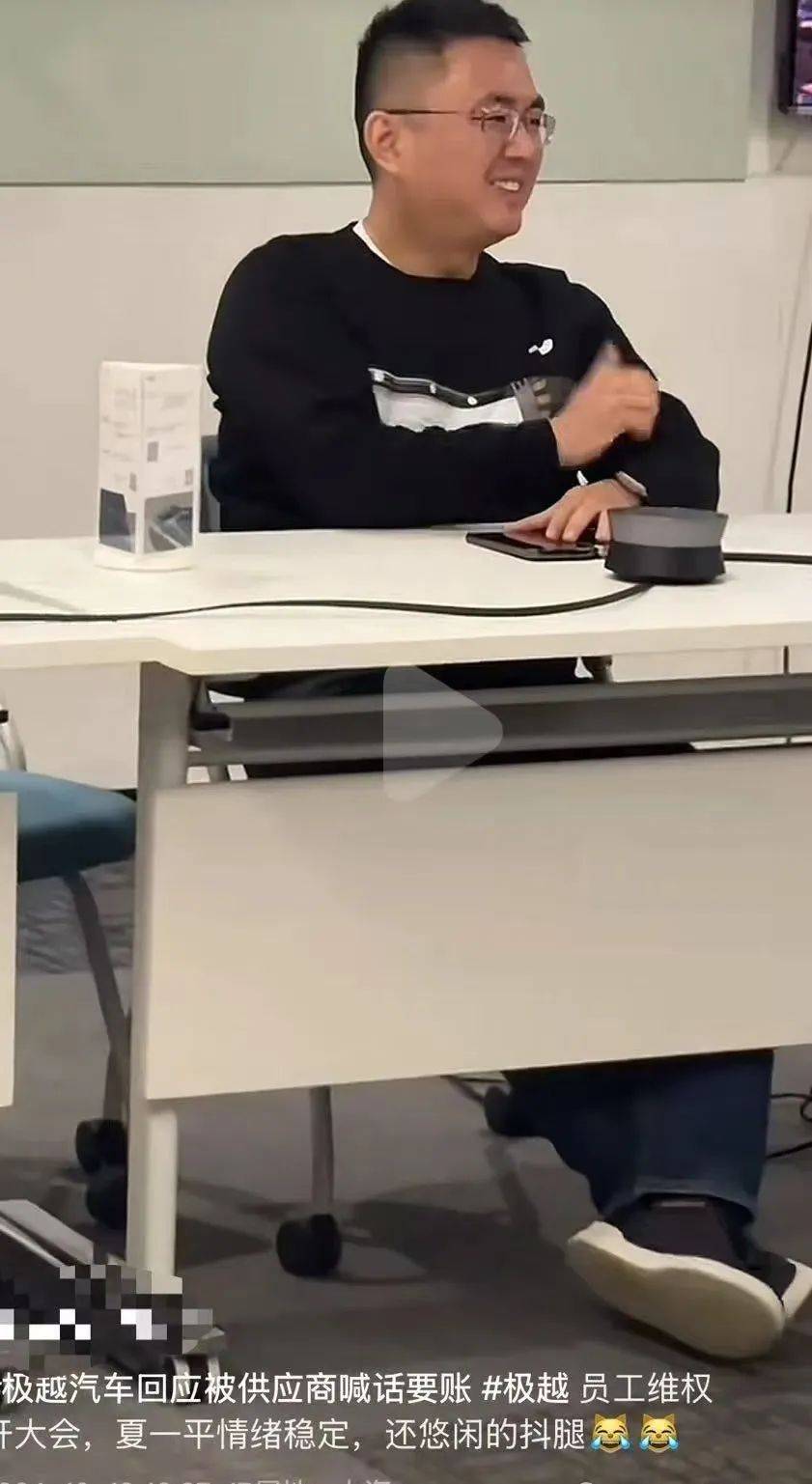

After the crisis became public, facing anxious employees and suppliers, Xia Yiping appeared relaxed and carefree with a smile on his face. During negotiations with employees, he even shook his legs continuously. This detached "relaxed feeling" made it seem as if the employees and suppliers in distress had nothing to do with him, causing many of them to feel chilled.

Furious, multiple employees confronted Xia Yiping on the spot: "Did you only find out today that social security contributions would be discontinued? Why did you wait until today to say something? Why didn't you inform us of the risk in advance? Can you disclose the company's financial situation?

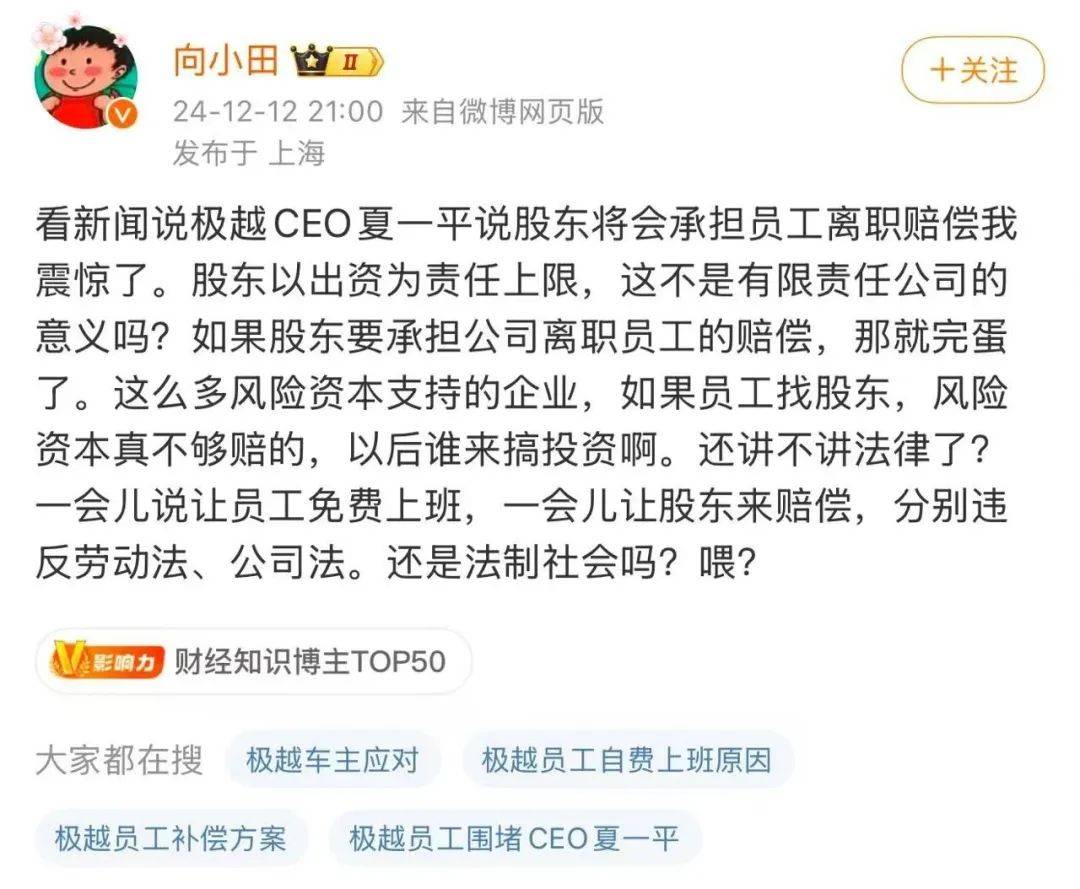

Xia Yiping's adept skill at shifting blame and directing the fallout towards shareholders directly shocked economist Xiang Xiaotian, who severely criticized Xia Yiping for lacking basic legal knowledge.

According to the Company Law, under the system of limited shareholder liability, shareholders are only responsible for the company to the extent of their subscribed capital contributions. In other words, shareholders are not required to bear unlimited joint and several liabilities beyond their capital contributions. Therefore, the primary responsibility for employee social security contributions, severance payments, and after-sales service for car owners lies with GeeYue, not Baidu or Geely.

Even from a fairness perspective, shareholders are the ones who suffer the most when an invested company fails. Moreover, if venture capital institutions were required to bear unlimited joint and several liabilities, no companies or institutions would dare to incubate startup projects in the future.

Even so, Geely and Baidu proactively stepped forward to take responsibility for employees and car owners. This action was not based on their legal obligations as shareholders but rather out of the decency expected of large public companies.

When it comes to future after-sales service and maintenance for GeeYue car owners, it is both practical and feasible for Geely to assume responsibility. Firstly, GeeYue Automobiles are based on Geely's SEA (Scalable Electric Architecture) platform, which ensures parts compatibility. Secondly, as a leading automaker, Geely boasts a well-established after-sales network and robust service capabilities.

Furthermore, the question arises whether GeeYue still holds value that warrants a revival and who should spearhead this effort. Geely, with its vehicle manufacturing credentials, emerges as a more fitting candidate for acquisition. Additionally, Geely has consistently demonstrated proficiency in cultivating a robust brand matrix.

In this multi-billion-dollar crisis stemming from GeeYue's abrupt collapse, there were no winners, only losers. Shareholders lost their investments and ideals, employees saw their careers and incomes jeopardized, and suppliers faced significant losses. However, it becomes evident who is trying to shift blame and who is acting with integrity.