30% Defection: Huawei Takes Over BBA 4S Shops

![]() 12/23 2024

12/23 2024

![]() 692

692

With a 30% defection rate, Huawei is encroaching on BBA's 4S shops, mirroring its earlier rivalry with Xiaomi for mobile phone market share. The best-selling car in Audi's 4S shops is now AITO... When major Audi dealer groups in Beijing and Zhengzhou switched to AITO, it became a social media sensation, with some netizens humorously suggesting that a new generation of 'A' (AITO) is replacing the old 'A' (Audi).

Restlessness isn't limited to Audi dealers. According to public reports, Mercedes-Benz and BMW dealerships in some provincial capitals have also defected to AITO.

Recently, it was reported that the top dealer group Zhongsheng Group obtained authorization for 50 Huawei Select Cars. These shops won't be new constructions but conversions from Zhongsheng's existing 4S shops representing luxury brands like BMW, Mercedes-Benz, Audi, and Volvo.

As all sectors decry the deteriorating conditions for auto dealers, it's challenging for outsiders to fully empathize. When even financially strong leading dealers embrace new brands, this signal cannot be ignored.

While the authorities improve the exit mechanism for struggling automakers, they're also considering one for dealers. In an explanation circulated online from FAW-Volkswagen Audi to dealers, a poignant question was posed: "Audi has allowed you to maintain relatively stable profits for 36 years. How long can a new brand keep you profitable?"

This question remains unanswered by Zhongsheng, which has switched to new brands. "It's hard to predict the future, but for now, it's better than BBA," a Zhongsheng Group insider told Luca Auto.

Selling AITO is More Profitable Than Selling BBA

"In the early stages, AITO will be more profitable than BBA," the aforementioned Zhongsheng insider confirmed. The reason is apparent. Not only do luxury brands face the well-known issue of wholesale and retail price inversions, but for models with a guide price over 500,000 yuan, a terminal discount of over 100,000 yuan is standard. If consumers choose a financial plan, the price can be negotiated further. In the long run, even accounting for year-end rebates from manufacturers, dealers lose money on every car sold. It's no exaggeration to say that in the price wars of the past two years, dealers bore the brunt.

Brands like AITO have relatively stable terminal prices. Even if the profit per car is lower than that of luxury brands, their expanding market size means that for dealers, the turnover days won't be too long. "The core issue isn't profitability but sales. Too many turnover days will break the dealer's capital chain," said a circulation field professional.

A luxury brand dealer from a provincial capital city in northern China revealed that about 30% of BBA dealers in his city have switched to Huawei Select Cars. He added, "Not only is there no inventory pressure, but the cost of store renovation and other investments is also very low."

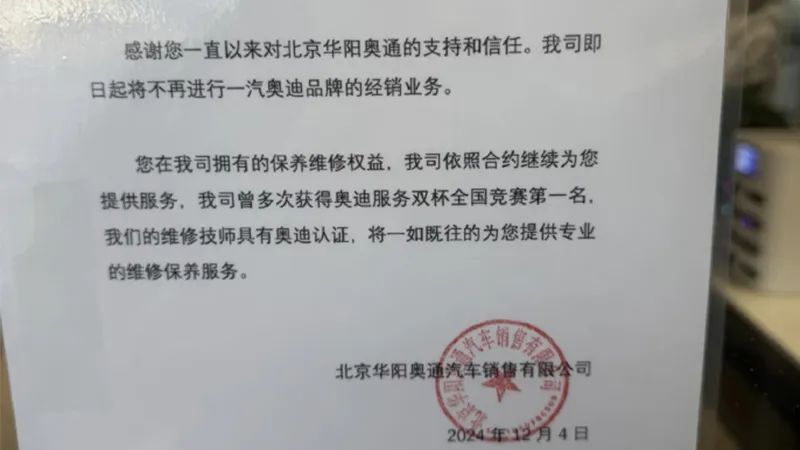

Without external forces, things will always develop in the direction of least resistance. This is true for BBA as well. As a result, some stores have even placed BBA's exhibition cars in the same room as those from AITO and Zhijie. Even when Beijing Huayang Aotong lost its Audi authorization, it calmly stated that it would no longer engage in dealership business but would continue with after-sales services as usual.

The relationship between automakers and dealers has undergone subtle changes. Additionally, competitive pressures among dealers have forced dealer groups to adapt to market trends. As the passenger car market enters a stock era, the growth of new energy vehicles signifies a weakening of the fundamental base of fuel vehicles.

National Bureau of Statistics data shows that from January to September, domestic passenger car retail sales were 15.574 million units, an increase of 2.2% year-on-year. However, retail sales of automotive consumer goods were 3.5361 trillion yuan, a year-on-year decrease of 2.1%. The stark contrast between retail sales and retail volume also reflects the operational pressure on dealers. Xiao Zhengsan, President of the China Automobile Dealers Association, pointed out in a recent public speech that there are too many and too dense fuel vehicle channels. To maximize channel value, the adjustment and exit of auto dealer networks will become the new normal.

"There are many stores under the group, and some brands have multiple stores in one city. For luxury brands that are currently not performing well, we will make some integrations. For example, for stores that are relatively close, four can be merged into two," said the aforementioned Zhongsheng Group insider. Besides reducing the number of stores, switching to new energy brands is also a form of integration.

Before recently switching to AITO, Beijing Huayang Aotong's 4S shop had already converted part of its showroom into a Li Auto store in the middle of this year. This once-largest Audi 4S shop in Beijing now only handles Audi's after-sales business. This change makes Huayang Aotong a microcosm of the transformation of traditional dealers.

"Zhongsheng + AITO" Is Being Replicated

These top dealer groups are not only high-quality resources in themselves but also hold the best customer resources. That's why Thalys prioritized the top 100 dealers recognized by the China Automobile Dealers Association.

Before news of the Zhongsheng and AITO partnership emerged, some Huawei stores in Beijing stopped displaying AITO exhibition cars in October. As the model matrix under Hongmeng Zhixing continues to expand, establishing separate channels is more conducive to forming a clear brand identity for the AITO brand.

Take the recently launched Chery and Huawei Zhijie R7 EREV version as an example. Its starting price of 249,800 yuan is exactly the same as that of the AITO M7, and both are medium to large SUVs under Hongmeng Zhixing. In terms of positioning, the two cars seem to be in direct competition.

In terms of sales, the cumulative delivery of the AITO M7 alone exceeded 170,000 units in the first 11 months. The industry generally believes that annual sales of 300,000 units are the benchmark for an automaker to cross the scaling gap. A preliminary estimate suggests that AITO's annual sales in 2024 will easily exceed the 200,000 mark, providing a premise for establishing separate channels.

As delivery volumes continue to rise and the customer base expands, the direct sales model is no longer revered by new energy automakers. This model, once hailed as a business innovation, is a significant test for automakers' cost investment and capital chain due to the absence of dealers as an intermediary buffer.

Before this, new energy brands such as Avitar, NIO, Denza, FANGCHENGBAO, and Zeekr have already embraced the dealer model. The Circulation Association issued a warning in the middle of this year that an estimated 4,000 4S shops will exit the market in 2024. Not only are automakers' sales targets far exceeding real market demand, but the overcapacity of brand distribution channels has long been an indisputable fact. For mature dealer groups, switching from fuel vehicle brands to new energy brands is one of the least painful transformation methods.

As the number of new Hongmeng Zhixing vehicles increases, so do the channel requirements. Public reports indicate that the initial investment for a Hongmeng Zhixing authorized user center is approximately 20 million yuan. Moreover, selling different brand models in the same store poses considerable challenges in terms of store size, delivery capacity, and service capabilities.

Therefore, besides opening larger independent stores, channel expansion will also become inevitable for Hongmeng Zhixing. Referring to the smartphone popularization period a decade ago, when market shares in first- and second-tier cities became saturated, Huawei, Xiaomi, and other manufacturers expanded their channels to compete for shares in third- and fourth-tier cities and below, previously dominated by vivo and OPPO.

In this regard, auto dealers have a natural advantage: mainstream automotive brands have already completed their layout. Even Li Xiang commented, "We learned from BBA how to open 4S shops and choose locations, reducing customer acquisition costs to one-fifth of those for mall stores."

Therefore, we can reasonably speculate that once the "Zhongsheng + AITO" model is proven successful, it will also be replicated for other brands under Hongmeng Zhixing. Especially for Zunjie, with a pre-sale price starting at one million yuan, separate stores are needed to serve its ultra-high-end positioning.

It's worth noting that the official information released by Zhongsheng Group is that it has signed a preliminary negotiation agreement with Thalys to distribute its new energy vehicles. However, from the fact that some BMW 4S shops display the Zhijie R7, a collaboration between Huawei and Chery, it's evident that Huawei's Hongmeng Zhixing division is also making corresponding layouts.

November terminal sales data shows that in the sales ranking of models priced above 300,000 yuan, AITO M9 surpassed popular models such as Audi A6L, Q5L, Mercedes-Benz E-Class, and GLC with sales of 16,409 units. "Besides profitability, we also believe in Huawei's brand appeal. There used to be many BBA stores, and we want to take the opportunity of cooperating with AITO to change the situation of underperforming stores," said an insider from Zhongsheng Group.

In fact, this give-and-take isn't a bad thing. Just as Porsche is also improving channel profitability by reducing the number of dealers. For Huawei's Hongmeng Zhixing, after expanding to a certain stage, it will also encounter the same challenges faced by today's BBA: The era of easy profits is no more, and market share and profit are often difficult to balance.