Merger Negotiations: Honda-Nissan Alliance Aims for Global Third-Largest Automaker Status

![]() 12/20 2024

12/20 2024

![]() 647

647

Honda and Nissan are in talks to form an alliance that could potentially propel them to the third-largest automaker globally by sales.

A week ago, foreign media outlets reported that Nissan was facing a potential bankruptcy crisis and was actively seeking new investors to help navigate its difficulties.

Now, it appears that this "new investor" has emerged.

According to Nikkei, Nissan and Honda are in discussions to merge, aiming to better adapt to the rapidly evolving global automotive industry. The proposed merged entity, valued at $52 billion (approximately RMB 380 billion), could emerge as the world's third-largest automaker by sales.

Furthermore, Mitsubishi Motors might also join these merger talks. Currently, Nissan holds a 24% stake in Mitsubishi Motors, making it the latter's largest shareholder.

Reports indicate that Honda and Nissan are considering operating through a holding company structure and are poised to sign a memorandum of understanding (MoU) soon.

However, neither Honda nor Nissan has made any official announcements regarding the merger, neither confirming nor denying the discussions. Both companies stated that the merger reports were not issued by them.

In email statements, both companies said, "As announced in March this year, Honda and Nissan are exploring various possibilities for future cooperation to leverage each other's strengths. Should there be further developments, we will inform stakeholders at an appropriate time."

If this merger is successfully concluded, it will be the biggest in the global automotive industry since the merger of Fiat Chrysler and the French PSA Group to form Stellantis in January 2021.

Analysts believe that a successful Honda-Nissan merger would create an automotive giant capable of rivaling Toyota, effectively consolidating the Japanese automotive industry into two major camps and providing both companies with more resources to compete with larger global players.

Desperately Seeking a Lifeline

Currently, Nissan is accelerating its restructuring efforts to address stagnant revenue growth and declining profits.

Last month, Nissan released its first-half financial report, revealing a 90.2% decline in operating profit to JPY 32.9 billion (approximately RMB 1.568 billion) for the first half of fiscal year 2024 (April-September this year). The operating profit margin dropped from 5.6% in the same period last year to just 0.5%. Net profit was JPY 19.2 billion (approximately RMB 915 million), down 93.5% year-on-year, marking the lowest level since pandemic-related losses in 2020. In the second quarter of fiscal year 2024 (July-September 2024), Nissan incurred a net loss of JPY 9.34 billion (approximately RMB 444 million).

During the same period, Nissan's global new vehicle sales declined by 1.6% year-on-year to 1.596 million units. The company also revised its global sales forecast for fiscal year 2024 (April 1, 2024, to March 31, 2025), reducing it by 1% to 3.4 million units, a decrease of 250,000 units from the previous forecast.

Nissan's performance in the capital market has also remained sluggish. The company is under pressure from activist shareholders and a concerning debt burden, leading to speculation in the credit markets about its investment-grade rating. Moody's changed its outlook on Nissan from "stable" to "negative," confirming its "BAA3" rating, while Fitch revised its outlook on Nissan to "negative," maintaining its "BBB-" rating.

'We have 12 to 14 months to survive,' said a senior Nissan official.

To improve its deteriorating operational performance and enhance efficiency and adaptability, Nissan is undertaking a series of restructuring measures.

These include reducing global production capacity and implementing layoffs. Nissan plans to cut global production capacity by 20% and lay off 9,000 employees worldwide. Additionally, Nissan executives have taken pay cuts to address the company's financial challenges. Nissan's President and CEO, Makoto Uchida, announced that he will voluntarily forgo 50% of his monthly salary starting this month, and other executive committee members will also voluntarily take corresponding pay cuts.

On December 11, Nissan announced a reorganization of its senior management to readjust the company's operational structure.

Nissan's current Chief Financial Officer (CFO) Ashwani Gupta will become Chairman of the Nissan China Management Committee, focusing on strategic implementation and operations in the Chinese market. Jeremie Papin, the current Chairman of the Nissan North America Management Committee, will succeed Gupta as CFO. Both will report directly to Uchida.

Nissan will further adjust its management layer in April 2025 to achieve a leaner and flatter management structure, enabling it to respond flexibly and quickly to changes in market conditions.

However, these measures do not seem to fully resolve Nissan's difficulties.

According to foreign media reports, Nissan is actively seeking a stable long-term shareholder to replace part of Renault's stake. Nissan has partially dissolved its complex 25-year strategic partnership with France's Renault Group, with Renault reducing its shareholding from 46% to 40%.

Nissan hopes to find a stable long-term investor, such as a bank or insurance company, to replace part of Renault's equity. It does not rule out the possibility of cooperating with other Japanese automakers, including Honda.

A source familiar with the matter said that Renault Group may consider partnering with Nissan, Honda, and Mitsubishi to jointly develop electric vehicles to compete with China's strong competitiveness in the electric vehicle industry. Renault also stated that the two parties have not discussed broader cooperation but support a potential "win-win" scenario between Nissan and Honda.

From Double Loss to Win-Win?

Honda, the other protagonist in these "merger rumors," is also facing operational challenges.

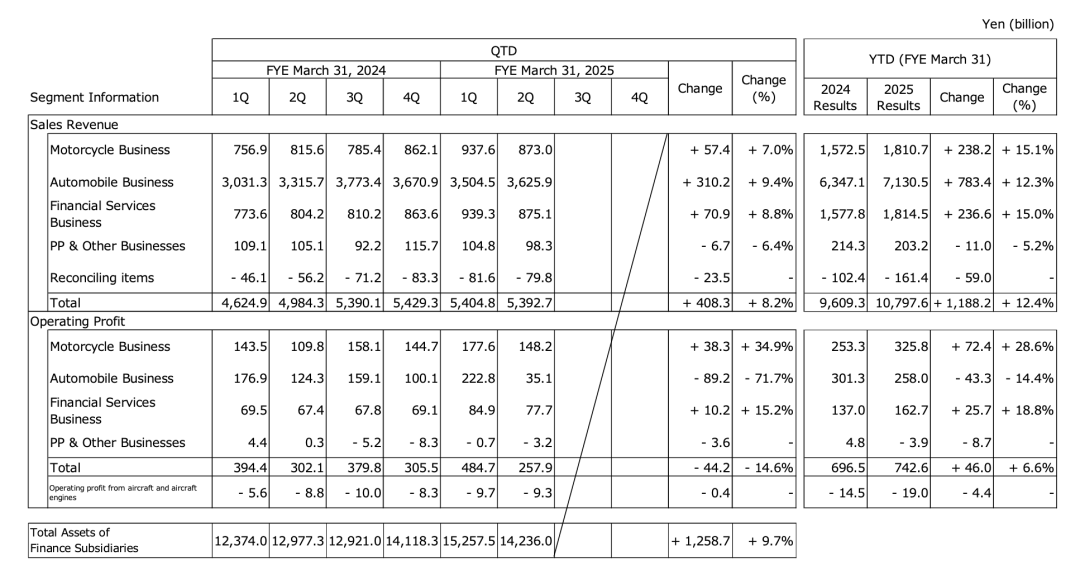

Its second-quarter financial report for fiscal year 2024 showed an operating profit of JPY 257.9 billion (approximately RMB 12.014 billion), down 15% from JPY 302.1 billion in the same period last year. This marks the first negative growth in Honda's profits since 2020.

This performance decline can be attributed to a sharp drop in Honda's sales in Southeast Asia and the Chinese market. Especially in China, the world's largest automotive market, Honda's sales declined by as much as 43%. During the same period, Honda's sales in the U.S. and Japanese markets increased by 8% and 22%, respectively, which, although alleviating some pressure from the overall sales decline, was insufficient to compensate for the gap in the Chinese market.

Currently, Honda's automotive manufacturing business has an operating profit margin of only 3.6%, significantly lower than the 18% margin of its motorcycle division. Analysts estimate that the operating profit margin of its automotive division may increase by only about one percentage point by the end of March 2026.

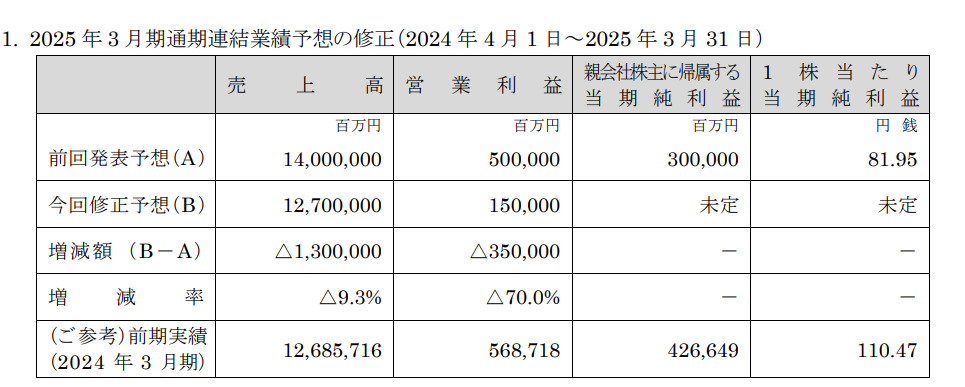

In its financial report, Honda noted that despite the overall sales setback, it maintains its full-year operating profit forecast of JPY 1.42 trillion and raises its full-year sales forecast to JPY 21 trillion. This reflects the company's strategic adjustments but also highlights concerns about Honda's declining competitiveness in emerging markets.

In fact, according to related reports, as early as 2019, the Japanese government pressured Nissan and Honda to consider a merger.

In March this year, the two companies signed a memorandum of cooperation, aiming to conduct in-depth collaboration in software, batteries, and other electric vehicle-related technologies. Both parties hope to leverage each other's strengths and share costs through joint development to cope with increasing market competition. Subsequently, Mitsubishi also announced its participation in this alliance.

Industry insiders believe that "this alliance makes sense." Considering the current situations of Nissan and Honda, joining forces rather than going it alone would better position them to compete with Toyota and Chinese manufacturers.

According to related reports, the cumulative global sales of Honda, Nissan, and Mitsubishi in the first six months of this year were approximately 4 million vehicles, compared to Toyota's sales of 5.2 million vehicles.

Visible Alpha's forecast data suggests that Nissan and Honda will collectively sell nearly 6 million vehicles by 2026. Since these two companies share similar key markets, their merger could reduce expenses related to management, procurement, production, R&D, and other aspects.

Following the merger news, Mitsubishi Motors' share price surged by up to 17% in Tokyo trading today, Honda's U.S. share price peaked at around a 2% increase, and Nissan's over-the-counter share price peaked at over an 11% increase.

-END-